Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Thisisgame.com conducted a survey on the marketing budget trend for 2010 earlier this month. Total 24 major publishers in Korea participated in the survey.

Thisisgame.com conducted a survey earlier on the marketing budget analysis this month. Total 24 major publishers in Korea participated in the survey: Actoz Soft, Aurora Games, CCR, CJ Internet, Com2Us, Dragonfly, EYA Soft, Freechal, GameHi, Goorm Entertainment, Gravity, KTH, Liveflex, Mgame, NCsoft, Nexon, NHN, nPluto, Ntreev Soft, Sonov, Webzen, Windy Soft, and YD Online.

In 2009, a total of 90 new games launched in Korea. This year out of 24 participants, 23 publishers responded they had a plan to launch at least one game in the first half. That would be 6o games in the pipeline, an average of two games per week.

11 participants expected to launch 3~5 games and 10 participants to launch 1~2 games in 1H. There are even 4 vendors that plan to launch around 6~10 games. Browser-based games seem to cause such rise in the number of launching games.

Most publishers aim to conclude CBT or OBT in order to release a game during the winter breaks, which is the high season when it comes to online games in Korea. Such trends force publishers to begin their CBT/OBT in 1H and at the same time boost their revenue.

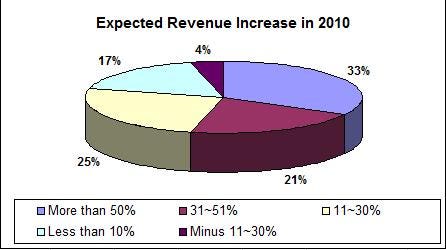

In fact, 13 out of 24 participants answered they expected 50% increase in their revenue in 1H compared to the same time period last year. Only one participant expected a revenue decrease in that time period.

Highly anticipated games are pouring in: CJ Internet's Dragonball Online, NHN's Tera, Nexon's Dragon Quest and Mabinogi Heroes, Neowiz' Age of Conan and Battlefield Online, and Mgame's Argo all begin OBT in 1H 2010. The first half of 2010 can be a turning point for some of them.

14 out of 24 participants increased the marketing budget from the same time last year. Four vendors expect more than 50% increase and three vendors expect somewhere between 31 to 50%.

Two participants decreased the budget down to 30% and four are still undecided. The reasons behind such decrease include better budget management and less game launch compared to last year.

The main reason for the increase is stemmed from the increase of game launch followed by increasing marketing costs.

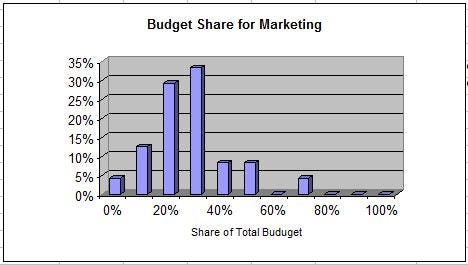

33.3% of participants answered that they spend 30% of the total budget on marketing activities.

"As games launch and costs soar, the marketing budget naturally increases as well. So it just reflects such inflation," explained a participant.

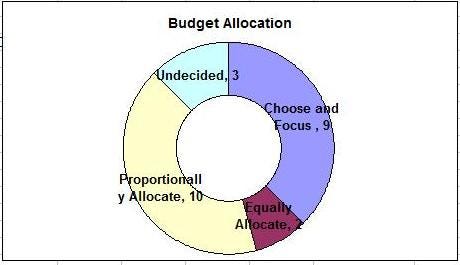

When it comes to game publishing and marketing, 'choose and focus' is a dominant mantra. 79% answered they weigh the budget allocation differently depending on games. 41.7% self-grade each game then allocate the marketing budget accordingly. 9 participants answered they only focused on a main title.

"It is natural to bet on something more likely to succeed. It's not about hedging a bet. While developers may want all the love and attention for their games, publishers have to be careful to choose and focus. That's why some of small developers complain about promotion and marketing on publisher's end," explained an industry insider.

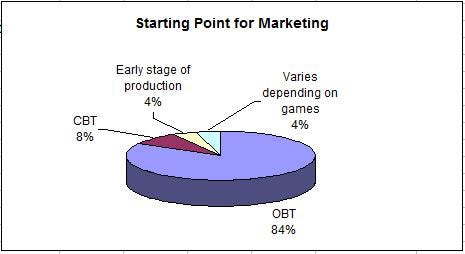

20 participants picked an OBT as the most concentrating period of marketing activities as well as the budget. Two participants spent the marketing budget on a preview party or CBT, and two answered it varies depending on the games.

Publishers prefer OBT to maximize its result with limited budget because OBT can accommodate unlimited number of users.

Participants selected advertising as the most effective form of marketing. 18 participants weighed heavily on "ads on portals, webzines, and TV." Five participants used in-game events and promotion. The result shows there are not many alternatives available rather than advertising as a form of marketing.

"Practically marketing means advertising. With limited budget, OBT is the best time to spend phase in order to solicit players. It is like stocking ammos before going to a war," explains a publisher.

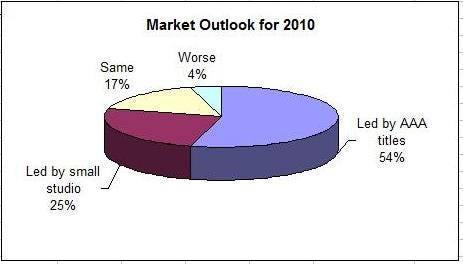

Most publishers expect the market will be led by more active and visible marketing activities due to increasing number of game launches.

13 participants expect triple A titles to lead the market while six participants find small-and-medium studios will lead the growth.

You May Also Like