Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

In Gamasutra's detailed NPD U.S. console/game sales analysis for October 2009, we examine Sony's post-PS3 price drop results and PSP Go launch, Nintendo's Wii price cut timing, and a possibly grim outlook for the rest of 2009.

[In Gamasutra's detailed NPD U.S. console/game sales analysis for October 2009, we examine Sony's post-PS3 price drop results and PSP Go launch, Nintendo's Wii price cut timing, and a possibly grim outlook for the rest of 2009.]

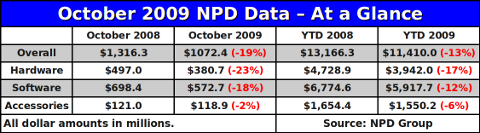

Earlier this year conventional wisdom held that the video game industry would make a dramatic turnaround in the back half of 2009. However when the NPD Group released October 2009 retail sales data last week, the dire reality of the market was plain for all to see.

In every segment of the market – hardware, software, and accessories – the revenues were down significantly, and the overall total was down 19% relative to October 2008.

Given the recent hardware price cuts by Sony and Nintendo, it was no surprise that there was a drop in hardware revenue. For example, the increase in PlayStation 3 hardware sales over the past three months has just begun to offset the loss in revenue from the system's price cut.

Software prices continued to decline with respect to prices a year ago and software unit sales were down as well. The combination of these factors drove a software revenue loss of 18% or over $126 million dollars. Only the accessory segment was close to flat year-on-year, contracting only 2%.

As of the end of October the year-to-date revenue figure stood at $11.4 billion. Even with the biggest two months of the year still to go, some analysts now expect the industry to post at least a 5% decline for the year.

We retain our conservative outlook and expect a decline of at least 8.5%, putting the final annual total revenue at $19.5 billion. Clearly if revenue comes in above that, we'll be pleased to be wrong.

Below we break this month's sales out into three highlights. First, we'll examine Sony's fortunes as its PlayStation 3 experiences a resurgence in sales but its PlayStation Portable languishes. Second we'll examine the trend of Wii sales and how the DSi has helped maintain strong sales for Nintendo's handheld platform. Finally, we'll look at just how deep the hole is for this year, and how contraction from 2009 has become a virtual certainty.

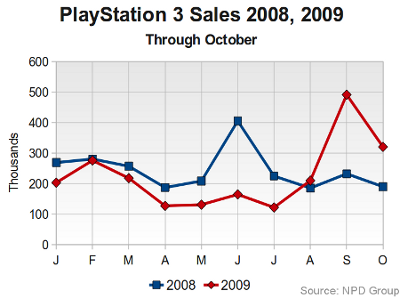

October was Sony's third month running with better year-on-year sales of its flagship console, the PlayStation 3. Just over 320,000 units of the new PS3 Slim model were sold, an increase of 69% from the same month in 2008.

When we first examined PS3 sales after the August 2009 price drop, we suggested comparing the PS3 in 2009 to the Xbox 360 in 2008. During the three months from August to October 2008, right after price drops and the introduction of the Xbox 360 Arcade, Microsoft sold 913,000 systems with an average retail price of around $270-$280.

With the average price of the PS3 just above $300, Sony has sold over 1.02 million PS3 systems during the same three months of 2009. While PS3 sales did drop month-on-month from September to October, the increased level of interest suggests that Sony's PS3 Slim should do very well during the holiday months of November and December. It seems possible that year-to-date (YTD) PS3 hardware sales could nearly double by the end of the year.

The software situation has, likewise, also turned around for Sony. According to figures from Michael Pachter, analyst for Wedbush Securities, dollar sales of PS3 software have increased year-on-year for each of the past two months: up 135% in September and 12% in October. Some of the scale of that increase can certainly be attributed to a weaker performance of PS3 software in 2008, but keep in mind that most other platforms are seeing year-on-year declines in software this year.

While Sony's console fortunes are turning around, there is not much good news for its handheld, the PlayStation Portable (PSP), in particular the newer and smaller PSP Go.

Since Sony launched the PSP Go on 1 October 2009, industry observers have sought any concrete indication of its sales. At best Sony has released statements of being pleased with the system's low-key release (“additive to Sony's PlayStation business” and not “at the expense of PSP-3000 sales” according to Sony's John Koller) and the NPD Group rolls all PSP hardware sales up into the single figure that it releases for the system each month. Repeated requests to the NPD Group for more detailed data have been politely declined.

However some information appears to have slipped through the cracks. The post history of “creamsugar”, a member of the rowdy NeoGAF forum, reveals numerous data leaks, presumably from official NPD Group reports, and those leaks have proven reliable when later compared with official data.

According to a post made by creamsugar last week, sales of the PSP Go were around 100,000 units during October 2009. Moreover, the black PSP Go system was apparently twice as popular as the white model.

The NPD Group would not confirm the accuracy of the data offered by creamsugar. According to private discussions with analysts, we feel the number of PSP Go systems sold in the U.S. so far is between 100,000 and 145,000, lending some credence to the leaked figure.

Assuming launch-to-date (LTD) sales of the PSP Go in that range, the smaller handheld has assumed around 25-40% of the platform's hardware sales. Given that the PSP sold 1.4 million systems during November and December of last year and the system's declining sales during 2009, we feel it likely that the PSP Go installed base will range from 450,000 up to 550,000 systems by the end of the year (just in the United States).

One recent move that we see as potentially positive for the PSP Go is GameStop's announcement of an in-store downloadable content program. A download-only system like the PSP Go runs contrary to the used-product resale model which accounts for much of GameStop's profit margin, and indications are that GameStop will only initially sell DLC for physical games. However, we see benefits for both Sony and GameStop in the mid-term as long as physical games can be traded and the credit can be used to purchase games for the PSP Go (as well as for other PSP models).

We are undecided about the PSP Go's success so far and its long-time prospects. Sony's decision to simultaneously support the PSP-3000 and games packaged on UMD while also offering the download-only PSP Go may appeal to retailers (or at best anger them less) but the split confuses consumers. At least Sony's older hardware can still purchase and download games, a benefit if the ultimate goal is a download-only handheld.

Moreover, we have seen no significant PSP Go promotions, either at retail or in mainstream media, although that is merely an anecdotal observation. In fact, the primary PSP commercial on television features Gran Turismo and the PSP-3000 model, not the PSP Go.

Finally, the $250 cost makes the PSP Go a luxury game system. Few consumers will have any software they can transfer to the PSP Go (in the form of games downloaded from Sony's PlayStation Store), so new owners will then need to spend additional money to play games.

Until Sony clarifies its vision for the PSP Go, initiates serious promotion of the system, and reduces the system price, we expect its hardware sales to remain modest.

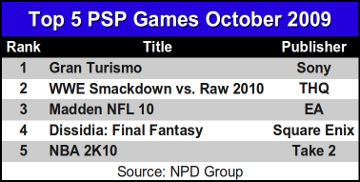

Even beyond the PSP Go, we have strong reservations about the PSP platform itself, strictly on its ability to move software. According to previous reports, the PSP generally accounts for only 4-5% of all software revenue each month, on par with what the PlayStation 2 is still generating as that system begins its tenth year.

Heavily promoted titles like Gran Turismo, Motorstorm: Arctic Edge, and Grand Theft Auto: Chinatown Wars have failed to reach the top 20 all-format chart. With an installed base of nearly 16 million systems in the United States, it is disconcerting that only one PSP title, Dissidia: Final Fantasy from Square-Enix, has made it into the top 20 games for any given month during the past year.

The PSP version of Grand Theft Auto: Chinatown Wars is particularly troubling. The PSP has played host to both Grand Theft Auto: Liberty City Stories and Grand Theft Auto: Vice City Stories, and each has sold particularly well. Yet in its launch month Chinatown Wars didn't even make the PSP software top 10 list at retail – it placed somewhere below #10, the PSP version of LEGO Batman.

While it is possible that some of the PSP's retail sales have moved to downloads through the PlayStation Store, we think it unlikely that those sales are the key reason for the weak retail performance.

Whereas Sony's console is doing well and its handheld is faltering, the story is nearly the reverse for Nintendo. The Wii had seen diminishing sales through the middle of 2009 while the Nintendo DS Lite and DSi maintained extremely strong sales.

However, Nintendo's Wii experienced a tremendous turnaround in sales during October, shooting up to nearly 127,000 units per week, compared to only 93,000 units per week in September. While this falls well short of the 188,000 units per week that Nintendo enjoyed in February of this year, it does demonstrate that cutting the Wii price to $200 was immensely effective.

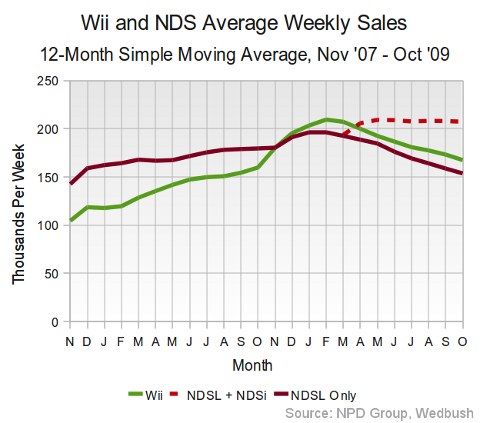

However we do feel that Nintendo took too much time to drop the price of its console. Looking at a simple 12-month moving average of Wii hardware sales for the past two years reveals that sales of the system peaked in February of this year, and have dropped steadily since then.

A key part of the picture here is that Wii hardware sales were extraordinarily high during the last half of 2008 and into the first half of 2009. As those insane sales figures drop out of the back end of the 12-month moving average and are replaced with the strong-but-lower sales of mid-to-late 2009, the average is bound to drop.

But we fail to see any reason for Nintendo to have waited as sales dropped so dramatically before dropping the system price. October's Wii sales show that the demand is still there for Nintendo's console, and we believe an earlier price drop would have given the Wii more momentum heading into the end of the year.

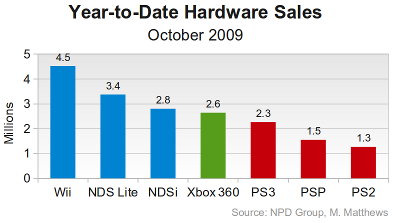

We don't wish to overstate Nintendo's difficulties. We hasten to point out that the Wii is still well ahead of both the Xbox 360 and PlayStation 3 in hardware sales and, to a lesser extent, software sales for the year.

The real puzzle going forward is what to make of the slower growth rate of Wii software sales in 2009. According to data from Wedbush's Pachter, the Wii software market contracted by 20% in September and by 35% in October.

The graph above shows both Wii and Nintendo DS sales and reveals an interesting trend. The running average dropped slightly for both the Wii and the Nintendo DS in March, and Wii has been declining since.

The launch of the Nintendo DSi appears to have reversed the trend for the Nintendo DS platform, and in fact the average weekly rate of sales has stabilized at just over 200,000 systems per week for seven months running.

When Nintendo last announced consumer sales of the Nintendo DSi at the end of July, the total installed base was 2.0 million systems. In August and September no data was available, but according to data provided exclusively to Gamasutra the average price of all Nintendo DS systems sold in October 2009 was $150.

In the absence of retailer promotions, that suggests a 50/50 split between Nintendo DS Lite hardware (priced at $130) and Nintendo DSi hardware (priced at $170).

This is completely in line with the trend through July. For the first four months after the DSi launched its share of Nintendo DS hardware sales dropped steadily from 80% down to 54%. Thus we feel confident that the Nintendo DSi now accounts for approximately 50% of all DS systems sold in October.

Given these figures, we estimate that the Nintendo DSi has reached an installed base of nearly 2.8 million systems in the United States.

That's an immensely strong showing for seven months into a launch, and the only system launches which are stronger included November and December – a benefit that the Nintendo DSi is just now experiencing. (Results of November sales will be available in about one month's time.)

Here's a full graph of year to date U.S. hardware sales in millions:

In fact, were we to break our Nintendo DSi estimate out separately, it would be the third best-selling platform of 2009 behind the Wii and Nintendo DS Lite and just ahead of the Xbox 360.

Should the current Nintendo DSi sales trend continue and should the Nintendo DS platform overall perform approximately as it did in 2008, then the Nintendo DSi could have an installed hardware base of around 5 million systems by the end of 2009. With a large enough installed base, Nintendo and third parties will move more overtly toward DSi-specific software in the near future.

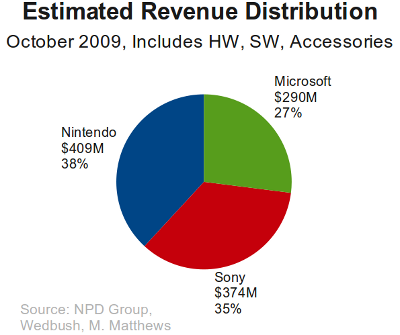

According to Anita Frazier, analyst for the NPD Group, the Xbox 360 was the dominant platform during October 2009 with hardware, software, and accessories totaling around $290 million. Just behind Microsoft's console was the PlayStation 3 with a significant $279 million in revenue.

Using history as a guide and other estimates, we used these figures to estimate the distribution of October's revenue among the big three – Nintendo, Sony, and Microsoft. When revenue from Sony's PSP and PS2 are added, we estimate that its total share of the market grows to 35% or about $374 million.

Nintendo's claims the biggest share at 38%, or over $400 million. For all of 2008 we estimated that Nintendo's platforms generated over half of the industry's revenue. The company itself went on to claim that 99% of the American videogame market growth in 2008 was due to Nintendo platforms.

Consider Nintendo's flat software unit sales for the year, the declining average price of software, weaker Wii hardware sales, and the effect of the Wii price cut. Together these factors suggest that a significant part of the decline of the market in 2009 could well be due to just Nintendo's shortfalls.

We clearly can't put all the market's present difficulties should be laid at the feet on Nintendo, but when one company accounts for half of the revenue in an industry for a whole year, that company's fortunes the next year will likely determine much of the direction of the market.

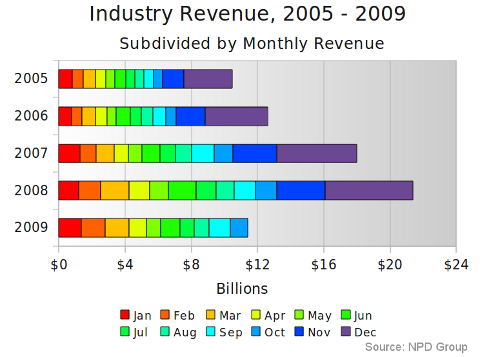

The whole market, including Nintendo, Microsoft, Sony, and all the third parties, is struggling. The big question left for this year is not whether the industry will contract in 2009 but by how much. Let's run down some key measures.

Music Games – The collapse of the music game market is now well-known, but October's sales figures brought with it new evidence of the crisis the genre is experiencing.

Not only did Guitar Hero 5 and The Beatles: Rock Band fail to make the top 20 chart, but those games almost didn't make it into the top 10 games on any given platform. Only the Wii version of The Beatles: Rock Band made that platform's top 10 list, at #7, behind Cabela's Big Game Hunter 2010 by Activision.

With DJ Hero sales coming in just over 120,000 units across four platforms, the evidence for consumer fatigue grows each month.

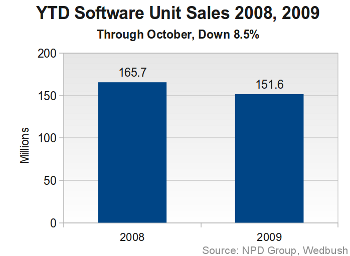

Software Unit Sales – At the end of October 2009 just over 150 million units of software had been sold in the U.S., down 8.5% from the same time in 2008.

Even given the scale of the Call of Duty: Modern Warfare 2 launch, this deficit will be extremely difficult to make up by the end of the year. Nearly 103 million units of software were sold in November and December 2008.

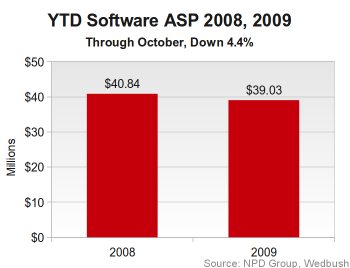

Software Prices – The average sale price (ASP) for software so far in 2009 is $39.03. At the end of October of last year the average price of software in 2008 was $40.84. During 2008 the price of software rose as consumers purchased millions of music game bundles and Wii Fit balance boards. The single-month software ASP in October 2008 was $47.29, over $3.50 higher than it was in October 2009.

Together the drop in software volume and price has contributed to a 12.6% drop in total software revenue during 2009.

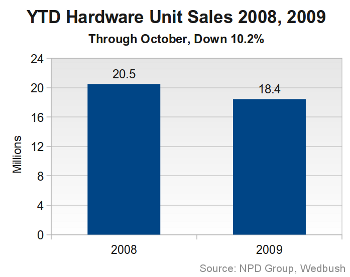

Hardware Unit Sales – The Xbox 360 is the only console whose YTD sales are up in 2009. The PlayStation 3 is still down for the year, but its price cut gives it a chance to post annual growth by the end of the year. Wii system sales were so extraordinary in 2008, it seems unlikely that it will best that record this year. (Regardless, it will still have very strong sales.) The PlayStation 2 is still riding its slow decline. Nintendo DS sales are still up over the same time in 2008 while PSP sales are off by 34%.

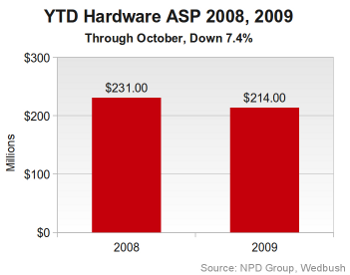

Hardware Prices – Every console has seen a price cut or adjustment this year. The PlayStation 2 dropped to $100, the PlayStation 3 to $300, and the Wii to $200. The Xbox 360 Elite had its price cut to replace the old $300 Pro model. Only the handhelds have seen prices increase in 2009 with the introduction of newer, more advanced models. As a result of these changes, the price of the average system sold in 2009 has dropped to $214 from $231 at the same point in 2008.

Taken together, the contraction in the hardware market and the drop in hardware prices have put total hardware revenue down by nearly 17% for the year.

It is true that some of the biggest releases of the year – namely Call of Duty: Modern Warfare 2, Assassin's Creed 2, and New Super Mario Bros. Wii – have yet to be released, and the figures above do not reflect those revenues. However, the deficit at this point is so severe that it's difficult to comprehend how total revenues will come in above last year's figures.

To put it as simply as we can, if we simply copied last years November and December to this year, the total revenue for the year would only come to $19.6 billion. Given that seven of the last eight months have shown double digit declines from 2008, and external factors like unemployment have only gotten worse since the beginning of the year, reaching $19.6 billion – much less $20 billion – would be amazing.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance and Anita Frazier for her analysis. Additional credit is due to Michael Pachter, analyst for Wedbush Morgan Securities, for his perspective and information. Finally, many thanks to colleagues at Gamasutra and commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like