Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Epic Games, the publisher behind Alan Wake 2, a premium single-player game on consoles and PC, is defying consumer expectation by releasing the game as an exclusively digital release.

Epic Games, the publisher behind Alan Wake 2, a premium single-player game on consoles and PC, is defying consumer expectation by releasing the game as an exclusively digital release. Though this is rare among single-player “AAA” (titles with the highest development and marketing budgets) games on console, there are a number of key drivers behind this decision that are worth examining.

Alan Wake 2 is the first AAA release from Epic Games’ new publishing label, Epic Games Publishing. Epic claims that its publishing program offers third-party partners more favorable terms.

As is typical for a publisher-developer relationship, Epic is providing both support for publisher-led activities such as localization, distribution, and marketing and funding and advances to cover the development costs of the game itself. Once the game goes on sale, Epic will receive 100% of net revenue up to the amount it has invested and a share of revenue thereafter, with the remaining portion going to the developer as royalties, a not unfavorable 50%.

Where Epic’s model differs in a big way is in its pledge to ensure partnering developers retain full ownership of their IP while also exercising full creative control of their projects. Epic is also pledging to pay the full development cost rather than a certain defined amount.

This arrangement is unusual for AAA games publishing, where the vast majority of titles are made by studios that are publisher owned. By contrast, what typically happens in indie games development is an independent developer strikes deals with an independent publisher on a per game basis.

Epic Games Publishing is bringing this model to the AAA games market, having signed deals with developers to publish multiple AAA titles, including Alan Wake 2 and a new game from The Last Guardian developer, genDESIGN. These titles are significantly riskier propositions, typically taking upward of five years to make and also requiring a much higher marketing and development spend. It is in this space where publishers traditionally have demanded IP ownership, a degree of creative input, and lower royalty shares after development advances have been paid.

Once development on Alan Wake 2 is complete, it will enter distribution channels for release to market. The profit margin on each copy sold enables Epic Games Publishing to recoup its publishing investment, including all advances used to fund the game’s development. Developer Remedy Entertainment will not see any royalties before these advances have been fully paid.

Given the generous publishing terms at play for a AAA single-player title without postpurchase recurring revenue, Epic sees it as imperative that it does not just recoup these costs to ensure its new publishing operation is sustainable: it must fulfill its pledge that partnering developers receive a generous cut of postsale profits as royalties.

On the PC platform, Alan Wake 2 is being published via the Epic Games Store, a distribution platform fully controlled by Epic, with its costs largely being absorbed internally through economies of scale.

However, when publishing digitally on console, Epic does not own or control the digital distribution platform, instead receiving a cut of revenue from every copy sold via Sony’s and Microsoft’s digital PlayStation and Xbox storefronts.

This distributor cut can be up to 30%, according to Omdia’s Games Tech Market Forecast 2023 (see Further reading). At a macro level, an estimated 17% of games market revenue is taken by digital distributors.

With a physical retail release, there are even more additional costs. On top of third-party licensing fees paid to platform holders Sony and Microsoft, Epic must pay for the manufacturing of each disc and surrounding case. It must also cover shipping, insurance, and storage costs for the physical product while also ensuring the retailer takes a cut of the final sales value. Demand may also be overestimated, leaving unsold inventory to be heavily discounted.

In recent times, Epic has specialized in operating live-service games that are primarily monetized after sale or download via monthly recurring revenue from in-game purchases. These titles, which include Fortnite, Rocket League, and Fall Guys, are built around online multiplayer and are free to play, making them a natural fit for digital-only distribution.

This is in stark contrast to the approach of other major publishers such as Ubisoft, Capcom, and Bandai Namco, which continue to maintain a business around premium AAA games, many of which include a significant single-player component and do not have significant postsale downloadable content. These publishers continue to ship millions of disc copies of games annually, and this volume sustains their relationship with physical retailers and the distributors that supply them.

Because Epic is not in this position, releasing a physical version of Alan Wake 2 at retail would require Epic Games Publishing to strike deals with other publishers that do hold these established physical distribution pipelines. In fact, Epic has previously done exactly this: in 2018 it handed the publishing rights for the physical disc version of Fortnite to Gearbox Software.

If Epic was to use a third party as a route to market with Alan Wake 2, it would see a further reduction on profit margin on every disc copy of the game its partnering distributor sells.

Simply put, this means more copies must be sold before development costs are paid off, a requirement before developer Remedy Entertainment sees a 50% cut of future royalty payments. Given the favorable terms it is offering for the publishing of AAA titles, Epic has determined this is not a price worth paying.

By cutting a physical release from its publishing strategy, Epic Games is hoping enough console players will switch to the higher-margin digital version of Alan Wake 2 to offset revenue lost from the lower-margin disc release on console.

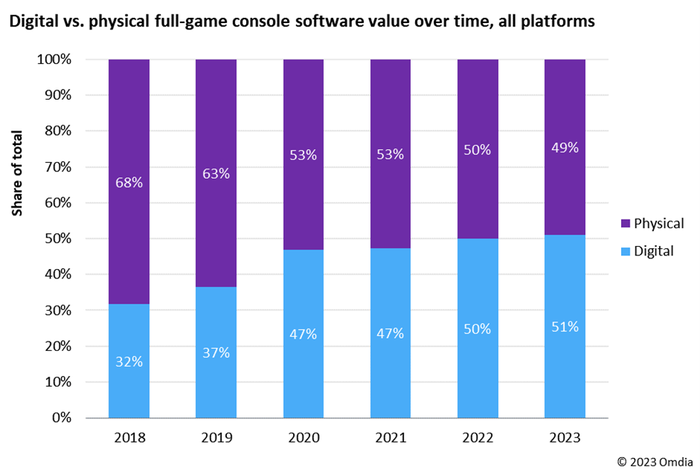

There are reasons why this may not be a risky gamble for Epic’s new publishing label. Omdia’s Console Report – 1H23 reveals that the digital share in value terms of full-game purchases on console platforms in 2023 has exceeded that of physical games, at 51.1% (see Figure 1).

1. Figure 1: Digital’s share of consumer spend on full-game purchases to surpass that of physical in 2023

Source: Omdia

This is notable. Digital’s share of software purchases in volume terms exceeded that of physical four years ago in 2019, but its share in value terms has since caught up, presenting an opportunity for Epic Games. Omdia expects this trend will continue at the expense of physical, driven by the high market share of the digital-only Xbox Series S console and an expected digital-first revision of PlayStation 5 in 4Q23.

Because Alan Wake 2 is a single-player title, earnings from full-game purchases become increasingly important in the absence of postsale recurring revenue. Though Epic Games Publishing currently has no plans to release Alan Wake 2 on disc, as sales of the digital version mature and reach a discounting phase, a disc version of the game’s more expensive deluxe edition becomes a viable option if it wishes to reach the shrinking physical games market.

Alan Wake 2 is the first true test for an unconventional publishing arrangement for AAA games. If other publishers soon choose to follow suit, it may well come to be seen as a pioneering move. For now, the penetration of digital distribution on console has certainly laid the foundation for a new format for AAA titles to be funded and released.

Console Report – 1H23 (May 2023)

Games Pricing Database – Spotlight (May 2023)

Games Console Content & Services Database (March 2022)

Games Tech Market Forecast 2023 (January 2023)

Games Tech Market Landscape Database – March 2023 (March 2023)

Steam Deck Forecast Report (April 2023)

James McWhirter, Senior Analyst, Games

You May Also Like