Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Why did so many arcades fail? Why are so few companies making video arcade games? MBA and CEO Eric Yockey of Unit-e Global discusses the contemporary arcade industry and the climate and market forces that sent it into decline.

I recently spoke on the topic of the contemporary arcade market at the Baltimore IGDA, and now that we just returned from exhibiting our game (“Neon FM”) at our third industry trade show in 2 years, I wanted to revisit the subject here for everyone else. Let’s address the elephant in the room for people outside the industry:

Why did so many arcades fail? Why are so few companies making video arcade games?

Many people of my generation have fond memories of wandering the dimly-lit, flickering halls of machines that seemed to be making money hand-over-fist in the ‘80s and ‘90s. Everyone I knew back then would celebrate their birthday somewhere with an arcade. The arcade was a unique experience, where you could compete with strangers, win fabulous prizes (to us), and play games that were far beyond what you could experience and/or afford at home. Consoles and the rise of the internet are the most common scapegoats for the decline in arcade popularity, but the main reasons actually have much more to do with a business model that makes video arcades unattractive for both manufacturers (arcade game developers) and operators (arcade owners). As a consequence, the only people left playing on the supply side are people who are too established to change, have too much invested to quit, or whose love for arcades supersedes profit (we would be the latter); and the result is an old-fashioned industry that resists change.

Trust in new products and new companies is tremendously low in this industry, which isn’t entirely unfounded when you consider the high price of a new arcade machine (upwards of $10-12k) and the long term before a break-even point is reached on the unit (typically 10-12 months or longer for video arcades). As a result, every product purchase is a considerable investment on the operator’s end, and even moreso for independent arcades. Location tests are therefore the standard, and can run for 30-60 days before the operator makes a purchasing decision. During this time, the manufacturer is at risk, since modern arcade machines cost multiple thousands per unit to make, payment is delayed for months, and return on investment is not guaranteed. Further, (and contrary to what many operators believe is a mutually-beneficial arrangement) no one location test contributes to building confidence in another buyer—markets are perceived as regional and unique, even within the same city, and everyone wants to complete their own test before committing to a purchase. Consider the cost of building dozens of machines to arrange these tests, and the faith you must have in a product to bet on your game being successful in markets and conditions you cannot control. Does your game benefit from the internet? Your operator may not have a connection available, may accidentally disconnect it for days at a time, may be paranoid that you or an invader could access the machine’s data, or may have a network that is mysteriously incompatible with your unit for reasons that you can’t diagnose because you just shipped a machine to them across the nation (perhaps that one is a bit specific). Can your machine that usually behaves at a smooth 60 FPS do the same in a location that skimps on air conditioning and then backs your unit’s ventilation ports up against walls and other machines? Location tests seem to be perceived as boons to manufacturers who get answers to these questions, but the reality is that a location test is not a public beta—it is a live-fire exercise that determines whether your game will be sold. Major franchises such as Dave & Busters have a reputation for immediately ending tests on machines that fail for any reason during their test, and any public failure for a company will certainly lower the probability that they will get a chance with another game.

I plan to address the true cost of trade shows in a future post, but for now, understand that trade shows are frequent, very relevant to this industry, time-consuming, highly unpredictable, and outrageously expensive. For those of us who don’t have the resources to attend the multitude of shows around the world, there is a standout: IAAPA Attractions Expo is the largest arcade & amusements show in the US, has the highest buyer attendance, and is relatively affordable as well (no, I have no stake in them). The industry is founded on the relationships built along the supply chain, often over decades, and this is where those relationships are made and maintained. This is different from many high-tech industries (where efficiency is valued more highly than loyalty, and risk-averse behavior is less common), so these shows are by far the best—if not the only—way to introduce your game and build your brand. Most of the people in the industry who can make a purchasing decision do so exclusively at trade shows, making manufacturer attendance mandatory. That said, depending on a number of factors (including time of year, location, proximity to other shows, parking, nearby hotel rates, and so on) it’s hard to predict who will actually attend the show. Further, there’s no guarantee that even if a potential customer attends a show that they will find your booth. Every show we attend, buyers tell us that they’ve never seen us at previous shows, and it’s not for want of our machine being obnoxious (a loud music game with 6-foot tall neon tube lights is hard to miss). However, booth placement at these shows is determined by the coordinators, with preference given to vendors who buy multiple booth spaces. Should you actually get to speak with a potential buyer, someone on your team will need to understand how to pitch the game and close a sale (which is a science in itself).

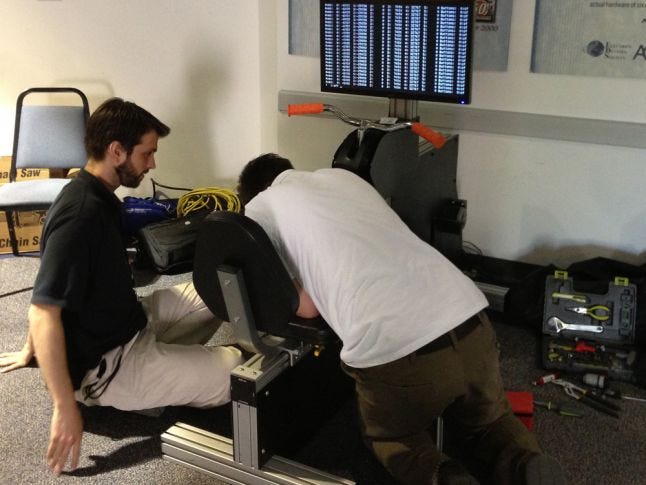

Further, the damage done by unit failure is even higher at a trade show than a location test, since there are so many important eyeballs on your product at all times. We carry spares of everything in our machines in triplicate for shows, and most veteran manufacturers will ship separate crates full of spare parts in the event something goes wrong (and something will go wrong). That said, the one benefit of machine failure at a trade show is that you’re there to do something about it, and while we learned the hard way that you should never update your software during a show, a precaution that’s worked well for us is to run our most stable build and insert debug keys to quickly and silently change or disable software features. And while we’re on the topic of software…

I mentioned that hardware failures are disastrous for arcades, but software failures are equally fatal because there’s no difference to the end user, and unlike other platforms, players cannot restart your software (and often lose money) if something goes wrong. You would be completely fair to assert that a game in public should be bug-free and never malfunction anyway, and you would also be amazed at what people can do to your lovely software when they touch it in just the way that only a fresh pair of hands can (one common oversight is failing to thoroughly test the easy difficulties, which are over 90% of what get played at shows, and which neither we nor our vocal players commonly experience because we’re pros). Day-0 patches may be common in the rest of the games industry, but arcades do not get that luxury, and therefore time spent in QA is much longer, and simplicity in game design to avoid logic errors is strongly encouraged. The arcade industry has evolved somewhat from the days of mailing out repair boards to all your locations whenever Shang Tsung starts to march across the ceiling (I may be dating myself with that reference), and internet access is largely ubiquitous among arcades, but developers cannot assume that their machines can receive updates and that operators will be willing to bother themselves with your problems if online updates fail. And this is especially true when most operators have an attractive alternative.

This may be the single biggest reason video arcades are rare and/or pigeonholed into “safe” genres, such as “shooters” and “drivers.” The average video arcade player shares similar demographics with the rest of the games industry and is unusually price sensitive. Consider that one of the first games to charge 50 cents per play was Dragon’s Lair in 1983 (a notoriously short game, too, for casual players), which the Consumer Price Index values today at $1.19 per game. With an estimated cycle time of 2 minutes between players, the game was effectively earning $35.70 per hour. However, to this day, players will balk at a price per game above 50 cents, despite the value being 58% lower than when the price point was introduced over 30 years ago. Even then, players expect to get quite a bit of mileage out of their two quarters. Card-based payment systems are gradually replacing traditional coin mechs and seem to help operators overcome this hurdle through price obfuscation (alcohol always helps too), but the fact remains that consumer willingness to pay is far lower than it was in the golden years of arcades.

The exception is redemption (ticket or prize) games. With a tangible reward on the line, price sensitivity is turned on its head and gameplay duration is suddenly a non-factor. The demographic expands to a younger audience, tantalized by dreams of fashionable spider rings and sweets. Adults are still playing, too, for higher-ticket items such as game consoles and tablets. The typical price for a redemption game is $1, and the cycle time for a game can be as low as 10 seconds. Even with the cost of prizes at a typical 30% of revenue, these games can generate hundreds an hour in profit. What’s more, redemption games don’t cost any more to purchase than video arcade games, and many players don’t seem to even care if the machines are new—looking at arcade data shared with us, some of the top earners were made in the 80s and can be bought at an auction for as little as $500. Price sensitivity for redemption games among operators is also much lower than with video arcades because the investment can be recouped so quickly. Is it really any wonder that so few people are trying to make video arcades, much less straying from proven design formulas?

Why did the American video arcade industry fall into decline? Because consumer demand (willingness to pay) decreased, operators became more risk-averse, and more risk was passed on to manufacturers. Compounded by the rising budgets of software titles, many developers moved on, lowering supply. Why were they not replaced? Because of the cost barrier, considerable effort, uncertain returns, lower margins caused by a high amount of power among distributors (where a near monopoly exists), and a slew of other barriers to entry (patents, safety concerns, engineering considerations, et al) which are worth an article in themselves.

So why would anyone make a modern video arcade game? Because there’s still something magical about arcades that can’t be found elsewhere. Every new arcade game challenges the developer to invent new interfaces and modes of control. Fringe and once-fringe technologies such as virtual reality, stereoscopic displays, motion controls, panoramic screens, et al are first explored in the arcade space because the end-user investment is low and the goal of arcade development is to perfect a brief but unique experience. We’re here because, to us, the arcade will always be the frontier of gaming, and the curator of our fondest memories.

Eric Yockey is an MBA graduate from Johns Hopkins University, CEO of Unit-e Global & Unit-e Technologies (creators of the arcade music game Neon FM, releasing for mobile this Spring), and on the board of the Baltimore IGDA. He can be followed on Twitter at @EricYockey and has a project portfolio at http://www.ericyockey.com.

Read more about:

Featured BlogsYou May Also Like