Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

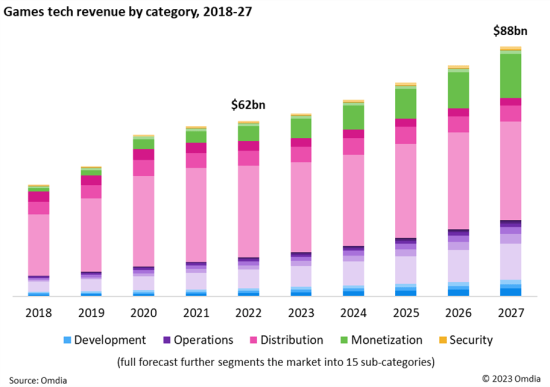

Games Tech Market Forecast 2023 finds that games tech revenue totaled $62 billion in 2022, equivalent to more than a quarter of the total income of the games industry.

New Omdia research has for the first time measured the total size of the market for technology products and services consumed by the games industry. The Games Tech Market Forecast 2023, a major new addition to Omdia’s Games Tech Intelligence Service, finds that games tech revenue totaled $62 billion in 2022—equivalent to more than a quarter of the total income of the games industry.

This comprises revenue from five broad areas: Development (the core set of tools for designing and creating video games content); Operations (solutions for operating, managing, analyzing and promoting games); Distribution (platforms which digitally deliver games content to end users); Monetization (solutions which enable games to generate revenue from consumers or advertisers); and Security (protections against piracy, fraud, and other security threats).

Omdia’s forecast segments the market in considerable depth, capturing revenue not just in the above five areas but also in each of 15 more granular sub-categories, individually measuring market segments ranging from game engines, to analytics, to adtech. This data is further split by device type and region, yielding an unprecedented level of insight into tech spending in the games industry.

“Currently, distribution accounts for the majority of games tech revenue,” commented Liam Deane, Principal Analyst covering Games Tech at Omdia. “Key platform holders including Apple and Google on mobile, PlayStation, Xbox, and Nintendo on console, and Steam on PC are able to extract substantial revenue cuts from games on their platforms, which earned them a total of $41 billion in 2022. However, increasing competition from new players such as Huawei on mobile and Epic Games on PC, combined with increased pressure from regulators, will limit future growth in distribution revenue.”

The rest of the games tech market, by contrast, is set for rapid growth. This growth will be broad-based, spread across a wide range of market segments. For instance, as more game development moves into the cloud, the demand for cloud services is growing rapidly, while the growth of in-game advertising (a market valued at over $67 billion by Omdia’s In-Game Advertising Market Database) is generating booming revenue for adtech vendors.

Meanwhile, the increased cost and complexity of modern games development is opening up a plethora of new markets for established players and startups alike as game studios increasingly turn to specialist vendors for their tech solutions.

As a result, Omdia expects that all segments of the games tech market will grow over the next five years, with most set to see double-digit CAGRs. Overall games tech revenue is set to grow by some 42% from 2022 levels to reach $88 billion by 2027, making this one of the most lucrative opportunities in the games industry.

Omdia and gamedeveloper.com are sibling organizations under Informa tech.

Read more about:

BlogsYou May Also Like