Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

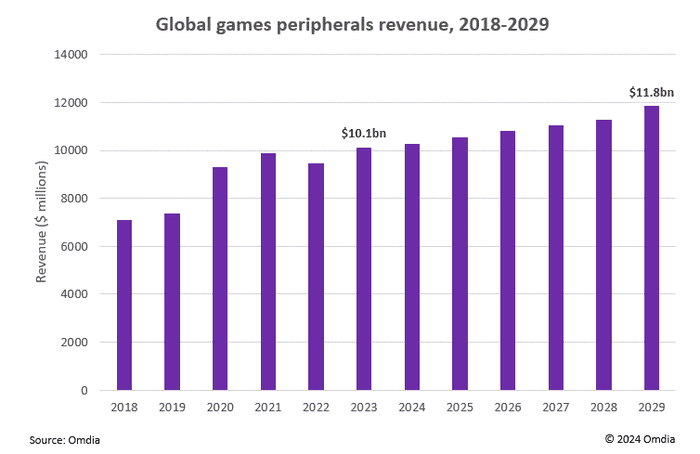

Global revenue from games peripherals and accessories surpassed $10 billion in 2023.

New research from Omdia shows that global spend on games peripherals and accessories surpassed $10 billion in 2023, with 2029 revenue set to be close to $12 billion.

The research, newly published in Omdia’s Games Peripherals and Accessories Market Forecast 2024, shows that gamepads accounted for 44.3% of spend in 2023, and will more or less maintain their share to 2029. Headsets, keyboards, mice, and other peripherals form the remainder of revenue, with all except mice being $1 billion-plus market categories. It is the Other category that will see the strongest rises to 2029, buoyed by sales of higher-value peripherals and accessories such as gamer chairs and steering wheels.

Source: Omdia’s Games Peripherals and Accessories Market Forecast 2024

The latest data shows that global peripherals spend has kicked on from its new post-pandemic baseline, with 2023 revenue now surpassing the previous high from 2021.

While games themselves face strong consumer resistance to price increases, there is more price elasticity for premium peripherals, with products such as PlayStation’s DualSense controller selling strongly despite costing $200+. With leading PC games storefront Steam stating that controller usage on its platform has tripled since 2018, there are positive factors beyond the ebb and flow of the console cycle contributing to what will be 2.9% annual growth from 2024 to 2029.

This year, for the first time Omdia has broken out gamepads revenue by brand, sizing Sony, Microsoft, Nintendo, and other brands’ gamepads. Nintendo’s growth comes from the runaway success of the Switch, but it has not tested the premium gamepad market in the same manner as its console rivals, with its top branded controllers coming in at well under $100.

Conversely, Microsoft’s current-generation Series X/S console has underperformed expectations, but the company’s position as the leading gamepad brand for PC has led to respectable growth nonetheless; Steam has stated that 59% of its greatly increased gamepad sessions were derived from Xbox controllers. Like Sony, Microsoft is also adept at providing offerings for the premium market, further boosting revenue.

Sony, however, enjoys both strong gamepads sales tied to console and an increased PC presence—Sony gamepads revenue is expected to break $2 billion by 2029—as well as providing desirable audio equipment such as the $200 Pulse earbuds.

Other gamepad brands straddle a wide range, from cheap, third-party versions of console controllers to top-of-the-range products from the likes of Turtle Beach, Razer, and SCUF.

A sector to watch within this category is mobile controllers – gamepads from companies such as Backbone that attach to a smartphone, transforming it into a gaming device with a similar form factor to the Switch.

The potential to improve both mobile gaming itself, and the cloud gaming experience on mobile, is self-evident, and a factor behind Omdia’s belief that the Other category will surpass Microsoft gamepads revenue by 2029.

Game Developer and Omdia are sibling organizations under Informa.

You May Also Like