Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra's latest comprehensive NPD analysis looks at the U.S. console retail figures for September 2009, with spotlights on the music game genre, hardware price cuts, Wii, console DLC and more.

[Gamasutra's latest comprehensive NPD analysis looks at the U.S. console retail figures for September 2009, with spotlights on the music game genre, hardware price cuts, Wii, console DLC and more.]

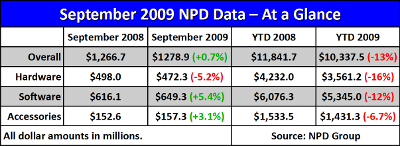

After months of double-digit declines, the U.S. videogame industry appears to have begun a turnaround in September 2009. The latest American retail figures, released on Monday by the NPD Group, showed that total videogame sales were up a modest 1% in September relative to the same period a year earlier.

While analysts had expected revenues to be somewhat stronger, even a flat market is preferable to the declines of the last half-year.

Software was the key driver of revenue for the month, with revenue up 5% from September 2008. Accessory sales were also up over the year prior, but hardware revenue was down over 5% from a combination of fewer hardware units sold and lower prices on hardware generally.

In the text below we'll explore many intriguing aspects of last month's sales, including an in-depth look at the launch of Guitar Hero 5 and The Beatles: Rock Band. Further along, we'll examine the impact of the hardware price cuts for each of the three current generation consoles.

We'll also show some evidence that Wii software sales are somewhat weaker in 2009 than they were in 2008, and compare with the latest software sales figures for the Xbox 360 and PlayStation 3. Finally, we'll finish with an estimate of how map pack DLC revenues have increased the average sale price of the PlayStation 3 and Xbox 360 versions of Call of Duty: World at War.

The September 2009 showdown between The Beatles: Rock Band and Guitar Hero 5 is perhaps the most direct competition between the two franchises the industry has yet experienced. The Harmonix-developed Beatles game launched on September 9th while the fifth major installment of the Guitar Hero franchise hit stores eight days earlier on the first of the month.

At the end of the NPD Group reporting period for September (which ended on Saturday, October 3rd) the final tally showed a decisive win for The Beatles: Rock Band in both units of software sold and dollars of revenue.

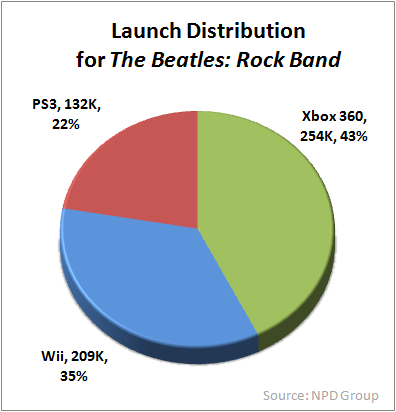

The Beatles moved a strong 595,000 software-only and instrument-bundled units across three platforms. The Xbox 360 versions accounted for 43% of those units while 35% and 22% were sold to Wii and PlayStation 3 owners, respectively.

According to figures provided by Mr. Michael Pachter of Wedbush Morgan Securities and Ms. Anita Frazier of the NPD Group, the average price of a copy of The Beatles during this period was approximately $100. Total revenue for the title was around $59-$60 million or more than 9% of all software revenue for the month.

Despite launching on four platforms and over a week earlier, Activision Blizzard's Guitar Hero 5 only sold 499,000 units through 3 October. Again the Xbox 360 was the lead platform with 42% of the total units while the PlayStation 3 version claimed 21%. The PlayStation 2 version and Wii collectively accounted for the remaining 37%, although precise figures were not made available to us by the NPD Group.

Based on analyst comments, copies of Guitar Hero 5 averaged about $67 at retail during the game's launch month. With the 33% lower per-unit price and 16% fewer units sold, the revenue for Guitar Hero 5 during September was only $33 million, or about half of the revenue generated by The Beatles: Rock Band.

The emergence of the Xbox 360 as the definitive primary platform for these games is a notable development. For example, during the launch of Guitar Hero: World Tour in October 2008, the Xbox 360 and Wii versions were 11th and 12th, respectively, in the monthly all-format top 20 software chart.

Then in November 2008 the Wii version took a definitive lead over the Xbox 360 version and by December the Wii and PlayStation 2 versions both outsold the Xbox 360 version of Guitar Hero: World Tour.

When Guitar Hero: Metallica launched in March of this year, the Xbox 360 version charted for two straight months while the Wii version never made an appearance.

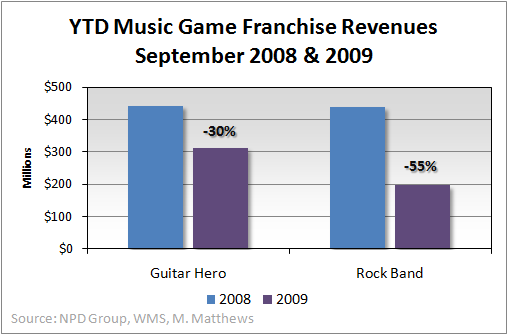

As we have pointed out previously, both the Guitar Hero and Rock Band franchises have seen revenue drop in 2009 relative to the same period in 2008. As of September 2009 the two franchises together (across all packages, including track packs) have generated $373 million less in revenue from the comparable period in 2008.

For some perspective, the software category as a whole is behind by $720 million compared to the first three quarters of 2008. That is, the revenue drop in the Guitar Hero and Rock Band franchises accounts for more than half of the drop in revenue across all software from 2008 to 2009.

Overall, however, the Rock Band franchise has taken the larger hit with revenues down by 55% year-to-date in 2009. (However, many of last year's sales may have been bundled with expensive hardware like guitars and drums which the consumer now owns.)

The one part of the business that we cannot see directly is the revenue that comes in from the sale of songs and song packs through each game's online store. At the moment Rock Band has the larger catalog of songs and has recently touted over 60 million downloads since the launch of the first Rock Band.

Even at $2 per song, the additional $120 million in revenue over the last two years doesn't come close to offsetting the drop in retail revenue just in 2009.

Last month we saw that the PlayStation 3 experienced a surge in sales after the introduction of the new PS3 Slim at $300. By the end of the month Microsoft had adjusted its hardware line to remove the Xbox 360 Pro and reduce the price of the Xbox 360 Elite to $300.

Finally Nintendo dropped the price of the Nintendo Wii to $200 for the last week of the September 2009 period covered by the NPD Group's latest data release.

Our examination of the hardware market focuses on two points: average sale price and year-to-date unit sales.

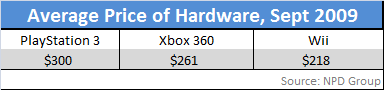

First, the average retail prices for each of the current generation consoles were made available to us by the NPD Group. The average price of the PlayStation 3 dropped from $335 during August 2009 to precisely $300 in September.

This is particularly striking because even when the PS3 was priced at $400 and $500 a number of consumers were still purchasing the $500 model.

However sales of the $300 model appear to have been so strong in September as to completely swamp any sales of the $400 models available.

While constrained supply of the more expensive models could have dictated consumer options, the message appears clear: consumers were ready to buy a $300 PlayStation 3.

On the other hand, Microsoft's new model pricing strategy has done almost nothing to move its average price. Whereas the average Xbox 360 sold for $260 in August, the same hardware sold for $261 on average in September.

Under the assumption that the only two models of the Xbox 360 available during September were the $200 and $300 models, we see that approximately three Elite models were sold for each Arcade model. Together with the strong sales of the PlayStation 3 at $300, this suggests that there is a significant pool of consumers willing to spend $300 on either an Xbox 360 or a PlayStation 3 even when less expensive console options exist.

Until September 2009 the Nintendo Wii had held its original launch price of $250. With only one week at its new $200 price, the average price of the Nintendo Wii dropped to $218 for the month. During October we expect that average price to drop to precisely $200, much as was seen with the PlayStation 3 price going to $300 last month.

The PlayStation 3 was the top console platform for the month, its first time having that honor. We suggested last time that the system could hit 2.0 – 2.5 million units during the final three months of the year, and its September sales rate of 98,000 units per week is consistent with that expectation.

Again turning to the Xbox 360 price cut in Fall 2007, we note that Microsoft's system moved just over 100,000 units a week on the back of a price cut and launch of Halo 3. Sony managed to reach that level of sales at essentially the same price even without the killer app.

Regardless, the PlayStation 3 has a steep hill to climb if it is to outsell its rival, the Xbox 360, for all of 2009. It is currently 450,000 units behind Microsoft's system and will have to outsell its rival by around 35,000 units per week through the end of the year just to pull even.

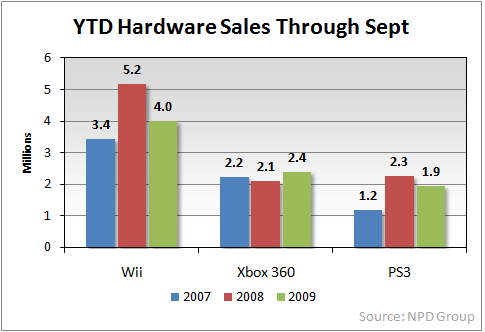

Even with the PlayStation 3 and Xbox 360 showing growth or strong growth potential, they both lag far behind the year-to-date total for Nintendo's Wii.

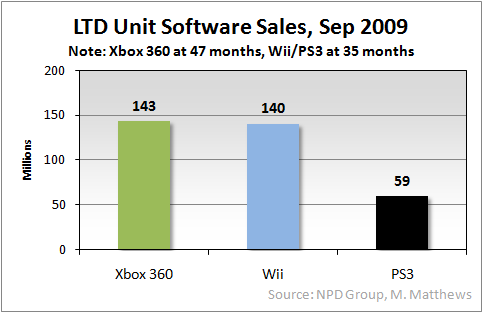

According to exclusive data provided to Gamasutra by the NPD Group, Microsoft's Xbox 360 has improved its tie ratio to 8.8 titles per system as of September 2009, up from 8.6 titles per system three months ago. The Nintendo Wii's tie ratio also increased in that period, from 6.4 to 6.5 titles per system.

Only the PlayStation 3 held its tie ratio essentially constant in the last quarter. According to NPD Group data 6.8 titles have been sold for each system. The tie ratio for the PS3 may remain constant, or even decline, as its hardware sales pick up and a commensurate jump in software sales lags a month or more behind.

Note that these figures are for software sold at retail only. Software sold on each system's online storefront are not included in NPD Group retail figures, although the firm does separately track such sales. Those figures are not publicly available.

Utilizing these new tie ratio data and the installed base of each system, we can determine the total software sales for each system. When we last checked these figures at mid-year, the Wii was within two million software units of overtaking the Xbox 360.

In the intervening period Wii software sales appear to have slowed somewhat, and the Xbox 360 still has a lead of about 3 million software units over Nintendo's Wii. In 47 months on the market around 143 million units of Xbox 360 software have been sold through U.S. retailers.

In just 35 months the Nintendo Wii has sold nearly as much software. To put this in perspective, the Wii has sold nearly 50 million more units of software than the Xbox 360 had at the comparable point in its lifetime.

The PlayStation 3 has been selling software at a slightly higher rate than the Wii, but on a much smaller installed base. With only 59 million units of software sold to date, the PlayStation 3 not only lags the Wii (which launched simultaneously) but also the Xbox 360 at the same point in its lifetime.

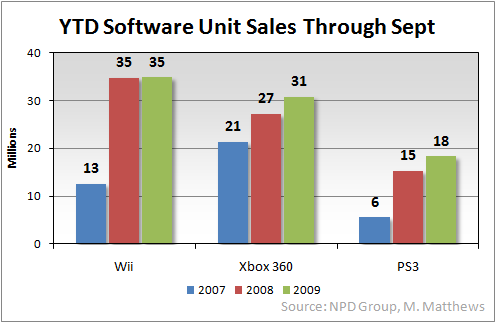

The year-to-date software totals for these consoles provides a very interesting perspective on the state of the software market.

As the graph above shows, both the Xbox 360 and PlayStation 3 have seen about 20% growth in software unit sales over the first three quarters of 2008. During the same period, however, Wii software sales have been flat. Even though Wii software sales are still higher than either of the other platforms, there is clearly something amiss.

One possibility is that Wii software sales were extraordinarily high during the first three quarters of 2008. Certainly Nintendo's first-party software dominated during that period with titles like Super Smash Bros. Brawl, Mario Kart Wii, and Wii Fit launching while Wii Play continued to appear in the all-format top 10 software chart month after month.

However, a closer look at the underlying figures suggests that Wii software sales really have slowed down throughout 2009, precisely in the period during which Wii hardware sales have also shown declines. It is also notable that Nintendo has not had a truly big first-party software release on the Wii this year.

Even with the price cut stimulating hardware sales and New Super Mario Bros. Wii, due out in November, it will probably be quite difficult for Nintendo to demonstrate growth of software for the year. According to our figures, over 36 million units of Wii software were sold in just the fourth quarter of 2008.

(Note: While tie ratio and attach rate are commonly used interchangeably by some, they are indeed quite different. As indicated above, a tie ratio is a measurement of the number of titles sold on average to system owners. By contrast, an attach rate is the percentage of a system's installed base which own a particular title or accessory.)

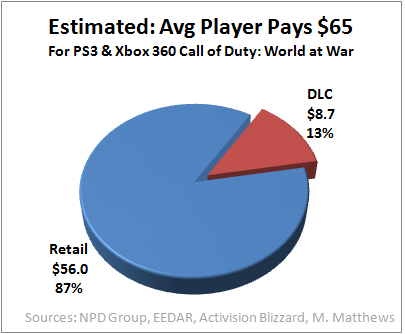

Analysts and gamers alike anticipate that Activision Blizzard's Call of Duty: Modern Warfare 2 will set the charts on fire in November of this year. We've selected its immediate predecessor – Call of Duty: World at War – as an example of how well a strong retail game can extend its revenue stream beyond the initial purchase.

According to exclusive U.S. sales data provided by the NPD Group, the Xbox 360 and PlayStation 3 versions of World at War have sold for an average $56 since the game's launch in November 2008.

Moreover, Activision Blizzard has published three Map Packs as paid downloadable content (DLC) in March, June, and August of this year. Each pack sells for $10 and as of mid-August the latest figures revealed that 6.5 million map packs had been downloaded by consumers worldwide.

We spoke with our colleague, Mr. Jesse Divnich of EEDAR, about how we might estimate the number of World at War DLC purchases in the U.S. According to Mr. Divnich, “59% of Call of Duty: World at War retail sales occurred in the United States.”

Elaborating further, he added that Xbox 360 owners and North American consumers more generally are more likely to purchase DLC. Based on those figures, Mr. Divnich said that 65% of all World at War map packs could easily have been sold to U.S. owners.

Including sales since August 2009, we expect that World at War map packs have now reached nearly 7 million units worldwide. Assuming that 65% of those sales were inside the U.S. at $10 each, we estimate that Activision Blizzard could have realized an additional $45 million in revenue on top of retail sales of Call of Duty: World at War on just the Xbox 360 and PlayStation 3.

However, the DLC revenue is different from retail revenue because it more closely resembles the publisher selling directly to the consumer with greatly reduced overhead and a higher margin. Not only is there no physical product to be manufactured and shipped, but retailers simply aren't an issue. There are, however, some network fees incurred when distributing through Microsoft's Xbox Live service or Sony's PlayStation Network.

We estimate that in the U.S. the average PS3 and Xbox 360 Call of Duty: World at War consumer has paid approximately $65 for the game. This takes into account the PS3 and Xbox 360 consumers who bought only the game along with those who bought one or more map packs. In effect, the DLC sales have increased the revenue per software unit by 15%.

There are several assumptions we've made along the way. First, we have neglected Windows PC sales of Call of Duty: World at War. While the retail sales figures we have cited did not include that version of the game, it is not perfectly clear whether those figures were included in the map pack download totals that Activision Blizzard publicized. We don't believe so, but cannot be positive.

If one must consider Windows PC sales, the situation becomes even more difficult to track since that version of the game was sold at retail and through both Valve's Steam and IGN's Direct2Drive digital distribution systems.

With Modern Warfare 2 expected to best World at War's 11 million units in sales, it seems certain that consumers will again be tempted with paid DLC throughout 2010 as Activision Blizzard attempts to maximize its revenue per sale.

In mid-November when the NPD Group releases its measure of retail videogame sales in October 2009, we'll need to keep an eye on several data points.

Did Sony's hardware sales continue to improve? In particular how much, if any, did PlayStation 3 sales fall on a per-week basis? Also, with a full month of sales for the PSPgo handheld, have the handheld's hardware and software sales shown any signs of life?

How well did Sony's Uncharted 2: Among Thieves sell during the month? With hardware sales on the rebound, the company now needs for its key software titles to come through with stronger unit sales.

Microsoft is pushing its console as the best way to play the hit games of the season. Are consumers swayed by this pitch, building more Xbox 360 hardware sales momentum through the holidays? Where will Microsoft's Forza Motorsport 3 appear on the software chart? Did Halo 3: ODST return to the top of the software chart for another big month?

Nintendo DS hardware sales were down significantly from August 2009 to September 2009 (on a units-per-week basis). If declines continue through October, will Nintendo feel any pressure to make price adjustments to its Nintendo DS Lite and Nintendo DSi hardware line?

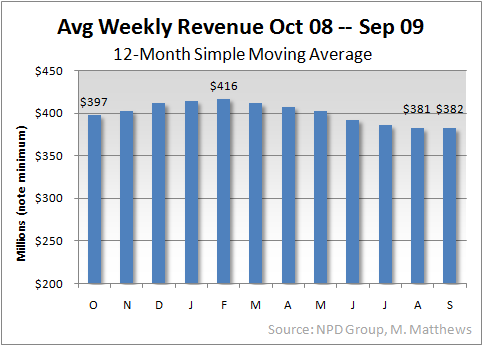

Finally, has the industry really turned a corner, as some suspect. Certainly September 2009's results were a step in the right direction. As the graph below shows, the declines have leveled out. October's sales will help determine where the industry is headed next.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to Mr. David Riley for his assistance and Ms. Anita Frazier for her analysis. Additional credit is due to Mr. Michael Pachter, analyst for Wedbush Morgan Securities, for his perspective and information. This month we also thank Mr. Jesse Divnich of EEDAR for his comments. Finally, many thanks to colleagues at Gamasutra and commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like