Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra analyst Matt Matthews goes behind April's NPD U.S. console retail numbers -- why the surprising 26 percent drop, and what does it mean for the months ahead?

[Gamasutra analyst Matt Matthews goes behind April's NPD U.S. console retail numbers -- why the surprising 26 percent drop, and what does it mean for the months ahead?]

After a one month respite, the latest retail videogame figures reported by the NPD Group last week showed that April 2010 sales fell by nearly every measure. Analyst expectations were cautious, with some expecting small increases in software dollar sales and modest gains in console hardware sales.

In the final tally, April's software dollar sales fell by 22% year-over-year while console hardware sales fell by 16%. Even the accessories segment – which has shown reliable growth in past months – contracted by nearly 9%.

Surveying the scene, we are left with several key questions. What happened to software sales in April? Why did hardware slow down so much? What do the possible explanations for April's results tell us to expect for May?

Hardware took the biggest hit in April's figures, showing a year-over-year decline of $143 million or 37%.

As we've explained many times before, the declining prices of console hardware have driven down hardware revenue generally in the past few months, but a decline of this magnitude cannot be fully explained by that factor alone.

In fact, it's worth noting that the average price across all hardware actually went up slightly in April 2010 relative to April 2009. At first this seems impossible, given that Sony's PlayStation 3 and the Nintendo Wii have both gotten price cuts in the past year and consumers have increasingly opted for the least expensive Xbox 360 model.

The explanation turns out to be quite simple: current-generation hardware accounted for only 33% of all hardware units in April 2009 but over 53% in April 2010. As these are precisely the systems nominally priced at $200 or more, their prominence pushes up the average price in the hardware category.

As for software, we know that dollar sales dropped 22%, but the full story is more complex. According to Michael Pachter, industry analyst for Wedbush Securities, software prices increased 7.3% over April 2009, which means that unit sales actually declined at a rate greater than the 22% seen in just dollar sales alone. We'd conservatively estimate that software unit sales dropped by 25%.

We can say more, however. According to comments from Anita Frazier, analyst for the NPD Group, the portable segment itself (including portable hardware, software, and accessories) contributed 61% or just over $160 million of the $268 million decline in total industry revenue.

Given the Nintendo DSi and Nintendo DS Lite sales figures released by Nintendo last May, the PSP hardware unit sales released by the NPD Group that same month, and reasonable hardware price estimates we can estimate that over $100 million of that lost revenue came from losses in the portable hardware segment specifically.

We estimate that portable accessories account for less than $10 million of the lost revenue, leaving well over $50 million in lost software revenue in the portable segment, from April 2009 to April 2010.

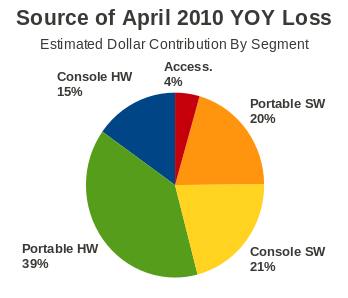

Given that the losses in each of the hardware, software, and accessory segments are known, we can produce the following picture from our estimates. The figure below shows how much of the $268 million loss in April 2010 can be attributed to each segment and subsegment of the market.

We'll have even more detail to add below, but we believe a key takeaway from the figure above is the loss contributed by console software. Yes, the portable segment contributed much of that hit, but it is also a smaller segment in general. The console software segment should be robust now with an installed base of over 60 million current-generation systems, but the sales figures do not give the impression of a healthy console software market at retail.

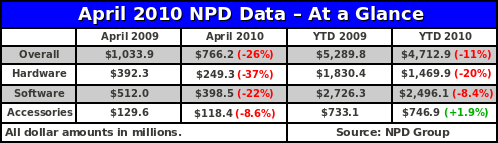

For reference, the table below summarizes the monthly and year-to-date revenue figures reported by the NPD Group as of April 2010.

As the figure above shows, the only segment to show growth so far this year in the accessories segment. That may well be a clue to the changing revenue picture.

The figures above are for retail revenue in the U.S. only and do not reflect sales of software or downloadable content (DLC) through online stores for consoles like the Xbox 360, Wii, and PlayStation 3.

According to our estimates outlined above, more than $100 million of the loss in April's figures is down to losses in software sales, split about equally between consoles and portables. Several explanations have been put forward to explain this, and it's worth looking at each in detail.

Easter – According to Anita Frazier of the NPD Group, the timing of Easter may have influenced sales. Adults purchasing videogame-related presents for youngsters would have had those sales recorded during NPD's March 2010 reporting period which ended on 3 April, the Saturday before Easter Sunday. Other analysts echoed this sentiment, including Michael Pachter of Wedbush, Jesse Divnich of EEDAR, and Doug Creutz of Cowen & Company.

We have access to much fewer sources of data than the professionals above, and generally defer to their expertise. Looking at the data that is available to us, however, we at least entertain some questions. For example, weekly software revenue fell month-over-month during each of the Easter months in 2005, 2007, 2009, and 2010. In three of those years – 2005, 2007, and 2009 – software revenue continued to decline in the period after Easter.

On the other hand, Easter month in 2006, 2007, and 2008 demonstrated very strong year-over-year increases in software revenue.

Nintendo Wii – Following on from that point, EEDAR's Divnich notes that Nintendo's systems benefit more from Easter sales than do other systems, and see steeper declines afterward. Given Nintendo's commanding position in the software market, any loss to their systems will also be felt more generally by the industry as a whole.

Accepting this, we would add that Nintendo may have software difficulties that extend beyond just Easter. In comments to us, Wedbush's Pachter suggested the possibility that the Wii installed base could buy fewer than two units of software on average during all of 2010, a low figure that he called “unprecedented”.

According to Pachter's monthly reports, Wii software has shown negative year-over-year growth every month so far in 2010. With Wii Sports Resort now included with new Wii systems, Pachter believes that Wii hardware sales will be bolstered but that software sales could be further eroded by the availability of more pack-in software.

Used Single Player Games – By far one of the more interesting analyses came from Creutz of Cowen & Company who suggested that some of the decline in April was due to poor second-month sales of March's new releases. NPD's Frazier appeared to agree, noting that new releases declined 75% from March to April 2010 while the corresponding figure for March and April 2009 was only 54%.

However, Creutz goes on to add an angle that we find interesting: that the single-player nature of March's God of War III and Final Fantasy XIII hurt their second-month sales as consumers opted for used copies (at retailers like GameStop) instead of new ones.

He notes that, by comparison, Battlefield: Bad Company 2, a game with a very strong multiplayer component and an earlier launch date, saw stronger second-month sales, exceeding April sales of the other two games combined.

The major weakness in this particular example is that God of War III saw its sales decline by 84% from the first month to the second while Battlefield: Bad Company 2 declined 79%. We feel the argument would be more robust if the decline in sales between these two titles showed a stronger discrepancy.

To these possible explanations for the sharp decline in software sales in April, we'd add a couple of our own.

Nintendo DSi Launch – April 2009 was the first full month during which the Nintendo DSi was on sale, and according to Nintendo the system sold around 828,000 units of the new handheld during that period. While the new Nintendo DSi XL sold relatively well in April 2010, nearly 600,000 more Nintendo DS systems were sold in April 2009.

To that end, we would suggest that at least $20 million in software revenue generated by the Nintendo DSi in April last year was not made up for by new system software purchases this year. That alone would account for more around 20% of the loss in overall software revenue and 36% of the loss in the portable software segment itself.

Modern Warfare 2 Stimulus – The NPD Group's April 2010 reporting period was bracketed on the ends by the Xbox 360 (30 March) and PlayStation 3 (4 May) launches of Infinity Ward's Stimulus Package downloadable content for Call of Duty: Modern Warfare 2. The add-on costs users $15 and Activision announced that it had sold 2.5 million downloads worldwide during the first week, on the Xbox 360 alone.

Given previous conversations with EEDAR's Divnich we feel it is reasonable to estimate that 60% of those downloads were in the U.S., leading us to a figure of $30 million the five weeks between the two launches.

For a sense of perspective, $30 million would be about 10% of the total software revenue at retail during all of April 2010, and 25% of the decline in software sales from April 2009 to 2010.

While the time periods here don't perfectly align, it isn't unreasonable to expect that a consumer who drops $15 for a major add-on to Modern Warfare 2 will at the very least delay his or her next big purchase, whether at retail or elsewhere.

Moreover, we believe that some of the money consumers previously spent on software at retail could now be accounted for under another segment: accessories. The NPD Group estimates sales of console store currencies (Xbox Live Points, PSN money, and Wii Points) as well as Xbox Live subscription cards in this other category. The shift of a modest segment of revenue that was previously classified as software could easily explain why the accessory segment is up 2% for the year while every other segment is in the red.

And of course, there's the larger online game market as a contributing factor. The NPD's results only track U.S. retail sales -- and do not take into account major online game sectors such as Facebook game microtransactions, MMO subscriptions, and other sectors. This sector has poor to non-existent revenue tracking, due to the closely held companies in the space, but is believed to be rapidly increasing in overall revenue, likely at the expense of retail games.

These are just some possible explanations for the significant drop in April 2010 software revenue relative to the figures from a year prior. It is entirely possible – we would actually suggest probable – that some or all of these are contributing factors to the state of the market.

Not only did software take a beating in April, but hardware was similarly hard hit, with unit sales of just under 1.2 million systems, compared with 1.6 million units as expected from analysts like Wedbush's Pachter and EEDAR's Divnich.

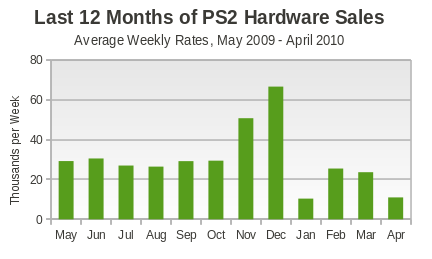

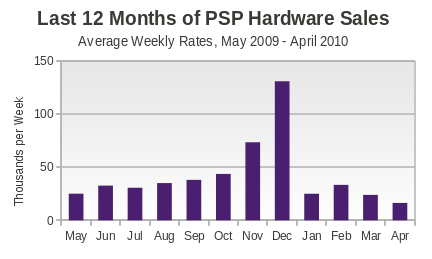

Sony's older systems were particularly weak during the month, with only 65,500 PlayStation Portables and even fewer PlayStation 2 systems sold during the four week period. According to Wedbush's Pachter, the PSP and PS2 both fell far below expectations, showing year-over-year declines of over 50% and 70%, respectively.

PlayStation 2 unit sales appear to have declined to the point that the NPD Group will no longer report them in their media releases, although the company will presumably continue to track sales and provide those figures to their customers.

This is reminiscent of when the NPD Group dropped Microsoft's original Xbox and Nintendo's GameCube from their media releases in 2006, as sales for those consoles dropped significantly below the 50,000 units per month mark.

The figure below shows how PS2 sales have changed over the past year, represented as average weekly rates for each month.

Prior to April, PSP software sales were commonly known to be quite poor, especially relative to its installed base of over 17 million systems. With the apparent collapse of hardware sales, the situation has gone from difficult to nearly impossible. Look at it this way: on average no more than three PSP systems were sold at each retail store every two weeks in April. In reality, online sales probably drove that average to 1 system every week, or lower, at brick-and-mortar locations.

What are Sony's options? We've long suggested that a PSP successor should be announced sometime in 2010, although the actual launch of that system could realistically come any time from the end of 2010 into mid-2011. Another option is the soldier on stoically and continue to support the existing base with software both on UMD and through the PlayStation Store on PSN, although we would argue that this leaves the PSP brand, such as it is, open to further degradation.

The figure below shows how PSP sales have varied over the past 12 months, ending with the weakest sales in April 2010.

While Sony's PlayStation 3 was up 32% year-over-year, monthly sales of 181,000 units still falls short of the industry's expectations. In response to April's sales, SCEA President and CEO Jack Tretton made no mention of the hardware shortages that the company has suggested as a key cause for sluggish PS3 sales earlier this year. Sony has clearly improved its fortunes in 2010 – NPD's Frazier noted that the PS3 was the only system to see growth across all segments in April – but its hardware is lagging.

If Sony has a good explanation for why its flagship system sold 90,000 systems per week in February but only 45,000 systems per week in April, we'd be interested to hear it. Maybe they company is still having difficulty getting hardware to retailers. Fortunately, the company has three very easy comparisons in May, June, and July, so it will be able to continue to tout year-over-year sales increases until at least August.

Microsoft's Xbox 360 had another record first quarter and is still up year-to-date from the same time in 2009 after the modest April results. At the end of that month the system was on the cusp of breaking the 20 million system barrier, and has no doubt passed that milestone as of this writing. Even as Sony's PS3 sales have improved, the Xbox 360 has maintained a healthy lead over its main competitor.

The conventional wisdom holds that Microsoft can move on the pricing of its system at essentially any time, and that it will exercise that power as needed later this year. We think this is reasonable, especially as the company incorporates Natal into its system bundles later this year.

As for Nintendo, the Wii had the weakest sales it has had since mid-2009, but the new hardware bundle should bolster the system's sales in the near term.

As for the Nintendo DS platform and its three systems (Lite, DSi, and DSi XL), the results of April 2010 were very encouraging. In a conversation with Pachter, he suggested that Nintendo DSi XL sales were roughly three times the level of PSP sales during the month. That's certainly a lower average rate than the system saw for its launch in March, but we are impressed that the newer model with its larger screen and commensurately higher $190 price accounted for more than 40% of the platform's sales for the month.

While an exact hardware breakdown is not publicly available, we can estimate that at worst the Nintendo DS platform now has an average price that is at least $8 higher than the system's 2004 launch price of $150. We're not aware of any other console or handheld whose average price has risen above its launch price after more than five years on the market.

The bad news in April was manifold: software was down year-over-year by more than 20% (measured in total revenue or total units) and hardware was down by more than 35% (again measured in total revenue or units). Fortunately, there are a few reasons to think that April could be an outlier and that May's results will be closer to what the industry demonstrated during the first three months of the year.

First, the software launches in May will offer “something for everybody”, to echo Wedbush's Pachter. It isn't every month that one sees the launch of hotly anticipated exclusives like Super Mario Galaxy 2 and Alan Wake along with big cross-platform launches for titles like Red Dead Redemption and UFC Undisputed 2010.

Our only concern for the software launches of May 2010 is that we don't want a repeat of Fall 2008 situation, where even deserving games got passed over by overwhelmed consumers.

The analyst consensus seems to be that May software revenue could see 15-30% growth from last year's results, and that certainly is a significant improvement from last year. However, to put that estimate in another context, a growth rate of 30% would still make May 2010 the second weakest month for software sales this year (behind April, of course).

Even if hardware sales rebound to last year's levels – something we haven't seen all year – and accessories achieve just a modest bit of growth the total industry revenue in May will still be around $1 billion, up 15% year-over-year but still weak compared to January and February 2010. And that's under the best-case scenario of 30% growth in software.

Ultimately we are concerned that the retail industry may have peaked, and that revenue has escaped to other sectors that cannot be measured by the NPD Group's retail estimates.

We appreciate the skepticism of analysts like Cowen & Company's Doug Creutz who feel that games on social networking sites, iPhone games, downloadable console games, and other extra-retail segments are not the explanation for the weak sales in April. The impact of those factors has yet to be fully quantified, but we are not as confident that they aren't in aggregate taking a toll on the retail system.

It seems entirely reasonable to us to consider that while no single external segment might itself pose a threat to the current console/handheld market, the traditional gaming platforms may still suffer a death of a thousand cuts from total set of competing external segments. All that has to happen is for a consumer to have his or her gaming time and dollars sufficiently diminished (not depleted) to provide a barrier to additional retail purchases.

As we suggested earlier with the Call of Duty: Modern Warfare 2 DLC, the total effect of that release could easily exceed the total dollar value of its online sales. Not only did each consumer have his or her available cash reduced by $15 – which could take them out of the market for another $60 game – but their available time for games was probably also reduced by significantly more than it would have been with any other $15 purchase.

Let's be clear: We're speculating about the effects here, and we openly admit we could be misreading the importance of the extra-retail markets. But we have at least one data point from a retail company that we feel is relevant.

In its latest full-year results specialty retailer GameStop updated the way in which it described the threats to its business model. The relevant section now says this (with our emphasis):

While it is currently only possible to download a limited amount of video game content to the next generation video game systems, at some point in the future this technology may become more prevalent. If advances in technology continue to expand our customers’ ability to access the current format of video games, PC entertainment software and incremental content for their games, as well as new types of browser and casual games through these and other sources, our customers may no longer choose to purchase video games or PC entertainment software in our stores.

That filing, made at the end of March of this year, is the first time that GameStop has seriously addressed downloadable games on current generation consoles, downloadable content, and casual games. If the world's biggest videogame retailer is worried – even just a little – then we're willing to bet there is money being made in these segments that is not insignificant.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance and Anita Frazier for her analysis. Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective and willingness to answer inquiries. Also we consulted the comments of Doug Creutz of Cowen & Co. and Jesse Divnich of EEDAR in the preparation of this report, and greatly appreciate their insights. Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like