Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Key trends included the emergence of new AI tools, the erosion of platform boundaries through new translation layers, and the surprise re-emergence of web-based gaming.

The 2024 edition of GDC, the world’s biggest games development conference, was characterized by cautious optimism despite coming amid a challenging period for the industry. Key trends included the emergence of new AI tools, the erosion of platform boundaries through new translation layers, and the surprise re-emergence of web-based gaming.

Recent games industry news has been dominated by an ongoing wave of layoffs that has already seen over 8,000 publicly announced job cuts in 2024. This did not augur well for the mood going into GDC, the world’s biggest games development conference, which Omdia attended last week in San Francisco. And layoffs—along with wider industry malaise—certainly were a major topic at the event. Larian CEO Swen Vincke’s attack on publisher greed and short-termism at the flagship Game Developer Choice Awards produced some of the biggest headlines at GDC, and captured the feeling among developers well, for whom the relentless news of layoffs has naturally felt like a raw wound.

But despite this worrying backdrop, there was also a surprising amount of cautious optimism in the air in San Francisco. Much conversation focused on recent success stories, ranging from Baldur’s Gate 3 to Helldivers 2, and from Balatro to Monopoly Go, which have demonstrated that plenty of life remains in the market for games that manage to capture the zeitgeist. Developers, as a rule, were hopeful about the prospects for their games and the market as a whole in 2024.

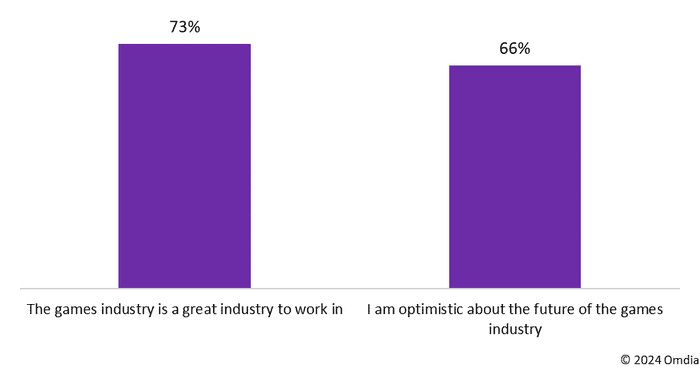

Of course, some of this is survivorship bias. Attendees at GDC came by and large from companies that have endured the recent market turmoil, remain in business, and can afford to send people to events. But it also reflects an enduring optimism and can-do spirit among developers. This came through clearly in Omdia’s recent Game Developer Collective survey, which found that 72% of developers still thought games was a great industry to work in, and 66% were optimistic about the future, even in the context of a survey that found that over 40% of studios had recently been hit by layoffs.

Figure 1: Games industry sentiment: % of developers agreeing

Source: Omdia Game Developer Collective survey, December 2023, N=205

This emerging sense of optimism is by no means irrational. Omdia expects consumer spending on games to grow by 4.3% in 2024—the first significant expansion in the market since 2020. While far from the astonishing growth of the pandemic years—or even the mobile-driven growth rates of the 2010s—an extra dose of incoming revenue will do much to ease strains in the industry. It’s perhaps too soon to declare that the corner has been turned, and further layoffs sadly remain a threat in the coming months, but it is looking increasingly likely that the games market will be in a healthier place come the end of 2024.

On the technical side, AI continued to dominate discussions at GDC. The conversation has moved on considerably since last year’s event, which took place just a few months after the seismic release of ChatGPT. Over the last year, generative AI has become a more familiar technology, and developers have had time to get to grips with the technology and its implications. GDC’s own State of the Industry survey found that 31% of developers are already making use of AI. The emerging consensus, however, is that existing AI tools are not yet ready to make a major mark on games development.

While the potential for generative AI to have a revolutionary impact across a wide range of game development functions has been clear for some time, the practical applicability of general-purpose tools like ChatGPT has proven to be limited. While the output of such models can be sporadically impressive, they are ultimately insufficiently tuned to specific use cases to reliably produce usable results for developers. Many studios, meanwhile, are reluctant to commit while the legal status of AI models trained on copyrighted material remains disputed.

It's now clear that what is needed to realize genuine breakthroughs is productization of specialized tools that can increase developer productivity in specific ways. Some of the highest-profile demos at GDC were of tools developed by Nvidia and Inworld AI capable of (mostly) effective automated generation of NPC dialog. In particular, Ubisoft’s proof of concept based on Nvidia’s large language model—featuring an NPC member of a resistance group who could react convincingly to whatever dialog was sent his way—shows immense promise. The first game able to implement this technology at a seamless conversational speed could provide a major breakthrough. Such eye-catching examples are certainly a step in the right direction, then, but ultimately much of the impact will be felt via less flashy tools—many of them entirely invisible to the player—to speed up production across a wide range of areas from asset generation, to animation, to moderation.

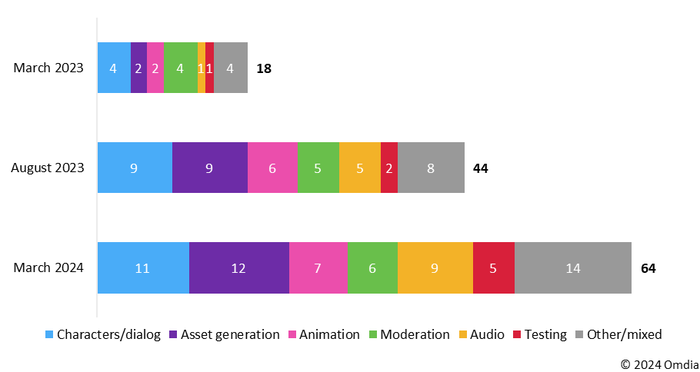

Figure 2: Number of games tech companies offering generative AI tools

Source: Omdia Games Tech Market Landscape Database – March 2024

Inworld was just one of a number of AI startups to be seen on the GDC show floor addressing use cases including asset generation (Kaedim, Meshy), testing (Modl.ai, Agentic), moderation (Modulate), and more besides. In total, Omdia’s Games Tech Market Landscape now tracks 64 companies offering generative AI tools for games development, a figure that has trebled in the last year. With so many companies now focusing on the critical work of turning foundational AI technology into practical tools, it looks increasingly likely that 2024 will prove to be a pivotal year for AI in games development.

Another trend on display at GDC was the growing industry effort aiming to make software, including games, compatible with Arm-based devices like laptops and handheld consoles by employing translation layers. For instance, Rosetta was used to bring x86 software to Arm-powered Macs, while Proton was successfully utilized by Valve to bring a huge proportion of Windows software to its Linux-powered Steam Deck. In other words, robust translation layers can extend the reach of existing platforms, and Qualcomm’s latest efforts in this space aim to make Windows on Arm a viable alternative to x86/64 Windows.

During a GDC session titled “Windows on Snapdragon, a Platform Ready for your PC Games,” Qualcomm presented its advances in gaming on Arm-based PCs. Qualcomm engineer Issam Khalil underscored the forthcoming launch of laptops utilizing emulation to run x86/x64 games at nearly full speed, without necessitating extensive porting efforts from game developers. This could establish a leap towards making new form factors and product categories of gaming devices viable.

The new laptops powered by Qualcomm’s latest Snapdragon X Elite laptop processors (which are expected later this year), along with reported plans from Nvidia and AMD to launch Arm PC chips as soon as 2025, point to a rapidly evolving landscape. Despite the promising prospects, challenges remain, particularly around game optimization and developer adoption of Arm architecture, with historical precedents suggesting a gradual transition rather than an immediate shift. Many technical questions also loom large, including Qualcomm’s lack of compatibility for highly bespoke anti-cheat solutions, which could render many popular online multiplayer games unplayable on Qualcomm-powered devices.

As translation layers continue to evolve and Arm-powered systems gain traction, the future of gaming on diverse hardware platforms appears increasingly promising. Omdia expects the nascent PC gaming handheld product category—led by Valve’s Steam Deck—to especially benefit from this in future.

Game developers are increasingly recognizing the potential of web-based games platforms, which offer a wider reach, and greater flexibility in distribution and monetization. This trend is underscored by recent significant advancements in web game development tools, as well as growing adoption of web-based platforms.

Unity's latest engine iteration, Unity 6, places a big emphasis on enhancing support for web games. This includes features for mobile web support, WebGPU integration, and support for Instant Games on Facebook and Messenger. Of particular importance is the transition from WebGL to the next-generation WebGPU API, promising significant performance improvements and wider browser support. Unity's push towards WebGPU adoption is expected to solidify its position as the default API for web games, paving the way for web-based games to rival their native app counterparts in terms of performance and accessibility.

One of the most prominent web-based gaming platforms on the GDC show floor was Poki, a Netherlands-based company offering free online games boasting over 60 million monthly players globally. Revenue is generated through ads, with profits shared with developers. Another notable company is now.gg, boasting over 100 million registered users worldwide, which instantly delivers mobile games via web browsers, including the likes of Roblox and Sims Mobile.

Industry players are drawing inspiration from the success of WeChat's mini-games in China (with over 400 million monthly users), aiming to replicate similar achievements on a global scale. Despite the existing technologies enabling seamless game delivery via web browsers and messaging apps, challenges remain. These include achieving widespread adoption, maintaining long-term player engagement, and effectively monetizing players. Furthermore, the dominance of Google Play Store and Apple App Store in the mobile games space poses a significant hurdle to the growth of web-based gaming platforms.

The continued innovation on display across a wide range of areas at GDC—both those discussed above and many others besides—has to be seen as a positive sign, even amidst an unprecedently difficult period for the industry. While serious structural challenges remain and growth is likely to remain harder to come by than the games market has historically been accustomed to, we are still seeing plentiful new games, new hardware, new development tools, and new business models emerging. All of this is reason for optimism that the games industry still has the capacity to innovate and find solutions to the challenges it faces.

CONTACT US

Omdia is a sister organization of Game Developer under the Informa Tech umbrella.

Read more about:

Featured BlogsYou May Also Like