Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Is the road to the VR promised land finally here?

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back, folks. Hope you had a wonderful weekend, and are raring to go for an exciting week during which, I presume, there won’t be any other $50+ billion acquisitions in the video game space. (For all our sanity’s sake.)

So - we haven’t led many newsletters with VR games recently. Don’t worry, if you’re not a VR aficionado, there’s items on Steam and discovery trends if you scroll down. But given the relative success of the curated Quest 2 store, we thought we’d dive into the game-specific numbers, with the help of a guest.

[We’re delighted to welcome a guest post from Cassia Curran of the Curran Games Agency. Cassia’s background at NetEase, Jagex and Wings Fund has given her much industry insight & she’s presenting research on the Meta VR (formerly Oculus) store, as well as partnering with us for more info.]

Meta's Quest 2 probably has sold about 10 million units since its release in October 2020 - this far outstrips all the other VR headset sales. I believe sales on the Meta VR Store constitutes the vast majority of VR sales in the last 12 months. So I set about synthesizing public data on the Meta VR Store for the benefit of all, thanks to a research commission from Fruity Systems.

The charts below are using a semi-arbitrary ‘ratings to sales’ multiplier of 115 to calculate gross revenue. This multiplier won’t give us accurate revenues in the absolute sense, but we can use them to make general comparisons between games.* And don’t forget - the VR games industry is young and dynamic. Trends present now are highly likely to change in future. (*There will be a survey to collect and improve this data later, please read on!)

Top-selling games on the Quest 2 seem to fall into one or more of the following broad categories:

A high-quality game that was one of the first VR titles to be available and continues to sell well - e.g. Arizona Sunshine, Job Simulator.

Uses a high-profile movie/TV/game IP intelligently - e.g. The Walking Dead, Five Nights at Freddy’s, Star Wars.

Has great multiplayer - e.g. Onward, Demeo.

Is a realistic or semi-realistic sports or hobby game - e.g. Eleven Table Tennis, Gun Club VR, Real VR Fishing, Walkabout Mini Golf.

Is an already-popular, quality PC VR game that has been polished and then ported to Quest 2 - e.g. Onward, Blade & Sorcery.

Obviously, this is a reductive overview, but it’s a good idea to understand very wider types of games that we think are doing well.

When reading the below, please remember that the Meta VR Store is heavily curated, and getting a slot is key to success. There are a total of 290 games/apps, including demos, released for Quest 2 specifically - though some were originally released for Quest. And Meta often only releases 2 or 3 games per week on Quest 2.

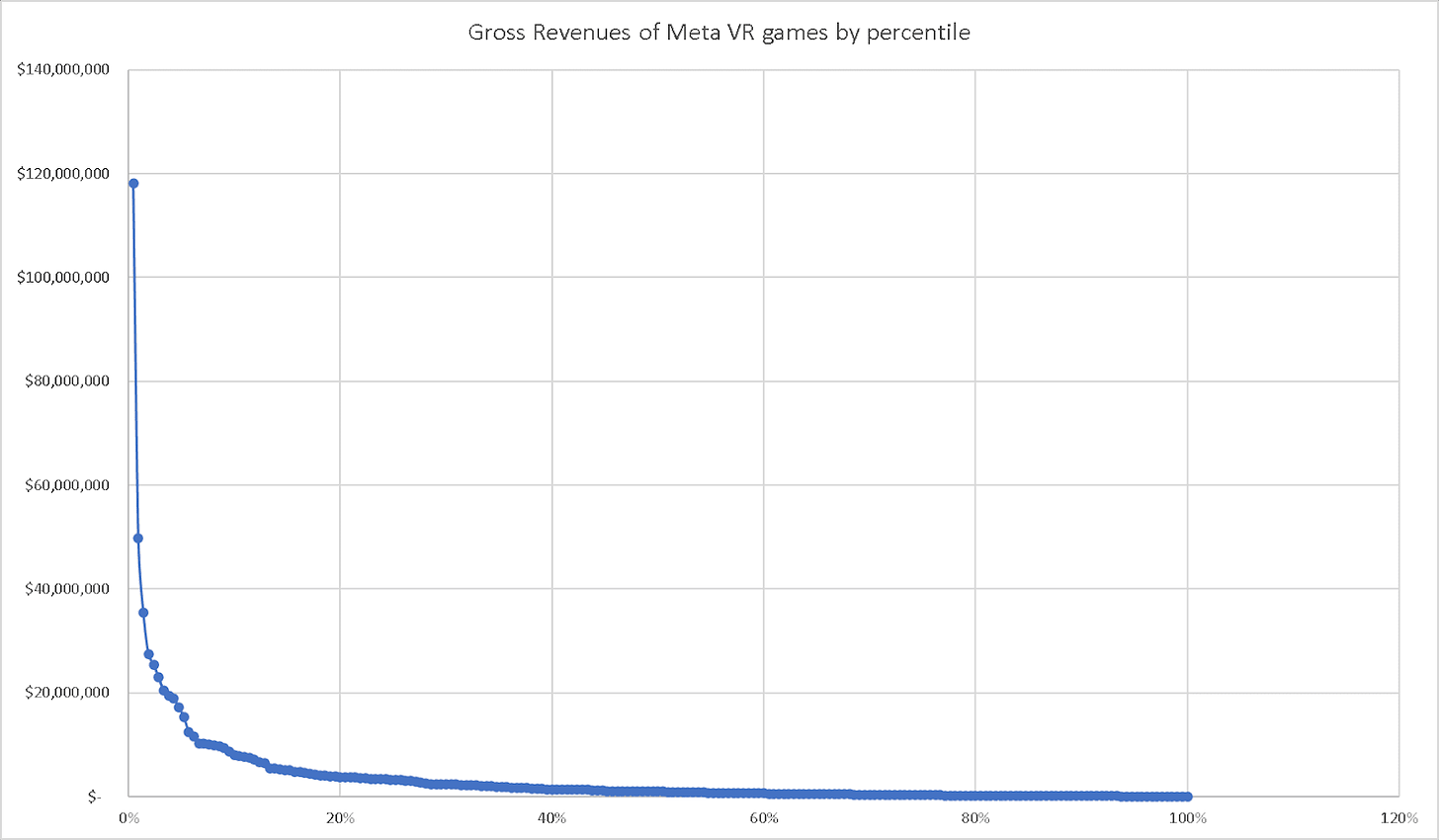

This graph gives a general idea of the revenue spread of Meta games - although we didn’t factor in things like discount or regional pricing, so it’s likely overstated somewhat.

Nonetheless, the “hockey stick” graph shape is important to bear in mind when comparing average and median revenue in the below graph. A much higher average revenue compared to median revenue suggests one - or a few - super-high-performing games are selling much better than the rest of the games in that same category.

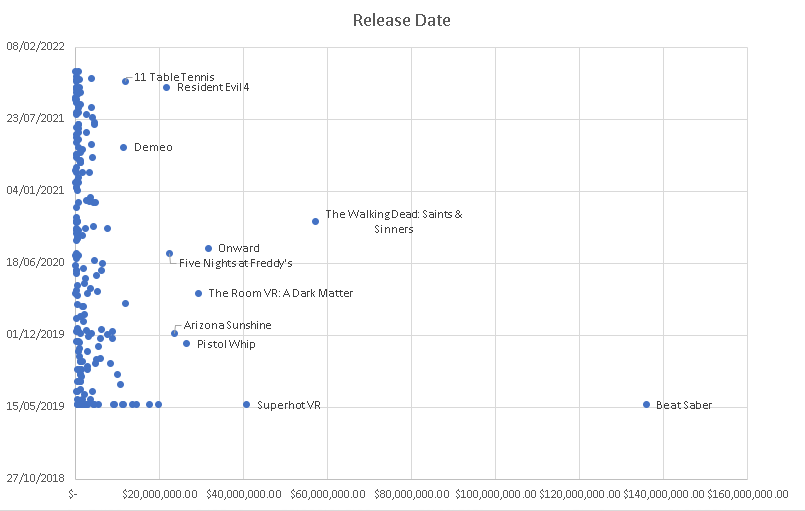

It’s great to see some recent VR games break out and perform very well. For example Resident Evil 4, Blade & Sorcery: Nomad, and Medal of Honor: Above and Beyond have released in the last few months, and are selling very well despite the short time on the store.

And obviously, games available on the Meta Store from May 2019 have had a distinct advantage - both more post-release development time and ‘launch game’ advantages with scarcity of product for the first Quest.

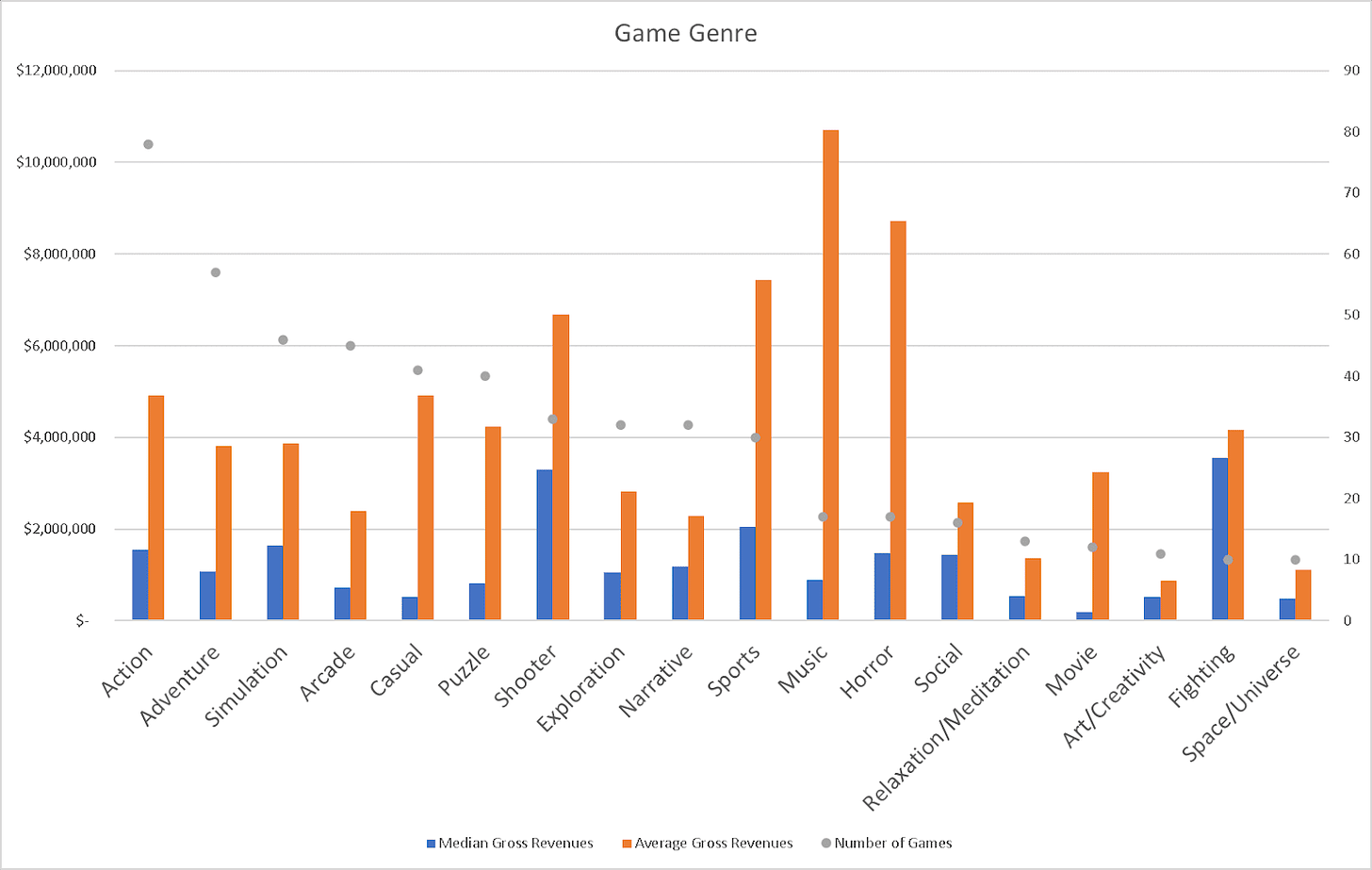

This graph is intriguing - though please note that genres with less than 10 games are not represented here. By the way, Beat Saber’s genres are listed as Casual, Music, Sport, as can be easily seen in the spikes for those average gross revenues.

Overall, arcade, casual and puzzle genres look quite crowded and relatively underperforming. On the other hand, shooter and fighting genres overperform. And it looks like music & horror games either perform massively well, or not that well at all.

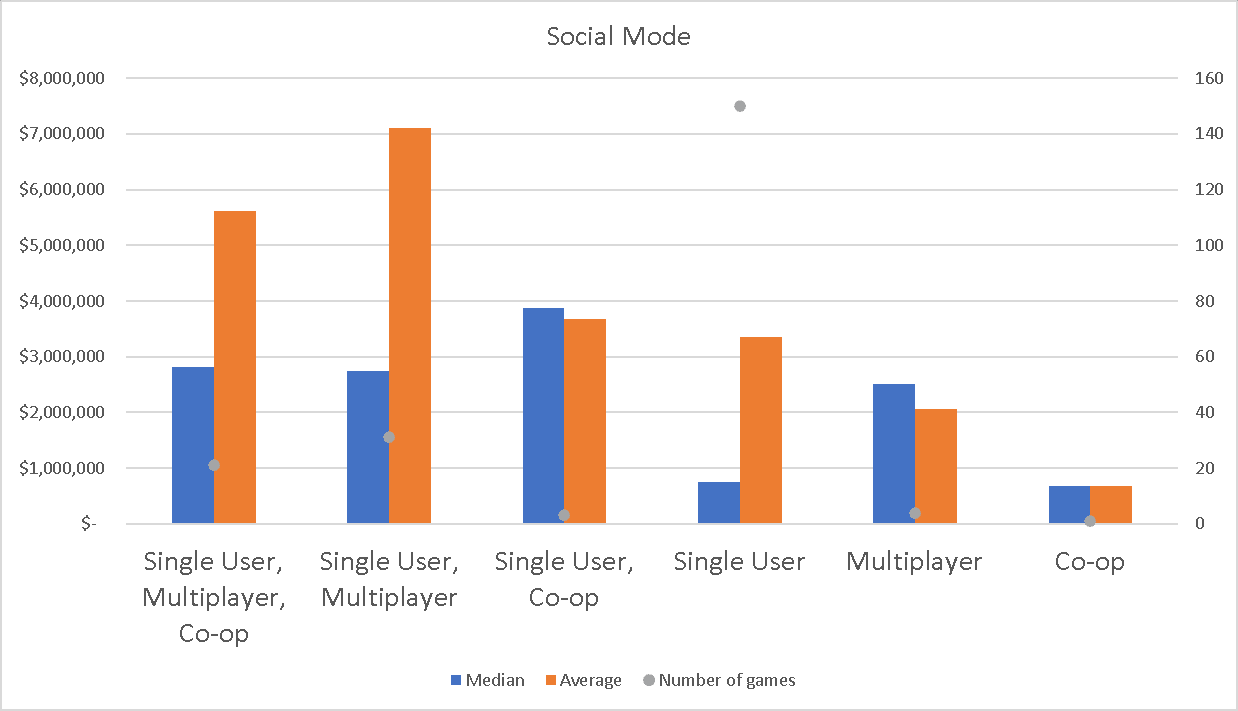

We thought it’d be interesting to group Quest 2 releases so far based on multiplayer or single-player. For what it’s worth, most games are single-player; very few are multiplayer or co-op only.

Overall, you can see that multiplayer games perform significantly better than single-player games in VR. However, this may partly be down to multiplayer games often being higher-budget, higher-effort affairs, so actual ROI is difficult to track.

Finally, myself and GameDiscoverCo would like additional data - and opinions - from you, if you’ve shipped VR games on Quest, Steam and other VR platforms recently, to help us get a more accurate picture of relative sales. We’ll present the results back to everyone in the near future.

We’ve made an anonymous survey for you to fill out, which should only take 5 minutes to fill out. You don’t have to tell us your game’s name or its sales numbers - we’re just interested in review to sales ratios, your sentiment on the VR biz, and relative sales percentages. You have until February 4th to send us info - please help out!

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.

Read more about:

Featured BlogsYou May Also Like