Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Following some live service hits and misses, Sony feels single-player titles have a 'higher predictability of becoming hits.'

Short-lived live service shooter Concord represented a huge miss for Sony when it launched earlier this year, but the PlayStation maker claims it has "learned a lot" from the experience of reportedly pouring $200 million into a project (thanks Kotaku) only to pull it from sale within weeks and swiftly shutter the studio responsible for its creation.

The Japanese company shared that takeaway in its latest fiscal report and claimed launching a commercial dud shortly after finding success with Helldivers 2 (in its capacity as publisher) was a pretty big learning curve.

"We gained a lot of experience and learned a lot from both," reads the report. "We intend to share the lessons learned from our successes and failures across our studios, including in the areas of title development management as well as the process of continually adding expanded content and scaling the service after its release, so as to strengthen our development management system."

There are some internal studios, however, that won't be given the chance to learn from those mistakes. Concord developer Firewalk was shut down in October alongside mobile studio Neon Koi. The Getaway and VR Worlds developer London Studio was also torched earlier this year.

Those closures followed mass layoffs across PlayStation Studios, which made 900 people redundant in February–including workers at major internal teams like Guerrilla, Insomniac Games, and Naughty Dog.

Moving forward, Sony said it intends to create an "optimal title portfolio" as part of its current mid-range plan that will include on single-player games that lean on "proven IP."

"We intend to build an optimal title portfolio during the current mid-range plan period that combines single-player games, which are our strength, and which have a higher predictability of becoming hits due to our proven IP, with live service games that pursue upside while taking on a certain amount of risk upon release," continues the report.

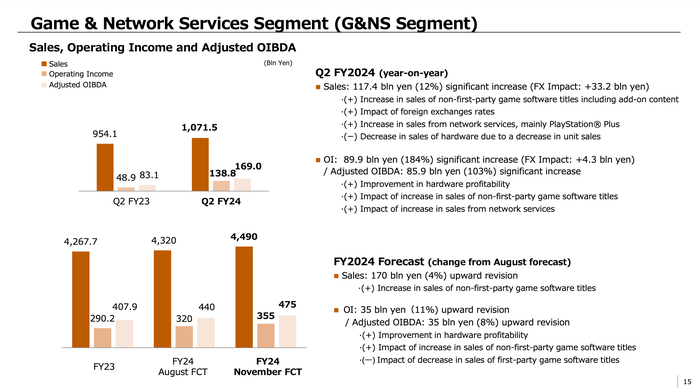

Digging into Sony's financial performance, sales within the Game & Network Services (G&NS) division increased by 12 percent year-on-year during Q2 to 1.07 trillion yen ($7 billion). That upswing was attributed to an increase in third-party software sales. Operating income rose by 184 percent year-on-year to 138.8 billion yen ($909.1 million) over the same period.

Sony explained that's a record high for the segment during the second quarter, and said the surge was due to an "increase in the profit of hardware, third-party software, and network services."

In terms of first-party software, Sony said Astro Bot sold 1.5 million copies in nine weeks and described the exuberant platformer as a "hit." It also revealed that 37 percent of Astro Bot players hadn't purchased a first-party title from the company in the past two years.

"The percentage of younger age groups and families purchasing the title was much higher than other titles, and the title is contributing significantly to a widening of the user base through the acquisition of new users and the expansion of our title portfolio," said the company.

PlayStation 5 hardware sales totalled 3.8 million units during Q2, down on the 4.9 million units sold this time last year. PS5 console sales were also down in Q1.

Sony said its wider platform business still has "strong momentum." The number of monthly active users across all PlayStation devices in September increased by 8 percent year-on-year to 116 million accounts during Q2. Total play time also increased by 14 percent year-over-year.

"PS Plus is providing a stable base of earnings as sales on a U.S. dollar basis increased 18 percent year-on-year," added the company. "This is due to an increase in ARPU (average revenue per user) primarily resulting from a shift to higher tiers of service and the impact of price revisions."

That was reflected in the G&NS supplemental information report, which shows Q2 sales from add-on content (211.9M yen) and network services (124.5M yen) contributed more than digital (153.3M yen) and physical software sales (24.4M yen) combined. Shout out to Kotaku reporter Ethan Gach for clocking that morsel.

Based on its Q2 results, Sony has upwardly revised its G&NS forecast and now expects the segment to deliver sales of 4.49 trillion yen and operating income of 355 billion yen by the end of the current fiscal year on March 31, 2025.

You May Also Like