Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

How do you succeed with original IP in the license-heavy cellphone game biz? Vivendi's Palley discusses the trials and tribulations of creating Surviving High School, which has sold over 10 million downloadable 'episodes' since launch.

[How do you succeed with original IP in the license/generic-heavy cellphone game biz? Vivendi's Palley discusses the trials and tribulations of creating Surviving High School, a game that sold over 10 million downloadable 'episodes' since launch.]

As anyone who's ever developed or published a phone game will tell you, mobile isn't the best platform for original IP. The structural reasons for this have been discussed ad nauseum.

To wit: poor merchandising on mobile decks throws the commercial advantage to big brands; the mobile audience overwhelmingly prefers familiar gameplay styles; and carrier representatives are naturally skeptical of new ideas.

These are the facts of life in our industry. For proof, look no further than Verizon Wireless' Top Sellers list (Verizon Wireless is the biggest U.S. carrier for mobile games revenue, so this list is sort of an unofficial industry barometer).

As I write this article, 19 out of the 20 titles on that list are either branded (Guitar Hero III, Monopoly Here and Now, Frogger) or generic (Mini Golf 99 Holes 3D, Verizon Wireless Sudoku). Original games may pop onto the list for brief periods, but they never stay for long or climb very far into the upper echelons, where games like Tetris and Pac-Man are enshrined.

The one exception to this rule is Surviving High School '08, which currently holds down the list's number three spot. '08 is the third game in the Surviving High School franchise. The second game, Surviving High School '07, enjoyed a year-long run on Verizon Wireless Top Sellers, and the original game, Surviving High School, had a brief stint on Top Sellers back in 2006.

To give you a quick idea of the scale of business we're talking about here, a subscription to Surviving High School '08 currently retails for $3.49 a month on Verizon Wireless, while an unlimited purchase costs $7.99. Most publishers consider a game that sells 500,000 units a year (including renewed subscriptions) to be a solid success. Games that move 1,000,000 units a year qualify as huge successes. Several of Verizon Wireless' top 10 games reside in the latter category.

How did this happen? Where did this original franchise come from, and how did it manage to scale these rare heights?

The story of Surviving High School is the story of the industry's development and maturation in microcosm. It recounts a long (and ongoing) struggle to overcome the mobile platform's many technical, business, and creative challenges.

It's an important story to tell because it proves it can be done, even now, when cynicism within the mobile games industry stands at an all-time high. Hopefully, it will prove equally inspirational to those laboring in other developing corners of the games business, where the road to success looks like it stretches on forever.

Surviving High School's developer, Centerscore, has been making mobile games since 2001. Four Stanford engineering grads started the firm up in 2000 planning to make Java games for the internet, but quickly ran into financial trouble. Luckily, they signed their first mobile game contract the day before they were planning to pull the plug.

Surviving High School's developer, Centerscore, has been making mobile games since 2001. Four Stanford engineering grads started the firm up in 2000 planning to make Java games for the internet, but quickly ran into financial trouble. Luckily, they signed their first mobile game contract the day before they were planning to pull the plug.

For the next four years, Centerscore's founders lived the hardscrabble life of a small developer, taking on any work they could find and living from one project to the next. They also self-published some moderately successful branded games based on the Garfield and Hummer licenses, as well as some generic card and board games.

By engineering director Winston She's count, the studio developed about fifty games over this span of time. "As a small developer, you had to try to hit a steady stream of singles, or you'd be screwed," recalls She. "You really couldn't afford to go for a home run, because if you failed, you were done. There was no margin of error."

Centerscore endured thin operating margins for a long time before things started to change. By putting out a lot of quality product, the firm gradually gained a reputation with the most important people in the mobile games business - the carrier reps responsible for accepting and placing games on download decks. This, in turn, allowed Centerscore to experiment a bit with original IP. "It was still a pretty new business, so there was more room for carriers to accept games at that time," says Oliver Miao, Centerscore's general manager.

This newfound flexibility could not have come at a better time for Centerscore. By 2005, many small publishers were being priced out of the market for brands by capital-rich companies that could afford to pay large fees up front, like EA Mobile, Gameloft, and Glu.

This newfound flexibility could not have come at a better time for Centerscore. By 2005, many small publishers were being priced out of the market for brands by capital-rich companies that could afford to pay large fees up front, like EA Mobile, Gameloft, and Glu.

Many indie studios decided to quit while they were ahead and sell to big publishers, rather than struggle with the new barriers to entry. Others, like Centerscore, still had the wherewithal to take a few shots on original concepts.

Centerscore's principals left no avenue unexplored in their search for viable original IP. Although they produced several partial successes during this time, they didn't come up with any true hits, because they could never quite seem to get all the necessary factors together at the same time.

For instance, Alone: The Horror Begins seemed like a good prospect for a breakout, but survival horror turned out to be an awkward fit with the mobile games audience, which skews towards non-gamers and women. Plus, the game required a lot of graphical horsepower, which meant it couldn't run on many mass-market phones. The game didn't do horribly, but it didn't do particularly well, either.

Another product submarined by technical issues was Amy's Jigsaw, a game that allowed players to turn phone pictures into playable jigsaw puzzles. Centerscore failed to anticipate the difficulty of getting camera functionality to work across dozens of different types of handsets; it took months to write special camera code for each handset, killing any chance to break even on the game.

Centerscore almost hit on the magic formula on a third OIP title, Aquarium Pets. The game had a universally appealing theme, its title was self-explanatory, it was easy to play, and it was compelling in spite of its simplicity, just like a real aquarium might be. The game jetted onto T-Mobile's Top Sellers list soon after its release, and it performed very well on smaller carriers, too.

Centerscore almost hit on the magic formula on a third OIP title, Aquarium Pets. The game had a universally appealing theme, its title was self-explanatory, it was easy to play, and it was compelling in spite of its simplicity, just like a real aquarium might be. The game jetted onto T-Mobile's Top Sellers list soon after its release, and it performed very well on smaller carriers, too.

The problem this time was on the sales and marketing side, not the game side. Verizon Wireless didn't take the game because it had recently launched Glu's mobile version of Insaniquarium and was afraid of cannibalizing its sales.

Centerscore might have been able to secure competing placement with a stronger sales relationship, but without it, Aquarium Pets was stuck outside Verizon Wireless' promised land. This harsh lesson would pay dividends later, when it came time to market Surviving High School.

While putting together Aquarium Pets in mid-2005, Centerscore also started work on its most ambitious concept to date. When all was said and done, Surviving High School took a full nine months to bring to fruition - an eternity for a developer that had produced most of its games in a few months each.

Surviving's first twinkling came in 2003, when Centerscore pitched a concept based on the "Choose Your Own Adventure" series of books to T-Mobile. The carrier's representatives were skeptical of the brand's draw, which was enough to put the brakes on the project.

However, even if T-Mobile had liked the idea, it wasn't clear that Centerscore could have delivered on it. She notes that most mobile game downloads were limited to 64K at that time, which wouldn't have been enough space for a decent text-based game.

The idea for a text-based adventure went into cold storage for a few years, while Centerscore toyed with other concepts. During one particularly intense brainstorming session, the developers came up with an ideal theme: high school. "High school is universal. Everyone remembers it, and lots of people feel strongly about it," Miao explains. "There was a lot of passion behind the basic idea."

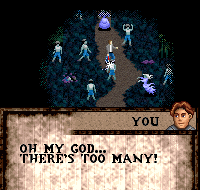

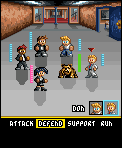

Centerscore Design Director Leighton Kan took the first crack at a high school concept with a "social RPG" called High School Kings. This concept looked like a cross between Final Fantasy and River City Ransom - you'd walk around high school beating up bullies, gaining levels, and shaking down fellow students for side quests.

These elements clearly would have appealed to experienced gamers, but the team wasn't sure it would do as well with casual players, who might be turned off by violent combat and RPG number-crunching.

She suggested that the studio turn High School Kings into a text-based adventure, along the lines of the moribund "Choose Your Own Adventure" concept. The game still featured some RPG elements, such as light stat-building, but its content and mechanics were refactored towards the mass market.

She suggested that the studio turn High School Kings into a text-based adventure, along the lines of the moribund "Choose Your Own Adventure" concept. The game still featured some RPG elements, such as light stat-building, but its content and mechanics were refactored towards the mass market.

For example, football stood in for fighting, and dating replaced item collection. The tentative title changed to High School Chronicles, which was more gender neutral.

Kan and She also replaced free movement with an on-rails story, featuring choice menus that popped up at important junctures. This way, players would still be responsible for all of their character's important decisions, without having to spend time traversing a map or managing an inventory. Those choices would have weight, too, because the game would have many different endings depending on how you played.

The game wouldn't necessarily end when the story was done, though. In an especially unique twist, the two designers envisioned a system that would allow Centerscore to distribute additional content over the air. These episodic content "packs" wouldn't be as deep or replayable as the main story, but the idea was to provide more of a continuation than a replacement.

In theory, if Centerscore got players hooked on the main scenario (or "big pack"), the supplementary episodes would help the game retain subscribers for longer periods of time. As Miao would soon explain to Verizon, it would be akin to running a syndicated TV show inside of a mobile game.

Although he approved all of the team's changes, Miao knew that the revamped concept would be a tough sell to carriers, because there was nothing remotely like High School Chronicles on the market. In fact, the major mobile games trends in the second half of 2005 were Texas Hold 'Em games and ports of casual games from the web. Of course, this uniqueness cut both ways. If the carriers agreed that the game had promise, it would have its own little niche to itself.

As it turns out, Verizon Wireless did agree. The carrier's reps were impressed by Centerscore's vision - especially the episodic content angle - and decided to take a chance on the game.

As it turns out, Verizon Wireless did agree. The carrier's reps were impressed by Centerscore's vision - especially the episodic content angle - and decided to take a chance on the game.

The game was slated for release in August 2005, but two weeks before it was supposed to go live, the team got some bad news: Chronicles weighed in over Verizon's download footprint, and the main culprit was the game's bulky big pack.

The best solution probably would have been to trash the big pack and start over from scratch, but the team didn't have time to design and balance a new scenario. Instead, Centerscore opted for a technological workaround. The team quickly chopped the big pack up into episode-sized pieces and fed them out over the air. Once again, the episodic content feature saved the day.

Meanwhile, Miao, Kan and She second-guessed the High School Chronicles title. There was nothing wrong with High School, but Chronicles sounded tedious. This was dangerous on a seriously impoverished merchandising and marketing platform like the download deck, where well-branded shovelware beats a superior game with a lame or inscrutable title almost every time. Centerscore ditched Chronicles and settled on the far more intriguing Surviving High School - an active title that evoked both the triumph and struggle of adolescence.

When the game finally launched in early 2006, nobody knew how these last-minute changes would affect the game's commercial performance, but the first returns were very encouraging. Surviving High School rose to #20 on Verizon Wireless' Top Sellers list after its first month on sale, generating approximately three times more revenue than any previous Centerscore game. The company had finally hit pay dirt.

Even so, Centerscore couldn't afford to rest on its laurels. Surviving High School quickly dropped off the Top Sellers list, and the business picture looked worse for small publishers by the day. After surveying the landscape, Miao and company made three quick decisions.

First, they increased the flow of new episodes to Surviving High School subscribers from a new pack every three weeks, to every two weeks, to weekly. Thanks to Verizon Wireless' enthusiastic subscribers and reliable monthly payments schedule, Centerscore could count on a steady cash flow for the first time in its existence. It had to develop that subscriber base, and that meant turning episodic content into the game's premiere feature.

Second, the company began work on a sequel, Surviving High School '07. The team desperately wanted to release the game with its big pack intact, while also making improvements to the UI, adding polish to the graphics, and conducting thorough user testing.

To that end, She researched and developed a custom scripting language that cut the size of the big pack in half, even as Verizon Wireless raised the download cap for its games service. The team now had plenty of real estate to play with.

Third, Centerscore reluctantly put itself on the market, after reaching the conclusion that staying independent was a losing proposition. The studio simply couldn't match the big publishers' sale and marketing muscle, and carriers were starting to freeze the smaller players out entirely.

Several suitors approached the company, but one stood out in particular - Vivendi Games Mobile (VGM), the French media conglomerate's new mobile games arm and one of four divisions within Vivendi Games. VGM had assembled studio assets in Europe and a strong business team in Los Angeles, and it was looking for an experienced studio in California to round out the ensemble.

Both sides felt that the studio's experience with original IP would be a great complement to VGM's business resources and connections. After all, if Centerscore had managed to boost Surviving High School into Top Sellers by itself, imagine what it could do when plugged into a big publisher's production pipeline. After a full summer of negotiations, the acquisition closed in September 2006, a month before the launch of Surviving High School '07.

Both Centerscore and VGM expected great things from Surviving High School '07, since it was a much better version of a game that had already tasted Top Sellers success. However, due to a logistical glitch, the game was released on Verizon in mid-October 2006.

When determining placement on Top Sellers, Verizon Wireless counts the total number of downloads during the previous calendar month; as a consequence, games that haven't been out the full month are at a serious disadvantage when census time rolls around. This accounting idiosyncrasy cost SHS '07 dearly. The game performed well in its weeklong debut in the What's New category, but not well enough to make up two weeks of lost ground.

Having missed its first and best chance, VGM was going to have to get SHS '07 into Top Sellers the hard way - with clever marketing, sales acumen, and a whole lot of arm-twisting. But even though VGM was growing fast, it hadn't yet been accorded top-shelf status by Verizon, and that impeded the distribution team's access to the carrier's understaffed games department.

In the mobile games industry, the usual causal relationship between marketing and sales is turned on its head; instead of seeking out products they've seen in advertisements, consumers tend to buy whatever is at the top of the deck. Thus, truly effective marketing targets the carrier operatives in charge of distribution, who are the publishers' real customers. The trick is to get those reps, who are constantly bombarded by requests, to pay attention.

In January 2007, VGM's marketing team decided that the company would get the best bang for its promotional dollar by running a campaign on MySpace. At a time when other large publishers counted on cross-marketing from big console game launches and advertising on mobile games sites, this was a fairly unorthodox strategy.

Still, it was innovative enough to fit for Surviving High School '07's requirements. The company had found a viable sales angle, no matter what the demonstrable return on investment was.

Happily, VGM's Surviving High School MySpace campaign turned out to be more than just an interesting story. VGM and Centerscore went all out for the campaign page, cooking up themed IM buddy icons, wallpapers, two different interactive applications, and a special raffle that would write five lucky participants (and their likenesses) into special episodes of the game.

More than 10,000 MySpacers became friends with VGM's Surviving High School profile, generating about 100,000 page views over the lifetime of the campaign. The page became so popular with SHS fans that it turned into a permanent hub for content and discussion; Centerscore still consults it on a regular basis for fan feedback.

This marketing coup helped VGM's distribution team secure prime placement for Surviving High School '07 on Verizon. The game spent a week in the carrier's "topslot," meaning it was the very first item on the download deck, and then followed that up with an extended tour of the Featured Games category.

From there, Surviving High School '07 began its year-long stay in Top Sellers, and fans began downloading episodes like crazy - more than 10,000,000 episodes over the life of the franchise, at last count.

What conclusions are to be drawn from the Surviving High School story? One possible reading suggests that Centerscore and VGM just got lucky. It took Centerscore five years of trial and error to come up with a concept that had real hit potential, and even that game didn't go very far until VGM applied significant resources to it. That sounds more serendipitous than systematic, doesn't it?

There's no question that Centerscore's winning formula involved more than a pinch of good luck. On the other hand, the company was always in a position to capitalize on whatever breaks came their way, which does not seem like such a coincidence.

Centerscore took chances on new concepts as early and as often as it could afford to, which was appreciably more often than other developers its size, thanks to its founders' painstaking stewardship of their business.

Plus, the firm placed its bets systematically, so each successive failure got closer to the center of the bullseye. Over time, these scientific guesses produced a fairly accurate picture of the market's sweet spot.

Just as importantly, Centerscore was aware of its limitations. It stayed independent just long enough to produce its magnum opus, after a long iterative process that probably would have been squashed under a publisher's supervision. It then traded in some of its operational independence for the resources that would take that product to the next level.

These lessons aren't just for the mobile games space. They also apply to gaming's new kids on the block - the latest "emerging platforms," like social networks, iPhone, and Flash - or any other industry where the contours of the market haven't yet settled down.

Creative brilliance isn't the only way to the top; patience and execution can also give any company a puncher's chance, if it can recognize when and how to let fly.

Read more about:

FeaturesYou May Also Like