Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Several recent mergers and acquisitions show that major businesses are investing in video games. Will the markets follow suit?

After several decades, it appears that the discussion over the legitimacy of video games as an art form and major part of the entertainment industry may be finally coming to an end.

In the stock markets, though, wariness over video games has tended to linger. The highly unpredictable volatility seen in the sector (which has seen several major players disintegrate or disappear altogether without warning), combined with its different business models and ‘niche’ label have all combined to ensure that only the biggest successes are clearly translated onto the markets.

In 2014, though, several major purchases and developments look set to ensure that the markets take notice of video games as a major industry and source for investment. That presents a major achievement for a medium that, shortly before the launch of the newest generation of consoles last year, had a significant number of commentators predicting its impending demise.

Instead, major players in mobile gaming – the supposed death knell for traditional platforms – have spent 2014 floundering on the markets, with King having shed almost $2 billion in value since its launch on the markets in March and Zynga still failing to turn its fortunes around.

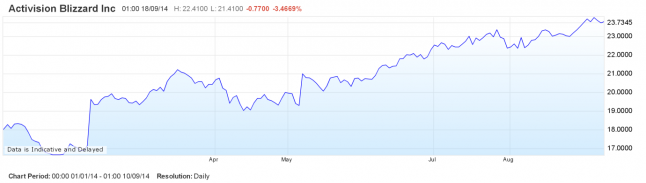

Meanwhile, the staggering amount of hype in the run up to the launch of Activison’s Destiny this month has seen their share price rise dramatically. As the game completed its successful launch on September 11, Activision Blizzard completed a run that saw its stock price grow 40% from the beginning of the year. Since then, the company has seen a moderate sell off as traders seek to consolidate their gains; but if Destiny’s launch was as successful as initial reports make out and it continues to drive profit for Activision, that impressive performance should continue into 2015.

Activision’s impressive run up to the launch of Destiny. Data from IG’s online stockbroking platform.

It is the major acquisitions in recent months, however, that have really grabbed the markets’ attention. First of all, Facebook’s purchase of Oculus signalled that major tech companies were starting to look at virtual reality as a real way to drive business and forced traders to take high-end PC gaming seriously (even if it looks like Facebook will seek to heavily diversify the Oculus user base over the coming years).

Facebook’s rapid growth and strong ad. revenue have made it an extremely popular investment over the past year, and the markets reacted positively to its acquisition of Oculus. Facebook’s share price rose around 9% in the week the deal was finalised and it has consolidated those gains, currently sitting with a value around 11% more before the deal went public.

A little over a month later, Amazon announced their takeover of Twitch in a move that signalled a belief that Twitch’s 55 million monthly users were worth almost $1 billion. And, once again, it appears that the markets agreed: Amazon’s share price rose over 2% on the day that the surprise deal went public.

Now, with the news that Microsoft has completed its purchase of Mojang – the studio best known for the stunningly successful Minecraft – video games are a talking point once again. The move might not be as surprising as those from Facebook and Amazon, as Microsoft are, after all, a major figure in the industry, but the $2.5 billion price tag for a game that is now several years old is still startling. Still, it increases Microsoft’s access to a huge, mainly younger user base and so is one, with sales of Window-based phones still struggling, that looks shrewd– in virtual reality at least.

In isolation, each of these events may not have been enough to force the finance markets to sit up and take notice. But each month this summer has brought more news of major mergers and acquisitions of businesses previously considered too niche for major growth from companies at the very top of US exchanges. That, combined with consecutive mammoth releases in 2013 and 2014 (GTA V followed by Destiny), could well mean 2014 is remembered as the year that video games finally registered their primacy in terms of entertainment investment.

Spread bets and CFDs are leveraged products. Spread betting and CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please ensure that you fully understand the risks involved.

This information has been prepared by IG, a trading name of IG Markets Limited. The material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

You May Also Like