Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra's latest analysis of NPD's U.S. console retail figures examines hardware prices and key software prospects -- and explains how the industry will likely miss $20 billion in revenue for the year.

Last Thursday, the NPD Group released its latest estimates for retail videogame sales in the United States during the month of August 2009. As predicted by many analysts, sales were down again compared to August of 2008, but there were signs that the industry could have passed an inflection point – or even a local minimum – and was headed for growth again in September.

This month we'll focus on several key areas. We'll look at pricing of console hardware, specifically Sony's PlayStation 3 and where Microsoft and Nintendo go from here. Madden NFL 10 sales were below expectations, and we'll examine the retail prospects for Activision's port of Call of Duty 4 for the Wii.

Finally we'll explain how the industry is likely to miss $20 billion in revenue for the year – down from the high of $21.3 billion in 2008 – and add some comments on the outlook for the rest of the year.

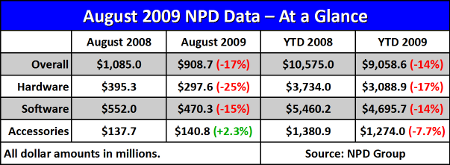

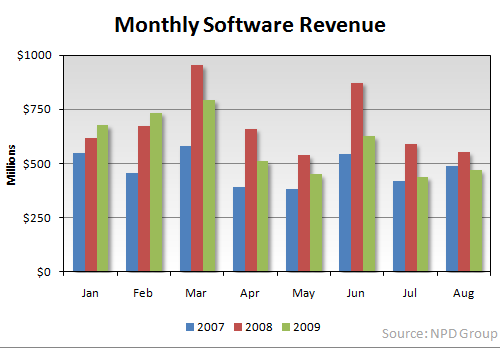

Industry revenue for August 2009 dropped $176 million dollars compared to the same month in 2008, a decrease of 17%. While the figures are scary, they're actually an improvement from July when year-over-year industry revenue dropped a staggering $340 million – or 29% – from the figures for July 2008.

To the extent that the loss was smaller, both in absolute and relative terms, the industry fared better in August than it did in July. These readings are the basis for much of the turnaround speculation surrounding September's sales.

One segment of the industry, accessories, actually demonstrated growth over 2008. All other segments were down, with the hardware segment particularly hard hit with revenue down almost $100 million for the month.

Software was down 15%, or about $80 million, in August. At least a quarter of that differential, or $20 million, could be theoretically attributed to disappointing sales of the month's big software release, Madden NFL 10.

We again offer the caveat that the NPD Group's figures cited here only include retail sales and do not include sales of software and content offered through the online storefronts on each current generation console and some handhelds.

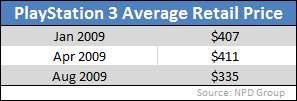

On 18 August 2009, Sony finally announced the new PlayStation 3 Slim model and the new price: $300. The last time the PlayStation 3 received a price cut was in November 2007 with the launch of the 40 gigabyte model, the first lacking PlayStation 2 backward compatibility.

According to average sale price (ASP) data provided exclusively to us by the NPD Group, it appears that the impact on Sony's hardware sales was immediate and dramatic.

In rough terms, the PlayStation 3 was available for $400 for the first two weeks of the period the NPD Group was tracking and $300 for the next two weeks. (We estimate sales of the $500 systems for the first two weeks can be neglected.)

By the end of the month, Sony's PS3 had sold for an average $335 per system. That works out to 65% of the systems selling at $300 and the remainder at $400.

According to Sony, “top retailers” saw a 300% increase in PlayStation 3 sales in the first week of September (the first week not covered in this latest NPD data) relative to the week in August before the price cut was announced. Speaking in general terms, that could work out to over 100,000 units per week if it were true across all retailers covered by the NPD Group.

Going forward, we can shift our question about Sony's business from “When and by how much will they cut the PlayStation 3 price?” to “What is the new baseline sales level for the PlayStation 3, and how long will it last?”. There are a couple of precedents we can consider.

When the $400 PlayStation 3 was released in November 2007, sales of the system surged through the middle of the the following year. Notably, the higher-priced system outsold its primary competition – Microsoft's Xbox 360 – in four separate months during the first six months of 2008.

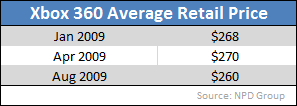

Another precedent to consider is the Xbox 360 in September 2008, when the Arcade model dropped from $280 to $200, the Pro from $350 to $300, and the Elite from $450 to $400. Consumers have responded by pushing sales of the Xbox 360 up 8% year-on-year during the last 12 months. Sales of the PlayStation 3 dropped 15% year-on-year for the same period.

Each of these was an effective price drop, and sales were positively affected for 8 to 12 months afterward. It seems likely to us that the PlayStation 3's new $300 price will increase the system's sales at least through May 2010.

By how much will it increase sales? During the last quarter of 2009, we expect the PlayStation 3 could finally move 2 – 2.5 million systems in the United States. The previous record was 1.4 million during the last quarter of 2007 followed by 1.3 million during the last quarter of 2008. When the Xbox 360 was priced similarly during the last quarter of 2007 it moved 2.4 million systems.

It would be prudent to revisit these questions in a month's time after the NPD Group has released its reading of September's sales. September may give a good indication of what kind of monthly PS3 sales to expect going into January and February of 2010.

At that time we should also have a better idea whether Microsoft's own pricing strategy – removing the Xbox 360 Pro and dropping the price of the Elite model down to $300 – has had any resonance with consumers.

Once the Pro hardware clears retail, Microsoft's system will have only two primary configurations on the market for the first time since the Elite model was launched over two years ago.

According to exclusive NPD Group data, the Xbox 360's average retail price in August 2009 was $260, a modest decline from around $270 earlier this year. That average price could drop even further now and we will hopefully finally get an estimate for how popular the Arcade model is at $200 against the Pro/Elite at $300.

Which brings us to Nintendo, whose Wii has not budged a penny since its November 2006 launch nearly three years ago. After blistering sales in the first quarter of this year, the retail temperature for the system has cooled significantly and its year-to-date sales are down 21% over the same period last year.

In part, that drop has to be attributed to the truly phenomenal sales the system experienced throughout all of 2008. One could easily take the view that sales of the Wii are now normal, and it bears pointing out that the Wii is still outselling each of the PlayStation 3 and Xbox 360 each month.

However, given the scale of consumer demand for the system at $250, it stands to reason that demand would spike again if the price were dropped.

The issue isn't just moving hardware for hardware's sake, but the fact that hardware sales drive software. According Mr. Pachter of Wedbush Morgan Securities, Wii software sales were down in August 2009 compared to August 2008 and he expects them to remain down year-on-year through November unless Nintendo drops the price of the Wii.

(To be fair, Nintendo isn't the only system whose software sales are down. According to Anita Frazier, analyst for the NPD Group, “the PlayStation 3 was the only platform to realize a year-over-year increase in total software sales.”)

The total revenue for the videogame industry in 2008 was $21.3 billion, according to the NPD Group. It appears now that the total for 2009 will likely fall short, perhaps by over a billion dollars.

Here are the factors involved:

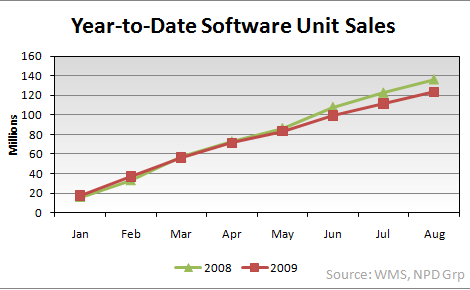

Software Unit Sales Down: In terms of software unit sales, the industry at the end of August 2009 had sold 12.5 million fewer units than at the end of August 2008. For a sense of scale, that's more than the combined 2008 totals for Mario Kart Wii, Super Smash Bros. Brawl, and the Xbox 360 version of Grand Theft Auto IV.

While there are still some guaranteed million-sellers this holiday season, it seems unlikely that retailers will be able to move enough software to make up for the 12.5 million unit gap. For future reference, over 268 million units of software were sold in all of 2008.

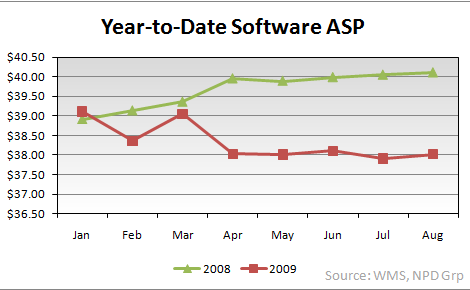

Software Prices Down: The average sale price (ASP) of software has been down dramatically during 2009. After peaking right around the release of Activision's Guitar Hero World Tour, prices have generally been heading down with occasional spikes from big releases.

The combination of fewer unit sales with generally lower prices has greatly depressed software revenue in 2009. Compared to the same point in 2008, the industry's software total is behind by $765 million.

Some of this is erosion of sales of higher-priced items. For example, the music industry – specifically Guitar Hero and Rock Band – lagging over $400 million so far this year, measured against the August 2008 year-to-date total.

Hardware Prices Down: All the price cuts may be good for the industry in the longer term, but until those new system owners start buying a lot of software the effect on total revenue comparisons will be negative.

For example, the average price of the PlayStation 3 will have dropped from over $400 to around $300 by the time September is over, a reduction of 25% in hardware revenue. If Nintendo were to drop its system price to $200, its hardware revenue would drop by 20%.

If each system were to sell as well during October – November 2009 as it did in 2008, but at these reduced prices, the industry would take a $375 million hit to overall revenue.

Under our assumption of over 2 million PS3 systems during that last quarter of this year, Sony would make up for the lost revenue in increased volume. If the current trend in PlayStation 3 software growth continues, Sony's total PS3 revenues for the year should look stronger.

However, we are not confident that Nintendo could move 5 million more Wii systems during the last quarter of 2009 as it did last year. That means its contribution to hardware revenues will likely drop, especially if its continued weakness in software continues.

Here's the bottom line. Compared to 2007, the revenue and sales posted in 2008 were spectacular. Also compared to 2007, the revenue and sales posted in 2009 looked like normal growth. So even if the rest of 2009 were to be exactly like the end of 2008 – that is, really great growth compared to 2007 – then we could probably consider that healthy.

Even under those rosy assumptions, the industry still wouldn't break $20 billion by the end of 2009. That's where we're putting our marker for now: total annual revenue for 2009 at just under $20 billion.

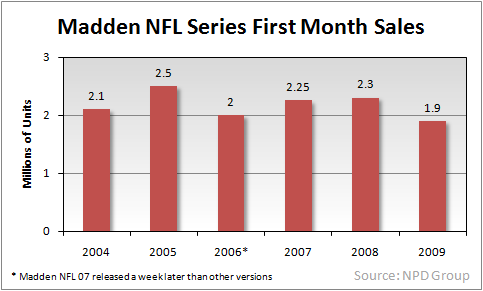

Each August Electronic Arts and its EA Sports division release another update to its dominant American football franchise, Madden NFL. While the industry is in the grip of a downturn, it's natural to look at standards like Madden to measure which way the wind is blowing.

As indicated in an internal EA memo, sales of Madden NFL 10 are down this year compared to last year's Madden NFL 09. In particular, Madden NFL 09 moved 2.3 million units in August 2008 while only 1.9 million units of Madden NFL 10 were sold in the same period this year. That's a drop of about 18%.

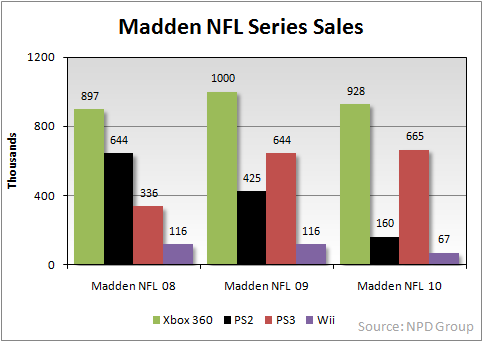

It's helpful to break down how Madden sales differed from 2008 to 2009. First, practically every system saw a drop in unit sales for the first month.

Unit sales of the Xbox 360 version dropped only 7%, while the Wii version fell by 42%, and the PlayStation 2 version by 62%. Sales of the PSP version were down while EA declined to publish a Nintendo DS version at all this year.

Against this set of declines the PlayStation 3 version grew a very modest 3%.

For the platform manufacturers the news was mixed. Unit sales for the Xbox 360 version were down, but Microsoft's first-month share of Madden NFL sales has now exceeded that of its key rival, Sony.

While the PS3 posted the only sales growth among the various platforms, sales on its PlayStation 2 collapsed and those owners did not appear to be upgrading en masse to the newer Sony platform.

As for Nintendo, Madden enthusiasm appears to have collapsed on its Wii, although history has shown that the Wii version may sell in higher volume through the remainder of the year than will other versions.

The key question here is whether Madden NFL 10 suffered inordinately weak sales this year compared to its potential in a down industry. While there may be some franchise fatigue – Madden NFL is now over two decades old – the 18% drop in first-month sales doesn't seem out of line to us, especially after several months of weaker software unit sales.

Moreover, we think it is particularly important that sales of the PlayStation 2 version have collapsed so utterly and yet there has been no corresponding surge on other platforms. That suggests to us the possibility that former PlayStation 2 owners are still waiting for an opportunity to upgrade and are holding off on buying Madden until acquiring that new platform.

The price war between the PlayStation 3 and Xbox 360 could have a profound effect on Madden NFL 10 sales through the rest of the year. As late adopters pick up their new system, so too may EA see sales of their football franchise rebound later this year.

As interest builds for Activision's Call of Duty: Modern Warfare 2, the publisher is keeping an eye on the Wii market and experimenting with better, albeit dated, support. In early August a port of Call of Duty 4: Modern Warfare for the Wii was announced, due simultaneously with its sequel on other platforms.

We think this will be an interesting title to watch. It carries a strong brand name, has been given the support of a skilled developer (Treyarch), and will likely benefit from all the market publicity surrounding the launch of the sequel. It is also a title rated M (for Mature) by the ESRB, putting it in a category of Wii software for which the sales environment has been considered difficult.

For example, Sega's Madworld launched with sales of only 66,000 units in March of this year. At the time some felt that sales might pick up over time. As of August 2009, total sales of Madworld have climbed to 123,000 or an average of around 11,000 units for each month after launch.

Another Sega game with a violence/action theme, The Conduit, also posted sales of only 72,000 units when it was released in June 2009. It should be noted that The Conduit is only rated T (for Teen) by the ESRB.

However, there is ample evidence that M-rated action games can sell well on the Wii, and we need only look at last year's Call of Duty: World at War for the proof. According to exclusive NPD Group data, sales of World at War on the Wii have finally reached over 750,000.

This is clearly not in the same class as some of Nintendo's own first-party game (none of which are M-rated), nor is it in the same class as sales of the Xbox 360 for PlayStation 3 versions. Still, it is a very successful M-rated game on a system whose audience some consider ambivalent or even hostile to such content.

That bodes well for Call of Duty: Modern Warfare on the Wii, and should prove an interesting case to follow at the end of 2009.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance and Anita Frazier for her analysis. Additional credit is due to Mr. Michael Pachter, analyst for Wedbush Morgan Securities, for his perspective and information. Finally, many thanks to colleagues at Gamasutra and commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like