Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

This article examines sales data from 2005 to 2015 and assesses the idea that the tastes of Japanese and American gamers' in PC and console games have diverged over the years.

This is a cross-post from the Skyboy Games Dev Blog. It is a piece I wrote for one of my classes at graduate school.

Many years ago while reminiscing with a friend, I happened to mention that, as a child, I had been so struck by the opera scene in Final Fantasy 6 that I kept a save file at that point in the game specifically for the purpose of playing that scene whenever I wanted to. My friend then responded that he had done the same thing. What struck me about this exchange was that my friend had never left Japan and spoke little English. Meanwhile, I had grown-up in North America and had not been to Japan until my early twenties. Despite growing up half-a-world apart, we had managed to share a moment of culture centered around a particular scene from a particular video game from Japan.

Given the market dominance in the 80’s of the Nintendo Entertainment System (Cunningham, 2013), the strength of its successor, the Super Nintendo Entertainment System, in the 90’s (Buchanan, 2009), and the success of the Sony Playstation (IGN Staff, 1998) and Playstation2 (Ewalt, 2011) into the mid 00’s, it is easy to imagine the size of the impact that Japanese games have had on the shared history of video game players. Yet, more recent news about the console games industry in Japan has a more pessimistic attitude. Articles state that “Japanese games are now by and large made to appeal almost exclusively to Japanese gamers” (Winterhalter, 2011) and that Japanese gamers typically equate foreign (non-Japanese) games with low quality (Kohler, 2010.) Meanwhile, Japanese games industry veteran Tak Fuji lamented that Western gamers “have no interest in Japanese games” (Yin-Poole, 2011.) Statements like these suggest a growing separation between the tastes of Japanese and American gamers.

Hypothesis

If it is true that the tastes of Japanese and American gamers have grown apart, it stands to reason that the number of common titles between Japanese and American sales charts should decrease. This hypothesis predicts that, over a significant period of time, we should see a decrease in the number of common titles appearing both in Japanese and American video game sales charts.

Methodology

This paper utilizes yearly top 100 game software sales charts for the USA and Japan as the basis for its analysis. The charts are taken from VGChartz, a business intelligence company that publishes weekly software and hardware game sales (“About VGChartz,” n.d.). These charts estimate sales of game software released on console game systems (such as the X360, PS3, and Wii), handheld game systems (such as the PSP and DS), and on personal computers (PC). This paper uses charts from 2005 to 2015. The year 2005 was selected as a starting point because it is the first year for which VGChartz lists data for both the USA and Japan.

In order to perform the analysis, the sales data was extracted from the VGChartz website and imported into a Google Sheets spreadsheet via Comma Separated Value (CSV) files. Each yearly sales chart page on VGChartz provides a version of the data formatted for easy inclusion in internet forums (Bulletin Board Code, a.k.a. BBCode.) For each sales chart, the BBCode was copied into a text file. The relevant data was extracted from the BBCode and transformed into CSV by a Python script using a regular expression. The resulting CSV files were then imported into a Google Sheet where the necessary cross-indexing of sold titles could be performed. The cross-indexing took advantage of the fact that the VGChartz data assigns a unique id to each game that is consistent across regions. Therefore, it was trivial to differentiate between software yet track the software across regions.

Caveats

While the VGChartz data was easy to process, there are some caveats concerning its use in this paper. Firstly, the sales data for 2015 was acquired on October 1, 2015 therefore the top 100 sales data for 2015 does not represent a full year. Secondly, due to the arbitrary yearly cut-off, the sales numbers may favor titles released earlier in the year. Whether and how this would affect the results is unclear and requires further analysis to confirm.

VGChartz methodology also provides ground for concern. They use a combination of methods to estimate sales including end user polling, statistical trend fitting, and acquiring data from retailers and publishers. These estimates are checked regularly against publicly released sales figures from manufacturers and other tracking firms (“VGChartz Methodology,” n.d.). Their data collection methods are proprietary and non-transparent so it is difficult to evaluate these methods for accuracy and freedom from deficiency. Detailed description of the methods used and firms consulted is not publicly available.

Lastly, no attempt was made to adjust for titles whose American and Japanese release dates are different. Therefore, any anomalies that may result from differences in American and Japanese release dates are not compensated for in this analysis.

Results

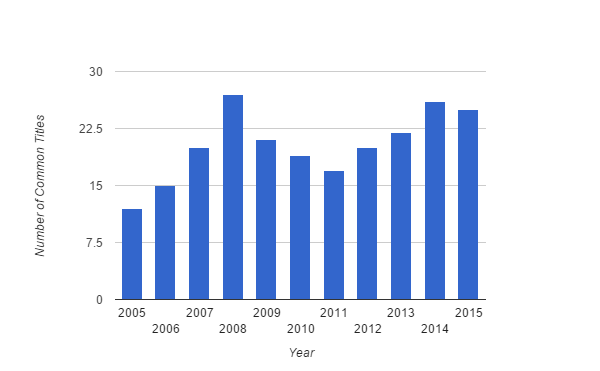

Contrary to the hypothesis, the number of titles common to charts of top 100 selling games for the USA and Japan show a general increase from 2005 to 2015. The number of titles appearing on both American and Japanese sales charts was 12 for 2005 and 15 for 2006. Meanwhile, data for 2014 showed 26 common titles and 2015 showed 25. The only significant dip in the trend occurs in the data for 2010 and 2011 with 19 and 17 common titles, respectively.

Figure 1. Number of games on Top 100 for both USA and Japan.

Figure 1. Number of games on Top 100 for both USA and Japan.

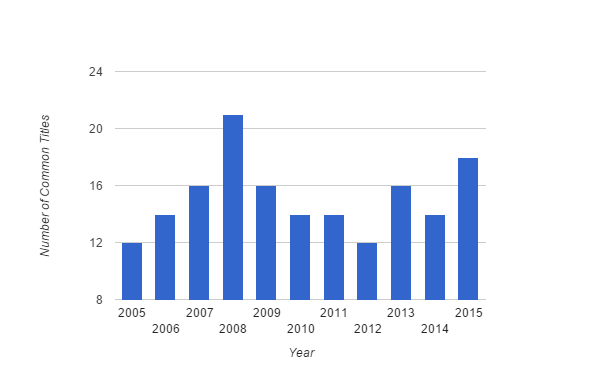

Limiting the data to consider the top 50 selling titles instead of the top 100 finds a similar trend except with prominent dips in 2012 and 2014. There is also a spike in 2008 where 21 titles (42% of the top 50) appeared within the top 50 of the sales charts for both Japan and the USA.

Figure 2. Number of games on Top 50 for both USA and Japan.

Figure 2. Number of games on Top 50 for both USA and Japan.

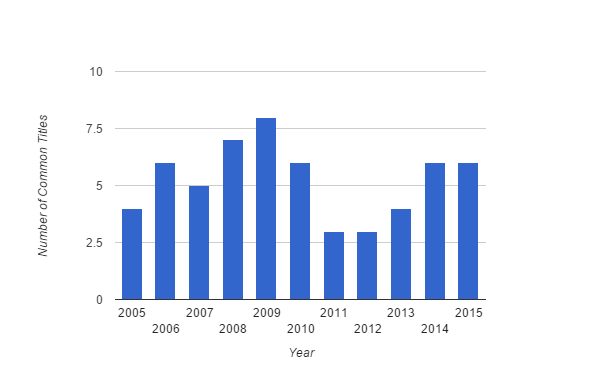

The pattern of a general increase in common titles from 2005 to 2015 with a valley in 2011 also appears when only considering the top 10. The low number of common titles observed in the top 50 data for 2012 also persists in the top 10.

Figure 3. Number of games on Top 10 for both USA and Japan. on Top 100 for both USA and Japan.

Figure 3. Number of games on Top 10 for both USA and Japan. on Top 100 for both USA and Japan.

Discussion

In response to the sentiment that Japanese and American gamers are gravitating towards different games expressed in the cited articles (Kohler, 2010; Yin-Poole, 2011; Winterhalter, 2011) this paper proposed the hypothesis that game software sales charts would show a decrease in the number of titles common between the USA and Japan. Instead, an analysis of top 100 games sold from 2005 to 2015 showed an increase in common titles. There is, however, a decrease in the number of common titles in 2010 and 2011 which coincides with the publication of the cited articles. It is conceivable that the sentiment in these articles could, at least partially, be in reaction to this short-term dip. Furthermore, limiting analysis to the top 10 (by definition the best selling games of which one would assume videogame press would be most conscious), shows the lowest period of common titles to be 2011 and 2012. These temporary decreases, particularly in contrast to the common title peak of 2008 could account for the sentiment. Further investigation of periodicals during the decade would be needed to see how prevalent the sentiment in question is before and after 2010 and 2011.

Taking the increase in common titles at face value lends credence to the suggestion of media convergence in games being driven, in part, by large firms Japanese firms like Bandai Namco, Square Enix, and Konami seeking to broaden their reach in global markets (Consalvo, 2009.) Square Enix’s 2009 acquisition of Eidos (Graft, 2009) also suggests the scope of its global ambition. However, Konami’s recent delisting from the New York Stock Exchange (Crecente, 2015) casts doubt on its ability, if not intention, to pursue a global market.

Alternatively, it is worthwhile to consider whether there are countervalent forces pushing for more common titles in the top 100 despite stratification in gamer tastes. For example, could the increase in common titles be due more to a decrease in the total number of titles being tracked by the top 100 seller charts? If that were the case, Japanese and American gamers could have been buying the sames games due to lack of variety rather than overlapping taste. Such consolidation of product would be a natural reaction for an industry facing decreasing market value (“Global Games Consoles.,” 2014.)

The analysis presented in this paper deals only in the number of titles common in sales data for Japan and the USA. It does not take into account where these common titles were created and therefore doesn’t make any comment on what these games’ origin may say about the evolving tastes of gamers. Where were these common titles made and what does that say about gamers’ preferences? Were common titles dominated by the titles of a single firm, say Nintendo? Would we see a different trend were we to remove said firm’s contribution from the analysis? How has the mobile game market affected the types of games people play in the USA and Japan? These are all questions that warrant further study.

References

About VGChartz. (n.d.). Retrieved from http://www.vgchartz.com/about.php

Buchanan, L. (2009, March 20). GENESIS VS. SNES: BY THE NUMBERS. Retrieved from http://www.ign.com/articles/2009/03/20/genesis-vs-snes-by-the-numbers

Global Games Consoles. (2014). Games Consoles Industry Profile: Global, 1–33.

Consalvo, M. (2009). Convergence and globalization in the Japanese videogame industry. Cinema Journal, 48(3), 135–141.

Crecente, B. (2015, April 27). Konami delists itself from New York Stock Exchange. Retrieved from http://www.polygon.com/2015/4/27/8503893/konami-delists-itself-from-new-york-stock-exchange

Cunningham, A. (2013, July 15). The NES turns 30: How it began, worked, and saved an industry. Retrieved from http://arstechnica.com/gaming/2013/07/time-to-feel-old-inside-the-nes-on-its-30th-birthday/

Ewalt, D. (2011, February 14). Sony PlayStation2 Sales Reach 150 Million Units. Retrieved from http://www.forbes.com/sites/davidewalt/2011/02/14/sony-playstation2-sales-reach-150-million-units/

Graft, K. (2009, 21). Court Approves Eidos Takeover by Square Enix. Retrieved from http://www.gamasutra.com/view/news/114246/Court_Approves_Eidos_Takeover_by_Square_Enix.php

IGN Staff. (1998, August 27). HISTORY OF THE PLAYSTATION. Retrieved from http://www.ign.com/articles/1998/08/28/history-of-the-playstation

Japan Yearly Video Game Chart, 2005. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2005/Japan/

Japan Yearly Video Game Chart, 2006. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2006/Japan/

Japan Yearly Video Game Chart, 2007. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2007/Japan/

Japan Yearly Video Game Chart, 2008. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2008/Japan/

Japan Yearly Video Game Chart, 2009. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2009/Japan/

Japan Yearly Video Game Chart, 2010. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2010/Japan/

Japan Yearly Video Game Chart, 2011. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2011/Japan/

Japan Yearly Video Game Chart, 2012. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2012/Japan/

Japan Yearly Video Game Chart, 2013. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2013/Japan/

Japan Yearly Video Game Chart, 2014. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2014/Japan/

Japan Yearly Video Game Chart, 2015. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2015/Japan/

Kohler, C. (2010, September 16). In Japan, Gamemakers Struggle to Instill Taste for Western Shooters. Retrieved from http://www.wired.com/2010/09/western-games-japan/

USA Yearly Video Game Chart, 2005. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2005/USA/

USA Yearly Video Game Chart, 2006. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2006/USA/

USA Yearly Video Game Chart, 2007. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2007/USA/

USA Yearly Video Game Chart, 2008. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2008/USA/

USA Yearly Video Game Chart, 2009. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2009/USA/

USA Yearly Video Game Chart, 2010. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2010/USA/

USA Yearly Video Game Chart, 2011. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2011/USA/

USA Yearly Video Game Chart, 2012. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2012/USA/

USA Yearly Video Game Chart, 2013. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2013/USA/

USA Yearly Video Game Chart, 2014. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2014/USA/

USA Yearly Video Game Chart, 2015. (n.d.). Retrieved from http://www.vgchartz.com/yearly/2015/USA/

VGChartz Methodology. (n.d.). Retrieved from http://www.vgchartz.com/methodology.php

Winterhalter, R. (2011, September 12). Why Japanese Games are Breaking Up With the West. Retrieved from http://www.1up.com/features/japanese-games-breaking-west

Yin-Poole, W. (2011, April 11). Konami dev: many Western gamers have no interest in Japanese games. Retrieved from http://www.eurogamer.net/articles/2011-11-04-konami-dev-many-western-gamers-have-no-interest-in-japanese-games

Read more about:

BlogsYou May Also Like