Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

In this article we’re going to take a close look at the annual reports that Take Two released to their investors over the years and analyze how the success of microtransactions has completely changed their business, with a focus on the NBA2K franchise.

The release of NBA2K18 brought a lot of attention to the increasing presence of microtransactions (MT) in full-price games. A lot of people feel that game publishers are constantly pushing the boundaries with how they monetize their games, and Take Two interactive (the publisher behind hit franchises like NBA2K and GTA) is certainly making visible efforts to generate revenue from selling in-game currency in their flagship titles.

In this article we’re going to take a close look at the annual reports that Take Two released to their investors over the years and analyze how the success of microtransactions has completely changed their business. This article is not going to be a rant on microtransactions. Whatever your views on MT are, this article should arm you with a better understanding of the article game industry.

We are going to focus on the NBA2K franchise because the yearly releases provide a clear view on how the MT trend is growing from year to year.

This article is also available in video form.

The annual report is a document that offers a financial summary of the year for investors. Every company that has publicly traded stocks needs to submit this report once a year.

An annual report doesn’t have to cover a calendar year, from January 1st to December 31st. Companies that have a business cycle where with a peak season and a low season usually choose to write the financial report after the peak season revenue comes in because that’s when they have a good idea on how the company performed that year.

Many game companies, and Take Two among them, choose to close their report one quarter after the end of the calendar year, on March 31st. That’s when they can accurately report on the revenue generated during the holiday season. They still report on 12 months of activity, but those 12 months start on April 1st and end of March 31st. That’s what we call a fiscal year, a term you’ve no doubt heard in the past.

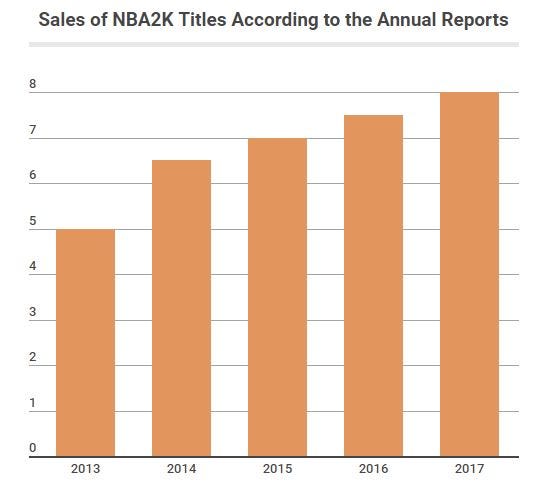

The implementation of MT in full-price games is a relatively new phenomenon. NBA2K13 was the first game in the franchise that featured virtual currency. It released on October 2nd 2012 and was received with a Metacritic score of 88 for the Xbox360 version.

To get a look into those exciting times, let’s open the annual report released in 2013 for the fiscal year ending on March 31st 2013. At this point NBA2K13 is on the market for about 6 months and they have a very good idea of how well the game did.

Keep in mind, the implementation of MT in NBA2K13 is very different from what we see today. Take Two were still testing the water. Here’s a quote from the Kotaku review of the game:

“10,000 in Virtual Currency is yours for $3, and it will buy a lot of talent for your fantasy team or your player.”

As some of you may know, 3$ in NBA2K18 will not get you very far. Up until a recent patch it was barely enough to get you a couple of haircuts.

In their 2013 annual report Take two revealed that NBA2K13 sold over 5 million units, a very respectable number. They mention the inclusion of virtual currency in the game in this revealing quote:

“Our ability to capitalize on evolving business models is a key driver of incremental growth and margins. In addition to DLC, we are also now receiving high-margin revenue from in-game purchases of virtual goods, both in front-line titles such as NBA 2K13, and in mobile and online titles, many of which are free-to-play.”

Notice the words “high-margin revenue”. High margin means that you get to keep a lot of the revenue you generate, or in other words — that your expenses are low in relation to the revenue. Implementing a virtual currency system in the game wasn’t a very big expense compared to developing the actual game, nor does it require as much maintenance, so every dollar coming from virtual currency is going be considered high margin revenue. It’s not what you earn, it’s what you keep.

NBA 2K14 was released in October 1st 2013 and was received with a Metacritic score of 85 for the PS4 version. It was the first NBA2K title on current generation hardware and it sold 6.5 million units, a considerable jump over the previous year’s result of 5 million.

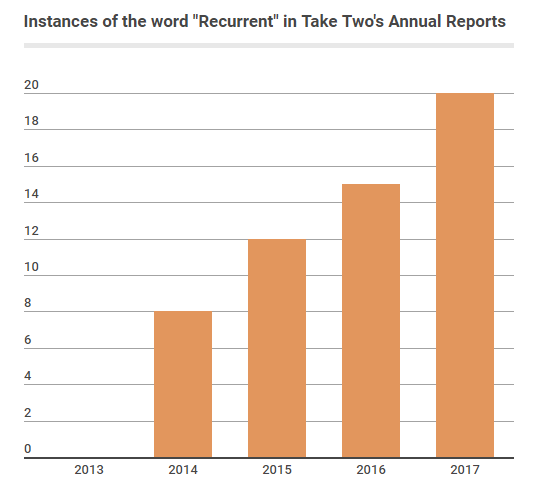

The 2014 report features a new term that is going to be very important on every report going forward, and that term is “recurrent consumer spending”. This new term shows up 8 times in the report. Here’s a key quote:

“Creating opportunities to drive ongoing engagement with our titles after their initial release is a key strategic focus for our Company, and we have started to generate significant revenue and profits from recurrent consumer spending. Our record fiscal 2014 results demonstrate that our strategy works.”

Judging by this quote, this year was a big turning point for the company. Last year they reported that MT revenue is high-margin, but this year they are reporting that those revenues are significant, and consider it proof that their new strategy works. The results came in and they were good.

They go on to say:

“We will continue to focus on developing additional offerings that promote engagement with our titles, deepen our relationships with consumers and boost profits over time.”

Some of you are probably nodding your heads at the claim that recurrent consumer spending “deepens the relationship” with consumers, but keep in mind, this letter is written for investors and in a way serves as PR for the company. This kind of language is expected.

Here’s what they had to say about virtual currency in NBA2K14 :

“The success of NBA 2K14 was enhanced by strong demand for the game’s virtual currency, sales of which increased 150% versus NBA 2K13.”

150% increase over the previous title on a user base that is only about 30% bigger. Using some simple math we can conclude that VC spending per-user grew by about 92%.

An article published by Kutako at the time claims that the virtual currency that was introduced in 2K13 is “Much more aggressively implemented” in NBA2K14. Looking at the huge increase in spending, it looks like this turned out well for Take Two.

NBA 2K15 broke the sales record again with over 7 million units sold, up from last year’s 6.5. The Metacritic score for the title was 83.

In the 2015 annual report, the term “recurrent consumer spending” shows up 12 times, up from last year’s 8. Here’s a key quote :

“Recurrent consumer spending is an important, high-margin growth opportunity and a key strategic focus of our teams. Through this we generate meaningful incremental revenue and profits, strengthen our results between front-line releases and, most importantly, provide additional entertainment to consumers.”

They use a lot of the same language from last year, but there’s a new point brought up here: Recurrent spending not only improves revenues and profits, it also helps strengthen the results between front-line releases. The video game industry is traditionally one where the cash flow isn’t very stable. Companies experience a peak in sales when they release a mainline title in a big franchise, but then may experience a significant drop in sales as the launch hype fades.

Think about a franchise like GTA, where a mainline title releases to huge success about twice per decade. In a world with no recurrent spending, a year where a GTA title releases would have spectacular financial results, but then the company won’t be able to reach similar results for years.

This might not seem like a problem at first, because the company is still profitable over the long term, but consistency of results is very important for public companies. Investors read annual reports and compare them to the previous year, and higher management is judged based on short term results.

Here’s an important quote that really emphasizes this:

“We have experienced and may continue to experience wide fluctuations in quarterly operating results. The release of a ‘‘hit’’ title typically leads to a high level of sales during the first few months after introduction followed by a rapid decline in sales. Competition in our industry is intense and a relatively small number of hit titles account for a large portion of total revenue in our industry.”

At the end of the day, everyone has a bias for certainty. Cash coming in every month is a lot more certain than a possible big pay day a few years down the line.

They go on to report another year of big growth for the virtual currency in NBA2K:

“Overall revenue is up substantially versus the comparable period for NBA 2K14, driven by both higher sales and growth in recurrent consumer spending. During fiscal 2015, virtual currency sales grew 150% year-over-year.”

That’s the second year in a row that VC revenue grows by 150%. When you have a business that grows at this rate for two straight years, you are going to lean into it.

Another interesting quote in the 2015 financials explains why we don’t see many original IP’s anymore, particularly ones focusing on single-player:

“We focus on building compelling franchises by publishing a select number of titles for which we can create sequels and incremental revenue opportunities through add-on content, microtransactions and online play.”

NBA2K16 was released on September 25th and received a Metacritic score of 87 for the PS4 version, up from last year’s 83. It broke the sales record again, selling over 7.5 million unit, half a million more than its predecessor. Again, virtual currency sales topped last year’s results by a significant margin:

“NBA 2K has benefited from strong player engagement, and sales of the game’s virtual currency were the largest contributor to recurrent consumer spending after Grand Theft Auto Online. During fiscal 2016, recurrent consumer spending on NBA 2K grew 64% year-over-year.”

This annual report is the first one to provide us with a concrete look into how big the MT business has become for Take Two:

“Recurrent consumer spending grew to its highest level ever, and accounted for 25% of our total net revenue.”

One quarter of the total revenue that 2K made that year came from recurrent consumer spending. This high-margin revenue helped boost the company’s profitability:

“Gross profit as a percentage of net revenue for the fiscal year ended March 31, 2016 was 42.4%, as compared to 26.6% in the prior year.”

I want to focus on two explanations that they provide for their enhanced profitability, because they offer valuable insight on how the emergence of digital distribution helped publishers. Here’s the first explanation:

“Lower software development costs and royalties as a percentage of net revenues due primarily to the sales mix and a higher percentage of revenues from catalog titles, which typically have lower capitalized software costs”

Translation: They are able to sell more copies of their older titles thanks to digital distribution. They go on to say:

“Digital distribution is disproportionately benefiting our catalog, as it gives consumers the opportunity to buy older titles that no longer receive physical shelf space.”

Older games no longer carry any marketing expenses and they don’t require manpower to support and patch the game. Digital Distribution allows publishers to keep profiting from them long after they lost their retail space to newer titles.

Here’s their second explanation:

“lower product costs as a percentage of net revenues due primarily to an increase in the proportion of net revenues from digital online channels.”

Take Two is receiving a growing percentage of its revenue from digital sales, which have higher margins than selling games at retail. Selling physical games requires the publisher to manufacture them, ship them to stores, deal with physical stock that doesn’t sell through and cut the retailer a piece of the pie.

Digital distribution is a big win for publishers. In 2016, 49% of Take Two’s revenue occurred on digital channels. That’s a huge boost to profitability compared to getting all your revenue through traditional retail channels.

Some people are claiming that MT’s are required for video games to remain profitable. One of their arguments is that game prices remained the same for years and haven’t kept up with inflation. That’s true, but we also need to consider that the rise of digital distribution greatly increased profit margins for publishers. Even gamers who buy their games physically often go on to buy additional DLC content digitally. We shouldn’t compare the price of games today to their price in the past while ignoring all the other changes that happened in the industry during this period.

MT’s are implemented in AAA games not because they are required to make them a viable business, but because the company decided it’s more profitable than not implementing them. And if they are implemented aggressively, it’s because they figured it’s more profitable than a subtle implementation.

Is there a point where it becomes too much, and starts diminishing the brand value of the franchises they’ve worked so hard to build? Maybe, but as we’re about to see in the 2017 report, we’re not quite there yet.

In case you’ve wondered, the word “recurrent” shows up 15 times in the 2016 report, up from last year’s 12. Spoiler: They break the record again next year.

NBA2K17, released on September 20, received a Metacritic score of 88 (the highest since 2013) and sold a record-breaking 8 million copies. 2017 was another incredible year for virtual currency:

Engagement with and recurrent consumer spending on our industry-leading basketball series continues to grow, with over 2 billion games of NBA 2K17 played on PlayStation 4 and Xbox One, up 16% over NBA 2K16. More than 1.3 billion of these games were multiplayer — a 40% increase. This remarkably strong engagement helped to drive record Bookings from recurrent consumer spending on NBA 2K, which grew 71% during fiscal 2017

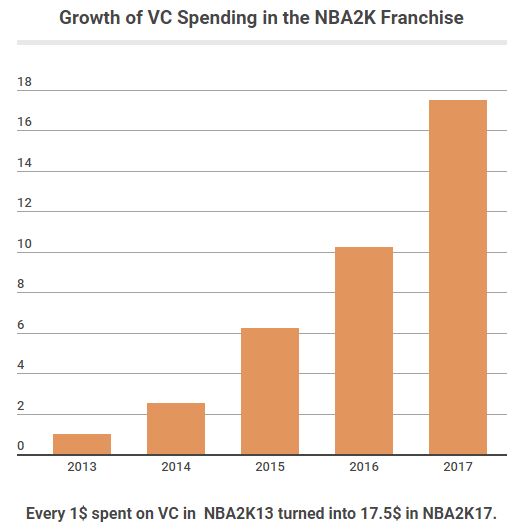

71% more VC spending on 10% growth in userbase shows that per-user spending is growing at a rapid rate. This is the 4th year in a row that they are reporting incredible growth in VC spending. We don’t have concrete dollar figures here, but using the percentages they present each year we can build a graph to demonstrate how VC spending exploded over the years:

Every 1$ spent on VC in NBA2K13 turned into 17.5$ in NBA2K17. This is a staggering growth rate. Even if we account for the growing user base, per-user spending in NBA2K17 was almost 11 times what it was in NBA2K13.

If you’re hoping that some of their games will remain free from microtransactions, listen closely to the following quote:

“Complementing our core business with digitally-delivered offerings that drive ongoing engagement with, and recurrent consumer spending on, our titles is a key strategic priority of our organization. We now support virtually all of our new releases with innovative offerings designed to achieve this objective.”

I guess the last line guarantees virtual currency in Red Dead Redemption 2.

In 2017, recurrent consumer spending accounted for 26% of Take Two’s revenue, up from last year’s 25%. This number though, impressive as it is, does not tell the whole story, because it doesn’t account for the fact that revenue generated through microtransactions has much higher margins than revenue generated through more traditional channels. One million dollars in revenue that have 500K in expenses tied to them aren’t equal to a million dollars in revenue that have 20K in expenses tied to them. Guess which one is virtual currency.

The following quote drives this point home:

“Fiscal 2018 is poised to be another year of strong earnings and cash provided by operating activities for Take-Two, despite an unusually light release schedule. Our ability to project significant profits with a lineup that solely includes new front line releases of our annual sports entertainment titles, reflects the strength of our robust catalog led by Grand Theft Auto and the substantial contribution we now receive from recurrent consumer spending. While we still have much opportunity to make our release slate and results more consistent over time, our enterprise has been transformed into a significantly higher-margin business than at any time in its history.”

There you go.

Microtransactions have transformed Take Two into a completely different business, one that can book incredible profits without relying on a diverse catalog of titles and frequent game releases.

The 2017 report is the first to provide some concrete numbers on the incredible growth of NBA2K. When they compare their overall results (which include their entire catalog) to the prior year, revenues are up 366.1 million $. Interestingly, most of this increase is attributed to NBA2K17:

“This increase was due primarily to (1) an increase of $265.8 million in revenues from our NBA 2K franchise.”

NBA2K17 brought in 265.8 million dollars more (!) than NBA2K16, which was already a hugely successful title for Take Two.

Let’s try to calculate what it would take to achieve that kind of increase by selling more copies of the game. Assuming Take Two pockets an average of 40$ per copy with a mix of retail and digital sales, they would have to sell an additional 6.6 million units to achieve this kind of growth.

NBA2K17 sold half a million copies more than NBA2K16. Using our previous estimate, that’s about 20 million dollars in additional revenue. Where did the other 245 million come from? Well, they do not disclose it in the report. Maybe some of it came from better deals with advertisers. Maybe the special editions sold better. If I had to guess, I’d say the bulk of this 245 million $ increase came from virtual currency.

Looking at these numbers, it’s not surprising that they pushed VC even more aggressively in NBA2K18. They are still testing the limits, and as long as their profits keep going up, this trend will continue.

In just 4 years, virtual currency in NBA2K grew from a small footnote in the 2013 annual report to a business generating hundreds of millions of dollars. And given that their user base keep growing every year, It seems like there’s no financial downside to making VC more and more essential to the NBA2K experience.

Will the next report be any different?

NBA2K18 has caused more backlash regarding MT’s compared to what we’ve seen in previous years. Gaming media covered this topic to a much greater extent, and 2K even rolled out an update slashing the prices of haircuts and other cosmetic upgrades. The user score on Metacritic is currently standing on 1.7 and the Steam reviews are “Mostly Negative”.

Will that affect sales of the game and the amount of money Take Two generates from it? We’ll take a close look at it when they post their financial results, so consider following us if that’s something that you want to see. Please join the discussion in the comment section below and share your thoughts on this issue. Thank you for reading.

Read more about:

BlogsYou May Also Like