Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Ever wonder how your mobile game KPIs perform vs industry benchmarks? Each week we release “Mobile App Industry Benchmarks” to uncover your performance vs competitors and see KPIs like CTR, CPM, CPC, CPI, IPM, Conv%, country breakdowns, and more.

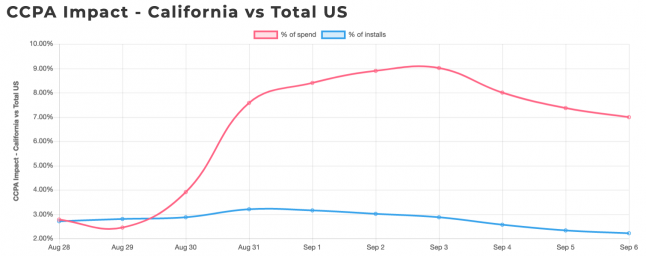

Share of CA installs from total US has stabilized below 2.8% over the past 7 days. Volatility has been observed in the share of CA spend from total US dropping from 3.6% to 2.4%, then springing up to 3.9% over the course of 6 days.

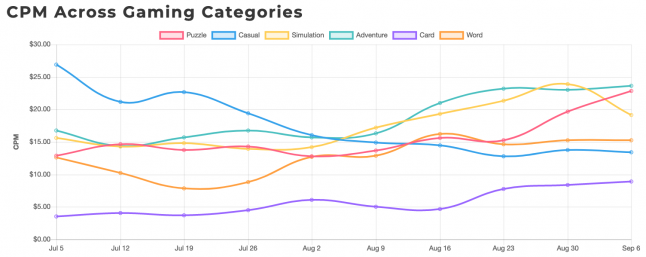

At the close of August, CPM rates all on the rise except for Casual Games, which has been trending downwards for weeks. With the holiday, election, and back to school trends in the marketplace, it’s reasonable to assume CPMs could continue their upwards creep.

CPM By Genre

Casual Games: $13.77 – down 4.8% from two weeks ago $14.46

WoW increase 8/23 – 8/30 of $12.81 to $13.77. Only the 2nd time in 9 weeks there’s been an upwards bump in CPM.

Simulation Games: $23.93 – up 23.7% from two weeks ago $19.34

Another aggressive upwards trend, now placing Simulation Games above Adventure with the greatest aggregated CPM.

Adventure Games: $23.02 – up 9.5% from two weeks ago $21.02

Slight relief in the past 7 days, but overall among the highest CPMs of all Gaming Categories.

Word Games: $15.26 – down 6.03% from two weeks ago $16.24

Word Games demonstrating stability throughout August with a gentle decline over the past two weeks.

Puzzle Games: $19.67 – up 26% from two weeks ago $15.61

The most dramatic percentage increase in all categories was magnified the past 7 days and has elevated the category to its highest point of the year.

Card Games: $8.40 – up 79.5% from two weeks ago $4.68

A titanic increase of 80% in the past two weeks with an overall increase of 38.2% over the month of August. Although Card Games remains the lowest CPM of all categories, the impact of post-COVID CPM is felt the same.

Oscillating weekly over the past two weeks, CTRs reached their 2nd-highest peak of Q3 at 0.87% then retreating to 0.82% the following week.

CPI has increased rapidly in lockstep with CPMs. As of August 30th, aggregate CPMs at 3x the level of late Q2; much of which attributed to a massive CPI surge of 4x over the course of August in the United States.

Read more about:

BlogsYou May Also Like