Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

The Apple vs. Epic trial serves up one last data iceberg.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

It’s the last free newsletter of the year here at GameDiscoverCo, and we hope you’re winding down acceptably. Chestnuts, open fire, etc. And Plus subscribers do get one last missive on Friday - we’ll be discussing how Noble Fates properly announced only 2 weeks (!) before release, and is still selling great. (Those cheeky so-and-so-s!)

So, the Apple vs. Epic lawsuit is basically done and dusted. We wrote what we thought would be our final article on it back in September. Final verdict? Epic CEO Tim Sweeney put a lot on the line for his company to disrupt what he sees as an unfair platform monopoly.

And though the lawsuit didn’t entirely come down in Epic’s favor (it was really just a minor technical win, but with most major points rejected?), it helped to bolster governments and associations to put further pressure on ‘big tech’ in general - and Apple specifically.

Sweeney’s wants can still read as overly idealistic. He recently said that “what the world really needs now is a single store that works with all platforms”, which is both adorable and brain-bendingly unrealistic - basically “what the world really needs now is free ice cream for everybody”? (Though he didn’t say that latter phrase. That we’re aware of.)

And the Epic Games Store has been his company’s attempt to make a new, low-cost, low-rules style of platform, from an essentially altruistic place. And it was certainly serious enough to spend over $1 billion on store-exclusive advances. (But it’s never been strong on platform feature set - why was that?)

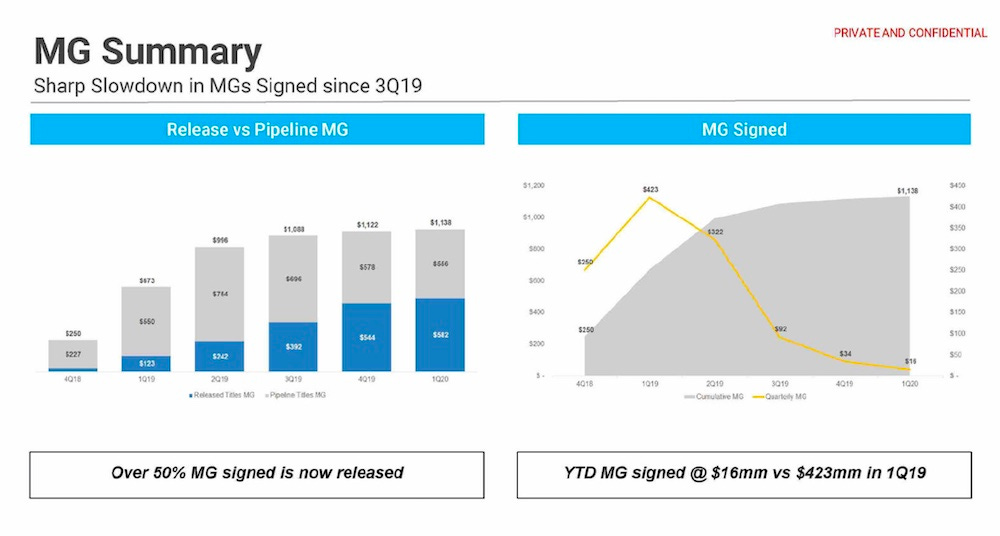

Yet when we covered lawsuit document takeaways back in May, we believed that financial realities were catching up with EGS: “We believe that EGS ‘minimum guarantee’ deals are winding down. The catalog is widening, and many more publishers/devs have been let onto the Epic Games Store to publish games with no exclusivity, but no advance.”

And.. we now have proof of this, at least as of mid-2020, thanks to some late November official court document updates spotted on Reddit. Surprised to see new, interesting data crop up after the trial concluded. The Reddit post only mentioned a fraction of the full doc, but here’s what got our attention:

So yes, minimum guarantees from Epic have been dialed way down. And from the existing Epic Games Store games that got upfront MG $ and launched by mid-2020, there’s interesting data, too.

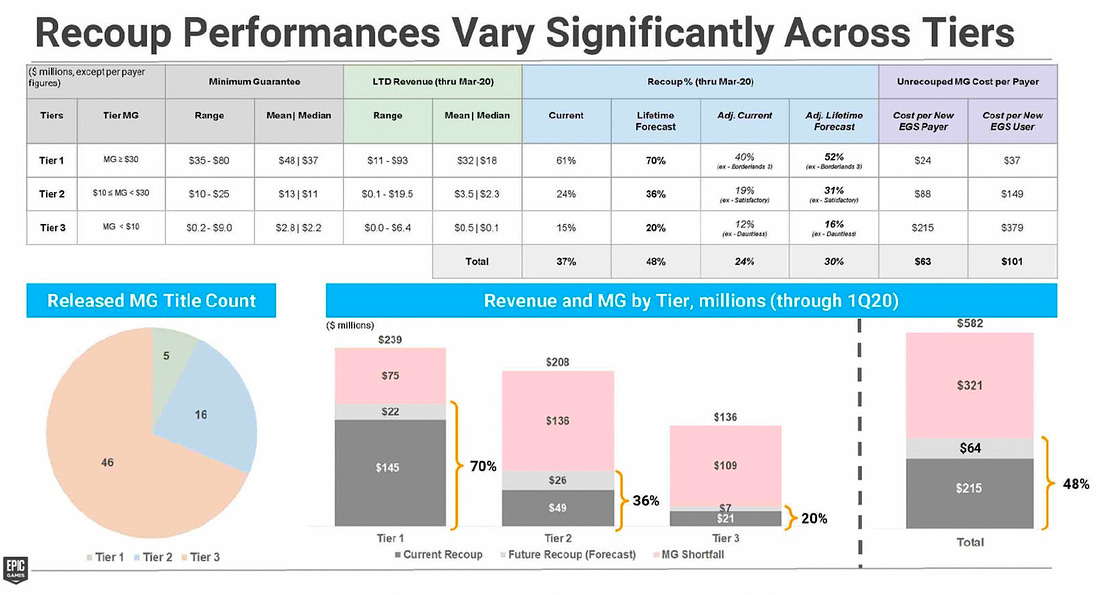

We particularly noted the below slide, showing it’s the smaller games (minimum guarantee <$10 million) recouping particularly badly - at 20% of lifetime forecast:

To me, this implies that people just haven’t been discovering new, smaller games via Epic Games Store. (Or maybe that Epic was just overpaying MGs vs. what the game would have done on the open market, I guess?) But players are still willing to turn up and buy the bigger titles.

And secondly, though all the game names are redacted, you can see how each of the MG titles have performed here. The pink part of each bar is revenue that will never be recouped, and the light grey is ‘future recoup’, btw:

Anyhow, we suspected that Epic was pivoting to publishing as a better use of its cash, rather than these poorly recouped EGS advances. Hence the formation of Epic Games Publishing in March 2020, with the first announced games being from Playdead, Remedy, and Fumito Ueda’s studio genDESIGN. (The more recently announced signings are games from Spry Fox and EYES OUT.)

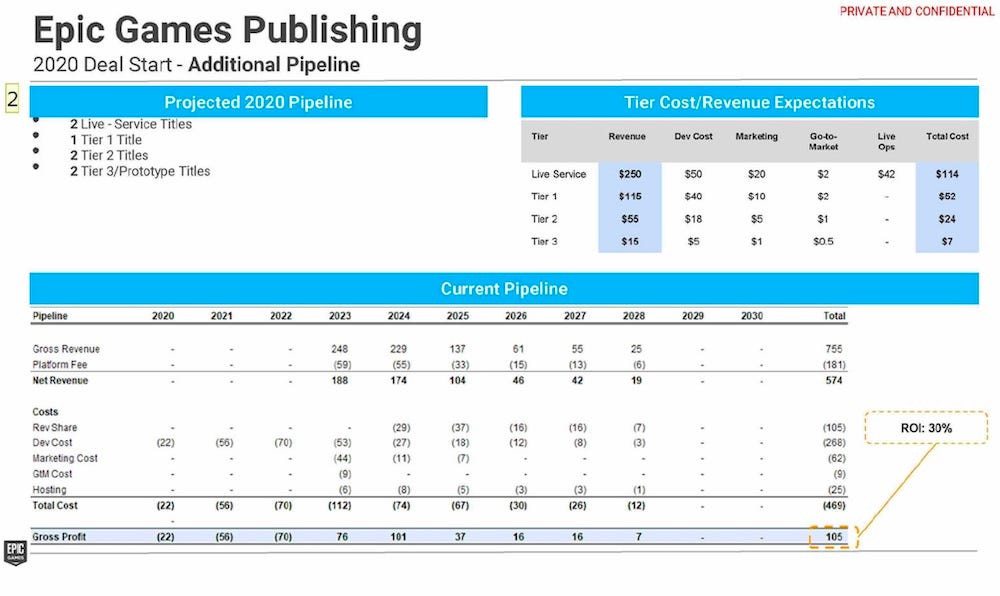

And this newly available slide deck also has broad plans and budgets for Epic Games Publishing. It’s rare to see a large-scale, multi-year publishing plan come out like this. So let’s take a look through some of the numbers. Firstly, here’s 2020 pipeline/costs:

So certainly, Epic isn’t messing around here - even its ‘Tier 3’ titles are $5 million budget. (Also great to see marketing budget as a % of total budget for various sizes of title. Whether standard or not, it’s very rare to get a concrete figure on this.)

And the ‘Live Service’ ones - such as the Iron Galaxy-developed Rumbleverse, which I’m guessing was a pre-2021 signing and just got announced - have as much as $50 million in development budget*. (*A separate slide notes there’s a ‘Live Service Tier 2’ with $25 million dev budget, these are all guide numbers, etc.)

Overall, I presume there’s a clear difference between ‘Live Service’ and ‘Tier 1’ because ‘Tier 1’ is going to be prestige AAA PC/console titles that perhaps have DLC, but don’t have Rocket League/Fortnite style complexity, Season Passes, etc. Guessing the Remedy signing was Tier 1, budget-wise and perhaps genDESIGN was Tier 2-ish?

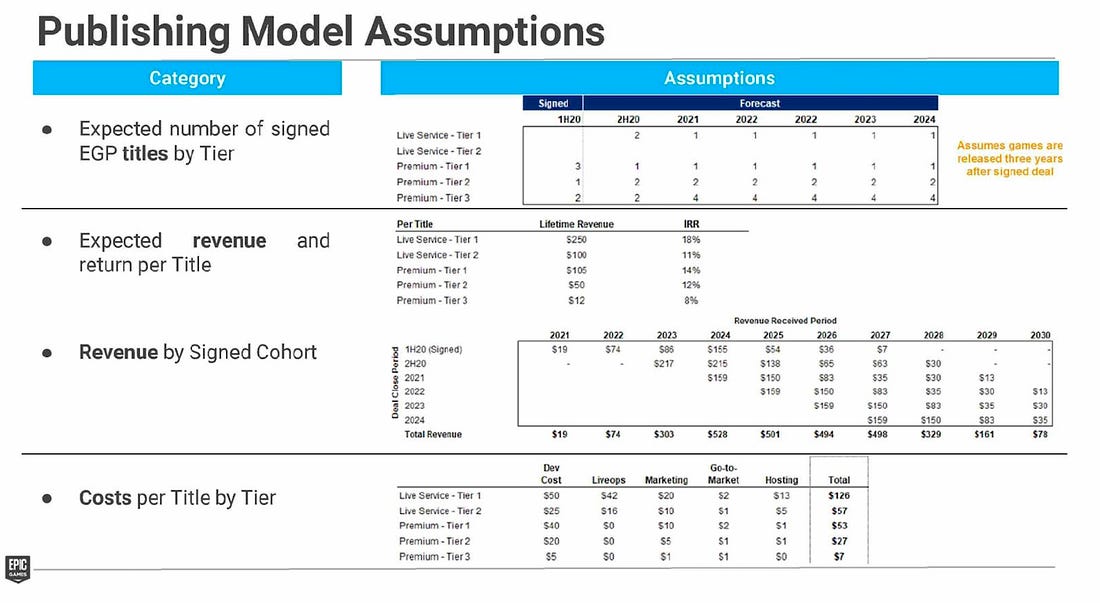

It’s also interesting to see longer-term pipeline for the EGP project. Epic was planning - at least as of mid-2020 - to sign around 8 titles per year, as follows:

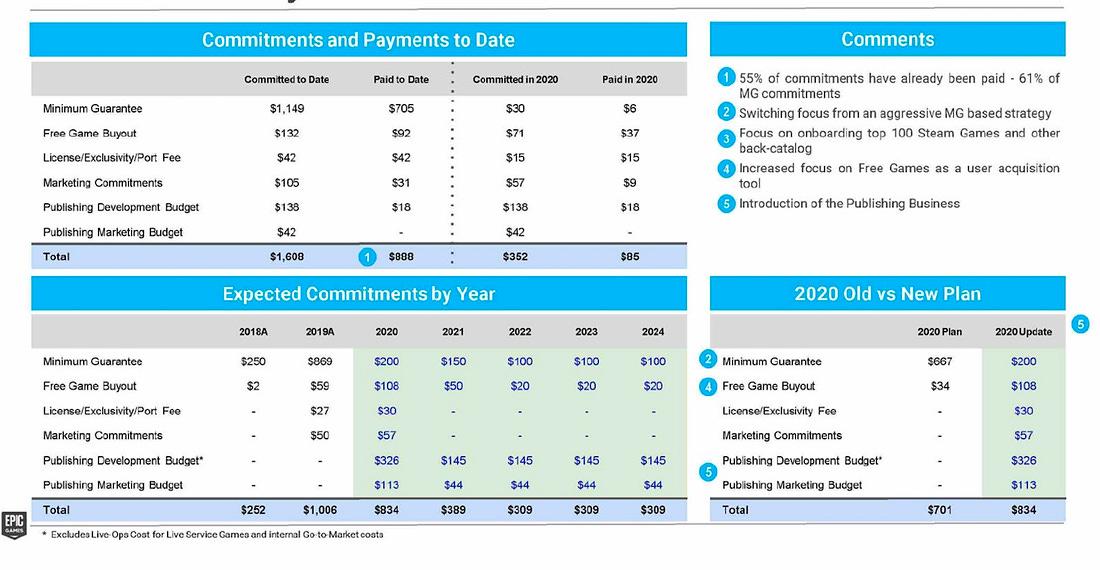

Finally, there’s a very illuminating slide which shows how the inclusion of Epic Games Publishing changes Epic’s long-term planning. It’s a shift from an aggressive Minimum Guarantee strategy on Epic Games Store to a “focus on onboarding top 100 Steam games and other back-catalog”, while pushing even harder in 2020 on free games, and introducing the EGP publishing business:

I did chuckle that one of the Epic Games Publishing slides says “keep staffing lean (hires MUST be multi-use)”, though. I get that it’s a pivot, but if you’re starting up a business spending hundreds of millions per year on new games, you probably want to… staff that correctly? Anyhow, I’m sure they’ve worked that out by now.

The bottom line? Rather than paying hefty up-front ‘minimum guarantees’ on titles on PC only, purely to bolster Epic Games Store, Epic Games Publishing can more holistically co-pilot high quality games across lots of platforms. This can still include an Epic Games Store-first approach on PC (but maybe even Steam later?)

Along the way, EGP can have deeper relationships with devs that might lead to acquisitions in the future, as Epic looks to ‘own the metaverse’. Or at least own more hit GaaS titles which people are really engaged in, along the same lines as Rocket League and Fall Guys. Makes sense to me!

In following up our deep dive into Devolver’s financials, there was one extra thing we wanted to point out. In these mammoth documents for public markets, there’s often a ‘risks’ section. It’s filled with tedious, but legally necessary disclaimers as to why the business might not succeed.

For example, the first risk listed on Devolver’s is: ‘The Group may not be able to publish successful new titles or enhance existing games.’ Gee, ya think? (BTW, this risks section is sometimes the source of poorly reported ‘X company may run out of money’ stories in the enthusiast games press.)

But there was one risk in Devolver that the company has clearly been thinking about, so I’m reprinting in full: “New models may restrict the Group’s game sales: There has been a notable increase in recent years in subscription-based gaming models such as… PlayStation Now, Google’s Stadia, Apple Arcade and Microsoft Game Pass, whereby players pay a monthly fee for access to a range of games.

In order to secure exclusive content to attract consumers to the platform, platforms will often partially or fully fund a game’s development costs in return for exclusive distribution rights for the title for a fixed period post-launch. In the event that Devolver adopts this distribution model, it may limit the financial upside for highly successful games until the exclusivity agreement expires.”

This particular risk is around the ‘timed exclusive’. But the idea of capped upside has absolutely been an issue in the streaming TV/film space. For example, Netflix “buys shows at a rate of the cost of production plus about 30 percent of production costs, but it retains most of its future licensing rights.”

So it’s really much closer to work for hire - with very nice overheads, and you get paid no matter how it does. (Maybe game platforms like Xbox/Netflix buying developers is sorta a version of the ‘cost plus’ model, now I come to think of it?)

But no, this ‘cost plus’ model isn’t coming to games in exactly the same form. Xbox has made the point repeatedly that you can design revenue upside into the games you license to Game Pass. And you can have titles out on lots of console/PC platforms at once - unlike Netflix which just buys your entire show, forevermore.

Yet I do think the issue of ‘who quantifies and retains the upside from a big subscription service hit?’ is a valid one - and ain’t going away. And very interesting to see it mentioned in a publisher ‘risks’ document.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Read more about:

Featured BlogsYou May Also Like