Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra analyst Matt Matthews reviews NPD Group's January 2010 sales figures, which reflect evergreen Nintendo-published titles and how Sony is headed towards a single-platform focus.

[Gamasutra analyst Matt Matthews reviews NPD Group's January 2010 sales figures, which reflect evergreen Nintendo-published titles and how Sony is headed towards a single-platform focus.]

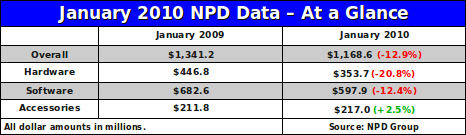

According to the latest video game retail sales figures from the NPD Group, released on Thursday last week, the industry started 2010 with another year-over-year decline. While many analysts now expect the industry to return to growth by March, it is clear that the industry once thought recession-proof is still struggling just to maintain an even keel.

On the hardware front, much is happening. We may be witnessing the collapse of two platforms – Sony's PlayStation 2 and PlayStation Portable.

Simultaneously both Nintendo and Sony have indicated that they are having trouble supplying enough hardware to the market after the furious holiday rush. These factors, along with last year's hardware price cuts pushed hardware revenue down a staggering 21% compared to January 2009.

For the month of January 2010, software prices remained flat when compared to a year prior. Therefore when software unit sales fell by 12.7%, software revenue also fell by nearly the same amount.

In fact, the accessory segment – which consists of controllers, points/cash cards, and many other items – was the only one which showed any revenue growth last month, inching up a mere 2.5%. However, the accessory segment is also the smallest of the big three, and therefore any growth there was more than consumed by the losses in the software and hardware segments.

The table below shows all the revenue data released by the NPD Group about retail video game sales in January 2010 as well as January 2009.

As we look at the available data below, we make three major points. First, it appears that Sony could become a single-platform company in the very near term. Second, Nintendo's evergreen software line-up appears to be getting even more evergreen; that is, the company has more and more titles making consistent appearances at the top of the software sales lists.

Finally, to understand how we might manage to turn the declines around we make a somewhat unusual comparison: how January 2010 is actually more like January 2008 than January 2009.

For months after the PlayStation 3 launch, Sony would respond each month to the latest figures from the NPD Group with a press release citing sales figures for the “PlayStation Family” of systems. Even after seven years on the market, hardware and software sales for the venerable PlayStation 2 were still significant.

And, at the time, the PlayStation Portable's fortunes hadn't completely collapsed. The relative strengths of these other platforms masked the weakness of PlayStation 3 hardware and software sales for more than a year after that system's launch.

Now, however, those other two systems appear to be on life-support, precisely as the $300 PlayStation 3 Slim is finding a surer footing.

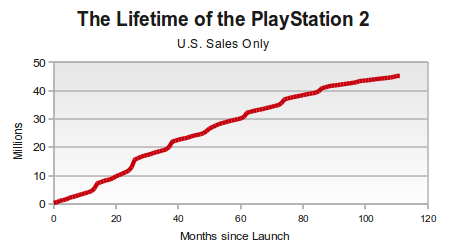

Let's look first at the PlayStation 2, which is now in its tenth year on the market. Recently we've become accustomed to sales records set by the Nintendo Wii, but prior to this era the PS2 was the dominant, record-setting system.

Sony reports that it has sold 140 million systems worldwide, and according to NPD Group figures 45 million of those have been sold in the United States. The figure below shows the trajectory of the system's U.S. life-to-date (LTD) hardware sales.

Sony reported several years ago that software unit sales had exceeded 1.24 billion units, with over 500 million of those just in North America.

Yet, in January 2010 the PlayStation 2 hit a historic low of just over 10,000 systems per week. And according to Wedbush Securities analyst, Michael Pachter, the system's software revenue has been down well over 60% for the last six months, compared to the time one year earlier. In fact, PlayStation 2 software revenue dropped to around 2% of the entire U.S. video game software market in January.

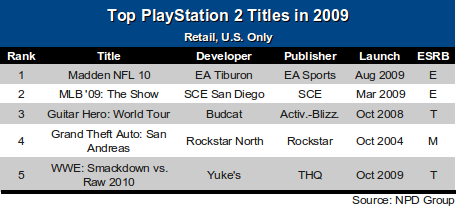

According to the NPD Group, the five best-selling games on the PS2 in 2009 included three sports games, a music game from 2008, and Grand Theft Auto: San Andreas (originally released in 2004).

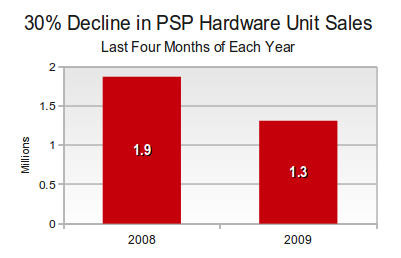

At the same time that the PS2 has become irrelevant, Sony's PSP has been suffering declining hardware and software sales of its own. From 2005 through 2008, the handheld has achieved sales of nearly a million units in the U.S. in the final month of the year. Yet in December 2009 Sony sold just over 650,000 of the handheld, including the newer PSP Go model.

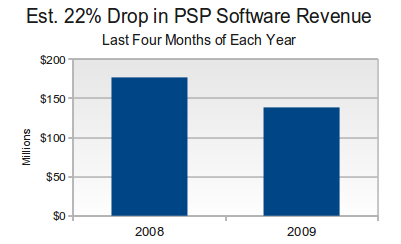

As the figure below shows, hardware unit sales in the last four months of 2009 were 30% lower than in the last four months of 2008.

On the software front, PSP software has hovered around 4-5% of the total software revenue in the U.S. but in January 2010 the system generated less than 3% of the industry's software revenue. The decline in PSP software sales is far more severe than what the industry has seen overall, as the figure below shows.

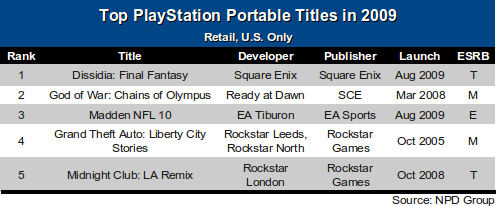

Sony tried to push the PSP back to the forefront with the PSP Go launch and the arrival of several high-profile games at the end of 2009. Among these were Gran Turismo, a game promised and expected since the system's 2005 debut, and Grand Theft Auto: Chinatown Wars.

Yet with Sony heavily backing Gran Turismo and an established GTA fanbase on the PSP, these two games still failed to make the top 5 PSP games in 2009. Instead Square-Enix's Dissidia: Final Fantasy was the top-selling PSP game for the year. The only other 2009 title to make the top 5 was EA's Madden NFL 10.

It's difficult to say where Sony should go with the PSP at this point. When it launched, it was a strong internet-enabled gaming device, but in the era of the iPhone and Nintendo DSi the PSP's advantages have largely disappeared. We don't see the advantage of the rumored PSP-4000 (thought to still contain a UMD drive), but would favor winding down the current hardware platform and preparing a successor with backward compatibility to hasten the transition.

The problem is made more complex by the PSP's continued strength in Japan, where it continues to sell relatively well and where several PSP titles sold well in 2009.

Which brings us to the PlayStation 3, the only part of the PlayStation family that doesn't appear moribund. In fact, it seems notable that SCEA president and CEO, Jack Tretton, did not even mention the PSP or PS2 in his recent comments posted on the PlayStation Blog.

At $300, the newer Slim hardware model has revitalized the prospects of the PS3 for 2010. Sony still expects to launch several big titles, like God of War III and Gran Turismo 5, sometime this year. Other titles, like Square-Enix's Final Fantasy XIII -- the latest in a franchise closely associated with the PlayStation brand -- could also figure into the system's popularity with consumers, although the game will also be on Xbox 360. On the other hand, we have yet to determine the value of Sony's upcoming, unproven motion controls and 3D television compatibility.

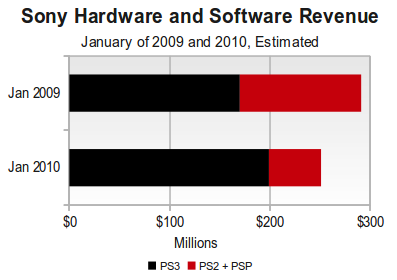

Yet, even these hardware and software sales will not cover the losses from the other two systems. Compare our estimates of Sony's software and hardware revenues in January 2009 and January 2010 below, and it is clear that the PS2 and PSP slices are shrinking faster than the PS3 slice is growing. We estimate that the combined software and hardware revenue from the PS2 and PSP accounted for less than 6% of the hardware and software market in January 2010.

In the coming year we expect the winding down of the PlayStation 2, including the end of the iconic Madden NFL series on the system. We think it's likely that Sony will announce a true successor to the PSP, perhaps not due until 2011.

Then Sony will effectively be a one-platform company, at least for 2010. To that end, Sony will spend most of the year touting the out-of-the-box value of the PS3 while declining to respond to any price drops by competitors. After all that, it seems likely that Sony's share of the market (in dollars) will finally end up around the same as that of its most direct competitor, Microsoft.

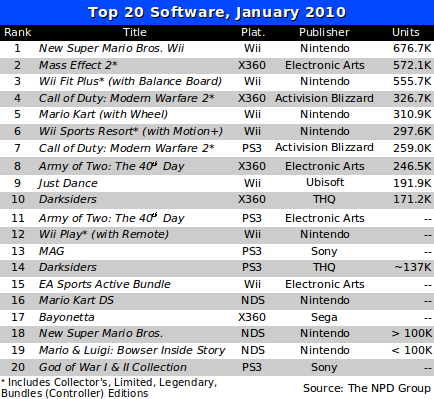

On Friday, the NPD Group released its extended top 20 all-format software chart. As noted previously, the list is interesting for the appearance of several new properties.

In particular, THQ's Darksiders appeared on the list for both the Xbox 360 (#10 with 171,000 units) and the PlayStation 3 (#14 with around 137,000 units, according to Doug Creutz of Cowen & Company).

Sony's new PS3-exclusive shooter, MAG, placed #13, and below that at #17 was the Xbox 360 version of Platinum Games' Bayonetta with just over 100,000 units. (According to Wedbush's Michael Pachter, only 18 titles sold more than 100,000 units in January 2010.)

Moreover, Ubisoft's Just Dance for the Wii is a new property, launched in November 2009, that made a strong showing in both December and again in January (#9 with 192,000 units).

We should see more new titles like these in the coming months, along with several sequels, that were pushed out of the last quarter of 2009 to avoid competing with Call of Duty: Modern Warfare 2 from Activision-Blizzard.

However, we think that the more telling trend visible in the January 2010 all-format chart is the apparent establishment of New Super Mario Bros. Wii as yet another evergreen title from Nintendo.

Look below at the top 20 chart, and pick out the Nintendo-published titles for the Wii and Nintendo DS. We'll go over each of them, with details, underneath the figure.

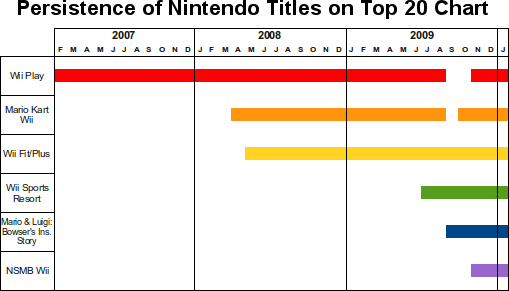

Much has been made of the long, broad appeal of Nintendo's software, but it is difficult to grasp the timescales involved when the charts are viewed a single month at a time. Consider graphical representation of the appearance in the top 20 all-format chart of several key Nintendo titles.

Here is a brief rundown of just how dominant Nintendo's titles have been, measured from their positions in the top 10 and top 20 charts.

Wii Play – First released in February 2007, this game has been in the top 20 for 34 of the last 36 months. Perhaps more impressively, it has been in the top 10 a stunning 29 times. It was the 2nd best-selling game in all of 2007, the top-selling game in 2008, and the 7th best-selling game in 2009.

Mario Kart Wii – The essential Wii racing game has appeared in the top 10 for 20 of the last 22 months. In one month it missed the top 10 but placed in the top 20. It was the #2 best-selling game of 2008 and the #6 best-selling game in 2009.

Wii Fit and Wii Fit Plus – The first iteration of this fitness title launched in May 2008, and its successor was released in October 2009. At least one of these titles has been in the top 10 for 20 of the last 21 months. The one month is wasn't in the top 10 it was still in the top 20. Wii Fit was the #3 title for all of 2008 while Wii Fit and Wii Fit Plus took the #4 and #5 spots, respectively, on the best-selling software chart for all of 2009.

Wii Sports Resort – The follow-up to the Wii pack-in game has been in the top 10 every month since it launched in July 2009, and was the #2 best-selling game of all of 2009.

To these four major lines we can consider adding at least two Nintendo DS games. New Super Mario Bros. for the Nintendo DS was released originally in May 2006 but has appeared in the top 20 for at least 15 of the last 21 months, four of those appearances also in the top 10.

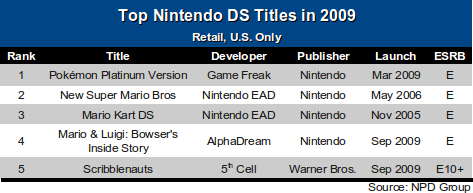

Moreover, Mario Kart DS has placed in the top 20 during 12 of the last 15 months. These older Nintendo DS titles sell so well that they are still outselling newer software on the platform each calendar year, as demonstrated in the following table of the top 5 Nintendo DS titles in 2009.

Given these precedents, it seems likely that New Super Mario Bros. Wii will follow in the footsteps of its handheld predecessor. Under those circumstances, we expect it to be a top 10 software title at the end of 2010.

As new Wii systems are added to the installed hardware base, it appears they are continuing to choose these Nintendo standards as part of their software library. Other than the end of the Wii's run as the dominant console platform (at least in terms of sales), it's hard to come up with a convincing reason for these standards to fall off the sales charts.

From a purely economic point of view, these titles present an impediment to at least some third-party software sales. If each new Wii owner is going to buy one or more of the standard first-party games (and this seems likely the case), then those owners will likely also have less money to spend on third-party games, at least at that time.

Then one key for third-parties is to be ready for when that consumer returns for a new game at some point later. Getting the consumer's attention in the crowded Wii software market requires not only an easily understood premise (see Just Dance), but probably also brand-recognition (LEGO Star Wars has done well) and at least some promotion (as Nintendo itself did with Professor Layton). Nintendo's own software success is simply part of the playing field when courting the Wii consumer.

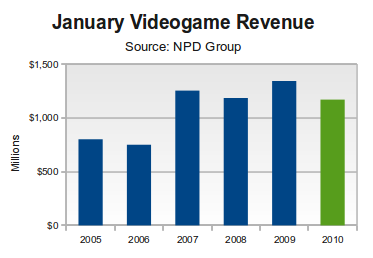

During 2009 we repeatedly looked back not to 2008 but to 2007 for a more reasonable comparison of the monthly revenue figures. The video game buying spree that consumers embarked upon in 2008 carried over at least through January 2009. In fact, February 2009 is the last month in which the industry had reported strong growth.

Therefore, instead of comparing January 2010 directly to the year prior, it actually makes some sense to look back two years to the last normal opening of a new calendar year.

We should note that publishers did not en masse move titles into the first quarter of 2008 to avoid the November 2007 release of Call of Duty: Modern Warfare. In that respect, at least, the comparison of January 2008 and January 2010 could be called ill-suited.

The following figure gives some context for the magnitude of the total industry revenue historically recorded in January, going as far back as 2005.

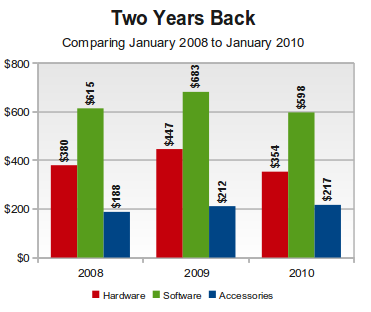

When we break it out into separate segments, the comparison to 2008 seems even more apt. Not only is the total revenue from each of January 2008 and January 2010 similar, but the revenues for hardware, software, and accessories are actually very close.

As the figure above shows, when compared to the last normal January, the industry is actually fairly stable. Hardware revenue dropped slightly, but actual hardware units were up 8% from 1.52 million in 2008 to 1.64 million in 2009. The drop in revenue, therefore, is completely explained by price cuts, especially on the Wii and PlayStation 3.

Again, looking back two years we see that software revenue dropped about 3%. However, we would point out that at least some of that revenue in 2008 came from sales of high-priced Guitar Hero III and Rock Band instrument bundles. Remember, two versions of Guitar Hero III made the top 10 in January 2008, as did one version of Rock Band.

Finally, accessory revenue is up a very healthy 15% in the last two years. While the NPD Group no longer provides accessory sales rankings, comments by Anita Frazier in the past few months have indicated that extra controllers for all systems, as well as Xbox Live points cards, have been top-sellers.

Some accessories are actually more expensive now than they were in 2008. For example, the $55 DualShock 3 has replaced the $50 Sixaxis controller for the PlayStation 3, and Nintendo offers the MotionPlus remote for $55 over the original $50 remote. Moreover, as Microsoft has continued to expand its Xbox Live customer base, the demand for its points cards has no doubt increased as well.

We believe the exceptionally strong sales in January and February 2009 are part of the reason that many analysts (like Doug Creutz of Cowen & Company and Michael Pachter of Wedbush Securities) are suggesting that the industry will return to year-over-year growth by March of this year. And we believe you can get a sneak preview of those flat-to-modest-growth results expected by the end of the first quarter by precisely the 2008-to-2010 comparison we have carried out above.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance and Anita Frazier for her analysis. Additional credit is due to Michael Pachter, analyst for Wedbush Morgan Securities, for his perspective and information. We also thank Doug Creutz of Cowen & Company for his comments and insight. Finally, many thanks to colleagues at Gamasutra and commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like