Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

In his regular, in-depth look at April 2009's NPD numbers, Gamasutra's Matt Matthews examines the disappointing month from multiple angles, from Sony's results and theorized price cut plans, through the numbers behind the software sales drop.

[In his regular, in-depth look at April 2009's NPD numbers, Gamasutra's Matt Matthews examines the disappointing month from multiple angles, from Sony's results and theorized price cut plans, through the numbers behind the software sales drop.]

Commonly characterized as “recession-resistant”, the video game industry finally appears to be feeling the global economic downturn that has affected so many other parts of the economy.

According to the NPD Group, which tracks retail sales in the United States, video game sales in April 2009 were down 17% from the same period last year.

There are a lot of reasons for the drop, and the recession is merely one possible factor. From the dynamics of the hardware market (including the phenomenal Nintendo DSi) to the doldrums of the software charts, from hardware pricing to a hidden trend in accessory sales, we'll try to give the context necessary for understanding where the industry stands right before the biggest trade show of the year, E3 2009.

As we reported last month, midnight launch sales of 58,000 Nintendo DSi units were recorded by the NPD Group as part of the March 2009 figures. Those initial sales were literally the tip of the iceberg for what appears to be another very successful Nintendo system.

According to Michael Pachter, analyst for Wedbush Morgan Securities, an additional 827,000 units of the Nintendo DSi were sold during April 2009, or 206,750 units per week. That is an exceptionally strong launch, especially during what is typically a slower month in the videogame industry.

Combined, the Nintendo DS Lite and the Nintendo DSi sold more than 1.04 million systems for the month (260,000 units per week).

Compared to the previous month (March 2009) sales of the Nintendo DS Lite were down 57%, but at 215,000 units one could consider it the third best-selling system of the month, behind the DSi and Nintendo Wii.

Roughly speaking, sales of the original Nintendo DS, launched in November 2004, probably topped out around 5 million units.

The first revision, the Nintendo DS Lite, has just reached 25 million units while the second revision, the DSi, was just under 900,000 at the end of April and has probably reached well over 1 million as of this writing.

The second-best selling system in April, the Nintendo Wii, moved 340,000 systems for the month, or 85,000 systems per week. That figure is the weakest for the Wii since January 2008, when the system suffered a severe post-holiday shortage.

All other months when the Wii had weaker sales were prior to July 2007, when Nintendo was still grappling with incredible global demand for the system.

While Wii sales were down in April 2009, they were still historically high for the month of April and really only disappointing in the sense that the system wasn't as wildly successful as it has been recently.

The last hit system, the PlayStation 2, never had April sales as strong as Wii sales were in April 2009. Consider also that year-to-date (YTD) sales for the Nintendo Wii are still up 11% from the same time last year.

Finally, to the extent that Nintendo's first-party software is a driver of its hardware sales, the company has not launched a game into the monthly top 10 since Wii Music in November 2008.

Even with those considerations, if the downward trend seen across every other platform is really a sign that the economic conditions are beginning to erode enthusiasm among videogame consumers, then it would be reasonable to expect even a popular system like the Wii to see diminished sales.

As noted last month, the Xbox 360 has had an exceptionally successful first quarter in 2009. While sales were down in April to 175,000 units, Microsoft's system is still up for the year compared to its position in 2008.

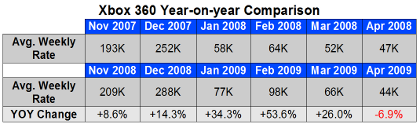

While looking over the figures we realized that sales of the Xbox 360 over the past six months exhibited an intriguing pattern, a rise and fall in year-on-year growth. (Comparisons for September and October 2008 are difficult because of the effect that the Halo 3 launch had for the corresponding months in 2007.)

The rates are shown as the last row of the table below:

Starting in November 2008, the platform saw a wave of increasing year-on-year growth which crested at nearly 54% in February 2009. The year-on-year growth then dropped to 26% in March and ended with a year-on-year decrease of about 7% in April.

Perhaps in these figures we are seeing a slowing of the momentum gained from the September 2008 price drop. As with the Wii, the software environment may also be a factor, although the recent hits like Resident Evil 5 and Street Fighter IV could suggest otherwise.

Finally, one again comes back to general economic conditions as a factor in the slowing wave of Xbox 360 sales growth.

According to the NPD Group, the average price of Xbox 360 hardware (including all three models) is now $270, which is well below the $300 and $400 prices of the upper two system configurations.

This appears to be a drop of around $3-5 dollars from Fall 2008, and suggests an increasing skew toward the $200 model. Such a shift would, indeed, be expected among consumers alarmed by economic news and correspondingly more sensitive to pricing.

One sign of the Xbox 360's inherent strength as a money-maker we think can be seen in the top 10 accessories lists released by the NPD Group each month.

In January of this year, the Xbox Live 1600 Point Card was ranked #6 with the top four spots taken by the Wii Nunchuk (#1), Wii Remote with Jacket (#2), PS3 DualShock (#3), and the Wii Remote without Jacket (#4).

Those accessories for the Wii and PlayStation 3 have continued to remain high on the chart, but the 1600 Point Card moved to #4 in February then to #2 in March and finally to #1 in April.

Did the 1600 Point Card become more popular or did the Wii accessories and DualShock get less popular? Regrettably, NPD Group policy forbids the release of accessory unit sales figures, so we can't know for sure, but we'd venture it's a mixture of both.

During the same period other Xbox 360 accessories – like the 3-month and 1-month Xbox Live cards and the wireless headset – have seen similar increases in popularity relative to accessories for other platforms.

Getting consumers to buy the Xbox Live Point and Subscription Cards on a regular basis is key to Microsoft's strategy of increasing the margin it makes in the videogame business, and the company has to be pleased with the results of the last four months in the accessories segment.

In 2007 and sometimes in 2008, Sony would refer to sales of the PlayStation hardware family – grouping the PlayStation 3 together with the PlayStation 2 and PlayStation Portable (PSP) – to draw attention away from faltering sales of the nascent PlayStation 3.

Not even that artifice would have reduced the discomfort of Sony's paltry hardware sales in April, sales which reached a mere 415,000 systems across the three platforms.

While PlayStation 2 sales were bolstered significantly by a price drop to $100, the PSP and PS3 both looked extremely weak. Also PlayStation 2 software did not see a corresponding increase, and in fact software sales for the aging platform were down 47% from the same time last year, according to Wedbush Morgan's Mr. Pachter.

At 127,000 systems for the month (31,750 systems per week), the PlayStation 3 had its worst showing since October 2007, right before the introduction of the 40GB system at a lower $400 price.

Moreover, since Sony has made no moves on price in May, it is quite likely that when results for this month are reported in mid-June, the figures will be even lower.

To understand just how attractive the $400 model is relative to the $500 model, the average sale price for the PlayStation 3 hardware (supplied to us by the NPD Group) suggests that the cheaper model is outselling the more expensive one by a ratio of about 9-to-1.

Consequently, Sony faces a PS3 hardware price cut. Publishers and retailers alike have been asking for it, and Sony's Dille made what could be construed as a veiled reference to a near-term price drop in a recent interview. (Such expectations, regrettably, could depress May sales even further.)

The key questions about the PlayStation 3 price drop are “When?” and “How much?”.

According to Sony's latest financial results, it believes it can sell 13 million PlayStation 3 systems globally from April 2009 through March 2010. That's up from the 10 million systems it sold in the previous fiscal year, and the 30% increase in PS3 sales will happen in a tougher economic environment (with higher unemployment, at least in the United States if not globally, and reduced consumer spending).

Yet we already know that United States PS3 sales will be significantly down for at least two months of this new fiscal year (April and May). Even if sales in May are equal to those of April, the PlayStation 3 would be down almost 50% for the first two months of Sony's current fiscal year.

For this reason – to make up for lost sales then increase them year-on-year in adverse economic conditions – we believe Sony will announce a $100 price cut at E3 2009. The longer Sony delays, and the smaller the cut, the harder it will be to make the fiscal year hardware sales target.

We note that others believe the cut could come later, and that it could be only $50. If recent reports are true and Sony still loses $40 on each $400 PS3 unit, a smaller price cut would certainly be gentler on Sony's bottom line.

On the PSP, it is hard to tell what Sony has planned. The recent download-only release of Patapon 2 along with increasing rumors of a hardware revision that nixes the UMD drive suggest that Sony will drop its current retail-focused model and consider using its PlayStation Store as a primary software outlet.

Even the PSP hardware bundles that had previously been so attractive to consumers have lost their appeal, with three core systems at a price of $170 sold for every two $200 bundles (estimated from average sale price figures provided by the NPD Group). A shift to core-only models and online software distribution might make sense.

Consider that the top 10 software titles on the PSP in April 2009 showed only two games released in March 2009 (and first-party games at that), three from 2008, three from 2007, one from 2006, and one from 2005.

Given the anemic sales of new PSP software releases, what would Sony and third-parties lose on a relaunched system and an online store? No one appears to be making much money on the PSP as it is, and removing retailers from the chain of software sales might make the system more attractive to publishers.

While videogame hardware revenue was down 8% in April from the same time last year, software took an even steeper dive. Just in terms of dollars, software sales fell 23%. However, revenue is but one measure of the software market, along with unit sales and the average sale price (ASP). We'll look at all of these below.

The first step to understanding the drop in software sales is recalling that Grand Theft Auto IV on the Xbox 360 and PlayStation 3 and Mario Kart for the Wii – three hotly anticipated releases a year ago and the top three games for the month – sold almost 4 million units of software by themselves in April 2008.

In all, the top 10 titles that month accounted for 5.6 million units of software or 34% of all software units sold.

Other than The Godfather II from Electronic Arts (for Xbox 360 and PlayStation 3), the only other new release in the top 20 during April 2009 was Rhythm Heaven for the Nintendo DS.

In fact, April's top 10 titles didn't total even 2 million units and accounted for only 13% of all software units (compared to 5.6 million units and 34% of all in 2008).

However the top 10 software chart, or even the top 20, cannot capture the full dynamics of the market.

Despite what looks like a loss of 3.6 million units in the top 10 from year to year, the actual loss in unit sales across the entire market was actually less than 700,000. The figure above makes clear how the software picture changed in April 2009 relative to April 2008.

The diagram below tries to make more clear just how the top 10 sales figures were dominant in April 2008 and how the market is broader, but not necessarily significantly smaller, in 2009.

Instead of a handful of new blockbuster titles, like Grand Theft Auto IV, older software titles sold in modest numbers and at lower average sale prices (ASPs).

It is precisely this double hit – slightly lower total unit sales and a corresponding drop in ASPs – that precipitated the 23% drop in dollar sales that many media reports have focused on.

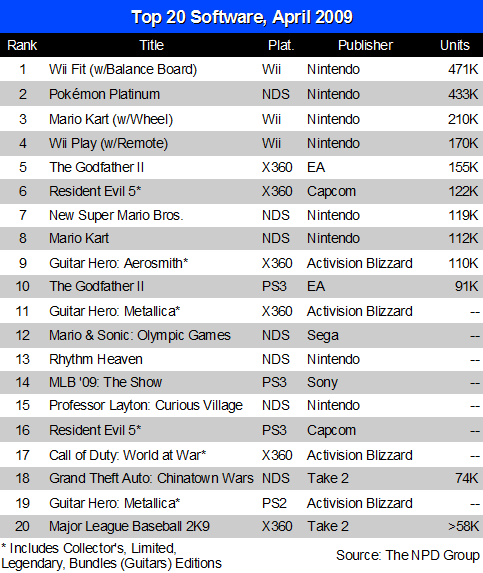

On Friday the NPD Group released its extended list of the 20 top-selling software titles in April 2009.

While the usual suspects appeared near the top of the list – Wii Fit, Mario Kart Wii, and Wii Play – the extended list revealed a surge in Nintendo DS software sales, probably on the strength of Nintendo DSi sales.

Along with Pokémon Platinum, the enhanced remake of Pokémon Diamond and Pearl, at the #2 spot for the month, six other Nintendo DS titles made the top 20.

Those were New Super Mario Bros. (#7), Mario Kart (#8), Mario & Sonic at the Olympic Games (#12), Rhythm Heaven (#13), Professor Layton and the Curious Village (#15), and Grand Theft Auto: Chinatown Wars (#18).

The Xbox 360 had the next best showing in the top 20 with six titles, while the Wii and PlayStation 3 had 3 each, and a single PlayStation 2 game made the chart.

The top 20-selling games for U.S. consoles in April 2009 at retail were listed as follows:

There are several other points of interest in this month's software sales data.

While analysts were vocally disappointed in sales of Take 2's Chinatown Wars during its launch in March, it did have a relatively strong follow-on with 74,000 additional units during its second month, according to figures provided to Gamasutra by the NPD Group.

With the additional April sales, life-to-date sales for the title have reached 163,000. Notably, sales of the game may have been bolstered when Best Buy discounted the game from $35 to $20 temporarily in April.

As of April, Wii Fit has made 12 consecutive appearances on the top 10 list and has reached LTD sales of 7.0 million units. Simultaneously Mario Kart Wii made its 13th consecutive appearance on the chart with a total of 5.9 million units and Wii Play made its 27th consecutive appearance with over 10.6 million units.

Guitar Hero: Aerosmith was heavily discounted at several retailers during April 2009. The Xbox 360 version made it to #9 on the overall chart and each version for the PlayStation 3, PlayStation 2, and Wii made it onto those platforms respective top 10 lists.

The only new console game to make it into the top 20 games for the month was The Godfather II from Electronic Arts. The Xbox 360 version moved 155,000 units and placed 5th while the PlayStation 3 version sold only 91,000 units and took 10th.

According to data provided to Gamasutra for this report, Sony's Killzone 2 sold 58,000 units for the month, dropping it out of the top 20 and bringing its LTD sales to 677,000 units.

As a result of the Killzone 2 figure, we know that Guitar Hero: Metallica for the PlayStation 2 and Major League Baseball 2K9 for the Xbox 360 (numbers 19 and 20 on the chart above) sold in excess of 58,000 units each during April.

The Chronicles of Riddick: Assault on Dark Athena for the Xbox 360 did not reach into the top 20 with its sales in April, but NPD Group data provided to us revealed sales of 57,000 units for the month.

From Dark Athena's position on the Xbox 360 software chart, we can deduce that Halo 3 and Halo Wars each sold somewhere between 57,000 and 74,000 units.

[As always, many thanks to the NPD Group for its monthly release of the videogame industry data. Additional credit is due to Mr. Michael Pachter, analyst for Wedbush Morgan Securities, for his industry analysis. Moreover, thanks to my colleagues at Gamasutra and on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like