Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

This time, we’re following up last Monday’s look at big PC game discovery trends in 2021 by focusing on the console side of things.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to a Monday. But it’s not just any Monday - it’s the Monday that you read the latest free newsletter from GameDiscoverCo. Next steps? Getting great hints on how to improve your discovery, getting a cool tidbit or just, well… going with the flow?

This time, we’re following up last Monday’s look at big PC game discovery trends in 2021 by focusing on the console side of things. It’s a large, complex subject that we can’t possible summarize in four multi-paragraph sections. But we’re going to do it anyhow. We laugh in the face of mortal danger.

[REMINDER: at a company with a learning, professional development, or training budget? You can (with your manager’s permission!) expense your paid individual or company-wide subscription to GameDiscoverCo Plus & get access to extra newsletters, data, and the Discord!]

So we explained already last week, but re-upping the disclaimer: “We’re biased towards devs and publishers who are intentionally trying to be profitable over time, we’re ‘pessimist realists’, we have a soft spot for indie creators who bootstrap their way to success, and we don’t love the business imperatives & moral compromises around aggressively monetizing IAP in games.”

Let’s take a look at which way the wind is blowing, here:

As we’ve been compiling ‘recent release’ console charts regularly (Xbox, and now PlayStation) for our Friday Plus-exclusive newsletters, we’ve noticed a strong overlap between ‘big on YouTube/Twitch - and therefore Steam’ and ‘actually making it into the charts on non-Nintendo consoles’.

It’s not always the games you might expect, either. For example, first-person melee combat game Paint The Town Red, which has 13,000 Steam reviews and is big on YouTube, was appearing in Xbox charts after its console debut in July. So was the similarly ‘good on PC’-selling Clone Drone In The Danger Zone. You need a very strong interest base, though.

It’s not a discovery mechanism of the console’s UI which is making these games popular, though - players are searching for these games directly. The main lesson here is: some very popular PC games, often GaaS titles made by indies, are leaving millions of dollars on the shelf by not converting to console. People are searching for your game on Xbox or PlayStation every day, and they can’t find it cos you didn’t make it yet!

Of course, the revenue upside is unclear - it’s not always ‘each console platform has similar sales to the PC version.’ But on occasion, it absolutely is.

If anyone has monitored some of the comments on the PlayStation YouTube channelwhen trailers for 2D games pop up (ouch!), you’ll know that PlayStation gamers really value 3D, graphically sophisticated games - think Bugsnax, as opposed to a Stardew Valley-looking title. (Or they dig less sophisticated, scrappier 3D games with plenty of Internet hype - see trend #1.)

This is especially true if those players want to justify purchasing new hardware. Both Returnal and especially Godfall overperformed thanks to the PS5-first approach to graphics. And with Xbox Game Pass snarfling a lot of the innovative 2D-ish titles into a subscription format (more on this shortly), it doesn’t look like that trend will change soon. The demographics of these Sony/Xbox console-buyers are just different.

So it’s definitely a Switch-centric market (plus subscription services!) for those making 2D platformers, RPGs, and other conspicuously non-3D titles which can sometimes do well on PC.

And while PlayStation and Xbox aren’t a complete dead zone for paid 2D indies - some micropublishers get by on selling 1-2,000 units per game SKU, multiplied by lots of SKUs - it’s not precisely fertile ground, either.

Perhaps the ‘monthly game subscription’ switch was bound to happen eventually, anyhow. But Xbox’s Game Pass full-court press is certainly accelerating it. And given its success, we’re expecting Sony to re-organize PlayStation Plus and Now to better compete with it at some point soon. (It’ll still be a less aggressive version, though.)

Xbox has pivoted from early ‘this will do nothing to the market’ positioning on Game Pass to a more realistic ‘this is changing the market, but get on board!’ message - which I appreciate. And since being on Game Pass solves some discovery problems due to Xbox’s UI, and the lump sum $ deals are good for indies - yes, Game Pass is a net positive right now.

And for those who have a game with service-based elements and IAP (a lot of AAA publishers!), these Game Pass-type setups are great for upsell and new userbase. The big unknown here is how crowded the line to get on Game Pass-like services is going to be over time, and what percentage of smaller dev income it’s eventually going to be.

(One issue: negotiations between publishers and platforms re: getting onto subscription services is becoming problematic. Platforms have near-infinite choice & can change their mind at any time, so are not motivated to communicate swiftly and decisively. Ironically, indie devs have this issue with publishers all of the time. Now the shoe’s on the other foot.)

We’ve been talking about the Nintendo Switch and discovery a whole bunch in the newsletter. And our recent newsletter on the ‘meh’-ening of console sales covered this in some details. But it’s worth repeating and amplifying some of it, since things are only getting more crowded.

As we said: “If you had any Switch game out in the 2018 timeframe, you could sell 1-2,000 copies per month at full price, just by being on the store, partly due to lots of hardware sales and a lack of titles to buy. The trend, clearly, is away from this.” In fact, it appears that 53 games came out on the Switch eShop last week, according to the most recent ICO newsletter.

So that’s happening, and now we’re seeing perfectly good Switch games sell a few hundred units in their first few days on sale. Less is the new normal. Yet we’re still seeing lower-profile indie games that discount smartly and often on Switch rack up five figures in unit sales over time. And it’s the first port of call after a PC version for most games - absolutely.

Overall, that’s what we are seeing on console right now. For the right games (see point #1), it’s absolutely still an exciting space. And for top cross-platform F2P games or those with dynamic fan interest, the overall console market is still T for tremendous. But it’s crowded. Did we mention it’s crowded?

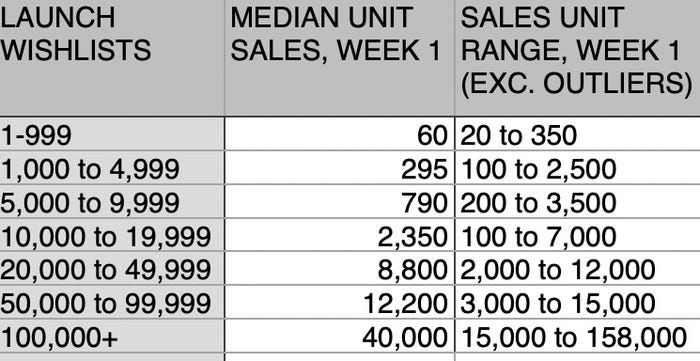

We continue to be in the weird situation where - on the one hand - devs want to measure (and increase!) pre-release interest in their games, and Steam wishlists are a great way to do so. But on the other hand, as GameDiscoverCo’s recent Steam dev survey (with results from 75+ titles released since 2019!) shows, wishlists are an unreliable narrator regarding final outcome.

Anyhow, we’re still in the ‘please measure your wishlists and take them seriously’ camp - not least because there are very clear top-level caps on performance, if you don’t have enough wishlists. (You won’t be selling 10,000 copies in your first week with only 1,000 Steam wishlists at launch, unless a ‘<1% of Steam games’ outlier.)

But we’ve had a couple of specific launch wishlist ‘hopes → sales realities’ discussions recently. So we wanted to return to the survey, and reprint the actual (literal) results we saw for some common mid-level Steam wishlist ranges. (The original article showed literals only for 50,000+ wishlists on launch.)

Firstly, here’s the overview of the games we surveyed, including rough sales ranges, excluding top and bottom outliers:

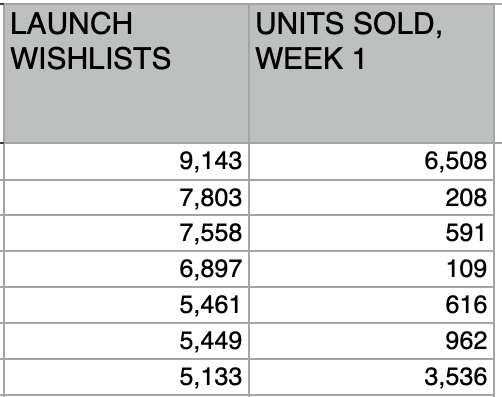

So, for the first time in public (*applause*) here’s the literals for the games that launched since 2019 with 5,000 to 9,999 Steam wishlists:

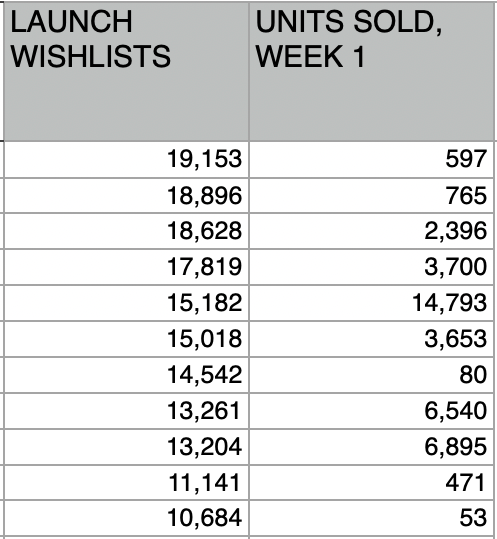

And here’s similarly specific examples for titles that launched with anywhere between 10,000 and 19,999 Steam wishlists:

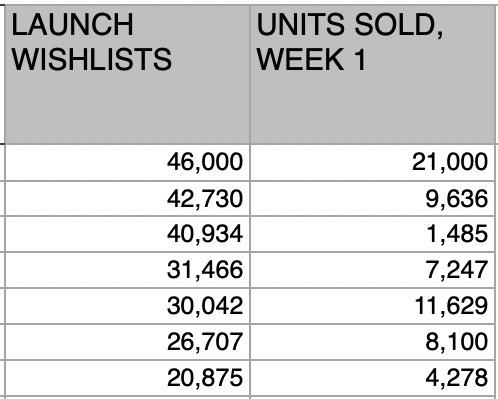

And finally, here’s the Steam wishlists vs. first week units sold for those games that debuted with between 20,000 and 50,000 Steam wishlists:

This is by no means a canonical survey, of course. It lacks data points, and could be biased by any number of things. But I think concrete examples like this give you - and everyone - vital context. Why?

Well, understanding the very large potential range of outcomes is very important. It’s about streamability at launch, how crowded your genre is, and your launch buzz / Steam rating - not just your wishlists, folks. So don’t NOT pay attention to wishlists, but also - don’t fixate on them to the expense of everything else? Whee.

Well, time to wrap up this fine newsletter with some hot links (mm, hot links) to a whole host of platform and discovery news. Your mileage, as always, may vary:

Mystified by which publishers, collectives, and organizations are getting Steam sales and which aren’t? Be mystified no longer, since SteamDB has added a ‘current and previous Steam sales’ page which scrapes the entire Steam sale pages history. It doesn’t tell you how much front-page featuring they got, of course. But it’s fun to peek all the ‘splash’ images next to each other!

Oh gosh, some Oculus stuff happened! First, there was the Oculus Connect 2021 game announcements, including GTA: San Andreas and a Vertigo Games/Deep Silver IP collab. And maybe you won’t need a personal Facebook account to use an Oculus headset, but we bet you’ll need some kind of Meta account. And here’s an interview with Zuck about his metaverse hopes & dreams. Oh, and the Oculus brand is being retired, which is weird. Fun times.

Capcom, being a Japanese-headquartered legacy console org that sometimes makes elaborate PPTs, is being much more specific about its new focus on PCas a platform. There’s a graph showing a fatter long tail after ‘digitalization’, and: “We are now able to sell in more than 200 countries and regions, a number that far exceeds the conventional console market… [we] think that there is great potential for future growth in this area and have designated PCs a priority platform.”

Sad to note that one of the three North American PAX B2C game expos, PAX South in San Antonio, has been permanently shuttered. Since it was the third event added (after PAX West / East) and larger exhibitors tended to stay away even pre-COVID, it makes sense. But there’s a question-mark in medium-term economics re: B2C game events, if merch vendors outnumber publishers.

Microlinks: the freeze in new Chinese government licenses for video games has now reached 100 days, even for domestic titles; the metaverse is already here… and it’s Minecraft, apparently; Google Stadia has a ‘play this game for 30 minutes’ demo option it’s trying out.

A cautionary tale in YouTube & game naming: we were sent this blog post by the developers of Kamikaze Veggies, formerly Suicide Vegetables, because a YouTuber believed his videos would be demonetized due to the word ‘suicide’. This apparently happened with the game Suicide Guy, even when the game name wasn’t mentioned on YT. The devs think Facebook and TikTok were also self-censoring on the word, so… name change it is!

The latest Sony results happened, too - the company sold another 3.5 million PS5s, PS+ subs were up a million to 47.2 million, but “PlayStation Network monthly active users declined for the third quarter in a row to 104m (down from 105m, 109m and 114m in previous quarters).” Oh, and the company formed the PlayStation PC ‘label’ for its continued push into PC games. Oh, PC - everyone loves you so.

In ‘platform downtime’ news, Roblox is, of course a massive platform. So it being down for 3+ days is a super big deal. Even UK tabloid The Sun had a slightly spurious ‘live blog’ - no doubt due to the amount of search engine traffic it was getting. These gigantic global services are getting harder and harder to restart after complex failures, huh?

Microlinks, Pt.2: many streamers aren’t very happy about Twitch’s new ‘users pay to boost streamers’ feature; Rust’s Garry Newman on how to get your job application/portfolio right; blockchain/NFT game companies are petitioning Valve to get the recent ban reversed.

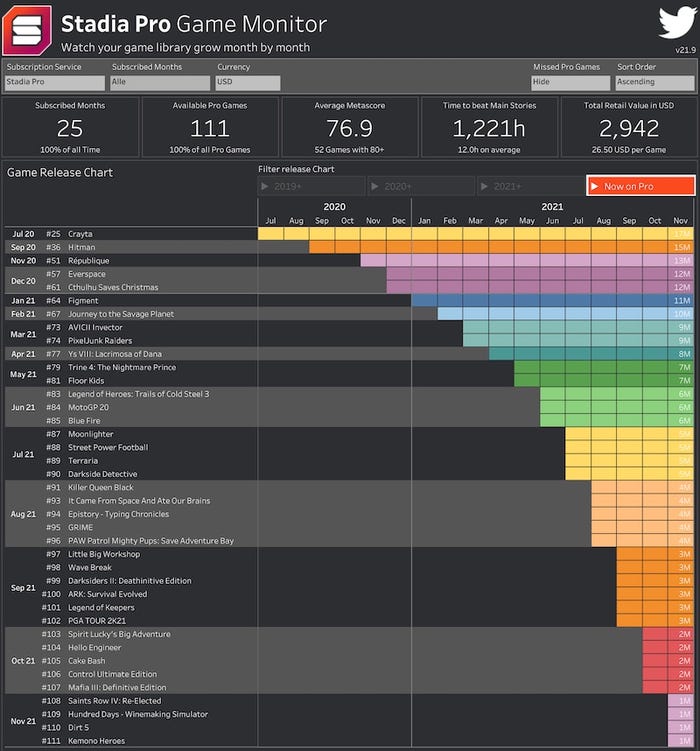

Finally, a kind denizen of the GameDiscoverCo Plus Discord pointed out (via the creator’s Twitter) a neat fan resource, the ‘Stadia Pro Game Monitor’. It uses a rather pretty Tableau visualization to show the ‘free’ games available with your Google Stadia Pro monthly membership.

According to the Monitor’s tracking, there’s been 111 Stadia Pro games available for the service since Nov 2019, and if you sign up with now, there are 39 Pro titles available - full line-up below. The more you know? See you Wednesday:

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Read more about:

Featured BlogsYou May Also Like