Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Digital distribution has empowered a handful of platforms, but their grip on the market is starting to look more fragile.

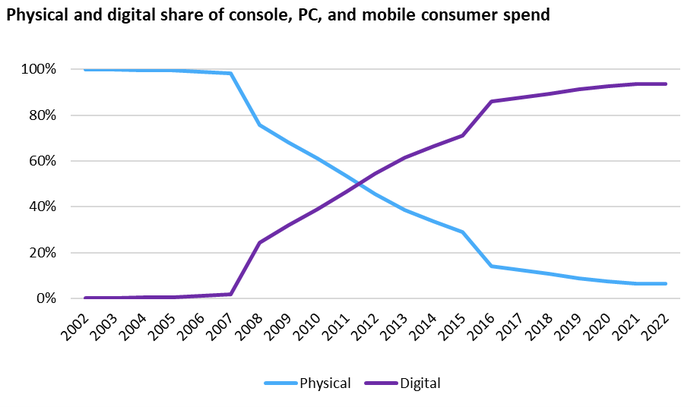

It’s surprising from the vantage point of 2023 to consider how recently digital distribution took over the games market. We take it for granted now that nearly all games are distributed digitally, but it was only in 2012 that digital games revenue overtook revenue from boxed games. In the console market, the crossover wasn’t reached until 2017. In the broader history of the video games industry we’re still actually quite early in the era of digital games.

A huge amount of market power accrued to just a handful of platforms in the first decade or so of the digital era. Apple and Google’s mobile app stores have virtual monopolies on distribution on their respective platforms, as do Sony, Microsoft, and Nintendo’s console storefronts, while Steam dominates to an only slightly lesser extent on PC. By now, 94% of games spending is digital, so these six platforms in particular have come to occupy a critical market position which enables them to extract fees upwards 30% of sales from publishers that use their platforms. As a result, distributors were able to collect, by Omdia’s estimates, a total of $41bn from publishers in 2022. But while games distribution will certainly continue to be a lucrative business, there’s good reason to think that the high watermark of distributor dominance in the games market has been passed.

The transition to digital distribution was rapid and relatively recent

Distributors are able to charge high fees because access to their platforms is indispensable to publishers and because they face little effective competition. The three consoles and iOS are closed platforms over which Sony, Microsoft, Nintendo, and Apple exercise an absolute monopoly on the distribution of software. Android and PC are more open, with multiple storefronts in operation, but in practice network effects make it extremely difficult to challenge the dominance of Google Play and Steam.

Nonetheless, in each case a well-funded challenger is attempting to take on the major incumbent. On Android, Huawei is hoping to make its App Gallery a credible alternative to Google Play beyond its home market of China; while on PC, Epic Games has poured hundreds of millions of dollars into developing the Epic Games Store as a challenger to Steam. It’s fair to say that neither of these efforts has so far met with resounding success, and both Huawei and Epic have somewhat idiosyncratic reasons for pursuing these longshot ventures.

But what makes these significant developments is that they come in the context of a regulatory environment which is growing much more hostile to anything which smacks of a monopoly in tech. This will make it much harder for the incumbent players to shut down challenges to their positions than in the past. The European Commission, for instance, is evaluating whether Apple’s monopoly on iOS software distribution is a violation of competition regulation, with some reports suggesting that Apple may be considering getting ahead of a potential ruling by opening the door to third-party app stores voluntarily. Any such development on iOS would be alarming for the console platform holders given the parallels with their own distribution monopolies.

Perhaps an even bigger threat than the rise of new direct competitors is the weakening ability of distribution platforms to control the revenue flowing into the games they host. Multiplatform games in particular are starting to pose a big challenge. In most multiplatform live service games, an in-game purchase made on any device will make the items or content purchased available across any device the game is played on. The choice of purchasing device is irrelevant from the player’s perspective, but still makes a big difference to how the money is divided between publisher and distributor. This creates an incentive for publishers to push players towards cheaper platforms with a more generous revenue share, or even to buy from them directly over the web and cut out the middleman entirely. Unsurprisingly, distributors don’t like this, and their refusal to allow publishers this option is the core of the Epic Games v. Apple legal dispute.

Whether or not Epic gets its way in court (and right now it doesn’t look like it will), this is likely to become another area of focus for regulators and legislators who increasingly do not look kindly on tactics that could be viewed as restricting competition. In-game purchases now make up almost 85% of games content spend, so it would be a huge boon for publishers if they could freely circumvent distribution fees for in-game content.

And another major industry trend is also bad news for distributors: the rise of in-game advertising. In-game advertising already accounts for over a third of mobile games revenue, and is perhaps set to become more common on PC and console as well. Based on current trends, Omdia forecasts that advertising could account for over 40% total games revenue by 2027. Because this revenue comes from advertisers rather than consumers, it largely bypasses distributors. Indeed, this is one of the major appeals of in-game advertising from the perspective of publishers. With advertising rapidly growing a share of games revenue, distributors might be tempted to try to find ways of capturing a share of the ad revenue earned on their platforms. But again, any such attempt would run a huge risk of being stymied in the current regulatory climate, leaving distributors with little choice but to watch this market segment grow outside their control.

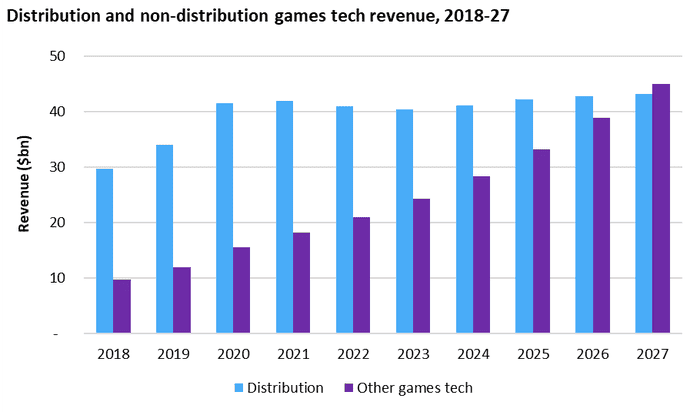

The confluence of all these factors—increased competition, the growth of cross-platform gaming, and the rise of in-game advertising—combined with a much less favorable regulatory environment is already hitting distributors’ bottom lines. Their share of total games revenue slipped from 20% to less than 18% between 2018 and 2022, and is set to fall further to 12.5% by 2027, by Omdia’s estimation. This is a big change in the division of revenue in the games market, with potentially far-reaching consequences.

Publishers can expect to pay less of their revenue to distributors than in the past, though this will not translate automatically into higher profits. Some of the changes reducing distribution costs bring with them costs of their own. This is particularly true of the rise of in-game advertising, where adtech vendors can and do claim a significant share of revenue. Increased adtech spending alone will soak up a considerable proportion of publishers’ savings on distribution fees, while other cost factors like fees for cloud services are also growing rapidly.

Non-distribution games tech revenue is surging

Distributors themselves will also have to adapt. Many are beefing up the range of services they offer in an effort to justify their cost to publishers. Some, such as Microsoft and Google, have the advantage of already having a wide range of tech services at their disposal to add to their offerings. Others are developing or acquiring capabilities across functions like analytics, cloud services, and LiveOps tools. This makes sense: while distribution revenue is stagnating, spending on other games tech is booming, and will soon overtake distribution revenue in Omdia’s reckoning.

Diversification will not be easy, however. While games tech spending is booming, these new markets are far more competitive than distribution has historically been. Sony, Nintendo, and Valve have all seen this in past as they struggled to commercialize game engine and middleware technology. Providing a more diverse range of services to go along with their distribution platforms will mean running into strong competition from the likes of Amazon and Unity, not to mention hundreds of potentially disruptive startups, meaning that distributors will have to work a lot harder for their profits in future.

Read more about:

Featured BlogsYou May Also Like