Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra's in-depth NPD analysis returns with a deep dive into September's U.S. numbers - exclusively revealing the full top 20 games, tie-in ratios, and plenty more on key hardware and games.

[Gamasutra's in-depth NPD analysis returns with a deep dive into September's U.S. numbers - exclusively revealing the full top 20 games, tie-in ratios, and plenty more specifics on how hardware and games are faring.]

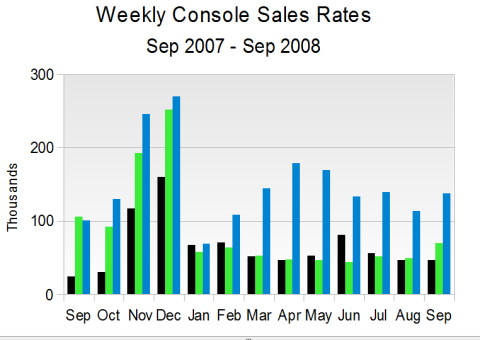

Industry observers always knew that the launch of Halo 3 would be difficult to match. After the NPD Group released September 2008 videogame industry sales figures on Thursday, everyone knew: the value of sales were down 7% from the same period last year. Relative to August, only the Xbox 360 and Nintendo Wii saw increased hardware sales, while Sony's PlayStation 3 was flat, and all other systems experienced a drop in sales.

In this month's overview we will explain the effect of the Xbox 360 price cuts, and how the PlayStation 3 and Wii are positioned as the holiday sales season begins. We'll also pore over the top 20 software list, and then provide updated tie ratios for the current generation systems.

After assessing the growth in software sales throughout 2008, we'll take a brief look at what analysts expect for the remainder of the year and how October sales may finally reveal whether the industry is being affected by the larger economy.

Price drops are exciting not just for consumers but also for those of us who watch the market and track sales. We fully expected strong sales of the Xbox 360 this month, given the significant price cuts Microsoft made on 7 September:

Xbox 360 Arcade cut from $280 to $200

Xbox 360 Premium cut from $350 to $300

Xbox 360 Elite cut from $450 to $400

The price cuts worked: 69,000 Xbox 360 systems were sold each week during September, giving Microsoft its best hardware month this year. What is far more telling, however, is how the average price of each system sold changed after the price drop.

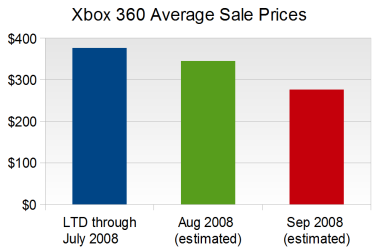

According to the NPD Group, the average sale price (ASP) of an Xbox 360 from its launch through July 2008 was just over $376. We estimate that the ASP was in the $330 to $340 range during August.

For September, we estimate that the ASP of the Xbox 360 dropped to $276, about $100 below its lifetime average and more than $50 below its average before the price drop. If our estimates are correct, then this signals an even greater role for the $200 Arcade model in Microsoft's hardware mix.

It is worth making two quick historical comparisons. The first Xbox 360 price drop, in August 2007, spurred a 63% increase in sales over the previous month. Then in September 2007, the month of Halo 3 and the second month of the lower Xbox 360 prices, sales rose over 50% from the already elevated August 2007 levels.

This year, with least expensive Xbox 360 model dropping below the price of the Nintendo Wii and finally hitting half the price of the least expensive PlayStation 3, Microsoft's system managed only a 43% increase in sales.

By these measures, the September 2008 price drop appears to have less of an effect than last year's more modest cuts. At least part of the difference is that the Xbox 360 sales this year have never been as weak as they were in July 2007, but there is still a lingering impression that Xbox 360 could have been stronger.

Regardless, with the deepest software library and the lowest entry-level price, Microsoft's price cut ideally positions the Xbox 360 for the coming holiday season.

Interestingly, Sony's PlayStation 3 did not suffer a drop in sales during September as some had expected. The weekly sales rate was, in fact, flat from August, at just over 46,000 systems per week.

For the moment, Sony can feel hopeful, but the headlines in the coming months should put tremendous pressure on them to cut the prices of the PlayStation 3.

Sony's quandary is this: it appears to have cut PlayStation 3 costs and prices as far as it can while maintaining its promise to reach profitability for the fiscal year (which won't end until 31 March 2009). Gone are the numerous memory card slots and the PlayStation 2 compatibility and extra USB ports, saving a few dollars per system.

Last year's free Blu-Ray voucher program would not benefit the PlayStation 3 as much this year, given the competition from the new generation of less expensive Blu-Ray players. The holiday bundle will be a PS3 with a copy of the adventure game, Uncharted.

While Uncharted is a wonderful game, and a great example of the PS3's power, it lacks the market recognition to do more than appear as a generic pack-in game to most consumers.

Even with an ASP far closer to $400 than just a few months ago, the PS3 will be exposed on price like never before, especially since its primary competitor has increased the average price gap between the systems to $125.

Ultimately, Sony must decide if it believes its own slogans. If they really intend the PlayStation 3 to have a decade-long lifecycle, then working through another tough Christmas should not be as important as fiscal health. But it has enjoyed being in second place in year-to-date sales and is likely to get clobbered, and the press will surely not be gentle.

The Nintendo Wii, too, may have another rough Christmas season, although for a different reason: demand may once again outstrip supply. However, Nintendo seems to be preparing for the coming frenzy and providing Wii hardware to retailers at a more rapid pace.

After a modest dip in August, sales were back over 137,000 units per week in September, even higher than sales from October of last year.

If supply has been throttled and is now being released by Nintendo, and demand continues through the end of the year, then we should expect Nintendo to sell in excess of 3 million systems through the end of 2008, achieving an installed base of 16 million systems in just over two years.

Incidentally, if the increased sales of the Xbox 360 did not erode either Wii sales or PS3 sales, then where did those consumers come from? Here's one suggestion: potential PlayStation 2 owners.

Undoubtedly, the PS2 continues to be a tremendous value, even at a slightly high $130. However, the new price of the Xbox 360 Arcade not only puts it $50 below the Wii, but only $70 above the PS2.

With a robust used game market providing a pool of inexpensive back catalog software, the Xbox 360 Arcade may well be attracting consumers shopping for a cheap system and cheaper software.

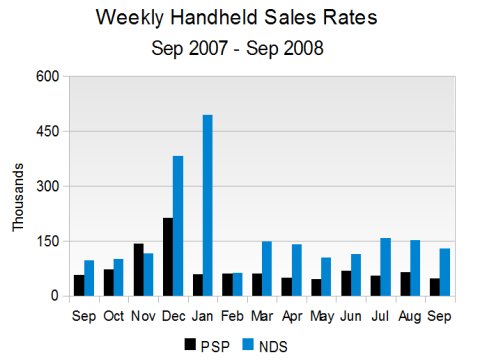

On the handheld front, the usual story continues to play itself out: the Nintendo DS outsells Sony's PSP two-to-one. As it nears the end of its fourth year, the success of the Nintendo DS is difficult to understate: year-to-date sales are up 20% over the same time last year.

And it is only against the backdrop of the Nintendo DS that the PSP looks like it is struggling. Sony's handheld is successful by any other measure, and sales are up 14% from the first nine months of 2007 even as its software market continues to struggle.

Sony has introduced a new model, the PSP-3000 (also known as the PSP Brite for its improved LCD screen), and bundle sales of this model have already begun. Those sales will be counted when October figures are reported. A standalone version of the PSP-3000 will reportedly appear later, possibly in November.

Given the same pricing structure, general consumer affinity for PSP bundles, and the lack of any compelling PSP software releases in the near future, the new PSP hardware will likely not affect sales noticeably in the near term.

(Nintendo has also announced a new model of the Nintendo DS, known as the Nintendo DSi, which will not appear in North America until sometime in 2009.)

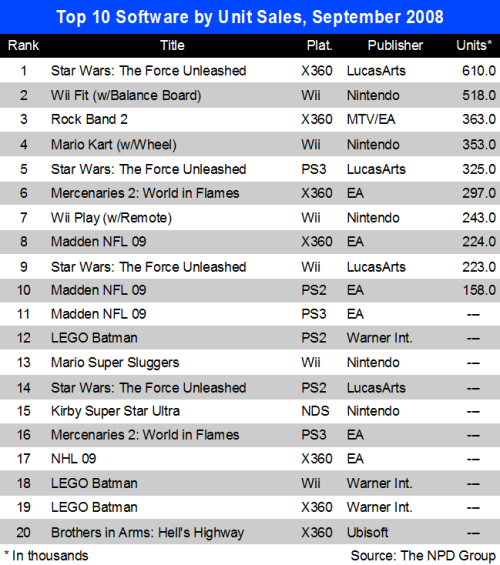

In Thursday's release to the press, the NPD Group provided the top 10 software titles, ranked by unit sales. Below is the extended top 20 chart provided to Gamasutra, with the caveat that NPD does not generally provide unit sales for games outside of the top 10.

As expected, Star Wars: The Force Unleashed from LucasArts was the top seller for the month, leading on the Xbox 360 with 610,000 copies.

Three other versions made the top 20: the PS3 version (#5 and 325,000 copies), the Wii version (#9 and 223,000 copies), and the PS2 version (#14 and over 100,000 copies, according to notes from Michael Pachter of Wedbush Morgan).

With the Nintendo DS and PSP versions below 100,000, Star Wars: The Force Unleashed probably sold around 1.4 million copies during its launch month.

A now common trio of Nintendo Wii exclusives populated the top 10: Wii Fit (five months on the chart, sales of 2.3 million copies), Mario Kart (six months, 3.1 million copies), and Wii Play (20 months, 2.7 million YTD and 6.9 million LTD).

Wii Fit sales accelerated again in September, up from 98 thousand copies per week to nearly 104 thousand copies a week. Mario Kart for the Wii has sold one copy for every two Wii systems sold in the past quarter, the kind of recurring role that Wii Play has held for over a year and a half.

The software release of Rock Band 2 for the Xbox 360 in mid-September sold well enough to reach #3 on the chart, with sales of 363,000 units. (The hardware bundles will go on sale this weekend, on 19 October.)

The Xbox 360 version of Mercenaries 2: World in Flames, developed by Pandemic and published by Electronic Arts, appeared at #6 on the chart after moving 297,000 copies. (The PS3 version sold somewhere between 100,000 and 150,000 copies and ranked #16 for the month.)

Finally, last month's hit game, Madden NFL 09, took three spots in the top 20 for September: the Xbox 360 version at #8, the PS2 version at #10, and the PS3 version at #11.

Warner Interactive's LEGO Batman was available for 12 days during NPD's September period, and three versions ranked in the top 20. The PS2 was the lead version at #12, and the Wii and Xbox 360 versions ranked #18 and #19 respectively for the month.

Given Mr. Pachter's comments that eighteen titles sold more than 100,000 units, we can say that the PlayStation 2 and Wii versions of LEGO Batman had sales over 100,000 each, while the Xbox 360 was probably just below 100,000.

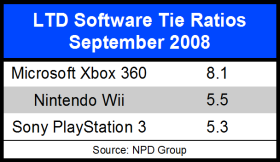

The tie ratio for a platform is the total number of software units sold for every unit of hardware. As NPD Group analyst Anita Frazier says, “they can be an indication of the health of a system”, but can also be used in misleading ways.

She goes on to explain: “As a system gets further along in its lifecycle and perhaps hardware sales start to diminish, the tie ratio tends to go up because software sales are the bigger draw."

"If a hardware system is doing gangbuster sales, then the tie ratio can go down even if there are lots of overall sales.”

Because Xbox 360 owners enjoy buying lots of software, Microsoft often publishes its own tie ratio in its monthly press release regarding sales figures.

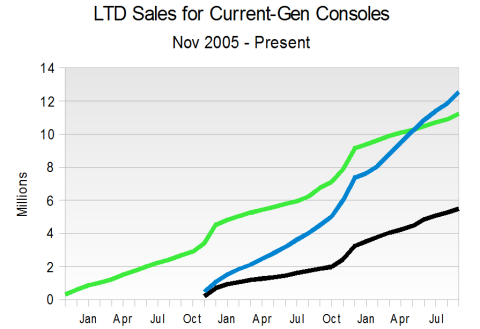

The NPD Group provided Gamasutra with updated tie ratios for the other two current generation platforms, allowing us to see the lifetime to date totals across the Xbox 360, the PlayStation 3 and the Wii, as follows:

We might choose to interpret these numbers as follows: each Xbox 360 owner has purchased on average 8.1 games, while Wii owners have purchased 5.5 games and PS3 owners have purchased 5.3 games. As with any average, it is a statement about the aggregate, not the individual.

For reference, the tie ratios at the end of 2007 were 6.98 for the Xbox 360, 4.64 for the Nintendo Wii, and 4.26 for the PlayStation 3. Our estimate of the tie ratio for the Nintendo Wii in June 2008 was around 5.5, and we believe that the tie ratio for Nintendo's platform may have held roughly constant since that time. By comparison, Microsoft's tie ratio has increased by about 0.1 each month since early 2008.

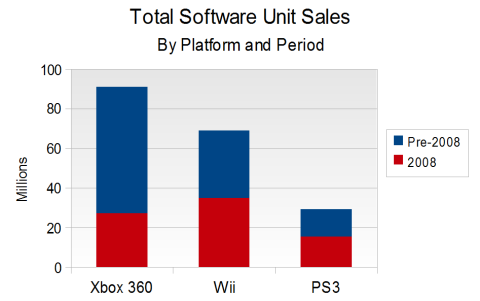

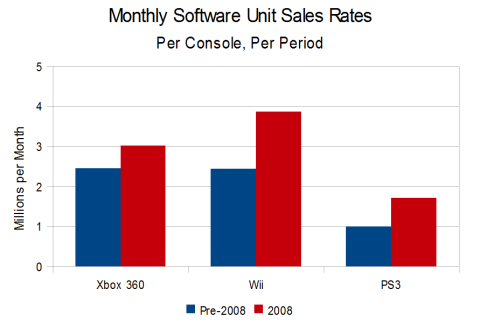

These figures may be used together to get an idea of how well software has sold for each platform overall and during the first nine months of 2008. The following figures show that data:

Over 91 million units of software have been sold on the Xbox 360, with 27 million units of that software being sold so far in 2008. For the Wii, around 69 million units of software have been sold with just over half of those sales from this year.

More than 29 million units of PlayStation 3 software have been sold, and well over 15 million of those were sold during 2008. (Since the Xbox 360 launched a year prior to the Wii and the PS3, we may also compare their figures to Xbox 360 software sales in September 2007; at that time 44.5 million units of Xbox 360 software had been sold.)

Microsoft's best angle on these figures is that Xbox 360 owners buy more software, per system, than for either of its competitors. Nintendo, on the other hand, can point out that it is currently moving the most software in absolute terms and monthly software unit sales are up nearly 60% this year.

The message for Sony has to be that software sales are getting much better on the PS3, with monthly averages up 73% this year. (You can see that Sony is already going this. Their press release on the September 2008 sales data pointed out that 1.7 million units of software were sold during the month, up 130% from the same period last year.)

In August, the videogame industry eked out a mere 9% growth over the same period in 2007. In September, sales were down 7% year-on-year, due in large part to the Halo 3 effect last year.

The key question right now appears to be where will things go from here. Across a broad range of indicators, from consumer confidence to credit availability to manufacturing, the American economy is undergoing a great deal of turmoil and the key question is how much those factors will affect the videogame industry.

Analysts seems to generally agree that the videogame industry demonstrates a large degree of independence of economic conditions.

Anita Frazier, analyst for the NPD Group, says that “even looking at sales results this year when the economy has been tough, we've never seen a correlation between the economy (good or bad) and industry sales.”

That distinction appears key: there is no correlation, even when the overall economy has been strong.

She goes on to add that “there has not been any evidence of an impact on the industry from the economy so it's really impossible to say what might happen if the current conditions prevail.”

Similarly, Michael Pachter and Wedbush Morgan Securities expect “continued software sales strength through the holidays.” Moreover, “any perceptions of consumer weakness” will be erased if the market bears out their prediction “solidly higher” October sales.

This optimism also comes through in Ms. Frazier's expectations for annual sales: $22 billion. To meet that prediction, sales in the last quarter of 2008 will have to realize a 19% increase over the last quarter of 2007.

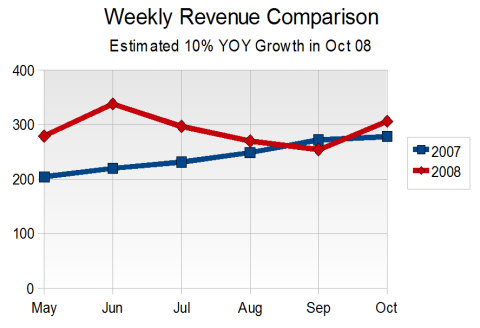

Here is one way of visualizing where the analysts feel the industry is headed. Below is a graph of the weekly revenue in each month, from May through October, for 2007 and 2008.

(Please note that the data for October 2008 is a conservative estimate of a 10% increase from sales in October 2007, which seems appropriate given analyst expectations.)

As the figure clearly shows, industry growth in October will be a dramatic turnaround given the trend from the previous three months.

On paper, October looks like a very solid month. The Xbox 360 should produce another month of very solid sales as holiday shopping begins and consumers avail themselves of the reduced hardware prices.

Demand for the Wii will again be met by increased supply from Nintendo. And there are many important software releases in October such as: Guitar Hero: World Tour (Activision), Dead Space (EA), Saints Row 2 (THQ), PS3 BioShock (Take 2), Fable 2 (MGS), Spider-Man: Web of Shadows (Activision), Fallout 3 (Bethesda), LittleBigPlanet (Sony), MotorStorm: Pacific Rift (Sony).

Obviously, the proof will come when October 2008 sales are released. If sales are flat, or down, it seems inevitable that expectations for the remainder of the year will have to be revised downward.

However, if the hardware and software drive increased sales, the industry will stand out once again for its resilience in the face of an otherwise gloomy economic environment.

Read more about:

FeaturesYou May Also Like