Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Through multiple acquisitions and mergers, GameStop is now the predominant specialty U.S. game retailer - and Gamasutra talks to GameStop VPs Bob McKenzie and Tom DeNapoli about the state of retail for the PS3, Xbox 360, and Wii, stocking AO-rated games, the firm's digital download strategy, and more.

As previously reported on Gamasutra, the GameStop Expo is one of the most relevant events on the gaming calendar -- but one few know much about. Every year, managers from GameStop's some 5,000 retail stores gather to be presented the holiday lineups of publishers both major and minor in a trade show environment.

At this year's Expo, held at Las Vegas's Mandalay Bay casino/hotel, Gamasutra sat down with some of GameStop's senior management, including senior merchandising VP Bob McKenzie and marketing VP Tom DeNapoli.

During the course of these exclusive interviews, the executives discussed not only what the event means for both the games retail giant and publishers, but how GameStop has evolved and maintained its identity throughout its many mergers and acquisitions, how it plans to compete with an ever-widening direct download market, and what chances each handheld and console platform stands as we move into the holiday season.

Can you talk a bit about what you do for GameStop, and what your job is like?

Bob McKenzie: I'm senior vice president of merchandising, and I have all of the new and used merchandising areas reporting to me. They all have the opportunity to get in front of all of our vendor partners -- a lot of them are out here and seeing the new product that's coming out.

I have an opportunity to meet with many of the vendors on a monthly basis, and really plan out some of the marketing activities, as well as product launches. We also handle picking up and distributing the merchandise to all 3,800 U.S. retail locations.

So you go look at games before they are complete, and provide feedback on whether or not the store would want to carry them as-is?

BM: Yes. A lot of the time the vendors will bring in beta or alpha copies, and definitely, they look to us for feedback. Not only in our support center, but that was also one of the advantages of the E3 in the past: we had a lot of managers who took their own personal vacation time, spent their own money to get there. During the last E3 (2006) there were over 650 of our managers who went there.

The publishers really look to our people, because gaming is all we do. We have the passion, and they know that we're going to give them the honest feedback -- the good points or the bad points.

The vendors really appreciate that. They need to know -- as they're coming along with their product -- how the builds are, and if people really feel like the gameplay will be there to hold the consumer's interest. It's exciting; it's fun to be able to look at them in some of the early development stages, seeing something get a little more polished, and eventually see a final product brought on the market.

You're talking about the managers, but most of the people who work at GameStop are gamers. You collected their feedback and then gave it to the game companies?

BM: Really, it was more of an open environment, where the managers actually had badges, and they were admitted as part of E3.

How did the feedback get to the companies when that was the case, with 650 different people looking at the games?

BM: They'd be going through the exhibition halls, and do the hands-on.

Just chatting with them there?

BM: Definitely, yeah. They were pretty active on the show floor.

I actually worked at Babbages before I was a journalist, and you'll probably find, in terms of the journalists, many of them worked at one of the predecessors of GameStop.

BM: That's great. I started out at Software Etc., about 18 years ago in Minneapolis. My categories at that time were Atari, Amiga, and Apple IIGS. Seems like a long time ago!

Starting out at Software Etc., can you talk about the evolution where Babbages, FuncoLand, and finally EB came in?

BM: It's really been fun to be a part of it over the last 18 years, to where the company is now. There were a lot of good years and there were a lot of tough years in between. The mergers that we've had -- the most recent being with EB, which was very successful, we're very happy with how the merger went. It really got a lot of synergy, which is the goal that we look to accomplish. The prior merger to that, with FuncoLand, brought a lot of unique opportunities to us at GameStop, and really helped us get full-time into the pre-used merchandise.

FuncoLand's focus when they emerged was used games, whereas at the time, the other stores were more focused on the new games. Now, obviously, GameStop is very driven toward used games as well.

BM: Yeah, it's a great blend. It really gives the consumer a unique opportunity, to provide them currency with their trade-ins. I know first-hand from having a couple gamers in my house, we often visit the local GameStop and bring in some of the games that my 7 year old has already grown tired of. It gives him an opportunity to find something new, and it's exciting to see that some of the games that he plays the most are some of the older games.

It seems like you're really focusing on getting people to bring in their games, and then selling those games back to consumers. Why is that such a strong focus?

BM: It really helps to extend the life-cycle, and give the consumer more choices. You know, gaming is all we do, and so we offer the broadest selection of merchandise, both new and used. We'll stay with platforms like the PS2. There's a lot of life left in PS2, and there's a lot of life left in the older titles.

There's a lot of good content, to expand that gaming experience for the consumer. Now that we're entering into a different era with Nintendo, on the Wii, and really broadening, expanding the consumer base, it's bringing in a consumer that may not have shopped in our stores previously. So it gives them an opportunity to expose them to gaming, and get them involved with our trade-in process, and that unique currency that we've got.

So you look at it more as a way to keep people coming back in? Or is there a financial benefit to it, as opposed to selling new games?

BM: Oh, it definitely is a financial benefit -- for the consumer! When they're coming in to buy a PlayStation 3, or an Xbox 360, or even a Wii or a DS, this makes it easier for the customer. You know, a lot of people don't realize what the value of their old inventory is, and it really is currency for them. What about for the company?

What about for the company?

BM: For the company, it is a great benefit. Obviously, as has been reported, the used games are a big portion of our business.

How do the publishers feel about the used games? Do they feel that it takes away from the new games sales, or are all of the relationships good?

BM: All of our vendor relationships are very good, and very strong. For the publishers, I think, there was a period of time a few years ago where it was a little bit confusing. The publishers didn't understand the model, so we spent a lot of time educating publishers to the benefit.

The consumer, typically, puts 80% of a trade transaction toward a new game purchase. So then we're able to sit down with the manufacturer, and provide that type of information to them, to make them realize that really it is a type of currency within our stores.

One thing about GameStop that strikes gamers is that big games won't be in any shortage, but you can find the smaller, more niche titles more readily. How is it, working with the small publishers? How important do you consider them?

BM: Oh, they're very important. All of our publishing partners are important, from the smallest to the largest. We value our relationships with our partners, and we enjoy seeing the small guys have a game, and for that one title that they may ship a year, we want it to be as successful as something that's coming out from Sony or Microsoft. I want to say all of our publishing partners are going to be present during the show. It supports the value relationship that we have with our partners, and they have with us.

Are you finding that the small publishers' games sell well for you because you attract more of a hardcore audience?

BM: I think that not all of the smaller publishers are for hardcore gamers. Definitely in the past, our consumer was more focused on the hardcore, but as I mentioned, Nintendo's done a great job. Two years ago, they made a statement, and they've proven it and delivered on it, that they were going to expand the consumer base and bring in a more casual gamer. They've done an excellent job of it. Microsoft has done a good job of bringing in the casual gamer with Xbox Live, and the more social gaming aspects that that involves. With Sony, they have the opportunity with Home coming. It all comes together, and there's definitely an opportunity for the smaller players to coexist within that environment.

How do you feel about services like Xbox Live Arcade, where Microsoft is selling games directly to the consumers and bypassing retail?

BM: We view digital distribution as another channel of opportunity for the consumer. We provide the consumer with choices, and as long as we're on an equitable distribution model with those choices, we just consider them another competitor. We're not afraid of competition; we know that there are certain limits within that model. Actually, we've engaged digital distribution within our own website. There are PC games that are downloadable from GameStop.com.

What percent of the market do you think is going to be digital, and what percent is going to be packaged software?

BM: I don't know the numbers off-hand. It's a smaller portion of the business. It's probably ten, fifteen percent. Again, I see that it definitely is growing, and it will continue to grow, but it will continue to coexist with brick and mortar retail.

There was a point a few years ago where it looked like everything was going to go to e-commerce. We actually opened some of our stores branded as GameStop.com. Actually, this year we've gone through the rebranding process, and by the end of September, 80% of our stores will have a GameStop storefront for the consumer to see a common look to our stores.

So is EB being phased out now?

BM: Yes, that is part of the strategy. A couple of years ago, during the holidays, we had five different brands.

The bags had four logos on them for a while.

BM: Yeah. Now that we've evolved, the company is at a position where we really want to focus on taking this to a new direction, and taking it into a common direction. Not only for the consumer, but for our associates as well.

Speaking about small publishers, recently some niche titles have become GameStop exclusive games. How do you build those relationships, and choose those games? What opportunities do you see there?

BM: I think those opportunities will continue to exist. There are a lot of creative individuals that have small development companies, and they try to find their way into the market either through a distributor, or most of our merchandise we buy directly from the publishers.

This provides a small startup company a good opportunity to get in with us and present their product, if they are having trouble finding another distribution channel. Or maybe they get in through a bigger publisher, like Atari, that does a lot of affiliated relationships. Electronic Arts takes in smaller publishers as well. I think there are opportunities, not only within the small publishers, but within some of the larger publishers as well. Last year, for example, with Square we had an exclusive version of Final Fantasy XII. That was an exciting opportunity for our stores and the consumer.

There also seems to be a lot of pre-order bonuses that have come along for GameStop, and there's a passionate audience there, that is going to want to spend ten extra dollars to get a bonus. Is that something that comes from you guys, or comes from the publishers?

BM: It is really a partnership with our publishers. I would say that the majority of the time, our merchant group is helping to drive that. We have a good idea of what the bigger titles are that are coming, and it's easier to start those conversations if the vendors aren't coming to us with them initially and offering up something unique that will help differentiate our consumer.

Let's run down the current platforms, and if you could, give us your opinion on how that platform is doing right now. What opportunity does the PlayStation 2 have, for example?

BM: I see great opportunity. There are 60 new titles that are coming on PlayStation 2 between now and the end of the holiday season. Sony made a comment a few years ago that there are five years left on the PlayStation 2, and we've had some of the best products released so far this year. God of War 2 is a great example. Phenomenal launch, and it's a lot of good energy. The installed base they have is definitely working with them there. We see several years ahead with PlayStation 2.

Move on to PlayStation 3; how do you feel about that now as it's moving into its second Christmas?

BM: I think that has a lot of different opportunities, because it brings in a different type of consumer. It's really the higher end. It's the core consumer that wants the latest and the greatest. They're more into the technology, they probably already own a high definition television, and surround-sound entertainment system.

They're the consumer that is more into the technology and really getting the benefit of the new development within that high definition game. There are a significant number of new releases that are coming out on the PS3, so we see a good holiday season ahead there as well.

Do you think it's living up to its potential just yet?

BM: I think they're not there yet. I think they've done some moves recently, with the mark-down on the sixty-gig that will help to show that they are reacting. That they see the opportunity, and they know that they need to continue to stimulate that. The eighty-gig is coming out now, and having a game packed in, they see that they have a little catching up to do.

And that brings us pretty nicely to the 360. It looks like they might have a pretty phenomenal holiday. Halo 3 is nearly here, Mass Effect...

BM: Yeah, the 360 lineup is solid. It's really phenomenal -- they've positioned themselves well. Last year we had a two speed strategy going in with the Pro and the Core. This year it is almost double. We have four different hardware SKUs that we have at different price points.

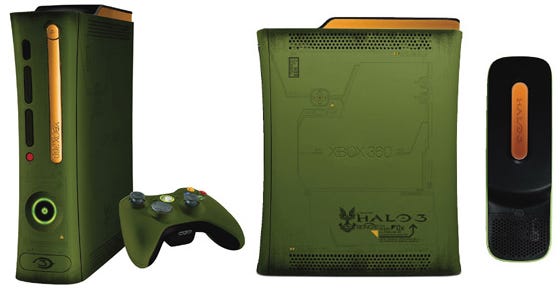

All the way from the Elite, which is fairly new to the market, has a lot of horsepower for the consumer that wants the 120 gig hard-drive. Now we'll begin selling, as all retailers will on Sunday, the Halo 3 Edition, which is basically the Pro model dressed up in the Halo colors, with the headset. Then they also have the Pro console and the Core. They'll be relaunching with a wireless controller, coming up shortly. They understand that there's a consumer at the end of each of those price points, and they have the product for us right now.

There are over a hundred 360 titles that are coming out for the holiday, and they're continuing to expand the platforms into more of the social gaming and the casual games as well. A very solid holiday; as you mentioned, Halo 3 is going to break all records. It already has. It's our highest reservation title, and probably going to be our biggest day-one...

Highest reservation ever?

BM: Yes.

Do you think that it is good for the market to have so many different hardware SKUs? When the 360 was first release, there were questions about whether even having two units was a good idea.

BM: Looking back at it, I would say that they had a pretty good strategy even at launch. I'm not sure, I would've preferred to have one. It always complicates things, having multiple SKUs, but now the time is right. Really, the Halo 3 is an in-and-out opportunity, for that kind of collectible consumer. So there are really three different models that will be on an on-going reorder, replenishment basis. So I agree with the strategy. I think that there are consumers at all levels.

Definitely, with the high-end gamer, they want all the horse-power, they want the bigger hard drive, they want to be able to download the larger games, and have the social thing. They need to have the social gaming aspect, being on Live, and having the download content. Then you have an opportunity below it. You get to the Wii, at $249, and then the next thing down with the PlayStation 2. There definitely is an opportunity to serve that consumer as well.

What do you think about the Wii and its prospects?

BM: As I mentioned earlier, I give Nintendo a lot of credit. They set out a goal to expand the consumer base, and I give them credit, they did a great job of it. I have one in my house. As I mentioned, I have a 7 year old boy, and a 5 year old daughter, and we all sit around the TV. They like playing some of those mini-games, whether it's fishing, or some of the easier games.

Even though they're mini-games, there is a lot of good entertainment value in those, and they've done a good job of marketing that. And releasing them, not only at the launch, but also having them bundled in, to give the consumer a taste of the gameplay, then having the subsequent launches of more acts and mini-games.

Mario Party 8, which some were concerned about for the Wii, came right back, charged in, and did phenomenally.

GM: Yeah. It's good, it's fun. They are truly bringing in a new consumer, that we feel has never walked through the doors of a GameStop before. It's bringing us an opportunity, not only for the Wii, but also on the handhelds. A significant number of our new releases between now and the end of the year, a little over 20% are going to be on the handheld platforms. And the majority of those are on the DS. Nintendo's done a good job of marketing both, and there is an opportunity for both to be out there.

So you are satisfied with the DS right now?

BM: Oh definitely. Very satisfied with the DS, and there is a good slate of merchandise coming for the holiday. They've done a great job of bringing in an extended gamer base. We have over 100 titles currently that are in the kids category. All the way from Cars to Hannah Montana, Ratatouille to Cooking Mama, we have these targeted games.

We have actually set up a dedicated merchandising section within our stores for kids entertainment, as well as for the music genre. Both are going to continue, with Guitar Hero 3 coming, and Rock Band, as well as a SingStar update, and all the DDR products. It is a unique opportunity. I just today saw Ubisoft's Jam Sessions for DS. A very unique product.

The spread of rhythm games feels like the Tony Hawk boom of the late '90s and early 2000s. It feels like the same sort of rush.

BM: Yeah. Targeting the casual gamer, definitely. Like I was saying, the majority of our kids entertainment products are on the handheld systems.

The PSP has got a different profile with the new, slimmed-down version. What do you think about that moving forward?

BM: I think that the PSP has had a good run since they've taken a markdown since early in the year. The consumer obviously was waiting for that. These new bundles are a great opportunity for the transition from the current system, which is the bigger system, to the new system. They have slimmed it down, they are going for these new configurations.

The opportunity with these bundles, they have their new system in there, and have a game -- Daxter is the first one, we began selling that last week. They have another bundle coming in October, with one of the Star Wars titles packed in. After that, I think the transition will be complete. We'll be in a position where we don't have much of that existing, current product on the shelves. It will be a very good transition into the new, slimmed down Core PSP model. Again, we have got a lot of new releases: a lot of vendors have support on the PSP platform.

Sony pushed God of War back to next year. Does that affect your stance or opinion on the PSP?

BM: I think it's definitely still strong. We see a great lineup of product coming. It is unfortunate any time a big title slips -- whether it be that on PSP, or Grand Theft Auto on PS3 and on Xbox 360. That was a tough one to work around as well. But again, there will be a lot of great product to have, and really have the opportunity. Assassin's Creed will be one of the titles that will currently benefit, especially on the 360 format, as well as Mass Effect, now that GTA 4 has moved into March.

This sometimes gets glossed over by some people, but the PC is one of your big sellers as well. What do you think of the PC gaming platform right now?

BM: I think it's great. PC is really near and dear to my heart. The PC category is really what I started out with, and it evolved from the Atari and Amiga software that I started buying back in 1988. Then the PC entertainment buyer left, and I began to buy PC entertainment. We had a lot of vendors calling on us with 5.25" floppy media.

So it's always been a great platform, and there are always good games. EA's got a great line-up. They've got Crysis, and sports, Spore won't be coming this year... Microsoft has done a great job of recognizing and realizing that they need to put money back into Games for Windows.

Do you like the Games for Windows initiative?

BM: You know, I do. I think it's great to be able to pull it together, and bring a brand look and feel to it. Especially now that we have undergone our own brand initiative for our own company. The consumer, I think, is just confused with the fact that things got to the point where they looked too similar to video games. The consumer wasn't sure what they were looking at any more. So I think it helped them put an identity to it, and realize that there is support behind it all the way up to Microsoft.

What's interesting is that GameStop has to choose when to "abandon" an older platform. When does that point come?

BM: We are one of the retailers that takes the position that we will be one of the last ones standing. For example, on GameCube and original Xbox, even though hardware has not shipped for a long time on them, we still have sections in our stores. We continue to promote.

You still see big walls of Xbox games.

BM: We definitely understand that a lot of consumers don't want to feel that they have been "abandoned" by a platform just because it is transitioning to a better system. We want to offer our consumer the choice, to have a broad selection.

Do you think that the backwards compatibility affects this? The 360 has some, the Wii has complete backwards compatibility. Does that continue to get them space in your store, and extend the lifespan of those games?

BM: Yeah, I think the backwards compatibility is a good thing for the consumer; whether it be on the launches, such as when they launched the 360 and had backwards compatibility. They took a little bit of heat from the consumers because they didn't have as broad a backwards compatibility.

I believe that the consumer stepping into these new platforms, whether it be the Xbox to the Xbox 360, or PS2 to PS3, that they also want to step up in their game selection as well. They don't want to feel that there is no backwards compatibility, that they would be leaving behind the library that they have already hoarded and have in their closets.

Do you see an opportunity there, where, say, a new Wii owner who never owned a GameCube might buy Super Mario Galaxy, and then might work their way back toward Sunshine?

BM: Oh definitely. I think their strategy is different from the others. Definitely, where they have the download opportunity for the older platforms. It's all about providing choices to the consumer, and we like that. Our service provides for that.

One of the biggest retail controversies, with something like Manhunt, is the ESRB rating system. Do you feel that it is effective for the consumers, and being executed well from the ESRB level?

BM: It's a good question. I think it's very worthy that the ESA has taken this on. We definitely have undergone a campaign this fall, all the way up to our executive management, that we are part of the Respect the Ratings initiative.

Being a parent myself, and having kids now that are coming of the age, I believe that it is the responsibility of the consumer. But I believe that it is our responsibility as an industry and as a retailer to educate the consumer that there are choices. That these things do mean something; for every game that is rated M, there is a reason that it is. We have put systems in place for any consumers who purchase M rated games, it prompts for an ID.

You do that at point of sale?

BM: Yes, we do. We initiated that several years ago. We take that very seriously, and communicate it very often to our associates.

There was a point where Manhunt 2 was considered an AO game. Is an AO game something that you would consider selling if it came out? Is it something that you would consider carrying in your stores?

BM: I think that it is an opportunity that we would have to look at on a case-by-case. In this situation, I'm glad that they went back, reworked it, and it will be M rated. I can't say that we would have supported it at AO, and I can't say that we won't.

In the past, when there was an AO game such as Leisure Suit Larry from a couple of years ago, GameStop wouldn't support that game in our retail stores. However, that was before the merger with Electronics Boutique, and EB did take the title into their retail stores. So, again, it is a situation that we have to take on a case-by-case. But I have to say that we prefer that the AO games are not anything that we are out there in the market looking for.

What we are talking about is on the fringe. Console manufacturers won't manufacture an AO game anyway, so it is on the fringe. But moving forward, we can't really predict what will happen.

BM: That's right. We see the opportunity, and we like it. Again, forme, I am glad that it's there. You don't know all of the games, and their reasons, whether it's language or violence or nudity within the game, they all have their points for being. And again, as a parent, that is where the consumer needs to know. 'OK, here are the choices, and do I really want my son or my daughter playing it. Is that OK?' Obviously it is if the parent buys it for them in the store. We won't sell it to anyone under 17.

Some of your stores in malls have been there for years before GameStop, versus stores in strip malls, some of which used to be FuncoLand -- is there any difference in these stores? Do they perform differently and have different character?

BM: I think there was a point in time several years back, where they did perform differently. It's really not that way any more. As I mentioned, we are closing in on rebranding those stores, and really that is a sign that we don't see them as differentiated anymore.

I would say that the stores within the malls are typically smaller format than the other stores: on average a twelve-hundred square foot location, where the average strip location would be a little bit larger: maybe fifteen, sixteen hundred square feet. That's really the only differentiation between any of our stores. A lot of our mall stores are in very good malls. We have good real-estate, and there are some high-volume malls that are around the country.

When you open a new store, some of them come from the previous stock of FuncoLand or Babbages -- moving forward, you'll have a unified look and stock?

BM: Oh, yeah. We've spent a lot of money over the course of this year to go in and not only have the name of the front of the stores to look the same, but also get some of the picturing within our store interior, as well, to give it a unified experience. Whether the consumer is in a strip store or a mall store, they'll have the same experience.

The years of guessing whether it used to be an EB or a FuncoLand are over.

BM: Yeah, they are. Now the only thing remaining is the saw-toothed walls within the old Babbages. [laughs]

With the PC productivity software! [laughs]

BM: And educational. They were big into educational.

Can you give us a little background, and tell us what you do at GameStop?

Tom DeNapoli: My job and what I do -- actually, that's a good question. Actually, my job, as the vice president of marketing, is the chief brand steward for the company. I develop the marketing communications programs, in terms of consumer insight, media, brand look and feel; that's really my job.

As we talked with Bob McKenzie, he was saying that, as you're moving forward with all the different stores that came from different chains, you're moving forward with a unified branding and look for your stores. Is that your job?

TD: Yeah, and what I'd say about that is that GameStop right now is really leveraging the expansion in the marketplace. We're strengthening our position as market leader. We see this marketplace expanding. We're opening, for instance, 550 stores this year, 60% of those will be in the U.S. With that "broadening," if you will, it's an excellent time for us to really take our brand and make sure that we've got a great brand identity, and that we weave it in to everything we do.

There are around 3,800 stores right now?

TD: I will say this about it: When you look at this company, we've been built through acquisitions, and alliances. When you think of all the names under one banner now, you're looking at Babbage's, FuncoLand, Software Etc, obviously GameStop, EB Games, Planet X. That roll-up has been a big, big piece to our ubiquity.

Now, as we do that, we now have to say, "how do you put that under one umbrella," which we've done. The fact that we're opening new stores is going to increase that footprint. And now we've got almost five thousand stores in sixteen countries. We're the number two fastest growing retailer in the United States. So, that addresses some of those questions.

Speaking of retailing in games, with digital distribution is becoming more prevalent through Xbox Live Arcade, Wii Virtual Console -- how do you keep the gamers interested in coming in to the stores? Especially now that Sony has tested the waters with a fully downloadable Warhawk?

TD: We have done a lot of consumer insight, such as focus groups, and we've done ethnographies where we've actually gone into the homes of gamers. We've talked to them about their preferences; we've brought in friends and they've talked to us; we've done shop-alongs. The retail environment, the need for brick-and-mortar, isn't going away any time soon. As a matter of fact, we've done some proprietary studies, and worked with a consulting group, and from what we can tell, the world in terms of digital downloading -- and the distruption that it's going to bring -- is years out. As games get more complex, as we see more and more with the graphics, consider the size of the pipe that it takes.

When you look at this sense of community -- at the "millennials" if you will -- this generation that's into this connectivity, and the social aspects of gaming, what we provide is a social aspect in itself: A place to hang. When you look at our stores, they're staffed with experts that are gamers themselves. They know what's coming out. They know what the right game is. They can interact with the community, they can hang, and I think that that footprint leads to the intimacy that you have in a store; to get your questions answered that you really can't get online.

Do you do anything, in terms of the stores, to cultivate that? Or do you feel that it is just a natural outgrowth of the way that gamers relate to one-another?

TD: I think that a fortunate part of it is that we have a very passionate group of sales associates. They're all gamers themselves, they're players. And what we're finding, too, with this Wii phenomenon: Nintendo has done a wonderful job of expanding the marketplace. Not only with the software they're developing, but obviously with the DS platform and the Wii platform. But I'll tell you -- there are a lot of core and avid gamers that are buying the Wii and the DS platforms as a secondary console, or as a portable gaming platform on their own.

So when you look at that, the fact that we have people in our stores; we have the best selection out there; we have the best used trade value proposition. We have a form of currency that nobody else offers. And, our store associates are agnostic. Certainly they have their preferences, and maybe games that they like to play, but they certainly understand that this consumer group is changing, and their consultative sales skills are more along the lines of helping those folks get it right, and get whatever they're into.

When you look at, say, Gap Corporation, they have Old Navy, they have The Gap, they have Banana Republic. With the games market changing, and its audience maybe splintering into different audiences, have you thought about any sort of evolution along those lines?

TD: That's a good question, and certainly, we answered a couple of those. That's more of a segmentation question. Segmenting the customer base, and how that might turn into segmented retail offerings. Is that what you're talking about?

Yeah.

TD: I can tell you that it's not something that we are sitting around talking about. But I will say this: We are more and more looking at the consumer insight; we're really doing more and more research, and listening to the customer, looking at these trends -- the social aspect of gaming, and what those adjacencies and extensions are.

We'll be responsive to the consumer needs once it needs, to the point that we have GameStop.com, if your preference is in a virtual environment and now you want to buy in the store and have it shipped to you, or to a GameStop store to pick up. These are all things that we've looked at, and are looking at. At the end of the day, we want the customer to transact with us where they're comfortable. It's certainly in our brick-and-mortar, it's certainly online, and as those needs and wants and desires change, we will be responsive to that.

Finally, what do you think that Game Informer does for GameStop?

TD: When I look at that, it's certainly something that we're very proud of. Look at our heritage, as GameStop: we're all about that. It's in our DNA. Gaming, playing video games is what we do. We share that with Game Informer -- certainly a sister company of ours. The fact that they're the number one video game magazine in the business, and the fact that their expertise, and the things that they do, and the respect that they garner within the community is what we aspire to as well in terms of our store associates.

Again, we see it as just one more way that GameStop -- and again, Game Informer is a separate company, they have that editorial bias that looks at things objectively, in their own manner. And that's a great relationship.

Read more about:

FeaturesYou May Also Like