Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Can your game be a hit in the Middle East? Gamasutra speaks to experts to gain a better understanding of just what it takes to launch in the region -- and how to sidestep the easy-to-make mistakes that come with global expansion.

Though you rarely hear news about the Arab game industry, video games are booming in the Middle East/North African market, just like they are in many other regions around the world. Last year, games generated an estimated $900 million (out of $24 billion for the global market).

And many predict the region's revenues will continue to shoot up in the coming years, even more so than in other areas. Research firm Ovum believes annual game revenues in the Arab market will more than triple by 2016 to $3.2 billion (29 percent compound annual growth rate versus 17 percent global growth).

The local game development scene is growing fast, but there are also plenty of opportunities for Western outfits to bring their releases to the region, whether you're a big social game studio or a small mobile team. Developers just need to know what to expect and what to prepare for.

For many, the idea of the Middle East becoming a rising powerhouse in the game industry likely comes as a surprise.

Joe Minton at Digital Development Management, which helps partners release their games to the Middle East and other countries all over world, notes that the area had been off the map when it comes to video games for so long. A lot of companies haven't paid attention to the market's progress in recent years as a result.

"Just five to seven years ago, you didn't hear about licensing games to the Middle East," Minton tells Gamasutra. "And if you did, it was just getting stuff to one broker to handle the whole region for a teeny amount of money. It was considered a throwaway because of piracy, because there weren't Xboxes and PlayStations to any sufficient quantities."

A number of factors have allowed digital games to explode in the Arab market, however, like the huge youth population, the high level of disposable income in places like Turkey and the Gulf states, and the increasing availability of payment methods like credit and prepaid cards.

"Internet penetration, penetration of Facebook, smartphone penetration -- all these things are growing at double-digit growth rates per month," points out Rina Onur, co-founder and chief strategy officer at Turkish developer and publisher Peak Games (Lost Bubble).

Minton adds, "It's like an immediate massive market suddenly coming online in the course of just a couple of years as opposed to decades. ... It's a staggeringly incredible opportunity for developers."

And with so many games flooding digital marketplaces now, teams can't afford to limit their sights to just North America, Europe, and Asia; they need to ensure they're relevant in as many regions as possible because they're competing with so many other companies in the main regions already.

The game companies Gamasutra talked to immediately answered that question by citing soccer games as a popular category for the Middle East -- Electronic Arts, for example, has received plenty of praise for its recent Arabic edition of FIFA. Non-culturally-specific games based on other locally popular sports like F1 Racing tend to do well, too.

"We also see games that you might not think of as being huge there," says Minton, who mentions there's even demand for Western-style RPGs. "Shooters are popular. Puzzle games are popular. When you begin to go down the list, it looks very similar to anywhere else in the world."

Peak Games, though, has found particular success with multiplayer synchronous titles that have a heavy emphasis on social aspects and communication between players. The company has adapted card games, tabletop games, and board games (e.g. backgammon -- culturally relevant games) as digital titles with that in mind.

Onur comments, "I think the reason these multiplayer games have been doing so well in these regions is that most of the time, people in emerging markets, especially in [Turkey], they don't have the liberties that a lot of people in the West have.

"It's much easier for people in the West, in North America, to just go out, meet people, and have conversations, whereas access to communication, people, or communities is much more restricted in a lot of the emerging markets because of the demographics and socioeconomic situations. I think a lot of the time, people use these games not only as just games as pastime but also as platforms to be able to connect with others."

Peak has found that when people come together in these types of communal experiences where they're playing and chatting in real-time, rather than wanting to purchase in-game chips to play more hands, they want to spend money on social aspects like private rooms, virtual gifts, etc.

"Games that provide this aspect, which creates communities on Facebook or on mobile within a game are proven to be very successful," says Onur.

Though there are local social networks in the Middle East, Facebook is still the king there, as it is in English-speaking territories. "I think it's impossible for any other player to break that domination anytime soon," says Onur. "In the greater MENA [Middle East/North Africa] region, there are over 40 million people on Facebook right now, and it's increasing really, really rapidly."

Turkey is the fifth largest country on Facebook right now in terms of population -- more than 30 million citizens there have registered on the site -- and Peak has capitalized on that by targeting Turkish users and other Middle Eastern gamers who are signing up for the site in droves. The developer is currently the sixth biggest social game company in the world according to monthly active users (over 24 million).

Onur makes sure to mention that mobile is also picking up in the region: "As a market in total, it's smaller than what it is in Asia or the Western markets right now, but the growth rate is really amazing. In the next 12 to 18 months, it's going to be a completely different scenario, with mobile becoming very viable and actually a big platform."

While the BlackBerry traditionally has been very strong in the region, most are turning their attention to iOS and Android smartphones and tablets now, as both are increasing their market share at a rapid pace. Already in many MENA countries, the average number of mobile devices per person is more than one -- over two, in some areas.

Mobile and social aren't developers' only options, though. Minton adds, "With the internet penetration, [for] PC free-to-play, having client-based games is a tremendous opportunity since you can take care of the piracy issue, as has been done in China and in other regions, or at least keep it tamped down. Then you really come down to do you need to have servers in the region and so forth, which does get trickier. But some games, of course, the lag isn't as vital."

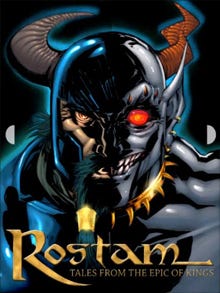

And CEO Mahyad Tousi from New York City-based BoomGen Studios, a transmedia outfit with a focus on the Middle East, advocates the idea of looking beyond just social or mobile, and consider attaching other media to increase the reach of their property, whether that's through books, films, comics, etc.

And CEO Mahyad Tousi from New York City-based BoomGen Studios, a transmedia outfit with a focus on the Middle East, advocates the idea of looking beyond just social or mobile, and consider attaching other media to increase the reach of their property, whether that's through books, films, comics, etc.

As with any title that's planned for international release, developers need to build their games with localization in mind from the start when targeting the MENA market. They need to make sure it's easy to drop in translated text or assets, and that the codebase and user interface can adapt to Arabic words, which are read from right to left.

But when it comes to deciding how much developers should localize or adapt their content for the region (beyond taking care to avoid sensitive issues or content), it's not as clear-cut what approach game makers need to take. Minton argues that since English is a very common language and there are so many different dialects in Arabic, some developers may decide against fully localizing a game.

"I don't think that the question has been answered yet as to exactly what content needs to be localized into Arabic," he says. "Certainly, having greater respect for the region, it would intuitively seem as though it would make sense to [fully localize games], but also in some countries, there's a sense that if it's in English, it's cooler to the kids."

He believes publishers and developers should take advantage of that thirst many have for connections to the West and to Western entertainment -- whether through music, movies, or video games -- by not just considering bringing their games to the region but also playing up the foreign style and content.

"Those are things that are really loved in the region. It can be very easy seeing headlines in papers that there's a gulf that is insurmountable between the Middle East and the West. That's not at all the case. The vast majority of people thirst for and want these connections," Minton continues.

Onur, however, takes a different view on the importance of localization. In her opinion, developers shouldn't stop at simply swapping in Arabic text. "You can't expect to take a generic game off the shelf, like a city-building game for example, just translate it, and expect that it's going to be a hit as it was in the Western hemisphere. [Failing to make] cultural tweaks is not going to do you any good. The product does not scale. If anything, it's going to hurt your brand image as a company."

Some of those tweaks Peak makes with the third party games it publishes in the Middle East include something as simple as implementing region-specific holidays (many social games feature special events or content on holidays). Rather than celebrating Christmas or Easter, which have little relevance in a predominantly Muslim market, the games feature events for Ramadan or Eid al-Adha.

Onur adds, "In terms of the characters that are included, if it's a farm game, instead of having a Western-looking [farm worker], we have an Egyptian-looking man or a woman that's covered up wearing a hijab, according to cultural apparel and gear." She says it's critical that companies invest the time and resources to make these necessary changes.

That's why Onur believes that working with local teams, or having people on your staff who have spent time in the region, is essential. "The one thing [you need to] make sure of is understanding the people who you are targeting," she stresses.

Another way developers can take an extra step to strengthen bonds between Arab players and their games is to draw inspiration from the history and stories the regions. Tousi calls the Middle East North African region the "greatest reservoir of storytelling ever. All of the three main religions, and a number of massive books of mythology all hail from that part of the world."

And because of a shared history in terms of stories between the Middle East and the West (e.g. Arabian Nights, the Bible), that kind of content won't necessarily alienate players outside of the region. "All of this historical culture and storytelling is actually very in common and speaks really well to the West," says Minton. "It's less unique than going, for example, between China and America, which is a tougher bridge in terms of finding commonality of mythos."

Game makers who decide to go down that road stand to gain a lot by partnering with local content creators -- not just in having access to people who know the stories, who know how to deliver products to that market, and who know how to shape those projects for local audiences, but also in collaborating with people who are motivated to contribute and produce great work.

"It's good for developers to work with regional content creators or people who are in the business of creating content that's rooted in that region because they get access to a very, very rich universe, which I think is going to completely excite them to actually do the work," points out Tousi.

"What we always forget is that the business of gaming is far beyond dollars and cents. It's a creative environment, and it's driven by creatives. What is exciting about this region is that it's rich in terms of content for creatives who want to create that type of content. And I think that content can relate to a far greater market than just simply that region."

Even though the Arabic region is diverse, comprising different countries with extremely different cultures and dialects, working with a content partners in one of those countries could still go a long way toward helping a game from a Western team find an audience in the broader market. Their proximity to the other countries and presence in the same cultural milieu are advantages that shouldn't be discounted.

Tousi says this idea of entertainment crossing local borders easily is older than gaming: "If you look at some of the most successful soap operas in the Middle East, they are Turkish soap operas that are dubbed into Arabic. Obviously we have tons of soap operas in [North America]. Why wouldn't they be dubbed? Why wouldn't they be successful? What we read into that is cultural relevance and proximity is key and very important."

Publishers looking to break into the Arab market and maintain a sizable presence there need to realize that significant investments in building and fostering relationships are required. Companies shouldn't presume that they can fly in a single licensing person who will make business deals and head back home. They have to send in senior people to meet with gatekeepers, telcos, payment providers, and other partners.

"It's an area that really requires sustained business development and personal connections," says Minton. If you're "very used to having a person jump off the airplane, expect that they can go around, shake a bunch of hands, sign a contract, and leave," he says, "That's just not the way it works."

"You need to have sustained involvement. And so then there needs to be the understanding, or the calculation as to whether or not that is worthwhile to the business. If you're not going to do it yourself, you need to find someone who is in the region who you can really use as a partner."

Minton reminds game companies that when they handle these arrangements themselves, they're not just signing a blanket deal that gives the Middle East rights for their title to a single publisher or a distributor.

"[They need to take] the time to look at the folks who are selling products there, and deciding who to align with," he says. "This is a day and age where you're creating a mobile game for example that you may well end up signing 22 different deals to take on the entire world as opposed to giving the product to one entity and expecting that they're going to do that. It's unlikely that any one entity really can."

Onur also re-emphasizes her point that developers need to have a strong understanding of local audiences, warning them not to make the same mistake some major Western publishers have made in Asia: "Consider PopCap or Zynga, who have launched their very successful franchises in China on platforms like Tencent. They've failed miserably and couldn't scale."

Meanwhile mobile developer Robot Entertainment, which has worked with local publisher Yodo1 to bring its game Hero Academy to China, was able to find commercial success by making considerable efforts to adapt its game to the country's culture, incorporating Chinese-themed fantasy characters and providing region-appropriate marketing.

Peak's chief strategy officer says the struggles of major Western companies in China underscore that emerging markets are "very, very different from what Western developers are accustomed to for North America and Europe, because these countries and geographies have different histories, different language, different political systems, different economies, and different religions. Everything is different."

Another mistake Onur has seen is developers not thinking about or investing in local support services: "A lot of the time, I think global companies out there provide America or Europe more service than in emerging markets, especially because they can't monetize these users. But it's a chicken and egg situation; if you can't provide the necessary service that they deserve, they're not going to be loyal users.

"We consider gaming as not only a technology business but also a service business, games as a service. So, starting from customer support to community management to payment systems to payment platforms, you have to be able to answer the questions of the people you're addressing on every step of the way."

Whichever platform or genre developers decide to pursue, they're likely to find an audience with Middle Eastern gamers, according to Onur. But she says "They're just looking for high quality content that they can relate to, and then the service. If you have these two issues under your belt, it's possible to scale really, really effectively."

Read more about:

FeaturesYou May Also Like