Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Ever wonder how your mobile game KPIs perform vs industry benchmarks? Each week we release “Mobile App Industry Benchmarks” to uncover your performance vs competitors and see KPIs like CTR, CPM, CPC, CPI, IPM, Conv%, country breakdowns, and more.

Ever wonder how your mobile game KPIs perform vs industry benchmarks? Each week we release “Mobile App Industry Benchmarks” to uncover your performance vs competitors and see KPIs like CTR, CPM, CPC, CPI, IPM, Conv%, country breakdowns, and more.

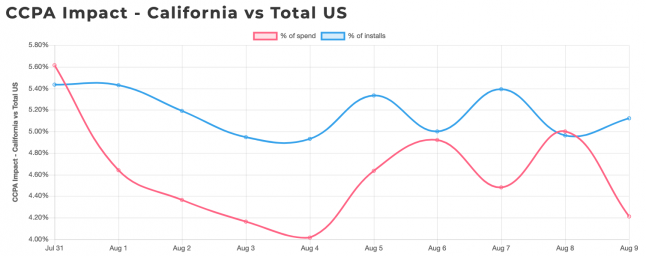

CCPA Compliance Impact

Share of CA installs from total US continues to stabilize around 5.25% over the past 10 weeks, while share of CA spend from total US is has been stabilizing at around 4.5% over the past 8 weeks.

CPM

30% of the way into August, CPM trends suggest a less-volatile “new normal” for key gaming genres, following a highly dynamic Q2 auction market

CPM By Genre

Casual Games: $14.92 – down 6.9% from last week $16.02

Continued downward trend that started about 6 weeks ago, beginning to ease into single-digit percent drop week-on-week, following several weeks of double-digit percentage drops. This may be an indication of longer term amplitude in auction market prices around a lower average cost than $25 – now estimated at $20 – indicating a mid- to long-term shift toward a lower price point for CPM in this category.

Simulation Games: $17.22 – up 21.0% from last week $14.23

Price amplitude seems to anchor around $16, with relatively minor changes week-on-week for the past 8 weeks.

Adventure Games: $16.33 – up 3.9% from last week $15.71

Continued stability in prices, suggesting a relatively narrow amplitude anchored around the $16 mark, following a volatile Q1, where rates fluctuated between highs above $20 and lows below $10.

Word Games: $12.91 – up 0.9% from last week $12.79

Apparent peak in pricing reached, suggesting a potential drop in the coming weeks back towards $8, assuming an amplitude anchored around an average of about $10 based on CPM behavior over the past 9 weeks.

Puzzle Games: $13.65 – up 6.7% from last week $12.79

Continued stabilization, averaging around $13.5 over the past 6 weeks

Card Games: $5.05 – down 16.8% from last week $6.07

A shift in trend after last week’s 10-week high spike, dropping back toward $5 mark.

CTR

In a departure from the relative stability of the past 4 weeks, CTR climbed to a 5-week high of 0.85%. The coming weeks will provide more robust indication of whether this is a continued upwards trend toward Q2 highs of 0.9%, or whether CTRs will continue to trend around a lower rate average of under 0.85%

CPI

CPI continues to climb at an exponential rate, shooting up +87% within just 2 weeks after several volatile weeks – a roaring return to pre-COVID rates not seen since March

Generally speaking, CPI was trending upwards in 6-8 week stretches ever since rates plummeted when quarantine measures had first been enforced throughout most of the developed world in mid-March

Pre-COVID: over $15

6 weeks between Mid-March and late-April: $8

8 weeks between early-May and early-July: $10

July: around $10.50, potentially indicating another uptick in CPI

August: Now close to $19, a massive increase in rates – even beyond our forecast for Q3

It remains to be seen whether this is a return in full force to pre-COVID rates, or local maximum that will dissipate back towards the $12-$14 mark

You May Also Like