Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Tim Merel, managing director of investment bank Digi-Capital, takes a look at the present and future state of the market and makes predictions about the direction and size of the global video game market between now and the near future -- information that could guide your company.

February 22, 2011

Author: by Tim Merel

[Digi-Capital, an investment bank focused on high growth digital companies, has just published its 2011 Global Video Games Investment Review (available at www.digi-capital.com). Its managing director, Tim Merel, has provided us with an overview of this new research in the form of a Q&A, giving a picture of the current and future state of the global games market.]

From a video games investment perspective, what trends do you see?

As we anticipated in our 2010 Review, video games activity accelerated and changed fundamentally during 2010.

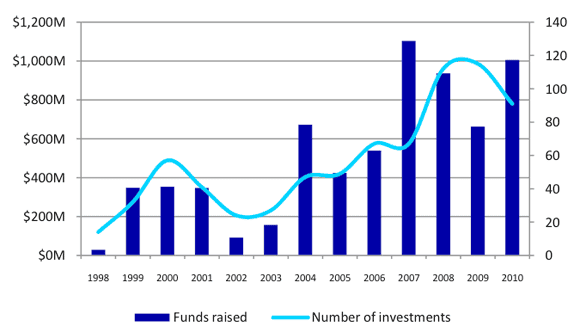

Venture capital games investment approached 2007 levels in 2010 in terms of funds raised, although the number of investments declined.

The top 10 investments accounted for approximately 60 percent of total games investment in 2010, with a fundamental shift to online/mobile games company investments.

However general VC market weakness and limited knowledge and relationships across complex, fast moving online/mobile games sectors still make generalist VC games investment challenging.

Global Video Games Private Placements

Global Video Games Mergers and Acquisitions

Major console publishers continue to struggle to adapt to online/mobile, with a focus on existing large console games franchises rather than new intellectual property -- as the console games market is flat to down, with declining profitability. The reason for this challenge is that major publishers' core competencies focus on management of $20m+ serial, high risk, complex developments, launches and commercialization.

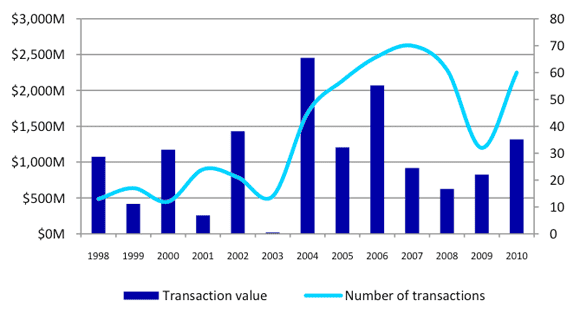

Online/mobile games require rapid, multiple, small scale parallel development platform investments, completely different to major publishers' business cultures, so they are not driving online/mobile games investment. Similarly, major publishers are wary of large scale online/mobile video games M&A in early stage, fragmented markets where market dominance is not yet clear.

Quality investment demand still exceeds supply, with high quality, high growth (100 percent annual revenue growth, 20 to 50 percent operating margin) online/mobile games companies seeking investment to accelerate growth.

Outside the major investment deals, online/mobile games companies still find it challenging to find high quality investors despite major publisher/media consolidation (Electronic Arts/Playfish $400M, Disney/Playdom $763M, DeNA/Ngmoco $400M, Tencent/Riot estimated $350M-$400M, Shanda/Mochi Media $80M).

You believe China, not America, could dominate the global games market?

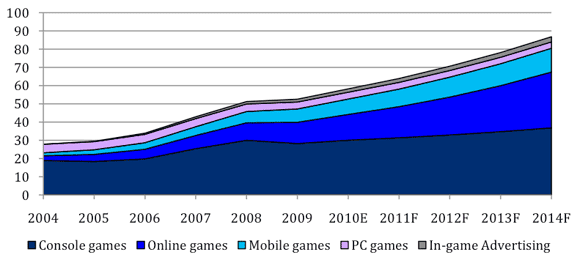

Yes, and we believe the data backs us up. Online/mobile games should grow total video games market size to $87B and take 50 percent revenue share at $44B (18 percent CAGR 2009-2014F), with the historically strong pure console sector flat to down.

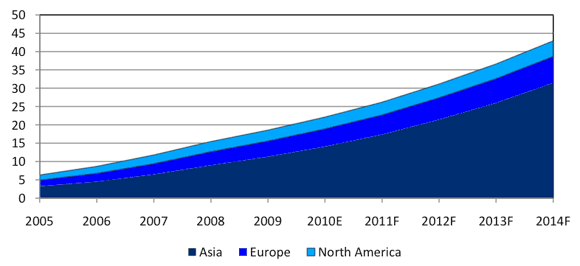

Asia Pacific and Europe should take 90 percent revenue share for online/mobile games (China 49 percent, Europe 17 percent, Japan 14 percent, South Korea 11 percent in 2014F), although North America remains important.

China's domestic strength has produced high volume (companies like Tencent deliver up to 20M peak concurrent users -- a population the size of Australia at one time), low Average Revenue per User, cost efficient online/mobile games businesses with up to 50 percent operating margins, enabling significant investment in foreign markets.

Global Video Games Sector Revenue ($B)

Regional Online/Mobile Games Revenue ($B)

Speaking at the Shanghai World Expo and GDC China last year, and interviewed by CCTV this year, I was struck by the singleminded focus and drive of the Chinese games companies I met. Their approach is analytically driven and commercially balanced; they understand how to make substantial profits while growing revenue at scale, and they are hungry for more.

Almost every Chinese games company I know is looking for two types of investment: foreign companies they can use as a business platform to leverage their domestic strength internationally, and foreign intellectual property and knowledge they can leverage in their domestic market.

At the banquet in honour of Vice Premier Li Keqiang in London in January, I was fascinated when he voiced sentiments that I heard many times last year. Chinese companies are excellent at execution, but they would like to move further ahead in global terms when it comes to innovation. Similarly, the 12th five year plan provides a stronger drive and support for Chinese games companies to increasingly globalize.

So we expect to see Chinese companies as major games consolidators in 2011, investing in, acquiring, partnering and licensing from the strongest international online/mobile games companies. The Tencent/Riot Games acquisition announced in February (est. $350M -$400M) is a portent of more to come.

So what should online/mobile games independents be doing in this market?

We believe online/mobile independents should invest for growth or exit in 2011.

Online/mobile games are high growth, but unconsolidated (2009 $19B revenue = 32 percent of global video games revenue, 2014F $44B revenue = 50 percent of global video games revenue), with >200M casual online unique users, >700M social online monthly active users, >20M Massively Multiplayer Online (“MMO”) subscribers and >10B iPhone apps (55 percent games) downloaded.

Barriers to entry remain low (outside of Facebook social games), with strong competition but limited market dominance by major competitors. Independents are competing successfully with more established competitors, with high revenue growth (100 percent+) and operating margins (50 percent+) being delivered by the strongest independents .

Video games investment and M&A are accelerating, with fundraising 52 percent higher in 2010 than 2009, and M&A 60 percent higher in 2010 than 2009. Online/mobile games valuations for both investment and M&A have been rising, with major deals attracting significant interest.

Major corporate acquirers are increasingly looking to external investments, acquisitions, joint ventures and strategic partnerships for online/mobile games growth and diversification, and as discussed the strong Asian players (from China, Japan and South Korea) are actively seeking foreign opportunities to leverage their capabilities internationally, as well as to source international IP and knowledge for large domestic markets.

But the opportunity will not last forever, as public companies are subject to intense analyst scrutiny of high valuation investments and acquisitions. Not all current online/mobile games investments and M&A are likely to deliver as expected during 2011, with a potentially negative impact on valuations.

So the time to act is now, either raising funds to accelerate growth prior to consolidation, building joint ventures and strategic partnerships to enter major foreign markets (particularly from and to China, Japan and South Korea), or exiting to take advantage of the strong M&A market and valuations.

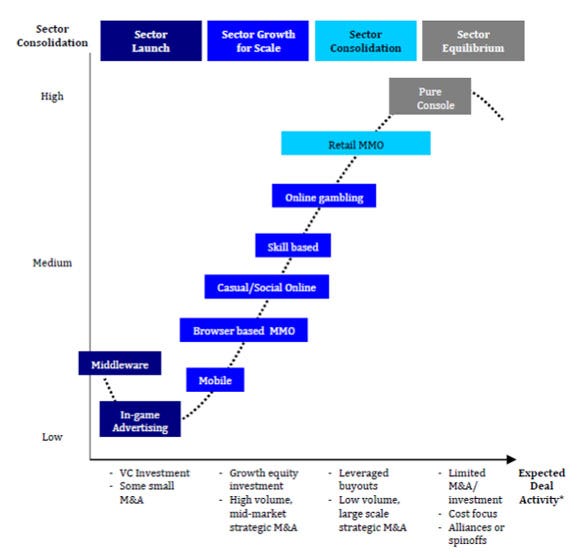

Consolidation Curve for Video Games

Do you think that console publishers are dinosaurs?

No, but we believe that major console publishers must evolve to survive.

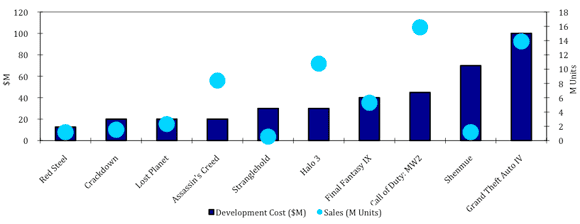

Console game investment is accelerating, as average game development costs have grown (Xbox 360, PS3: $15-30m, Wii: $5-7M). Strong development project management is crucial, and marketing costs can equal development costs or more.

With retail, distribution and hardware royalties significant at 30-40 percent of retail turnover, console publishers must generally sell 500,000 to 1 million units just to break even (ex-overheads).

I used to work with Ben Feder (retired as CEO of Take-Two in 2010) on the digital side of NewsCorp in the US years ago, and when we caught up in New York last year he had just “sucked the oxygen out of the room” with the launch of Red Dead Redemption.

What I understood him to mean was that the console market today is a true blockbuster market, where the marketing scale around major launches leaves space for just one major product at a time.

Given the Q4/Christmas sales bias in the console games market, that really restricts commercial opportunity even before you take into account the online/mobile games shift amongst consumers.

Console games are hit driven, with investment no guarantee of success

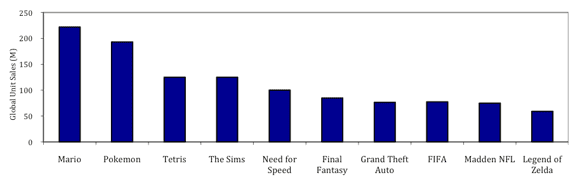

Franchises selling tens of millions of units are lower risk

However it is worth remembering that video games rival Hollywood, with a total of $77B video games (hardware $22B, software $55B) vs $85B film global revenue in 2009. So even though the console sector contracted last year, at up to $60 per game sold vs $10-20 per cinema ticket/DVD, it is easy to see that it remains a cash generative business.

We believe console games will remain flat to down this year, with growth hoped for from the next console hardware cycle in 2014 to 2016 (if it happens). Historically hardware cycles have driven the industry.

Our view is that conglomerates have the best chance to adapt, as major console publisher strategies appear to have converged on fewer franchises, refreshed more often with higher marketing budgets. While adapting to meet fundamental changes in the market with online/mobile organic investment and acquisitions, pureplay console publishers must prove that their repositioning can deliver sustainable profits.

We feel that conglomerates with diversified revenue streams may find it easier to invest in the change to online/mobile games. For example, Disney invested significantly with the Playdom social games and Tapulous smartphone games acquisitions in 2010, as well as indicating an apparent intention to invest less in console games.

It is also impossible to ignore Microsoft's investment in developing and launching Kinect (8M sold in first two months), revitalizing the sales and market share of Xbox 360 (sales up 42 percent in 2010 over 2009) and related games software. The Microsoft/Nokia announcement in February reinforces Microsoft's commitment to high growth markets such as smartphones and therefore mobile games, and they aren't to be underestimated.

So it would be fair to say that you believe there is significant opportunity to invest in 2011?

The video games market is changing across sectors (casual/social online, middleware, smartphone/tablet, browser based MMO, online skill based gaming, pure console, retail MMO, gambling).

Video Games Market Segmentation

As online/mobile games grow and fragment the games market, supported by high growth, high profit business models, we believe there is significant opportunity for online/mobile games growth capital funds to invest in the strongest independent companies.

China's Tencent, Shanda and Giant Interactive have already invested in games funds, and we are exploring the opportunity ourselves around both Chinese games companies with international potential and international companies with Chinese potential. We also see clear investment, M&A, JV and strategic partnership opportunities for corporate and financial investors, which are covered in depth in the Review.

I'll be at GDC in San Francisco in March, and expect to see more deal activity with the companies we are meeting there and those already in discussions across Europe, North America and Asia. We're very excited about the prospects for this year.

You can view Digi-Capital's full video games investment review at Slideshare.

Read more about:

FeaturesYou May Also Like