Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

In this exclusive analysis, Gamasutra's Matt Matthews looks in-depth at November's NPD U.S. results, revealing the real economic picture, Sony's challenges and much more.

Nintendo's grip on the videogame market has never been more evident than last Thursday, when the NPD Group released sales data for November, the first month of the 2008 holiday shopping season. Consumers purchased 2 million Wii consoles, 1.5 million Nintendo DS handhelds, and more than $700 million of software for the two systems combined.

This isn't to say there weren't bright spots for Sony and Microsoft, but they're much smaller accomplishments by comparison. Furthermore, even dominant software publishers like Electronic Arts are having difficulty finding a market for their newest wares.

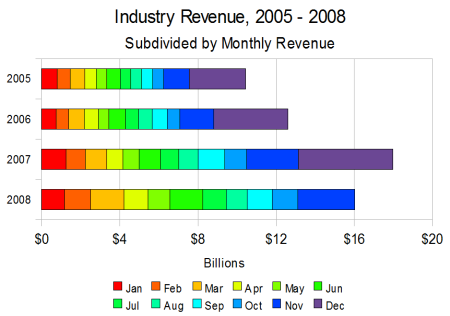

Overall industry sales for the month were up 10 percent, and year-on-year and year-to-date sales are still up 22 percent, but much of that growth was realized earlier in 2008. Analysts had expected the industry to reach a total annual revenue of $22 - $24 billion, but it now appears that the industry may not even reach the low end of that range.

According to the NPD Group's data, 2.04 million Nintendo Wii consoles were sold during the four-week tracking period ending 29 November 2008. No platform in history has ever sold as many systems in November as the Wii did this year.

Microsoft's Xbox 360 enjoyed robust sales of 836,000 systems, a year-on-year increase of 8.6 percent. Wedbush Morgan Securities analyst Michael Pachter, has said that the system's average sale price (ASP) during November was $270. That marks a slight decrease from September and October, and indicates that the $200 Xbox 360 Arcade model is attracting more consumers.

Sony sold 378,000 PlayStation 3 systems during the month, a disappointing decrease from last year's total of 466,000 systems. Sony currently offers the highest-priced console (from $400 to $500, depending on the specifications) -- and is consequently selling fewer systems.

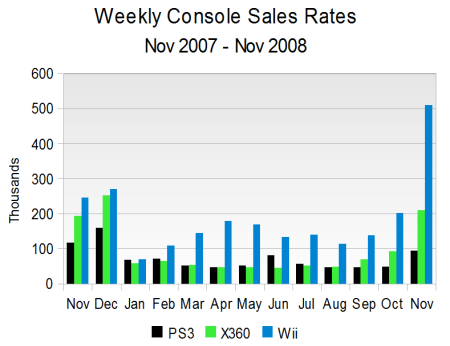

It is standard to compare average weekly sales rates to account for the different number of weeks in the monthly tracking periods.

Console unit sales often more than double from October to November, and in fact Xbox 360 sales were up 120 percent from the previous month and Wii sales were up 154 percent. The PlayStation 3 just missed doubling its October sales, with a growth of just 98 percent month-on-month.

The only other system not to double its October sales in November was the PlayStation 2, which saw an increase of only 51 percent. Nintendo DS sales jumped 220 percent from the prior month and PlayStation Portable (PSP) sales were up 118 percent.

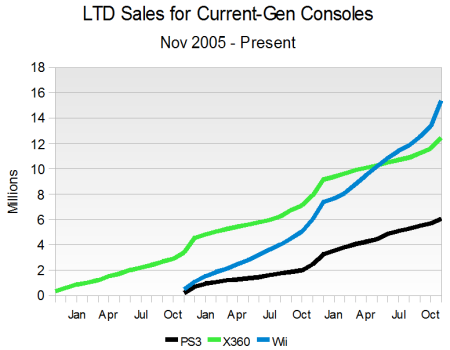

When the Wii launched in November 2006 it was 3 million systems behind the Xbox 360. Today, two years later, the roles are reversed and it is the Wii ahead of the Xbox 360 by the same margin.

Simultaneously, the PlayStation 3 has struggled to make up ground against the Xbox 360. During 2007 the Xbox 360 consistently outsold Sony's newest console, but then for a few months in early 2008 the PlayStation 3 made modest gains. The September 2008 Xbox 360 price cuts have since eliminated those gains.

This story is difficult to perceive in traditional installed base graphs because holiday sales spikes distort the figures. Here is the race as we have often pictured it.

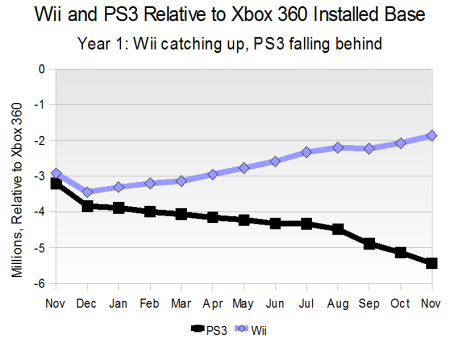

The following graphs, however, provide a much more informative reading of history. The first figure below covers the period from November 2006 to November 2007.

The above graph shows the installed bases of the PlayStation 3 and Wii, relative to the Xbox 360's installed base, starting in November 2006. Each started around 3 million systems behind the Xbox 360, represented as a vertical displacement of -3 million on each curve.

Starting with November 2006, the PS3 lost ground to the Xbox 360 at a nearly constant rate through much of its first year, with a slowing during July 2007 when Sony first adjusted the prices of the PlayStation hardware. Microsoft's own August 2007 price cuts and strong software lineup then pushed the PS3 further behind through November.

At the same time, the Wii was catching up to the Xbox 360, slowed only momentarily when Halo 3 launched.

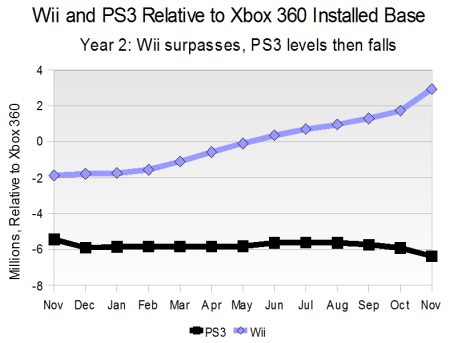

The next graph, covering the period from November 2007 to November 2008, tells a much different story.

Sony's November 2007 price drop was very effective. Instead of losing ground to the Xbox 360, it actually made some modest gains through July 2008, with a bump from the June sales which accompanied the release of Metal Gear Solid 4.

When Microsoft cut prices again, this time in August 2008, Sony began to lose ground and has ended its second year about twice as far behind the Xbox 360 as it was when it launched in November 2006.

By comparison, Nintendo was still hampered by hardware shortages during Holiday 2007 but then caught up to – and surpassed – the Xbox 360 by mid-2008. This is clearly shown in the graph as the Wii curve passes through zero and up toward a positive 3 million.

There are several facts which deserve careful consideration when assessing the current videogame industry.

Consumers are extremely pessimistic about the current economic outlook, according to the Conference Board Consumer Confidence Index. The Index reached a record low in October 2008.

The National Bureau of Economic Research has determined that the American economy has been in recession since December 2007.

Despite those factors, the videogame industry is still growing, up 22 percent for the year and up 10 percent in November alone.

The conventional wisdom holds that videogames as a medium offer a significant entertainment-to-dollar ratio compared to alternative media, and therefore the videogame industry may survive or even thrive while others struggle through hard times.

So the correct question to ask is not "How can the industry possibly still be growing?" but rather "How robust would the growth be if not for the poor state of the economy?" That is, if the industry can manage 10 percent growth in the midst of the worst economic downturn for decades, what could it be doing if consumer confidence were higher, unemployment were lower, and the credit markets were functioning properly?

Moreover, it is clear that not every player in the videogame market enjoys the same warm consumer reception. Sony's situation in particular is worth examining.

Sony is still trying to make the PlayStation 3 business profitable and start paying off the costs of developing the hardware. Its software sales are strong, despite weaker hardware sales, but both will need to improve significantly, and soon. Given Sony's ironclad devotion to profitability in the near term, the quickest route to higher PS3 sales -- a price drop -- simply is not feasible.

As an alternative, Sony could publish a must-have software title that attracts more consumers willing to pay the price for its hardware. Short of Metal Gear Solid 4 in June 2008, it would appear that no exclusive software has really driven hardware sales. Even Sony's flagship holiday title, LittleBigPlanet, only managed 141,000 units during November.

The PSP hardware business is actually robust and profitable, even though November hardware sales were down year-on-year. Software sales are still miserable. Until it finds a way to monetize the PSP market, Sony will never begin to make the kind of money from its handheld that Nintendo makes from its Nintendo DS.

For its part, the PS2 is still selling well in its ninth Christmas season, but is slowly fading out. Two years ago, or even a year ago, Sony might have been able to point to the PS2 as a solid source of revenue while the PS3 was finding its footing. That is less feasible with each passing month.

If Sony can find solutions to its PS3 and PSP problems (price reduction for the former, much greater software sales for the latter), then it should compete well against the Xbox 360 and Nintendo DS in 2009.

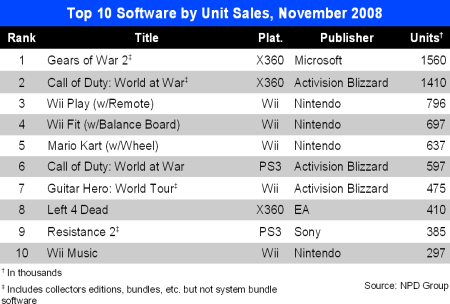

The NPD Group released the following data on the ten top selling videogames during November 2008.

Selling 1.56 million units in 22 days, Gears of War 2 for the Xbox 360 (developed by Epic Games, published by Microsoft Game Studios) was the top seller for the month. It performed significantly better in its first month than its predecessor, the original Gears of War, which sold 1 million units during November 2006. (Microsoft has since announced that Gears of War 2 has sold 3 million units worldwide.)

The biggest cross-platform release was Call of Duty: World at War (from Activision), which sold almost 2.2 million units across the Xbox 360 and PlayStation 3, ranked second and sixth, respectively. The previous iteration of the game, Call of Duty 4: Modern Warfare, launched in November 2007 and posted 2.0 million units in its first month on those same two platforms.

Resistance 2, Sony's follow-up to the popular launch title Resistance: Fall of Man, sold 385,000 units during November.

Taking spots 3 through 5 in the top 10, respectively, are the now-familiar trio of Wii Play, Wii Fit, and Mario Kart. Wii Play has now reached sales of over 3.8 million in 2008 and well over 7.9 million since its launch 21 months ago in February 2006. Mario Kart now stands at over 4 million units since it was released in April of this year.

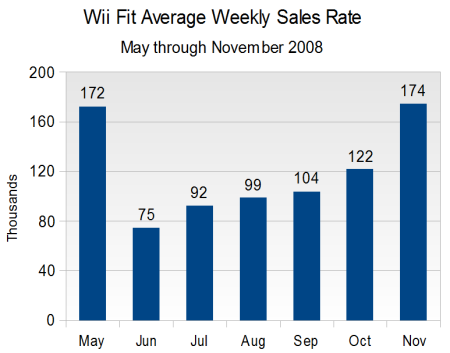

The sales trend of Wii Fit really is unusual. Most games are “frontloaded”, and sell best during their first weeks, tapering off over the course of the following months. Nintendo has had exceptional titles like Wii Play and Mario Kart which have had consistently good sales over the course of several months. Yet, Wii Fit follows neither of these trends: its sales have increased each month for half a year!

Sales of Wii Fit dropped to 75,000 units per week in June after a very strong 172,000 units during its launch in May. However, average weekly sales have then increased every month since, culminating with its strongest month ever during November when it sold 174,000 units per week. If supplies hold out, Wii Fit could surpass even that new high in December.

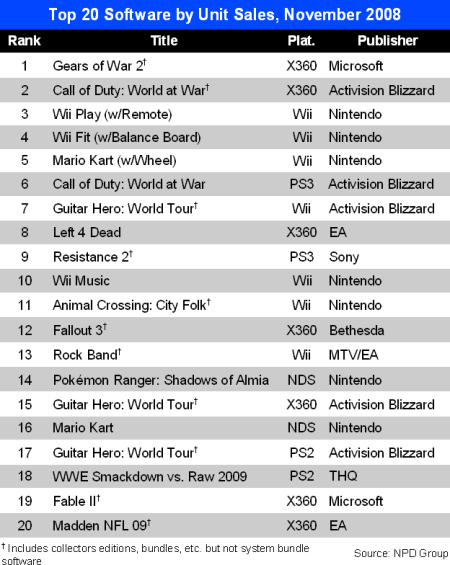

The NPD Group released an extended top 20 software list on Friday. It gives a broader view of the software landscape, and also shows an interesting trend: music-oriented titles appear to sell well on the Wii.

Of the five music titles in the top 20, the Wii has the top three: Guitar Hero: World Tour at number 7, Wii Music at number 10, and Rock Band (the original game, not Rock Band 2 due in mid-December) at number 13. Further down the list are Guitar Hero: World Tour for the Xbox 360 (15th) and PlayStation 2 (17th).

The other key music title currently out, Rock Band 2, did not make the all-format top 20 nor did it make the Xbox 360 top 10 for the month. It was, however, the 10th best-selling game on the PlayStation 3 in November (behind the PS3 version of Guitar Hero: World Tour, which was fifth).

Recently Electronic Arts announced that sales in the United States and Europe were not in line with its previous estimates, and therefore it would not meet its expectations for its fiscal year ending 31 March 2009. As a result, the company would enact several cost-cutting measures, including consolidation of its workforce and elimination of some planned titles.

Electronic Arts had previously professed its faith in the creative process and the potential profit to be found in new properties. Titles like Mirror's Edge and Dead Space, both completely new material, were key to the company's end-of-year strategy.

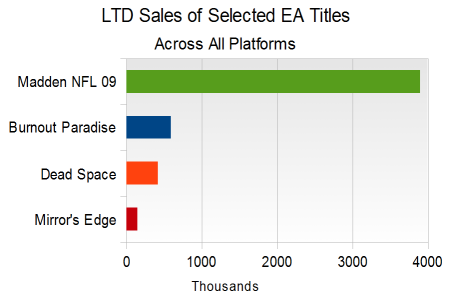

To get an idea of EA's position, it is instructive to consider the following data, provided to Gamasutra by the NPD Group. The figure below shows the life-to-date (LTD) sales figures for four key EA properties: Madden NFL 09, Burnout Paradise, Dead Space, and Mirror's Edge.

(Only Dead Space is currently available for Windows PC as well as consoles, so the data above includes all of those platforms. Data for the other three games includes only console and handheld versions.)

Not pictured, but worth mentioning, is Spore -- available for Windows PC, MacOS, and the Nintendo DS -- which has sold in excess of 2 million units since its launch.

What should EA make of these results? Its biggest annual software release, Madden NFL, is still doing quite well, although it is not growing its installed base as it has in the past. EA's high-profile designer, Will Wright, delivered a multi-million seller with Spore, but we have yet to see whether EA can successfully exploit it with add-ons as it had previously done with Wright's earlier game, The Sims.

To these successes we add Burnout Paradise, the latest iteration of the well-regarded Burnout series and the first on current generation consoles. It moved around 230,000 units (for the Xbox 360 and PS3 combined) when it launched in January of this year, yet the game is just now reaching 600,000 units LTD, even with heavily promoted gratis downloadable content. It goes without saying that Burnout Paradise probably has not lived up to the company's expectations. (It should be noted here that the complete PlayStation 3 game is available for download from Sony's PlayStation Store and sales figures for that version have not been released by either Sony or Electronic Arts.)

The two new creative ventures, Mirror's Edge and Dead Space, have both failed miserably. This is in spite of lengthy and extensive marketing for each game, including a series of graphic novel-style backstory trailers for Dead Space released over several months.

The brightest spot in EA's line-up turns out to be Left 4 Dead, a cooperative shooter developed by Valve and published by EA. The Xbox 360 console exclusive was 8th for the month of November with sales of 410,000 units. (It is also available for Windows PC, both as a boxed product and through Valve's own distribution platform, Steam.) The challenge for EA is generating those kinds of hit titles with the studios it owns.

In comments accompanying the media release on Thursday, NPD Analyst Anita Frazier commented that "the industry is still on pace to achieve total year revenues of $22 billion in the U.S." This expectation deserves closer scrutiny, since it tells us what kind of revenue the industry might realize in December.

As the graph above demonstrates, the industry will have to generate about $6 billion of revenue in December to reach $22 billion by the end of the year. That would represent year-on-year growth of 24 percent for the final month of 2008.

Looking at the first seven months of the year when year-on-year growth ranged from a low of 17.7 percent up to 56.6 percent, such expansion might have been natural, if not slightly pessimistic. However, growth has been much slower from August to November (ranging from -6.6 percent to 17.0 percent). Something exceptional will have to happen in December for growth to hit 24 percent over 2007.

If the industry maintains the growth shown in November, revenue in December could reach $5.3 billion and result in a more modest $21.3 billion for all of 2008.

As always, many thanks to the NPD Group for its informative monthly data on the videogame industry, and in particular to David Riley for providing additional information used in this article.

Read more about:

FeaturesYou May Also Like