Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

People say China is the most lucrative market now. Truth or false, no one wants to ignore the market size and its rapid growth. This article discloses some interesting business techniques - how to work with Chinese mobile game professionals.

Before we get into the data, let’s take a look around China:

Waiting in queues

In the subway car

The lucrative market

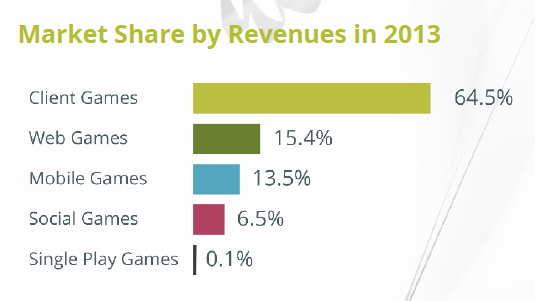

By the end of 2013, China had a $13 billion revenue game industry and 490 million players according to GPC, the China Game Publishers Association Publications Committee. Accounting for $1.8 billion, with 310 million mobile gamers, the mobile gaming market has been especially hot, seeing the largest growth in 2013 after rising 246.9% from the previous year. With the open policy of 4G license issuing (Dec. 2013) and economic growth in 2nd and 3rd tier cities, more people are expected to play mobile games. It is estimated that hardcore mobile games will be taking over half of the mobile game market in 2014. (Hardcore game mobile growth: 8% in 2008, 42% in 2013, 52% est. in 2014[1])

(From Newzoo’s report on Chinese Video Game Market 2013)

Though a business partner is not required for mobile games (according to Chinese law, foreign companies must partner with a Chinese service provider to run their online games in the country), the complex and highly fragmented market structure raises the bar extremely high for foreign companies to enter. Many times, local partners and 3rd party agencies are necessary to assist you with localization and publishing.

Characteristics of the market

The Chinese mobile game market shows different characteristics from western markets:

Most Chinese mobile gamers started playing online games first, so they are more into games with interactive modes (playing with groups, or pvp fighting).

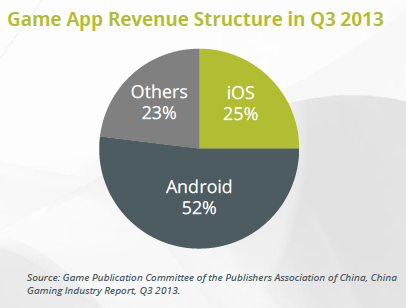

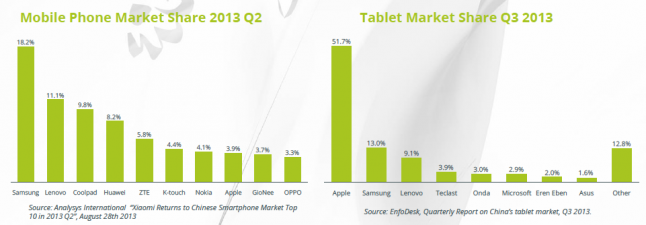

There are over 200 publishing and distribution platforms and stores in China. Since Google Play is not widely available in China and the Android market has captured over half of the market, major app stores like 360 Mobile Assistant, Tencent MyApp, Wandoujia, UC AppStore, Gfan Market, the Baidu app store, Anzhi Market, and Alibaba are considered the key to the market.

Android stores operated by the three main mobile carriers (China Mobile, China Telecom, China Unicom) have a very significant market share (up to 30% by some estimates[2]); carrier billing is the dominant billing channel for Android apps.

Revenue share doesn’t favor game developers (just last year it was between 90/10 and 50/50 publisher/developer) but it is getting better for developers.

Preloading by handset manufacturers plays an important role in distribution.

How to approach developers and publishers

Mobile game developers in China often work in teams of 10-15, or sometimes even smaller. With limited capital and unfavorable revenue share, they seek publishers to put up all the money (revenue share and a minimum distribution guarantee) so they are often passive during negotiations.

As mentioned earlier, publishing a mobile game in China is more complex than in the West due in part to the number of app stores, overlapping roles of publisher/app store/3rd party companies, and multiple revenue shares. Publishers usually lead the marketing campaigns, and perform other necessary adaptations and efforts.

Talk the talk

The most frequent word you will hear spoken by industry people at industry gatherings is “distribution channel” (“Qudao” or“渠道”). Compared to its neighbor Japan, China has more variety in terms of marketing and distribution channels. In Japan, the marketing approach is more straightforward: 3 to 4 marketing companies and ads on TV (6 channels). Game quality speaks more than distribution. However, in China, the big players show their own prowess to sell their games: Punchbox (Chukong) will seek money from VCs and make huge investments on ads; Tencent uses its platform to get all the consumers' attention; Shanda puts more effort on branding their games.

English acronyms are often used in China as industry jargon. However, be aware of the differences– they might not mean what you think. Here are a few examples: At a game show event in the B2B area, you will often hear lots of BDs (business development folks) say they’re looking for “CP”. “CP” here stands for “content provider”. However, it is actually equivalent to “game developer” in English-speaking markets.

Another common term is “SP” (service provider), which refers to companies who offer B2B services such as monetization, app store optimization, and in-game ads.

Also, some famous mobile game titles are often referred to by acronyms like “COC” for “Clash of Clans”. Similar acronyms are often used when referring to game genre.

Cities

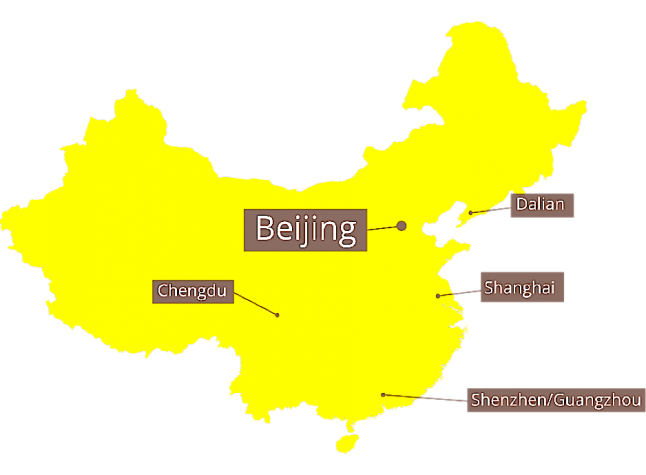

Beijing: This is where more established companies and many indie gamers are located. Zhongguan Village is considered to be the next Silicon Valley by many international investors.

Shanghai and surrounding area: Also has more established companies. Usually companies have their marketing office in Shanghai and R&D in neighboring cities, Suzhou and Hangzhou.

Chengdu: Tianfu Software Park is where most video game companies reside. Bigger companies like Perfect World, Tencent, Ubisoft and Shanda have their R&D center or development team here. This area also has many smaller, newer companies, many with an overseas market focus.

Guangzhou and Shengzhen: This area has many game developers who were originally in the online game business, and are now shifting focus into mobile gaming.

Nanjing: Big carrier companies have their gaming operations here.

Dalian: Many video game and software parks with a long outsourcing history are located here (a large percentage are devoted to IT outsourcing for Japan).

Major conferences/shows and inside-circle parties

Shanghai: ChinaJoy (largest, national), Game Connection Asia, GDC-Asia

Beijing: GMIC, GMGC, TFC

Chengdu: GMGDC

Guangzhou: Guangzhou Game Show

Inside-circle parties are usually hosted by large publishing companies during a conference or show week. Sometimes they are closed-door events. You often need to get an invite from a connection/friend in the industry and pre-register, as the seats are limited. Be prepared for a huge crowd and bring a few hundred business cards and a happy face. Usually there are no rules about formal dress, and most attendees come dressed in business casual. Some events are hosted in a casual atmosphere: a huge café shop, a roof club, or even in nightclubs. As a well-connected industry BD (business developer) during a major conference week, it’s common to attend several parties in one night. For example, last GMGDC (Nov. 2013 in Chengdu), there were 20 inside-circle parties in 4 nights. A well-connected BD in China knows who is the key contact of your potential partner/clients to talk to and always follows the market trends and their competitors’ next move.

Social Media

WeChat groups (US equivalent: WhatsApp): you can register a few local game community groups and add friends here. Each day you can monitor what is going on by reading their posts.

QQ group chat (US equivalent: skype): Some event organizers will invite you to join their chat group too, e.g.: ChinaJoy.

Weibo (US equivalent: Twitter)

Doubai/Renren (US equivalent: Google+/Facebook)

Buzz.com (US equivalent: Meetup)

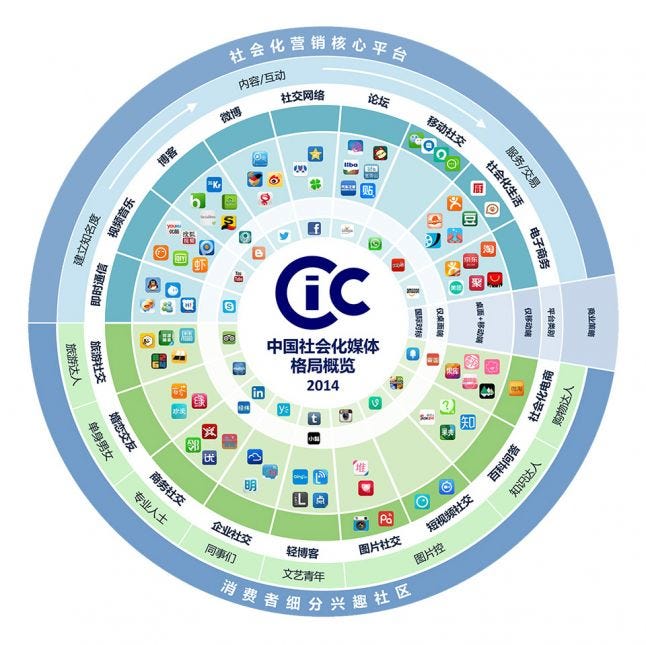

(Social Media Marketing Channels in China in 2014)

Know how to follow up

Chinese B2B contacts appreciate more direct communication compared to the West. Many of them prefer to keep in contact with you via phone and WeChat.

The video game industry is a young industry in China, and so is the average age of its industry professionals (born in 1980s and 1990s). It is not hard to start a conversation as almost everyone in the industry carries a passion for games and an open mind to new things. However, one thing you often find is that these highly mobile professionals won’t stay with one company for too long. I know of a few cases where people changed their email address after only 3 months - because they had already changed employers! At a party, someone once told me they considered themselves to be an industry veteran because they stayed with one company for a surprisingly long time – two entire years(!)

When making contacts at Chinese game companies, the BD is the first person you’ll talk to. Once they understand your purpose to engage with their company (or say they are convinced that your service provides potential value to them), they will refer you to the director of the internal department you are interested in talking to.

Though most industry professionals are from the younger generation and many have studied overseas, you still can’t ignore the importance of Guanxi (connections) when you are doing business in China. It is a unique skill to have – it is a combination of art and techniques of building your network with real work, friendship, trust, favors, dinners, and parties.

Final remarks

Chinese companies view western companies as prestigious but they tend to worry that foreigners do not understand the business culture necessary to get work done in China. Larger companies or some small companies whose founders have overseas experience should be able to communicate with English-speaking companies adequately, but for deeper engagement and networking, it is necessary that you have some employees who are proficient in Chinese. If that’s not feasible, you should consider working through 3rd party companies who have the expertise and the necessary language skills.

LAI Global Game Services (a unit of Language Automation, Inc.) can help you navigate the complex business climate and marketing and publishing challenges needed to achieve success in the China market.

Feel free to contact me directly ([email protected]">[email protected]) and I’ll be happy to provide assistance and guidance.

[1] Data from App Operation Group (App运营之家, A Chinese industry WeChat group)

[2] Reference: Newzoo’s 2014 China Games Market Trend Report

Read more about:

Featured BlogsYou May Also Like