Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

I've always known there was an undiscovered batch of players eager for indie games. Well, I found them: they're in China

For the past five years I've been maintaining Defender's Quest, I've kept telling myself: there's got to be some magical untapped audience I've yet to reach. I've tried every possible trick to find them, and while many have helped, none have been a silver bullet.

Support Mac and Linux

5.2% and 1.8% of lifetime revenue, respectively

Participate in Humble bundles

(back when they were really good)

Sell direct, on GOG, Itch.io, etc

significant chunk, still dwarfed overall by Steam

Localize all the things

Professional: German, French, Spanish, Japanese

Volunteer: Russian, Korean, Italian, Czech

Probably worth it? But not crystal clear.

Well, I finally found these magical undiscovered players: they're in China.

In "Steam Discovery 2.0, Stegosaurus Tail 2.0", we noted the trend of Chinese players appearing on the global PC gaming radar.

For one, Valve mentioned the trend at Dev Days 2016:

and I had noticed it myself, both anecdotally:

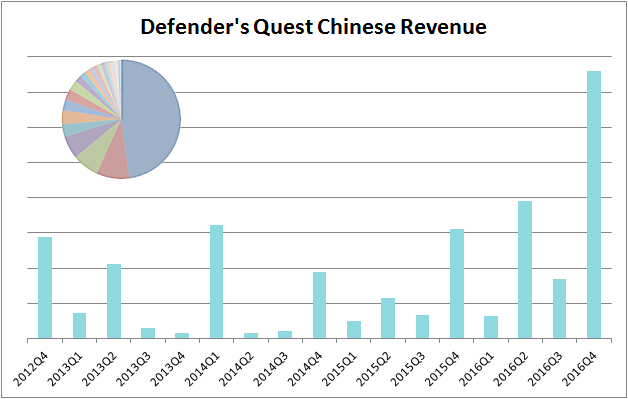

as well as in our revenue reports:

At the time, China was still a very small slice of our overall revenue (as you can see in the graph's embedded pie chart -- it's the tiny turquoise slice at the very top). Still, it was enough evidence to start localizing Defender's Quest into Simplified and Traditional Chinese.

Now, whether or not localization is worth it depends on how much text the game has. And Defender's Quest has a lot of text.

Category | # words |

|---|---|

Cutscenes | 22,196 |

Journal | 24,943 |

Everything else | 8,709 |

Total | 55,848 |

The Cutscenes and Journal together comprise a small novel -- 47,139 words, about the same length as Slaughterhouse Five. We decided to translate only the "everything else" category: the game would be completely playable in Chinese, but the story content would remain in English. This way we could test the waters, and if initial results were good, we'd follow up with a complete translation.

Spoiler alert: results were good.

I have never had a localization pay for itself this quickly, not to mention this unambiguously. When you localize a game, you are betting that sales from the target region will increase more than they would have had you not done it. Usually, however, you're never quite sure how many regional sales you would have made anyways. For example, my first language is Norwegian, and most Norwegians my age speak fluent English and consume lots of English media. Chances are they'll buy a game whether it's localized into Norwegian or not. This effect is so bad that prominent Norwegian games like OwlBoy aren't even localized into the developer's native language. (Same goes for um... Defender's Quest. Tilgi meg, Bestemor!) But what about Germans? There's a lot more of them, and research says they have a stronger preference for native-language media than Norwegians. So we did a German localization (among others). And it was probably worth it, but the effect was somewhat obscured since Germany was already a strong selling region.

The Chinese stats tell a completely different story.

For context, when we updated the game with Traditional and Simplified Chinese translations, we ran a Steam weekly deal at 50% off and popped one of our visibility tokens (see this article).

Result: China was our #1 sales region, not only in terms of units sold, but also in terms of gross revenue.

Last week's sale figures:

As mentioned previously, the before/after results of localization were completely unambiguous.

Of all the revenue Defender's Quest has earned from China on Steam in its entire lifetime, 45% of it was earned last week. That's right, we basically doubled our lifetime sales from China almost immediately! Obviously there's some degree of "pent-up demand" in play here, but based on other developers' experience, I suspect we'll see improved sales from China in our long tail, as well.

Here's a per-country breakdown for our lifetime sales, excluding this past week (ie, the entire time before the Chinese localizations were availalbe):

Back then, China was #22.

"But, Lars!" you say, "Defender's Quest has been on sale for five long years! Maybe it's already soaked up most of its potential western buyers already?"

Judging from 2016's figures, apparently not:

The same 10 countries that dominated lifetime sales show up here, just with a few positions swapped. The biggest change is that Japan and Korea represent a larger overall share in 2016 vs. overall lifetime (We shipped Korean and Japanese localizations in 2014). And the Anglosphere + Europe still dominate.

Here's a side-by-side chart of last week vs. 2016 for easy comparison:

So China zooming to #1, even for just a week, is amazing. Germany has traditionally been our strongest non-English region to date and it's never pulled off a feat like that. But you'll also notice Korea and Japan had a higher market share in this last sale, and Taiwan showed up out of nowhere to beat Russia, Canada, and the UK!

Concerning China, it's basically the perfect candidate for localization:

Large market (18% of world's population!)

Strong preference/need for their native language

Population spends money on games (middle class has exploded recently)

But there's another story here. During the sale, 50% of copies were sold in East Asia. The growth from Chinese speaking regions makes perfect sense, but I was surprised to see growth in Korea and Japan. We've had Korean and Japanese localizations available since 2014, after all. What's going on? I have five potential explanations:

First, it could just be statistical noise and I'm reading too much into things.

Second, it could be part of an ongoing regional rise in PC gaming in East Asia in general. Japanese publishers are releasing more games on Steam, whether it's Square-Enix's back catalogue of Final Fantasy games or From Software's latest Dark Souls title, and Japanese players are following them:

@larsiusprime Yes, Japan certainly grows faster than an average on Steam pic.twitter.com/FVx90voTJ3

— Steam Spy (@Steam_Spy) December 27, 2015

Meanwhile, Koreans have always been big fans of PC gaming, and Steam has lots of games they like, most notably DOTA 2. Also, Steam has made strides in supporting local Asian currencies, so this growth makes sense.

Third, it could be a result of Steam's discovery algorithm explicitly recommending games to players based on their native language. Just a few years ago, everyone in the world saw the exact same Steam home page, whereas now it serves up unique recommendations, and the user's language is a key variable:

Fourth, just as there are large numbers of Spanish speakers in the USA because of its proximity to Mexico and Central America, I bet there's a decent amount of Chinese speakers in Japan and Korea. So some of those extra sales from Japan and Korea might actually be from Chinese players.

Fifth, there might be a "cultural lift" phenomenon, where visibility in a major country (such as China) trickles down to nearby countries within its cultural sphere of influence. I'm not as sure about this last one as the observed lift in Korea and Japan happened a bit faster than this explanation might predict.

But if any of these effects are in play, I can still make a solid prediction: Asian countries will continue to dominate Defender's Quest's market share in 2017. Last year Asia was 11% of our revenue and 14% of our units sold. I expect that market share to at least double for 2017.

So, we got a lot more sales from Asia, and especially China. But how are these Asian customers finding us? Here's a breakdown of our traffic report during the post-localization sale:

Category | % Visits |

|---|---|

Home Page | 37.36 |

Weeklong Deals | 15.80 |

Specials | 14.01 |

Discovery Queue | 11.10 |

Tags | 7.79 |

Search | 4.61 |

Valve Website | 2.46 |

External Website | 1.46 |

Games < $10 | 0.97 |

Other | 4.44 |

These are some really surprising results. If you've been following this blog for a while, you'll know that the Discovery Queue almost always dominates our traffic charts. Here's our traffic from our last promotional event, by comparison:

Category | % Visits |

|---|---|

Discovery Queue | 23.47 |

Tags | 14.3 |

Specials | 11.73 |

Home Page | 10.62 |

Search Results | 9.15 |

External Website | 7.89 |

Weeklong Deals | 6.98 |

Valve Website | 5.29 |

Games < $5 | 3.05 |

Games < $10 | 1.64 |

Other | 5.88 |

Here's a combined table for easy comparison:

Latest saleCategory | % Visits | Previous saleCategory | % Visits |

|---|---|---|---|

Home Page | 37.36 | Discovery Queue | 23.47 |

Weeklong Deals | 15.80 | Tags | 14.30 |

Specials | 14.01 | Specials | 11.73 |

Discovery Queue | 11.10 | Home Page | 10.62 |

Tags | 7.79 | Search | 9.15 |

Search | 4.61 | External Website | 7.89 |

Valve Website | 2.46 | Weeklong Deals | 6.98 |

External Website | 1.46 | Valve Website | 5.29 |

Games < $10 | 0.97 | Games < $5/$10 | 4.69 |

Other | 4.44 | Other | 5.88 |

Expanding the "Home Page" category for the latest sale reveals that 30.40% of the traffic came from the Special Offers Grid, and 4.56% came from "Updated Games."

What's really interesting to see here is that despite the fact that this latest sale had a smaller discount (50% off vs. 67% off for the previous one), much more traffic came from the "in-your-face" promotional channels (Home Page, Weeklong Deals, Specials) rather than the softer-touch organic discovery channels (Discovery Queue, Tags, Search) we've almost exclusively relied upon until now.

Next, let's look at our visibility round results.

As mentioned in the previous article, post-Discovery update 2.0 visibility rounds are optimized for signal-boosting frequently updated games. They specifically target your existing audience as well as people who have wishlisted your game. On the face of it this seems pointless because it's not giving you any "new" visibility, but for games like ours, it seems to work -- probably because the "Recommended by Friends" module has the highest click-through rate of all the discovery channel on Steam's front page.

Here's where we're at so far:

Our click-through rate is lower, which makes sense as we ran the last round in December and have likely thinned out the pond a bit. However, we're still getting a good number of clicks. We've already beaten the previous view count in just one week -- it will be interesting to see if we're also able to surpass the total absolute number of clicks by the time the visibility round expires. I'm pretty sure these last for either 1 month or 1,000,000 views, whichever comes first, because my last round lasted for 1 month down to the minute, and my friend Ryan Clark recently ran a round that halted at around 1,000,002 views, a suspiciously round number to suddenly terminate on.

It's hard to tell how much the visibility round had to do with the Asian regions. Steam indicates 30.7% of our purchases in this period were fulfilled wishlists, but we don't get any kind of regional breakdown for that. The fact that we reached more eyeballs faster makes me think we've got wider Asian visibility than before, but I don't have solid proof.

So, should you localize your game into Chinese? Probably.

Some quick caveats. If your game isn't selling a whole lot already, I can't guarantee that localizing into Chinese is going to double your sales or anything, and the cost of a localization might even exceed what you could expect to earn from it. Furthermore, genre effects likely apply -- some games probably resonate with the Chinese audience more than others, and our story-heavy Tower-Defense RPG is apparently one of them.

If you've got a simple game, you can probably get away with simple bitmapped fonts, but if you absolutely need full true-type font support with arbitrary dynamic text (as we did), you'd better get your head totally wrapped around Unicode, text encodings, fonts, possibly even IMEs (Input Method Editors). In my case, the prior experience of eight previous localizations, including fellow "CJK" languages Japanese and Korean, was invaluable.

Nobody's going to bother buying your game if they can't even read the description, after all. If your game has minimal text, this might be all you have to do to reach the Chinese market.

Now, some things not to do.

Just don't. You'll wind up with a garbage translation that's incoherent at best and insulting at worst. Players will definitely notice and kill your review score. A partial translation is better than a "complete" garbage one.

Localization is much more than simple translation, and you'll come across plenty of guides that insist you pick up on the cultural context and make sure to make proper adjustments for those, too. And this is important! For instance, literally translating jokes and cultural references from English isn't going to work -- your translator will need to adapt, change, or even drop them entirely. However, if you do this wrong, you're in dangerous territory of going too far and confusing or even insulting your audience:

The bottom line is -- trust your translation/localization partner to suggest proper adjustments, but don't go off on your own as a clueless westerner trying to "Chinese-ify" things for the locals.

The rise of China, and Asia in general, has taken me somewhat by surprise. Conventional wisdom has always been that Japanese players only play console games, Koreans only play StarCraft and MOBAs, and Chinese players are only interested in mobile F2P games. Although I'm sure those larger trends are true, the sheer size and diversity of these regions shouldn't be ignored, opening a new niche for some indies. This is definitely a great opportunity for some of us, but this works both ways -- we should expect to see a rise in Chinese-developed games, both Indie and AAA.

We've already seen this famously with ICEY.

So I guess the question is -- how long until we see a Chinese-developed Indie game win awards for Game of the Year, Independent Games Festival, Game Developer's Choice, and sell over a million copies?

...

...

...

...

...

...

...

...

...

...

...

...

...

It's a trick question :)

That game is FTL:

According to GiantBomb, Subset games is based in Shanghai*, and the two main developers were former employees of 2K China.

*Technically the founders of Subset moved to Shanghai from the USA, but since my own game Defender's Quest was made by an "American developer" -- ie Level Up Labs -- despite the fact that I am a Norwegian citizen who lives in the USA, I think it's fair to call Subset games a "Chinese developer" by the same standard.

I can recommend a great translator by the way, her name is Amy Ho. She does both Simplified and Traditional Chinese and comes with my personal stamp of approval. You can reach her at [email protected]

Good luck out there!

Read more about:

Featured BlogsYou May Also Like