Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Omdia analysts George Jijiashvili and Matthew Bailey summarize Microsoft's latest news about Game Pass and cloud gaming, while highlighting their key takeaways.

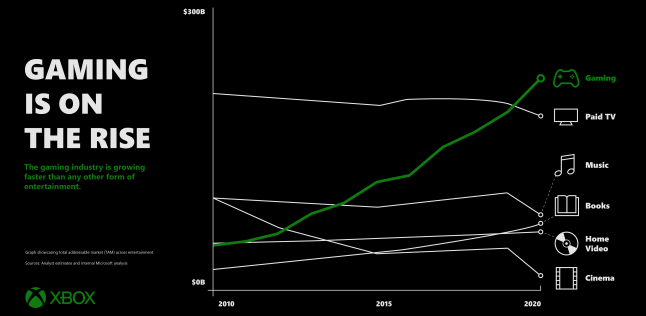

Ahead of virtual E3 and Microsoft’s own Xbox and Bethesda Showcase, Phil Spencer, Head of Xbox and Microsoft CEO Satya Nadella discussed the company’s focus on gaming, with emphasis on its Game Pass subscription service and cloud gaming. “Gaming is fundamentally aligned with our mission as a company,” stated Nadella, who underpinned the company’s big ambitions in gaming, which it hopes will grow in tandem with Microsoft’s array of capabilities ranging from hardware, consumer-facing services, development tools, and cloud services.

Microsoft provided several updates, including its intention to release Xbox streaming devices, upcoming partnerships with smart TV manufacturers and telcos to support cloud gaming uptake, and a geographical expansion of Xbox cloud gaming for later this year. This all represents Microsoft’s desire to expand the audience for premium gaming – beyond that currently offered by console and PC players.

The company also shared some new usage stats around its games subscription service, Game Pass. A web browser-based cloud gaming solution will also open up to all Xbox Game Pass Ultimate in the coming weeks, providing a way for iOS device owners to access Xbox cloud gaming. Microsoft also revealed that it will be bringing cloud gaming to the Xbox app on PC and importantly also integrate it into its consoles, enabling intriguing use cases such ‘try before you download’.

Xbox revealed that it is building its own streaming devices to enable Xbox cloud gaming on any TV or monitor. Details are light on the ground as to exactly what these devices will function and look like, but it is likely that they will compete with low-cost Amazon Fire TV and Roku sticks in a bid to more effectively expand the audience for Xbox cloud gaming. And, while these devices are likely to be mainly marketed as dedicated games streaming devices – effectively sitting below the One S/Series S in the company’s hardware lineup – they will almost certainly support other streaming media, most notably video. Microsoft got burnt when it placed TV and video consumption at the heart of its Xbox One strategy in 2013 and has, rightly, placed the emphasis squarely back on games since then.

But a more multimedia-centric strategy could make more sense with these cheaper devices aimed at more casual gamers. This will open up greater monetization opportunities for Xbox beyond games – the likes of Roku and Amazon have already enjoyed success as aggregators of OTT media services and content and have also built strong advertising businesses on the back of their connected TV (CTV) hardware. Microsoft does already operate in these areas, but such devices could significantly expand the addressable market for such revenue streams, as well as bolster the position of the Microsoft Store’s non-games content. Xbox has announced that Xbox cloud gaming will be coming directly to smart TVs from numerous manufacturers, but one question that remains is whether Xbox cloud gaming will come to competitor media streaming devices, like the Amazon Fire TV stick and Roku streamers. While this will no doubt be technically feasible and would present a great opportunity for Xbox to expand its cloud gaming-addressable audience, Xbox may be put off by Amazon and Roku’s existing policies of taking a cut of revenue from apps distributing on their CTV platforms.

Although Xbox content revenue growth has been one of the key performance indicators for investors, it’s not a secret that Microsoft views gaming as an opportunity to grow other parts of its business – namely its server and cloud segment. Microsoft’s ‘Gaming’ segment, which includes revenue from Xbox hardware and content services generated $11.6bn in 2020 (up 2% YoY), meanwhile, its ‘Server products and cloud services’, which includes Azure, brought in $41.4bn in 2020 (up 27% YoY) – making it its largest and fastest growing segment.

Although 2020 was a bumper year for gaming due to the pandemic, Microsoft’s Gaming segment was only able to achieve a meagre increase – this further supports Microsoft’s newfound focus on pursuing new commercial opportunities with leading game companies, which in most cases are expansions of pre-existing Xbox relationships. The likes of Ubisoft and Roblox are already utilizing Microsoft’s Azure and PlayFab solutions for building and operating live games. Even Sony now has a ‘strategic partnership’ with Microsoft over using Azure data centers for cloud gaming and content streaming services.

Undoubtedly, Microsoft's huge investment in cloud gaming is accelerating the whole industry's shift to cloud gaming, which is set to benefit Microsoft in many ways. As more publishers, game makers and device manufacturers make moves in this space, Microsoft will be well positioned to offer solutions across the whole value chain to aspiring cloud gaming providers.

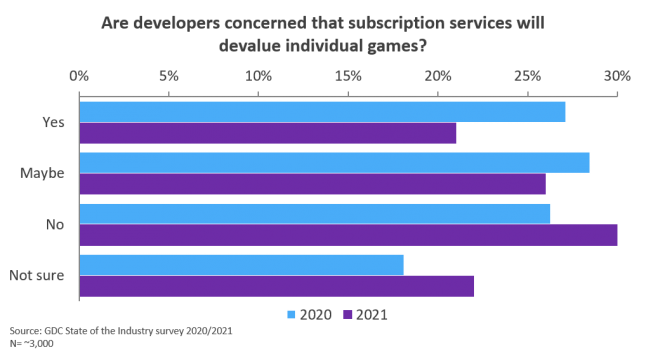

According to GDC’s recent 2021 State of the Industry survey (where 3,000 developers were surveyed), 47% of developers think that game subscription services like Game Pass could devalue individual games, while 22% were unsure. With only 31% of developers believing that subscription services will not devalue games, it’s clear that Xbox and other content subscription services have a lot of work to do in convincing developers about their apparent benefits.

As part of its effort to alleviate developers’ concerns, Microsoft reiterated its finding that Xbox Game Pass members play 30% more genres and play 40% more games versus before becoming members. Microsoft revealed some new stats as well, including that on average, Xbox’s partners see engagement go up by more than eight times when their games entered Game Pass. It also stated that Game Pass members spend 50% more than non-members (both inside or outside the library) and that more than 90% of members said they played a game that they would not have tried without Game Pass. In other words, it is gaining access to these complementary benefits – rather than direct compensation from Microsoft – that will be the biggest driver for publishers to add their games to Game Pass.

The initial uptake of games subscriptions was slow, but as consumer purchase behavior for entertainment media has changed fundamentally over the past decade, the subscriptions business model is now set for a period of fast growth. The leading game publishers and tech giants have made bold moves in this space, in many ways validating subscriptions as a viable business model—both for big and small companies in the games industry. To learn more about the impact that subscriptions and cloud gaming will have on the broader games market, tune into my GDC 2021 presentation titled 'Subscriptions as a Games Model' during 19-23 July (you can register for GDC by following this link).

Omdia, Gamasutra, and GDC are Informa Tech organizations

Read more about:

Featured BlogsYou May Also Like