Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Let's take a deeper look into Sony’s platform and content strategy, as the company orients itself even more singlemindedly around its video game IP and subscriptions.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

And a grand welcome to the first free GameDiscoverCo newsletter for the week. (Since Monday was a holiday in both the US and the UK, we’re going with a Tuesday / Thursday / Friday newsletter schedule for this week!)

And let’s start out with a look at a presentation which arrived just after we sent the newsletter out last week. It’s a deeper look into Sony’s platform and content strategy, as the company orients itself even more singlemindedly around its video game IP and subscriptions.

For data nerds such as you and I, the slides of Jim Ryan’s presentation to the Sony Investor Relations Day [PDF link] last week are seriously delightful. When the second slide is sales/profitability for the entire history of the PlayStation franchise, spanning almost 30 years, you know you’re going to be in for a good time!

(BTW, although the above chart includes hardware, ‘owned’ software, and platform royalties, you can really intuit how expensive/loss-leading Ken Kutaragi’s PlayStation 3 hardware was to manufacture in those results leading up to the PlayStation 4 launch, can’t you? Fascinating…)

Before we get started, I think it’s good to talk about the differing plans of the three main console manufacturers: Sony, Microsoft, and Nintendo. Specifically:

Both Sony and Nintendo are traditional Japanese-headquartered public companies with a conventional model: grow revenue and profit gradually. Nintendo tends to be less third-party focused than Sony - and quirkier in terms of fiscal planning, as Serkan Toto comments on Twitter - “their whole ‘forecast’ is a mockery”, lol.

But Microsoft is the video game division of a much bigger, massively profitable U.S. corporation. So they are willing to a) take chances b) be marginally profitable or even unprofitable for a while c) even destroy value to create greater long-term value. For example: I think Game Pass is value destructive for certain parts of the game biz, but will create a more powerful value chain centered on Microsoft.

So in many ways, Sony is the ‘Goldilocks’ of the major platforms. It’s neither internally-focused and highly idiosyncratic (Nintendo), nor disruption-focused thanks to corporate air cover (Microsoft). Sony is a company that has to build an integrated strategy around PlayStation which will be the center of the corporation for decades, not years. And here’s how they are planning it:

Firstly, Sony thinks its internal cohesion and PlayStation’s reputation for high quality hardware, games, and services will differentiate it as a brand. (Interesting to see that brand comparison, albeit based on likely favorable internal metrics. Going to say green is Nintendo, orange is Xbox, and cyan is Google Stadia, but your guess is a good as mine.)

It’s true that Sony’s own-brand PlayStation 5 games - whether it be Ratchet & Clank, Horizon Forbidden West, or whatever Naughty Dog comes out with next - are looking pretty spectacular. They will need to look good, since their $70 one-off purchase titles are competing against the ‘$180 per year deal’ from Xbox which nets you all Microsoft first-party titles and hundreds of third party ones.

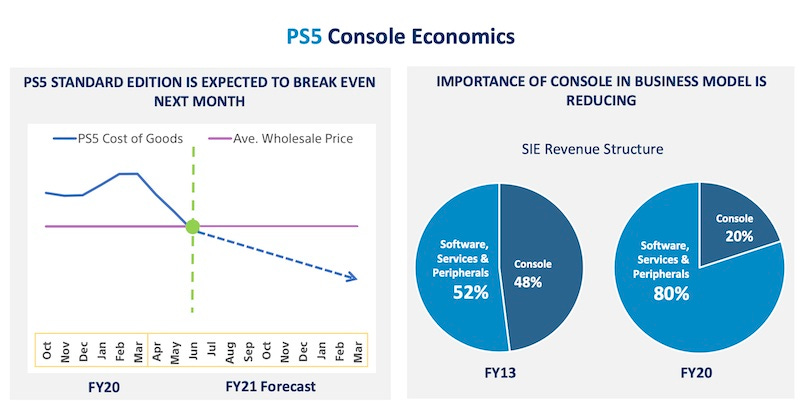

Also notable - in a world where both Epic and Microsoft’s Satya Nadella is using ‘consoles are a loss leader’ in various courts (public opinion, actual court!), Sony is publicly saying its standard PS5 hardware will be breakeven in wholesale cost as soon as this month. Impressive.

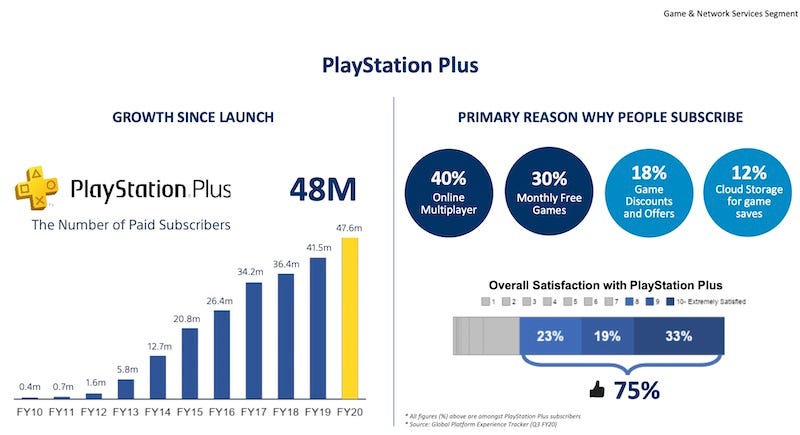

In addition, the increased dominance of Sony’s first-party software, the rise of PlayStation Plus, and the continued importance of F2P on consoles (25+% of total PlayStation spend in FY20!) has also helped shift revenue away from hardware, and towards software and services. This is good news for Sony, who has corporately been weighed down by having to divest (non-game) hardware divisions for many years now.

While it’s a good moneyspinner on its own, there’s also the hint that Sony can - and will - expand PlayStation Plus (or PlayStation Now!) further in the future, if they are threatened by Microsoft’s Game Pass gambit. But Sony, being a standalone company, doesn’t have billions to spend on acquisitions (like Microsoft has done with Bethesda) that won’t make their money back - and more - fairly swiftly.

Heck, Sony is a traditional Japanese company which doesn’t want to load up on debt to chase the Microsofts of this world. So it’s going to try to plate-spin its third-party premium and F2P platform revenue, $70 first-party titles, and PlayStation Plus as a subscription - and take money from all of them at the same time. And I think Sony can do it in the medium-term.

Concluding - I also appreciated MasterTheMeta’s take on this, in which they note: “Sony’s purpose is “to fill the world with emotion, through the power of creativity and technology” and there’s plenty of evidence that Sony’s different business units increasingly collaborate as an ecosystem.”

The story here is intended to be that Sony-controlled IP can win across PlayStation, PC, the cloud, TV, movies, and beyond. I find that intriguingly romantic - partly because I see Microsoft’s play - perhaps unfairly - as ‘content subservient to - or at least equal to - the platform we’re building’. The realist in me says that platforms win over content. But I do believe Sony is close enough to the pivot that they can make it work anyway.

So I’ve recently been virtually chatting a bit with Rand Fishkin, a smart chap who is ‘Internet famous’ as the co-founder of SEO/marketing company Moz. Nowadays, he’s set up his own company, SparkToro, which mines data to help you work out where your Internet audience is hanging out - and who they interact with.

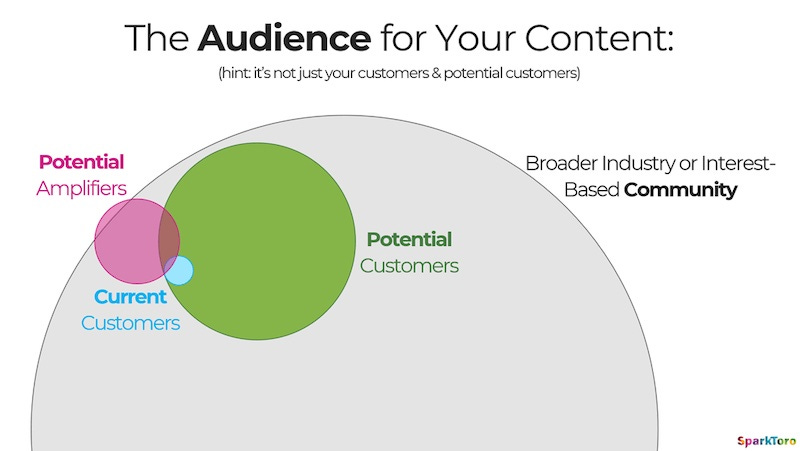

He recently put out a blog called ‘Who will amplify this? And why?’ which is directly relevant to pretty much everyone reading this newsletter. Why? Well - guess what - he’s talking about discovery as a problem! It may not be specific to games, but all of the principles and problems are broadly the same.

Rand lists some of the problems you may have if your content isn’t getting anywhere: “1. You’ve produced something of low quality; 2. You’ve produced something of high quality, but low resonance; 3. You’re at the early stages of brand/audience-building, and need to keep investing before returns will accumulate; 4. Timing and luck simply weren’t on your side, but repeated, similar efforts are likely to work.”

In the video game space, where it can take a couple of years or more to make each game, option 2 is the state that you have to particularly worry about - if ‘something of high quality’ is your game. (Both options 3 and 4 are also less pleasant, if you need to make ‘new game with better resonance’ for it to actually work out!)

And the article goes on to point out: “The root of amplification is caring. People don’t engage with, and platforms don’t amplify things they don’t care about. That caring almost exclusively comes from an emotional place, not a logical one. The process isn’t: “is this high quality and reputable? If so, I shall share it.“ Instead, it’s, “that made me feel something powerful, and I want others to share in that feeling.””

Getting into the deeper psychological roots of why people amplify things is key. Though neither Rand nor I are actually psychologists, of course. But some suggestions are made in the article - novelty, familiarity, surprise - that I definitely agree with.

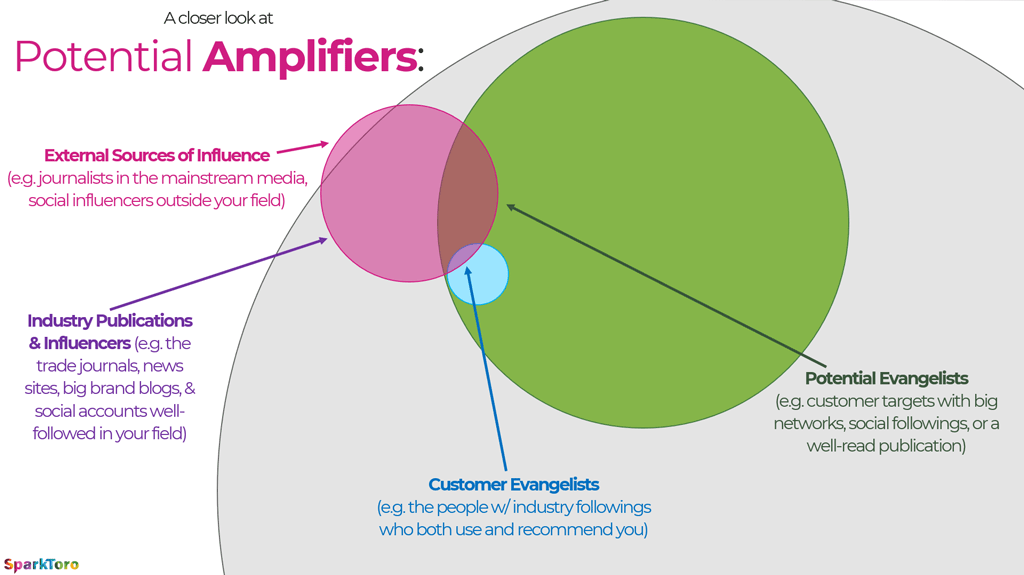

And then, filling in the ‘potential amplifiers’ diagram teased at the top of this section? Well, it looks a little different labeling-wise for games, since streamers are probably the most important external sources of influence, and game platforms also fit in there somewhere. But I still love it as a mental model:

Anyhow, that’s the general idea. I know SparkToro is based on the idea that you can map/identify and therefore utilize amplifiers effectively. But whether you use that service or not, the underpinnings make a lot of sense as a mental model.

And I’m constantly surprised about the amount of people who would love and buy a certain game who have just never heard of it, 2 or 3 years after release. Reaching potential customers via amplification is the key.

And after all that other good stuff, let’s take a final look at some of the interesting tidbits and trends coming out of the game discovery scene - in the last few days since you got one of these newsletters:

As part of a European Xbox survey of 14,000 gamers using a third-party, Microsoft chatted to GamesRadar about the results, noting that “the power of a shared library” allows people to play online with friends and family more easily - see above infographic. And it’s revealed that “[Game Pass] Ultimate members have three times the number of connections in the Xbox community that non-members do.” Some of this may be ‘more committed players buy Game Pass’, but a subscription approach has many advantages from a consumer point of view.

HowToMarketAGame’s Chris Zukowski has a short blog post about data he’s collecting on pre-release wishlists for games. One interesting tidbit - in the first 2 weeks after launching your Steam page, the average number of wishlists from his data set is 1,167, but the median is just 159 wishlists over those 14 days. And Chris is giving a GDC talk on Steam wishlists and what moves the needle - submit your data here if you can!

We love it when we get a real sales number, and ‘chill citybuilder’ Townscaper recently revealed it sold 380,000 copies (on Steam) as of two or three weeks ago. According to Steam250, it had around 8,500 ‘countable’ Steam reviews back then, so that’s 44.7 copies sold per review - solidly in the middle of our ‘20 to 60’ estimates. (Great software toy/game, btw!)

Since viral multiplayer hit Among Us is free on the Epic Games Store (on PC), Innersloth’s Victoria Tran did a thread on its effect on DAU, and this graph is interesting - it boosted overall PC DAU (including Steam/Itch) from just over 300k to over 2 million (!). Victoria did note: “not all new players, many people grab Among Us on as many platforms as they can and were probably testing it out.” Still, Epic Games Store continues to get great viral amplification for free games, even if simultaneous Steam/Epic releases are less juicy sales-wise.

QubicGames is doing a promotion with the Bit.Trip series on the Switch eShop where the game is discounted to $1.99, but only costs $1.49 if you own another eligible QubicGames title. The company is famous for an incredibly elaborate Xmas 2019 promotion with chained-together free games - which you can no longer do, haha. But maybe more devs/publishers should use the ‘own another title from us, get our new game discounted?’ promotion on Switch, since Nintendo makes it possible?

Microsoft’s CEO Satya Nadella has also weighed in on platform cut in a recent Axios newsletter, taking the '30% platform cut for games/apps is fine if the platform holder is loss leading on hardware' view: “Wherever there is no subsidized hardware or device, or what have you, we want to make sure that we have the most competitive (prices)… On Xbox, the business model is just a very different business model. Essentially, the box itself is subsidized.” Okey-dokey, then. (See Sony data above!)

Microlinks: here’s NPD’s latest U.S. retail hardware/game numbers for April 2021, a slight decline due to the mid-pandemic boost last year; here’s which publishers are putting their games en masse on Xbox Game Pass; love this profile of cheeky ‘game dev culture’ TikTok-er Leslee Sullivant.

Finally, following up on last week’s TikTok newsletter/interview, I thought this quote from the Before Your Eyes lead designer about the social media platform that helped his game take off was particularly notable:

Before Your Eyes was massively boosted on TikTok thanks to Wholesome Games and tons of smaller accounts. We didn't plan on it at all, but we wouldn't have had such a good launch without TikTok, simple as that. https://t.co/aHz9CtQqS1

— Bela ಥ_ಥ (@BelaMessex) May 27, 2021

BTW, Before Your Eyes now has 3,300 Overwhelmingly Positive Steam reviews, so has presumably sold over 100,000 copies. This is incredibly impressive given that it had just 364 Steam followers - probably around 3,000 wishlists - just one week before its launch!

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? You can subscribe to GameDiscoverCo Plus to get access to exclusive newsletters, interactive daily rankings of every unreleased Steam game, and lots more besides.]

Read more about:

Featured BlogsYou May Also Like