Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Following a disastrous 2016, it looks like 2017 will be critical year for the future of Glu Mobile (NASDAQ: GLUU). Here's why.

Surely 2017 can’t be as bad for Glu Mobile as 2016? Of course it can.

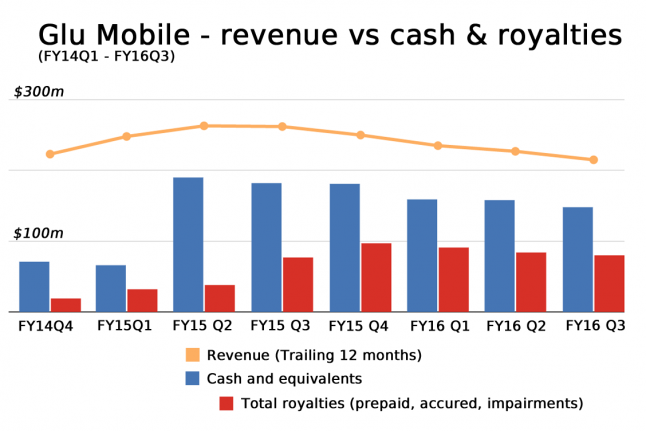

But 2016 started so well. Thanks to Chinese internet/games giant Tencent acquiring a 14.6% stake for $126 million in mid-2015, Glu Mobile (NASDAQ: GLUU) kicked off the year with hope in its heart and $181 million of cash in the bank.

Yes, the company had ended 2015 slipping back into two quarters of small losses following the slow decline of great success Kim Kardashian: Hollywood (released in 2014 and which to-date has generated over $170 million).

But what we can label Glu’s ‘Celebrity First’ strategy had just seen the release of Katy Perry Pop (December 2015), and with branded games from Britney Spears, Nicki Minaj and Gordon Ramsay due during 2016, another $100 million hit was surely a formality.

Bright lights, no trousers

Surely not. 12 months on and Katy Perry Pop has been discontinued, Britney Spears: American Dream was a flop and Nicki Minaj: The Empire (released in early December), has failed to break the US top 100 top grossing apps chart and already appears to be in terminal decline.

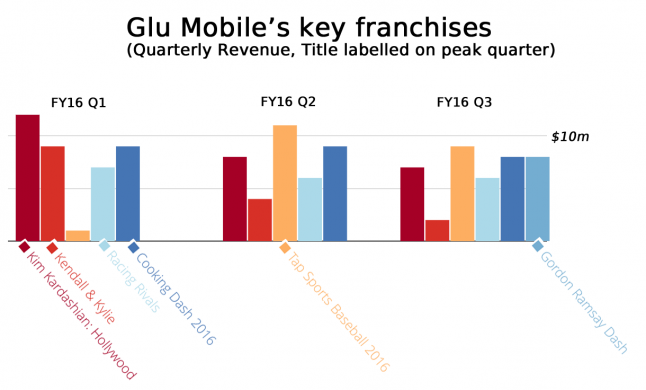

Not only has Glu failed to secure another hit celebrity-driven game - although Kardashian tie-in Kendall & Kylie has generated a modest $14 million to-date - it turns out that even failed deals with celebrities don’t come cheap.

In Q3 2016, Glu had to write down almost $30 million in prepaid royalty impairments, presumably to cover minimum guarantees to its celebrities, driving its GAAP loss for the quarter to $44 million on $51 million of revenue.

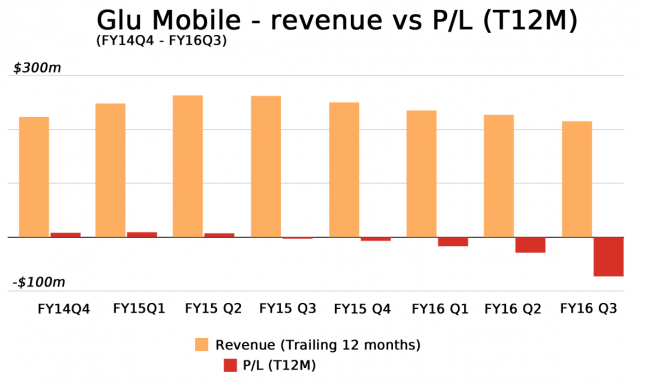

Indeed, looking at the company’s trailing 12 months performance, for Fy16 Q3 it had generated a loss of $73 million on revenue of $215 million.

More problematically, Glu has now been loss-making for the past five quarters, and on a year-on-year basis, revenue has been in decline for the same period.

Full year revenue for FY2016 will be closer to $200 million than the $250 million it predicted at the start of the year.

And Glu expects to end 2016 with less than half the cash and equivalents it started: $80 million versus $181 million.

Oh, and it’s kicked its longterm CEO upstairs.

Niccolo de Masi saved the company from extinction in the 2010s was behind Glu’s Celebrity First strategy but he’s now given up the fight, becoming executive chairman, with the relatively inexperienced Nick Earl handed the CEO’s hotseat.

No wonder Glu’s share price is near its 52-week low, although you could still argue that with a c. $250 million market cap, it remains over-valued.

One last bet?

Is there any potential upside? Yes, there’s always potential upside, no matter how unlikely.

Glu has one last throw of the celebrity mobile game die: it has a deal with Taylor Swift.

Basically,m your view on how good or bad Glu’s 2017 will be boils down to how successful you think Glu’s Taylor Swift game will be.

Note Glu’s Katy Perry, Britney Spears and Nicki Minaj games weren’t bad games, just financial flops. And that’s the problem for Glu.

It’s proven it knows how to make and operate a celebrity-based mobile game that has the potential to make a lot of money. But it doesn’t know how to replicate Kim Kardashian: Hollywood’s success, because the game’s success wasn’t about the game but is about its star.

Taylor Swift is a great musician with a large social following but she’s not a 24/7-365-days-a-year tweeting, instagramming celebrity in the way Kim Kardashian is. No-one does that like Kim Kardashian does, apart from husband Kanye West.

And that’s the reason I think Glu Mobile will continue to struggle in 2017.

Any other options?

The bottomline is Glu need something to big and hit hard in 2017.

Looking through its portfolio of games, it still has some mid-range midcore franchises but many are now in decline.

Racing game Racing Rivals did $40 million of revenue in 2015 but will be sub-$25 million in 2016.

The Deer Hunter franchise did almost $30 million of revenue in 2015 but will be sub-$20 million in 2016.

Glu’s many shooter games did $20 million in 2015, but will be sub-$10 million in 2016.

That leaves its sports games and Cooking Dash franchise.

Actually, both have been strong in 2016. Tap Sports Baseball 2016 could be a $30 million game in 2016, while the combination of Cooking Dash 2016 and Gordon Ramsay Dash is looking good for $50 million of 2016 revenue.

Yet their strong performance hasn’t been enough to lift Glu Mobile out of its losses, and it’s very difficult to see any of these games bringing the additional $50 million of revenue uplift Glu needs to regain quarterly profitability in 2017.

Even the company’s most recent acquisitions - $7.5 million spent on loss-making quiz game QuizUp or the more serious $45.5 million cash dropped on US female-focused outfit Crowdstar - look a bit desperate.

Crowdstar’s mobile app Covert Fashion has a solid audience but the now-mature game isn’t a regular US top 100 grossing app, and company isn’t profitable. Glu can certainly make operational savings but it’s unlikely it can substantially build double digit profitable revenue.

Which leaves Glu spinning its hopes on Crowdstar’s soft-launched Design Home app.

Glu says the pre-release numbers from the Canada App Store look good, but expecting Design Home to fill the increasingly large hole in Glu’s financials as Kim Kardashian: Hollywood’s decline continue is highly problematic.

Which leaves us pondering our original dichotomy: In 2017, when it comes to Glu Mobile, it’s a successful Taylor Swift tie-in game or bust.

Read more about:

BlogsYou May Also Like