Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Analysis of the latest app store and Amazon product page data suggests that sales of Meta’s latest entry-level VR headset have underperformed.

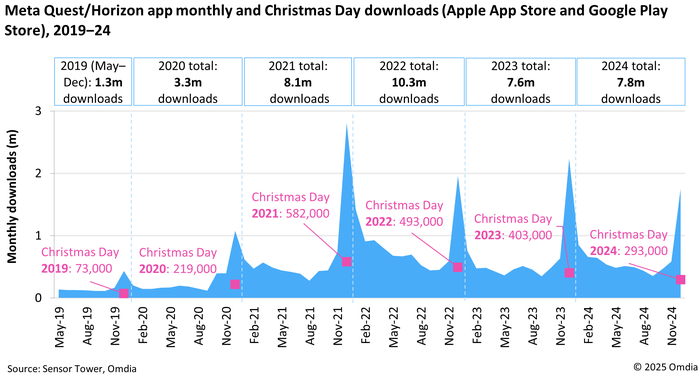

Omdia analysis of Sensor Tower data reveals that the Meta Quest mobile companion app downloads fell on Christmas Day 2024 by 27% compared to 2023, despite the launch of the Meta Quest 3S in October. Priced from $300, the Quest 3S is a follow-up to the highly successful Quest 2. There was a palpable hope within the industry that it would reinvigorate VR hardware sales thanks to its attractive price (starting from $300), bundling the new Batman: Arkham Shadow game, and its enhanced passthrough mixed reality features.

Figure 1: Meta Quest mobile app downloads over the past six years

Total 2024 app downloads grew slightly to 7.8 million, but this is still well below 2022’s record of 10.3 million (see Figure 1). December’s total downloads were down by 21% year-on-year. Even with an attractively priced bundle and good awareness for the brand, the Quest 3S struggled to attract new consumers, signaling broader challenges in the VR market (see: Reality check for VR: Omdia forecasts decline as Apple’s entry fails to galvanize market).

While not an exact representation of Quest headset sales, Meta Quest app download figures serve as a good barometer, given the mobile app must be downloaded as part of the initial setup of the headset. Sensor Tower does not count re-downloads, app updates, or subsequent downloads on new or additional devices for an existing iOS/Google Play account.

Factors like second-hand sales, upgrades, headset sharing, and non-owners downloading the app to explore the app store muddy the data. Nevertheless, the flat app download figures strongly indicate that Meta is not significantly expanding the Quest's audience beyond its existing user base. This aligns with other indicative data, such as sales figures on Amazon product pages and VR headset components channel data, which similarly point to a plateauing market. Meta’s growing focus on smart glasses signals a shift in strategy, as the company explores alternative form factors that may better appeal to the mass market than VR.

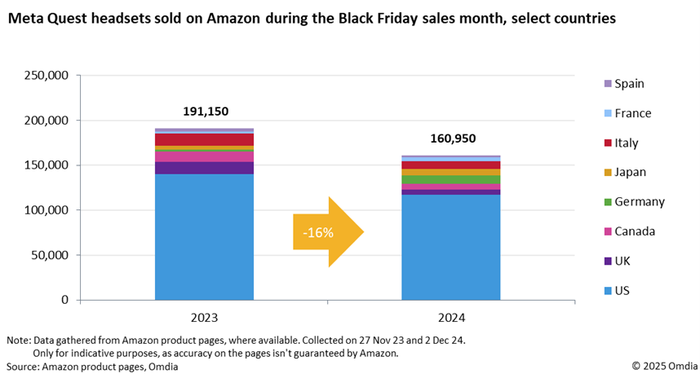

According to data from Amazon product pages, over 160,000 Quest headsets were sold in November 2024 across eight countries – down by 16% compared to 2023 (see Figure 2). The Quest 3S accounted for 66% of sales, with the Quest 3 making up the remainder. November typically marks the peak VR sales due to Black Friday and Cyber Monday, during which Meta offered substantial discounts on both Quest 3 and Quest 3S models in all markets. The US site represented 73% of total sales, providing a good indication of the global picture.

Quest 3S struggled to attract new VR users or serve as a compelling upgrade for Quest 2 owners, as its improvements were viewed as incremental. Internally, the Quest 3S is very similar to the Quest 2 and retains its bulkiness, largely due to the ongoing use of Fresnel lenses. A recurring criticism from reviewers and users has been its inferior comfort compared to the Quest 3—which likely stems from Meta’s cost-cutting measures. Further hindering Quest 3S’ appeal is the limited AR content fully leveraging its improved hardware, as well as the compatibility of most Quest Store content with the Quest 2. These factors, combined with VR’s continued inability to appeal to a broader audience beyond existing enthusiasts, dampened demand during the holiday season.

Figure 2: Quest headset sales on Amazon declined 16% YoY during the Black Friday sales month

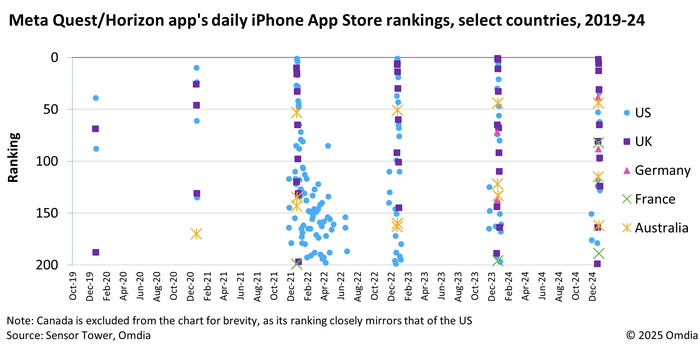

The Meta Quest iPhone app's recurring appearance in the top 200 free app rankings during the holiday season aligns with the seasonal trend of headset sales, particularly around Christmas when these devices are popular gifts. This pattern also underscores the dominance of the US, Canada, and UK as key markets, where the app reliably breaks into the top 10 and often briefly reaches the number 1 spot on the Christmas Day. In stark contrast, the other three countries—Germany, France, and Australia—hover much further down the rankings, never coming close to the top 10 and barely breaking into the top 50, highlighting a significant gap in market engagement (see Figure 3).

Figure 3: iPhone App Store ranking data underlines Meta Quest headsets’ seasonality and prominence in the US

Although the surge in popularity and peak concurrent users engaging in VR games during the holiday period signals some positive interest, the larger issues surrounding the VR category persist. According to Omdia’s Consumer VR Headset and Content Revenue Forecast, headset sales fell by 10% in 2024 to 6.9 million units, while those in active use fell by 8% to 21.9 million. Engagement throughout the year is inconsistent, posing a significant hurdle to Meta's ambition of cultivating a self-sustaining VR ecosystem. Limited compelling new content, developers questioning the ROI of VR projects, and a lack of broader consumer interest are the fundamental challenges that will be difficult to overcome, as long as VR headsets remain in their current form.

You May Also Like