Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Now that CPI has been the industry standard for app advertising for a few years, it's clear that we need a new way to look at user acquisition. Quality Engagements are what really matter, but it's difficult for developers to quantify and acquire them.

In 2009, I was part of the team at Tapjoy which came up with the first mobile app offer wall. We were tackling two of the most important problems for free to play mobile game developers at that time: distribution (how to get more users for a free to play game), and monetization (how to make money from free users).

At that time, most ads were sold on a CPM basis or a CPC basis. But most app developers didn’t really care about CPM or CPC, they wanted to know the true cost of getting a user. So, many app developers were forced to calculate eCPI (effective Cost Per Install) by backing out the impression and the conversion numbers.

Eventually, through the success of Tapjoy and other ad networks, including Chartboost, Flurry, among others, the industry standard for app advertising shifted to CPI – or Cost Per Install. Even display networks like AdMob (which was sold to Google) and what later became Apple’s iAd had to shift to providing enough data so that advertisers could calculate eCPI numbers for comparison. Today even Facebook has been forced to provide CPI rates for app developers.

Now that CPI has been the standard for a few years, mobile user acquisition is still a major issue for most app developers. In fact, the rising cost of CPI is often the #1 issue for a new game or mobile app – many apps have an LTV (lifetime value) that is less than the prevailing CPI rates.

To complicate matters, the cost-per-install quoted by a network isn’t always a reflection of the quality of users. Not only is it often expensive to get installs (on iOS the numbers have been astronomical and they’ve been rising on Android as well), but different networks charge different amounts and result in differing quality of users, so a simple CPI comparison isn’t enough.

While CPI numbers are tossed around almost casually now, I believe that most companies still haven’t truly figured out the cost of getting a real user. By real user, I don’t mean an install – in the mobile world, particularly for free to play games, most users who install a game never play it after the first day!

I was speaking to a very knowledgeable developer recently who was fed up with CPI – he wanted to know the true cost of getting an engaged user. Since most games have less than 50% day 2 retention rate (i.e. less than half of the users who install the app return the next day), the true cost of getting a user back on day 2 was what really mattered to him. If they came back on the second day, then there was a much better chance they could convert into long-term players of his game.

To get the cost of a day 2 returning user, you have to divide the CPI by the day 2 retention rate for your app. Seems simple? Not really, because users that come from different advertising networks will have a different day 2 retention rate. Which means you have to figure out and track the retention rate on a channel-by-channel basis.

As an example: if CPI is $1 but the day 2 retention rate is 50% from users from channel A, then the true cost of getting a day 2 user from this channel is $2. If another network, say an incented network, channel B, charges only .20 cents for a user, but their return rate is much lower, say 20%, at first glance it seems like you might want to go for the higher quality, higher cost user - after all, 20% day 2 retention is much lower than 50%.

But, if you do the math, you’ll see that in channel B, the cost of getting an engaged day 2 user would be only $1 (CPI * Day 2 retention). So in this example, channel B is not just less expensive to buy an install from, but less expensive to get an engaged user, even though on average the quality of users might be lower. Now if the retention rate of channel B was only 10%, then the cost of a day 2 user would balloon to $2, and there would be no significant quality difference with channel A.

However, the cost of a day 2 user is only one measurement of a the cost of an engaged user. How about the cost of getting a user that reaches level 5? Is that user more valuable than a user that just installed the game and never came back? Of course it is.

For a free-to-play slot machine game, it might be that users who have spun the wheel 30 times are much more likely to become engaged users or paying users.

We call these key “engagement points.” Developers want to maximize the number of users that reach these. For a card battle game, a key “engagement point” might be when someone joins a clan, or enters a weeklong event or tournament.

I was speaking to another mobile developer recently and he lamented that free-to-play games only have a few seconds to make an impression on a user. It’s pretty difficult for users to really get to know a game in only one play session. Many good games will lose users because they didn’t hook them in the first 30 seconds or 1 minute. Because of this, it’s important for mobile game developers to find ways to get a new user back into their game after the first play session several times before they make a decision whether to keep playing this game or not. This is a type of “re-engagement” that can be critical in improving the engagement metrics of a game.

At Midverse Studios, we started out as a game developer and faced all of these challenges in promoting our games. After trying out pretty much every ad network / user acquisition source available, we took the best elements of what we had seen and implemented our new CPE+ model for our new AppEngage network. We were fed up with CPI costs and the varying quality of users – when what we really wanted was an “engaged user.” We also wanted to be sure that any users we paid for would log into the game multiple times, and we wanted those users to return on the second day -- if they did this, we knew we’d have a much better chance of hooking them.

CPE generally refers to Cost per Engagement, or Cost Per Engaged User. The industry has been experimenting with CPE models over the last year or so, paying them lip service, but most ad networks have only half-heartedly implemented them and haven’t been able to provide any decent volume.

With CPE+, we recognized that a simple install is not as valuable as a user that completes the tutorial and actually plays the game a few times. A user that plays the game a few times isn’t as valuable as one that levels up and comes back the next day. And a user that comes back the next day may not be as valuable as a user that enters a tournament or a clan in the first week. And so on.

Event | Value of user |

|---|---|

Install app | Low |

Complete tutorial | Low |

Play game on day 1 | Medium |

Level up on day 1 | Medium |

Launch game on day 2 | Medium-High |

Play 5 rounds on day 2 | High |

Level up on day 2 | High |

... | |

Reach level 10 | Very High |

Join clan or Tournament | Very High |

Table 1: The relative value of users in the engagement funnel

Table 1 shows some sample types of engagement points and the relative “value” of users at each step. You can think of this as an engagement funnel, where each step consists of a higher value but decreasing number of users who achieve that step.

In fact, you can think of the engagement funnel as a parallel achievement system to your own in-game questing or achievement system.

It is a “new user achievement system” – you want to guide a newly purchased user down this engagement funnel. Moreover, in an ideal world, the cost of a user would vary depending on how far down the engagement funnel they got, and developers could bid on how much each engagement point is worth.

This is a long-term vision and a completely different way of thinking about user acquisition. Would you like to buy a user that reaches level 30 of your game? How much are you willing to pay?

In order to fully implement CPE+, a new model in user acquisition, the existing format of ads won’t really work. Existing formats – banner ads, offer-walls, full screen display ads, videos - are insufficient to provide a coherent user interface to guide users to try your game, log in again, and guide them to important activation points on subsequent days. Moreover, rewards can encourage users to try new games and travel down the engagement funnel, increasing their play-time and their “evaluation” period.

To fully implement CPE+, what’s really needed is a cross-game achievement system. Many companies have built custom integrations between games based on achievements. For example, a farming game might give a custom reward for someone that tries out their new aquarium game and reaches level 3. The industry is full of experiments like this, usually by a developer in two of their own games. I know anecdotally that many of these experiments have been successful at some of the best-known mobile game companies out there. The problem is that they are usually implemented in a one-off way and cannot be re-used across games and with different achievements and different rewards.

In order for the industry to fully embrace CPE+, it would need to:

1.Give users a way to try new games that they might be interested in.

2.Reward users who try new games to encourage volume.

3.Provide a generic way to represent events and achievements

4.Guide users towards activation points and track their progress

5.Give users increasing rewards for reaching further down the engagement funnel

6.Get users to come back to the game after the first day.

7.Provide a way to charge app developers based on the quality of users delivered and not simply based on “installs.”

In my experience with mobile and social gaming, I have learned that users love two things in their games: rewards and achievements. That’s why almost every game has some questing or achievement system. There’s nothing like seeing goals ticked off presenting how far the user has come and how close they are to their goal, which is usually some kind of in game reward.

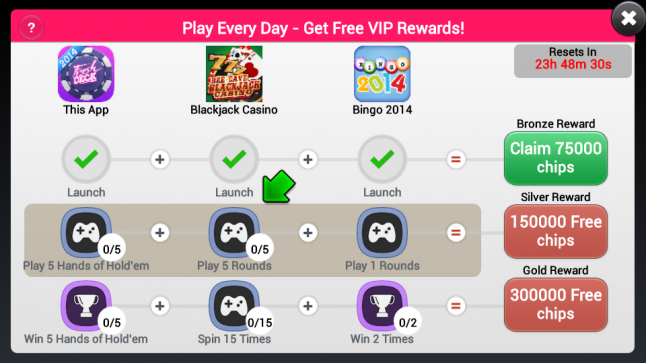

Figure 1– The AppEngage VIP Rewards dialog, implementing CPE+

Figure 1 shows Midverse’s specific implementation of CPE+, called AppEngage. In our implementation, users earn rewards by trying a limited number of new games. As they play, they get checkmarks for completing each “action” in each game, and are rewarded based on how may “checkmarks” they collect. The rewards come at increasing levels - bronze reward for trying out different games, silver reward for getting to first level of engagement in those games, and gold rewards for high level of interaction/returning to the games often. Users must engage not only in new games, but in the current game to reach each tier of rewards.

This is a very different way to think about user acquisition – it goes beyond simple measurement of how many installs can be provided at what cost. In fact, we believe that this CPE+ model can replace CPI as the dominant way to acquire users, but it will take some time since the whole industry is just recovering from being stuck in a commodity-like cost-per-install world. In other words, the refrain of the day has become something like: “hey buddy, how many installs can you give me and for how much?”

But installs aren’t fungible commodities like oil or gold - the quality of installs varies greatly. Many app developers are coming up with models to measure the quality of users they are getting from different user acquisition channels. I believe that engagement may be the most important measurement, and that’s why we came up with CPE+ as a model and started to measure the cost of an truly engaged user.

As the industry recovers, I believe that a shift to more “quality” users is inevitable, and CPE+ is a great way to get there.

About the author:

Rizwan Virk is co-founder of Midverse Studios and was previously co-founder of Gameview Studios, part of the original team at Tapjoy, and an angel investor in many gaming companies. To check out Midverse’s new CPE+ network, called AppEngage, visit www.midversestudios.com.

Read more about:

Featured BlogsYou May Also Like