Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra analyst Matt Matthews examines the shifting power dynamics in the U.S. console market, the attach rates of cross-platform software for the HD consoles, and the disruptive effects of inexpensive software and online distribution channels.

[Gamasutra analyst Matt Matthews examines the shifting power dynamics in the U.S. console market, the attach rates of cross-platform software for the HD consoles, and the disruptive effects of inexpensive software and online distribution channels.]

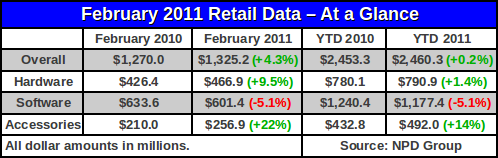

Last week, amid expectations of another down month the NPD Group reported its latest estimates for U.S. retail video game industry sales for February 2011. On the back of stronger than expected hardware and accessory sales, the industry grew by 4%, excluding PC software sales.

Despite the upbeat report, software sales declined by 5% in terms of dollars and unit sales were down 4%.

Below we will examine three key trends: the shifting power dynamics in the console market, the attach rates of cross-platform software for the HD consoles, and the disruptive effects of inexpensive software and online distribution channels.

The top line figures from the NPD Group show that hardware and accessories were the driving forces behind retail in February. While the accessory segment has been a source of good news for several months now, the turnout in hardware fortunes was unexpected.

In particular, the Nintendo Wii saw only its second month of growth since August 2010, with a very strong 455,000 units. The Xbox 360 sold over 500,000 systems in a non-holiday month for only the second time since its launch, the other time having been in September 2007 with the launch of Halo 3.

Even the PlayStation 3, which has suffered in sales since the one-year anniversary of the PS3 Slim price cut, eked out an increase in February, hitting just over 400,000 systems.

Despite those increases, total hardware unit sales were down, primarily due to softer Nintendo DS sales. Yet higher hardware prices helped push hardware revenue up 9.5%, driven by bundling.

According to data from the NPD Group, 44,000 Killzone 3 PS3 bundles (MSRP of $300) were sold in February. More importantly, approximately 350,000 Xbox 360 systems sold last month were Kinect bundles, priced at between $300 and $400, according to comments made by Michael Pachter of Wedbush Securities.

The impetus behind the increased hardware sales is unclear, although some have suggested macroeconomic factors in the U.S. (like decreased unemployment and increased consumer spending in general) may have played a role.

We recall that in March 2009 the NPD Group delayed its February results by a week to make internal adjustments. When the February 2009 results were reported, hardware sales were significantly higher than the January results, again without any obvious explanation. We have not ruled out the possibility that a similar adjustment was made this year, with a similar result. Along these lines, the NPD Group adjusted its revenue figures for February 2010 upward when it reported the February 2011 figures.

For the record, the NPD Group is now clearly labeling its media releases to indicate that the figures include only retail sales. They are providing quarterly estimates of extra-retail sales, including mobile games, downloadable content and online games, along with other segments, but those figures are not included in the figures above nor are they considered directly in this analysis.

As Cowen and Company analyst Doug Creutz spelled out in his comments last Friday, the industry has undergone a significant shift in the past year. In particular, the Xbox 360 and PlayStation 3 together account for a larger proportion of hardware sales over the past 12 months than did the Wii.

To the extent that the two so-called HD consoles represent a segment of the market separate from the Wii, Creutz suggested this change represents “a positive ongoing development for the U.S. publishers, who earn the majority of their sales on the 360/PS3.”

Last month we made a similar observation when we wrote that “the Xbox 360 sold 6.81 million systems in the past 12 months, compared to the Wii's 6.92 million” and that “110,000 unit advantage [for the Wii] could easily disappear by the end of March 2011.” However, our focus was primarily on the emergence of the Xbox 360 as the dominant platform over the past year.

Creutz took a more inclusive view of the market and noted that combined trailing 12-month sales of Wii, Xbox 360, and PlayStation 3 sales have remained relatively constant at between 17.0 million and 19.4 million systems per year since December 2008.

So the shift here is not in the total number of systems moved. Rather, it is in the share of the market that each system claims.

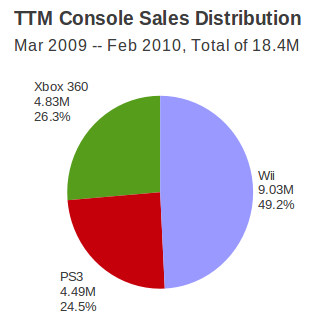

To see this, consider the 12 months from March 2009 to February 2010. Sales of the three main console are summarized below, showing how the roughly 18.4 million systems sold during that period were distributed.

During that 12-month period combined Xbox 360 and PS3 sales just barely edged out total Wii sales. (For historical context, in the 12 months prior to March 2009, the Wii outsold the PS3 by 3-to-1 and outsold the Xbox 360 by 2-to-1.)

Since February 2010, however, Microsoft has launched its Xbox 360 Model S (in June), which attracted many consumers, and then launched its Kinect sensor in November and has seen extraordinary hardware sales since that point. At the same time, the Wii has had several months of year-over-year hardware declines, bringing its annual rate down from its record sales peak to the level of the Xbox 360.

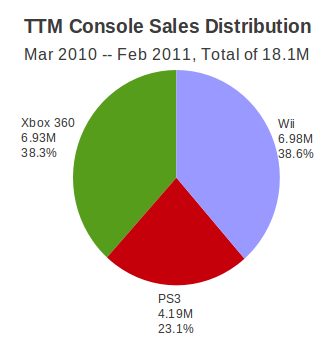

The result is the following figure, which shows the distribution of console sales in the past 12 months.

With total console sales in a 12-month period effectively flat at about 18 million units, only the shares for each console shifted around. The Xbox 360 was the clear winner with its share growing from 26% to 38%, and the Wii was the clear loser with its share falling from 49% to 39%.

However, in light of Creutz's claim that the HD console share is growing, we would observe that this glosses over the slight loss in PS3 share, down from 24.5% to 23.1%. The HD console share of the market grew precisely because the Xbox 360 has driven the growth and made up for a decline in PS3 sales.

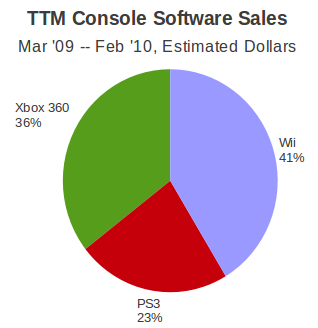

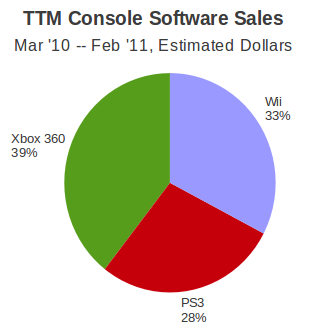

What about the other part of the equations, software sales? While we are not privy to solid unit sales data, we can look at estimated software revenue in the same TTM windows. In the figures below, we note that the total software revenue in each of the periods is approximately the same.

Here is the picture during the 12 months from March 2009 to February 2010.

And the corresponding image for the 12 months from March 2010 to February 2011 is below.

The HD consoles increased their share of software revenue from just under 60% to just over 66% of the market in the past year, while the total software revenue has increased slightly. Since the value of this segment of the market increased only marginally from the period in the first graph to the period for the second, we can furthermore say that the absolute size of the Wii software market also contracted while each of the HD consoles increased their software revenues.

If we wanted to use a very coarse measure of unit sales, we could say that there are approximately five Wii games for every four HD console games. Under that assumption, we would end up with a software unit split in the past year that looks like 60% to 40%, compared to 50% to 50% a year ago. Again, we stress that is merely a rough estimate, but it does capture the dynamics well enough to demonstrate the general direction of the market.

As we stressed earlier, this is merely a matter of Wii sales becoming slightly above average after the wild period from 2007 to 2009 in which its sales – both hardware and software – were amazing.

However, given that decisions about software development are made at least a year in advance, it appears that the die is set for the near term. Third party support for the Wii may continue to contract while resources are directed toward the HD consoles, and by sheer number of titles those HD consoles will see greater software sales.

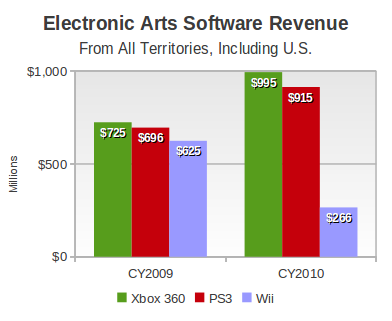

As but one example, in calendar 2009 Electronic Arts reported approximately the same amount of revenue from Wii software as PlayStation 3 software: $625 million compared to $696 million. In calendar 2010, those figures shifted to $266 million for the Wii and $915 million for the PS3.

The figures in the graph above are across all territories, including the U.S.

Under the assumption that the Xbox 360 and PlayStation 3 are still growing their markets, and may do so for at least another year, we now turn to the question of how well each of those systems is moving software.

To this end, the NPD Group provided us with exclusive data on the sales of some recent top-selling games. However, we were not provided with raw sales data, but rather with attach rates, which are another means one can use to measure sales on competing platforms.

Briefly, an attach rate is the percentage of a hardware installed base that owns a particular item of software or peripheral. So, for example, if a game sells 300,000 copies to an installed base of 1 million systems, then its attach rate is 30%, or 300,000 divided by 1 million.

(This is often used interchangeably – and we believe erroneously – with tie ratio, which is traditionally used to describe the number of software titles sold on average to a system owner. Platforms have tie ratios; software and peripherals have attach rates.)

Like every metric, attach rates have their own drawbacks. When a system has a larger installed base – as is the case with the Xbox 360 over the PS3 – its attach rates tend to be lower simply because a larger base includes a more diverse cross-section of gamer interests.

A game would have to have an attach rate 1.66 times greater on the PS3 to have the same absolute sales as the same rate on the Xbox 360. That is, in terms of just absolute sales figures, an attach rate of 5% on the PS3 is equivalent to 3% on the Xbox 360.

In all the examples below, there is no game for which the PS3 version outsold the Xbox 360 version.

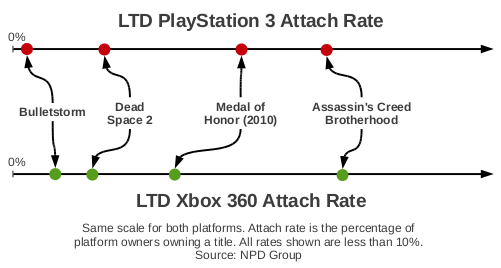

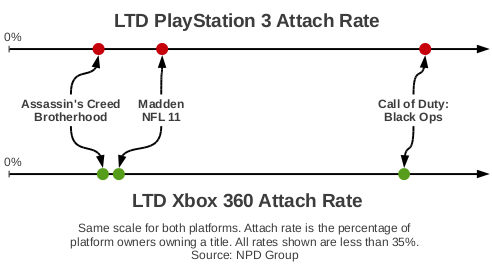

In our first comparison, we have taken several recent action games for which data was provided by the NPD Group and compared the attach ratios on the Xbox 360 and PlayStation 3. The corresponding figure is below.

(Regrettably, our agreement with the NPD Group prevents us from revealing the actual values of the attach rates.)

The new shooter, Bulletstorm, developed by Epic and People Can Fly and published by Electronic Arts had only a few days on the market and has been taken up by a very small percentage of the installed bases of the Xbox 360 and PlayStation 3, but strongly favors the Xbox 360. Given the popularity of Epic's Gears of War series on Microsoft's console, it is unsurprising that the lion's share of Bulletstorm sales were on that platform.

By contrast, Dead Space 2, another shooter from EA, has a higher attach rate on the PS3 than it does on the Xbox 360. However, because the rates are so close and the Xbox 360 installed base is significantly larger, even without specific figures we can say that it sold better on the Xbox 360 than it did on the PS3. This is also the case for Ubisoft's Assassin's Creed Brotherhood, where the rates are approximately the same but because of the larger installed Xbox 360 base, it actually leads the PS3 version by several hundred thousand units.

And, for the other extreme we have a third shooter, Medal of Honor (2010), also from EA which launched back in October 2010. Here the attach rate for the PS3 version is substantially different from the rate on the Xbox 360. As a result we estimate that the Xbox 360 version sold only 150,000 units more than the PlayStation 3 version, a relatively small differential given the game's total sales.

The observant reader will, of course, wonder where Activision Blizzard's Call of Duty: Black Ops figures on this scale. We will address that game last, after the next group of games.

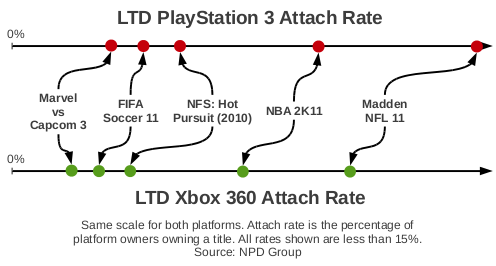

In our next comparison we have examined several games we have loosely characterized as competitive games. These include a racing game, a fighting game, and three sports games.

Unlike the situation with the action games above, the PlayStation 3 has a higher attach rate for all five of the titles considered above. Specifically, the best PS3 showing for any of these cross-platform games was Capcom's new fighter, Marvel vs. Capcom 3: Fate of Two Worlds. It sold roughly equally on both platforms in absolute terms but the attach rates are still quite small – only a couple of percentage points in each case.

The PS3 also substantially outperformed relative to its installed base for all three of the sports games compared above. For example, both FIFA Soccer 11 and Madden NFL 11 sold much better on the PS3 than the size of its base would otherwise have suggested. On the other hand, while NBA 2K11 still had a strong showing on the PS3, the Xbox 360 version still holds a significant lead in absolute terms.

Finally, we wanted to include Call of Duty: Black Ops in this comparison, but given the truly amazing sales of that title, its attach rate isn't in the same class as any other game considered here. We have taken the game with the top attach rate in each of the previous two comparisons and added it to the following diagram along with Black Ops.

With sales of over 13.7 million units across four platforms, Black Ops is reportedly the best-selling game ever in the U.S. Naturally, this excludes games bundled with hardware, like Wii Sports.

Given recent comments by analysts like Michael Pachter of Wedbush Securities, we can surmise that Black Ops has shifted 13 million copies on the Xbox 360 and PlayStation 3 alone. Given the installed bases for these systems, that would put the combined HD console attach rate at around 31%. Moreover, the ratio of Xbox 360 Black Ops sales to PS3 Black Ops sales remains essentially unchanged since the title launched in November 2010.

The only cross-platform title for which we have data that shows an attach rate exceeding Black Ops is the original Call of Duty: Modern Warfare which had an attach rate of 36% on the Xbox 360 and 32% on the PS3 back in January 2008, three months after release. Of course, the installed bases for each system were significantly smaller at the time too (9.4 million and 3.5 million systems, respectively).

The next-closest game in our data (which we admit is incomplete) is Grand Theft Auto IV which had an attach rate of 28% on the Xbox 360 and 32% on the PS3 in mid- and late 2008.

Before leaving this subject, let us return to the question of sales on the HD consoles. If indeed this is where publishers will focus their efforts in the coming months and possibly years, then how will they allocate their resources to target both the Xbox 360 and PlayStation 3?

First, both platforms are generating significant sales of these key cross-platform titles. With the exceptions of Bulletstorm and Assassin's Creed Brotherhood, every game here performed better on the PlayStation 3 than the ratio of installed hardware bases would suggest. So while we may casually refer to the PlayStation 3 as the “third place system” for this generation, it accounts for anywhere from 33% to 50% of the titles we've examined, and those sales aren't so casually dismissed.

Second, the Xbox 360 by itself generates a tremendous amount of software sales, and its dominance isn't yet threatened. Microsoft has successfully positioned its console with both developers and consumers and cultivated a reputation for having the best version of most cross-platform games. That advantage can't be eliminated easily.

That said, Microsoft may well be courting a new kind of consumer with its focus on Kinect, and we expect that this could make it more difficult to increase its base of consumers for some titles, like Gears of War or Madden. That is, it isn't clear that the family that buys a Kinect for Kinectimals will be as likely to buy the type of games which have traditionally defined the Xbox 360 demographic.

And while Sony currently holds an attach rate advantage in sports games, generally, it may find that advantage diminished as its also pursues customers with its Move controller. Realistically, given Move sales so far, this should not be a near-term concern.

During his GDC keynote two weeks ago, Nintendo president Satoru Iwata spoke in strong terms about the current trends in mobile and social games and how they threaten the value proposition traditionally offered by platforms like the the Nintendo Wii and DS. Specifically, these platforms host software that ranges in price from $20 - $50, far above the free or modest prices charged for applications on smartphones and on social media sites like Facebook.

While we typically don't address these non-traditional markets in this column, the time is fast approaching when those markets will be impossible to exclude from the conversation. Iwata's warning to developers may suit Nintendo and its chosen strategy, but the industry appears to have other plans.

Indeed, when analysts like Michael Pachter of Wedbush Securities suggested that devices like the iPhone and iPod Touch were a threat to Nintendo's business, Iwata famously replied that Nintendo's devices and Apple's devices “appeal to different consumers.”

If Nintendo's platforms and the iPhone appeal to different consumers, then why the impassioned appeal to keep the value of software high? Clearly, Apple's mobile platforms and smartphones generally have turned out to be a threat after all.

And Nintendo may feel that threat most acutely now, as it launches its new handheld, the 3DS. While we believe the 3D effects and exclusive software will certainly help push the 3DS initially, we remain dubious about the system for both the $250 system price and standard $40 software price.

Yet the 3DS will have a means for competing with mobile devices. Nintendo is readying a storefront that will allow 3DS users to buy software over a network connection (like DSiWare on the Nintendo DSi now), and has announced that Netflix movie streaming will be available on the system. However, Nintendo is relatively new to the distribution of software through an online channel, especially compared to its most immediate rivals in the video game industry, Microsoft and (to a lesser extent) Sony. Each company has had its share of challenges expanding into these areas, and Nintendo will be no exception.

Clearly, pricing will be one of those challenges. When asked about Iwata's keynote, Wedbush's Pachter drew an analogy with “a record company executive speaking to a group of recording artists and saying that iTunes was a terrible model” and “that they all band together to make sure that consumers buy only album length CDs for $20 instead of individual songs for $1”.

If we accept the analogy, then Nintendo's 3DS and its software will likely still sell well – there are, after all, albums that sell well even today – but the prospects for a Nintendo DS-like hit seem significantly dimmer.

The problem with pricing, we would argue, is not just on handhelds. The industry as a whole has maintained an average price for software of $39 - $41 for three years and during that period software unit sales have declined by 13%, leading to a decline in overall revenue. Most of those software units are for consoles, not handhelds.

Are console software sales also being undercut by another source? Possibly. When asked Pachter offered that he doesn't “see as great a threat to console games, since there is nothing analogous [to the App Store] available on the television” but that “ it's coming some day.”

We respectfully disagree. We believe that at this very moment Microsoft and Sony and, yes, even Nintendo are undercutting their own packaged software business with their online storefronts: the Xbox Live Marketplace, the PlayStation Store, and the Wii Shop Channel. While some sales on those services are likely to be additive – money spent on top of what one would already have spent – we think it is likely that those purchases are actually substituting for retail purchases on an increasing scale.

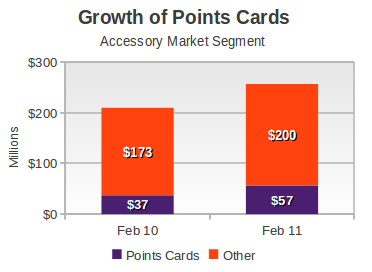

According to NPD Group analyst Anita Frazier, 22% of accessory segment revenue at retail in February 2011 was from points cards, like those used to purchase content on the aforementioned online storefronts. That works out to $56.5 million available for buying games, movies, and DLC. (See figure below.)

In fact, while the accessory segment saw a nearly $47 million year-over-year increase in February, $19.3 million (or 41%) of that increase came just from the rising sales of points cards. (In the same comparison, software revenue fell by $32 million, albeit much it lost in the handheld and Wii segments.)

The NPD Group retail figures moreover do not take into account purchases charged directly to credit cards or debit cards registered with these console services.

While there are some games on these services with full retail pricing (for example, Mass Effect 2 is sold on the PlayStation Store at $60), the majority of the content on these stores is priced at $20 or less. In effect, the consoles already have their own App Stores, and those are quite likely affecting consumer expectations with each passing month.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley and Liam Callahan for their assistance. Thank you in particular to NPD Group analyst Anita Frazier for her monthly analysis notes. Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective, instrucive conversations, and entertaining anecdotes.

We also wish to thank Doug Creutz of Cowen and Company for his insights. Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like