Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Gamescom, the world’s biggest games event, took place in Cologne from August 23–25, 2023. Omdia’s games team were again in attendance and provide highlights from the show in this opinion.

Gamescom, the world’s biggest games event, has just concluded in Cologne, attracting 320,000 visitors. Omdia’s games team was again in attendance. The success of the show demonstrates the continuing value of events to the games industry, as well as producing intriguing developments in terms of both hardware and software.

The disappearance of E3, which was once the games industry’s premier event but has not been held since 2019, has prompted considerable soul-searching in the industry about the continued relevance of physical events. Particularly since E3’s organizers officially abandoned their attempt to revive the event for 2023, the feeling has grown that publishers and platform holders no longer need marquee events to reach consumers when they can instead hold their own digital events and that the industry has less need for in-person business meetups in the post-COVID-19 era.

This narrative is challenged, however, by the success of Gamescom, which continues to go from strength to strength. This year’s event, which ran from 23–25 August in Cologne, was attended by Omdia’s games team and attracted some 320,000 visitors. This is an increase of 15% from last year, making it the world’s biggest games event. True, the massive announcements that were the staples of the E3 glory years were thin on the ground. But while Gamescom makes relatively little news, it still continues to attract huge numbers of visitors from around the world and provides brands with a unique opportunity to connect with the vast market of games enthusiasts, something that is particularly valued by companies such as Netflix, TikTok, and Amazon that are still trying to build their brands in the games market.

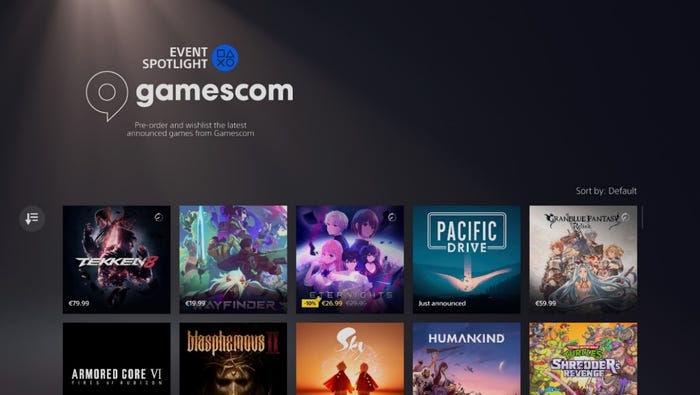

For the traditional games giants, too, this is clearly an event worth investing in. Nintendo and Xbox were both prominent at Gamescom 2023, with the latter occupying a vast area—its largest ever—at the show. Even Sony, which officially skipped the event, chose the week of Gamescom, when the media spotlight was on the games market, to announce a suite of new peripherals for PlayStation 5. Accompanying a couple of high-end wireless headsets, it revealed PlayStation Portal, a handheld gaming device designed specifically to stream PlayStation 5 games off-TV. As Omdia argues, PlayStation Portal highlights the maturity of the PS5 lifecycle as it approaches its fourth year on the market (see “Sony’s PlayStation Portal is little more than a retention play for PlayStation 5”). Sony’s strategy with the device is to engage and retain the 50 million-strong active installed base of PS5 consoles Omdia estimates it will surpass during 2023. Notably, Sony also created a special Gamescom-themed promotional page on its digital PlayStation storefront (see Figure 1). Events on the scale of Gamescom clearly remain valued as a unique channel to reach consumers.

Figure 1: Gamescom featured page on the PlayStation Store

Source: Sony Interactive Entertainment

Gamescom is also a major B2B trade show for the games industry, and here, too, we see ample sign that there is plenty of life yet in physical events. While the games industry, as much as—or perhaps even more than—many industries, has embraced remote working since the COVID-19 pandemic, games companies are growing increasingly convinced of the continued need for in-person contact with their customers, partners, and prospects. Gamescom 2023 attracted a remarkable 31,000 trade visitors, exceeding even the 28,000 who attended this year’s GDC—widely considered the games industry’s premier trade event.

Nowhere is the importance of events more obvious than for the thriving market of tech vendors that sell game developers tools for building and operating their games. This is a sector that is rapidly growing: Omdia estimates that spending on development and operations tools will grow by 13% this year to $15.6bn. Despite this growth, however, game tech vendors are constantly grappling with the build vs. buy question as they try to convince developers to adopt specialized third-party technology in place of in-house tool development. According to Omdia’s Games Tech Market Landscape, more than 400 game tech companies are competing for developers’ attention, so visibility and awareness are near-universal challenges. In this context, many companies find there to be little substitute for the in-person access that the biggest industry events such as Gamescom, GDC, and Tokyo Game Show provide.

The excitement for the upcoming Black Myth: Wukong was palpable at Gamescom. For the first time outside of China, its demo was made available to the public, resulting in a wait of up to five hours to try it (see Figure 2). Following the success of Elden Ring in 2022, so-called “Souls-like” games are now garnering broader appeal than ever before. Black Myth: Wukong is set to combine Souls-like elements with a unique setting and impressive graphics, leading many to believe that it will be the next Chinese hit game in the West when it launches in mid-2024. This, however, is not guaranteed.

Figure 2: Game Science’s dedicated demo booth for Black Myth: Wukong, with a sign stating a 300-minute wait

Source: Omdia

The culture gap is always a big challenge for Chinese games in the West—particularly for the RPG genre, where the story is a central pillar. Although the Monkey King is arguably the most popular Chinese mythical character worldwide, the game will nevertheless require great localization effort from the developer. The game will launch in China and Western markets simultaneously, and its developers hope that its story and character design will appeal to gamers in both regions.

Monetization is another challenge, as Black Myth: Wukong is expected to be launched as a premium title. Asian publishers are increasingly shifting their titles to the freemium model to expand their user base and generate stable, long-term revenue streams. It is, therefore, very likely that Black Myth’s developer is already preparing such a shift in the future after the single-copy sales drop following the launch period (see Asian Publishers' Strategy in Western Markets report).

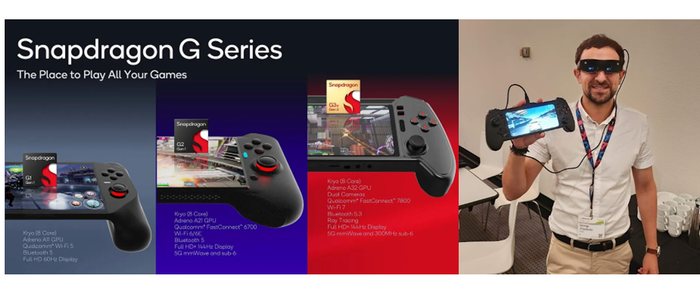

Qualcomm made the most of Gamescom by unveiling its new Snapdragon G series of system-on-chips (SoCs) alongside their respective handheld device reference designs, featuring three distinct tiers (see Figure 3). Android gaming smartphones are now a declining segment, having failed to resonate with mobile gamers despite the best efforts of several leading device manufacturers. The shutdowns of Lenovo’s Legion and Xiaomi’s Black Shark brands earlier this year highlighted the challenges of this niche market. Qualcomm, however, is confident that dedicated handheld devices address the gaming smartphones’ key shortcomings while offering distinct enough gaming experiences to appeal to a broad range of gamers.

Figure 3: The Snapdragon G Series overview and a hands-on with a G3x Gen 2 reference design handheld being used in conjunction with Lenovo ThinkReality A3 glasses

Source: Qualcomm, Omdia

As it stands, there is negligible consumer demand for these types of Android handhelds, but if two key challenges are overcome, this could change. Firstly, Qualcomm must secure strong support from the leading game engines—Unity and Unreal Engine—to ensure developers can easily enrich their Android games with the enhanced graphical capabilities that Snapdragon G devices bring to the table.

Secondly, publishers of leading AAA titles will need to bring true cross-platform support to their console/PC games on mobile. So far, appetite from the leading game makers appears low, with Fortnite and Genshin Impact proving to be exceptions rather than the rule. Significant developer buy-in is likely largely out of Qualcomm’s control in a world where publishers must target the widest possible audience for their live service games.

Still, it’s worth noting that the top-end G3x platform was revealed as supporting operating systems beyond Android. Qualcomm has remained tight-lipped about what this means in practice, but the emergence of AMD-powered handheld gaming PCs such as Valve’s Steam Deck and Asus’s ROG Ally suggests Qualcomm is seeing an opportunity for its Snapdragon SoCs to power Windows- or Linux-based gaming devices in future.

With publishers and platform holders now more able than ever to go direct to the consumer online, the days of gaming’s biggest announcements being announced at industry events are over. New announcements on this scale attract enough attention to no longer need the platform of an event like Gamescom. But as seen with the examples of Black Myth: Wukong and Qualcomm's new handheld gaming device SoCs, these events are still hugely valuable for game companies looking to break through with smaller or medium-sized announcements. For the B2B side of the industry, of course, cutting out the event middleman was never an option, and increasingly intense competition ensures that events are the premier event for connecting with customers and partners. All of these dynamics should ensure that the success of Gamescom 2023 was not just a blip but a strong positive signal for the long-term health of the games events sector.

Other notable announcements and developments

Netflix exhibited on the show floor for the first time since 2019. Despite its well-documented foray into the world of gaming since then, Netflix’s focus at the event was firmly on its video IP, providing photo opportunities and activities themed to the likes of Stranger Things, The Witcher, and Squid Game. Netflix did, however, announce a new series of story games based on its shows and movies. A case study on the adoption of Netflix’s mobile games is included in Omdia’s latest Mobile Games Report (see appendix).

Xbox had a huge presence at the show, with its booth more than double the size compared to previous Gamescom. Disappointingly, Starfield wasn’t playable at the show, as it opted for a video “presentation” despite the game launching on September 1. Following the poor reception to its other major release, Redfall, in May, Microsoft needs Starfield to succeed.

In an unexpected move, Microsoft announced a 15-year agreement with Ubisoft, giving Ubisoft the ability to license the streaming rights to Activision Blizzard games. This was done to alleviate the UK regulator’s concerns, who blocked the acquisition in April.

Epic Games launched its “first run” initiative, which gives game developers a 100% revenue share in their first six months (up from 88%) if they launch a game exclusively in the Epic Games Store. It also revealed that its store now has a global audience of over 230 million players and 68 million monthly active users.

Car maker BMW and the cloud gaming company AirConsole showcased their in-car gaming solution developed in partnership since 2022 inside the upcoming BMW i5 M60 electric car. AirConsole’s priority is now to expand its content library to make it more compelling and drive the uptake of BMW’s ConnectedDrive subscription service. This collaboration exemplifies the growing trend of non-gaming companies strategically partnering with gaming companies to enhance the attractiveness of their own services.

“Sony’s PlayStation Portal is little more than a retention play for PlayStation 5" (August 2023

Asian Publishers' Strategy in Western Markets (August 2023)

Mobile Games Report – 1H23 (August 2023)

Games Tech Market Landscape Database (March 2023)

Read more about:

Featured BlogsYou May Also Like