Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Our in-depth look at the state of the industry using September's NPD figures sees strong trends for the Xbox 360, examines the launch landscape for the PlayStation Move, and more.

At the beginning of 2010 just about everyone following the video game retail market figured that this year couldn't be nearly as dismal as 2009. After all, during 2009 the software revenue reported by the U.S. retail tracking NPD Group had fallen 10% from the 2008 – the industry had surely put the worst of its declines behind it.

Now, with three complete quarters of 2010 in the past, software sales have contracted another 8.4% and there are few reasons to think the trend will reverse itself before the year is out.

There are bright spots among the general gloom. The Xbox 360 and PlayStation 3 are having their best years ever, which has to please their respective manufacturers. The biggest launch of the year, Halo: Reach, shot directly to the top of the year-to-date software sales chart after consumers snapped up over 3 million copies during launch.

Below we'll first go over the general revenue and units figures and then dig into some larger trends. First up, we'll show just how well Microsoft appears to be executing its business plan for the Xbox 360, including how it can reach 6.5 million systems during 2010 – a new record for the platform.

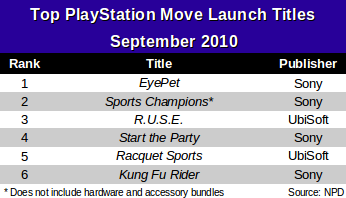

Next we'll look over what's known about the launch of Sony's new Move system for the PlayStation 3, including exclusive sales figures for Sports Champions, a first-party launch title.

Finally, we'll examine the software sales chart and reveal the top 10 titles so far in 2010, with a comparison to the standings from the first quarter.

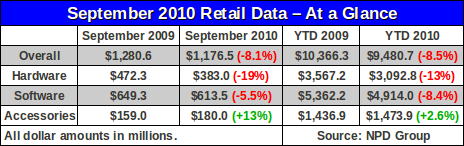

According to the September 2010 retail sales estimates released by the NPD Group last week, total consumer retail spending on new video game hardware, software, and accessories (excluding PC software) totaled $1.177 billion, down 8% from the same month in 2009.

With the declines in demand for the Nintendo Wii and DS, as well as the collapse of the PlayStation 2 and PlayStation Portable markets, the hardware segment is responsible for much of the decline in revenue in 2010. Hardware revenue is down 13% or $475 million, and unit sales are down at an equal rate.

In the software segment the industry appears poised to truly fall further behind this year. Already year-to-date revenue is down around $450 million and we estimate that total unit sales are down about 10% (approximately 140 million in 2009, compared to 125 million in 2010).

However, at this point in 2009 the industry still hadn't had its biggest release: Call of Duty: Modern Warfare 2. While it is possible that cumulative sales of several titles will drive industry revenue to similar levels this year, we are dubious about that prospect.

The top-line figures for the industry as of September 2010, as provided by the NPD Group, are shown below.

The NPD Group is now clearly labeling their media releases to indicate that the figures include only retail sales. On Friday they provided their estimates of extra-retail sales, including mobile games, downloadable content, and casual games, along with other segments. We will have more to say on this report in a future analysis.

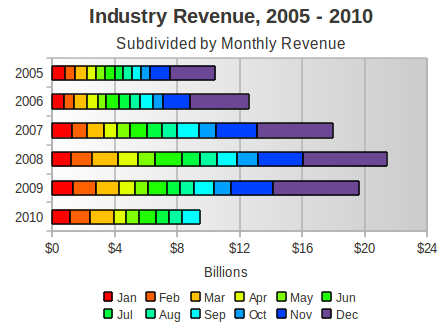

For the time being, our current discussion will focus primarily on the retail data provided by the NPD Group. We will revise our our expectation for the full-year figures, down from $19.5 to $18.5 billion. If this year's trend of -8% growth continues through the end of 2010, our current prediction will have still been too optimistic, since prolonged contraction at that level will force calendar 2010 revenue to the level seen in 2007.

The figure below shows how closely current revenue levels resemble 2007 more than 2008 or 2009.

Having outlasted the Wii's extraordinary sales run from November 2006 through March 2010, during which Nintendo's console racked up nearly 29 million system sales, the Xbox 360's recent success demonstrates how persistent and focused Microsoft's team has been this generation.

By what measures should one compare?

If one chooses hardware, then the Xbox 360 now appears to be tied with the Wii for the best selling platform of 2010. The data provided by the NPD Group actually puts the Xbox 360 up by just over 10,000 units, but we consider that small enough fall within the margin of error. Let us say that both systems have sold just over 3.2 million systems so far in 2010 and call it even.

If, on the other hand, one chooses to measure software sales, the Xbox 360 is outperforming the competition handily. On just a dollar sales basis, Microsoft's console appears to be outselling the Wii by 30% so far in 2010.

In terms of unit sales, the picture is less clear but given Microsoft's persistent 8.9 – 9.0 tie ratio throughout this year, we believe that 2 to 3 million more units of Xbox 360 software have been sold so far in 2010 than for the Wii.

Even in the accessory segment, the Xbox Live 1600 Point Card has replaced the Wii remote as the top-selling item.

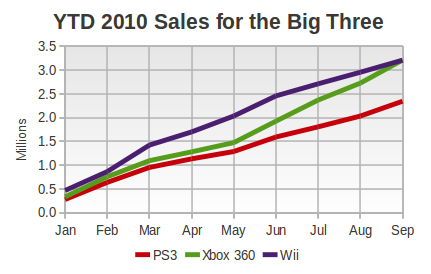

Perhaps the most telling image we can provide for the Xbox 360's continued strength is the following graph. This shows the increase in year-to-date sales for each of the big three platforms: Microsoft's Xbox 360, Nintendo's Wii, and Sony's PlayStation 3.

At the beginning of 2010 the Xbox 360 tracked most closely with the PlayStation 3, maintaining a modest margin over its high-definition competitor. During this period the Wii built up a nearly 500,000 unit lead over Microsoft's console.

Then in June Microsoft launched its new Xbox 360 S Model (commonly referred to as the Xbox 360 Slim), with updated features while maintaining its previous price structure. In the following three months (July through September) the Xbox 360 erased that entire half-million unit lead Nintendo had for the year.

Just as impressive is the fact that the average price for the Xbox 360 has remained at least $60 above the average price for the Wii during this period. Given that many Xbox 360 systems are purchased without a pack-in game, the entry-level cost for Microsoft's system is even higher, especially when all Wii systems come with not one but two pack-in first-party games.

With the Kinect motion-control system launching in early November, and an extensive advertising budget, the Xbox 360 is positioned extremely well for the remainder of 2010 and well into 2011. Microsoft can hold out another six months before it draws on its other ace, a possible price drop, especially if Kinect connects with consumers. (We remain dubious on Kinect's prospects and consider its outright success far from a foregone conclusion.)

We've not even mentioned the top-selling game for September, Halo: Reach, which totaled 3.3 million units across three different versions for the month. In fact, according to comments by Wedbush's Michael Pachter, the top three revenue-generating SKUs on the Xbox 360 in September were all versions of Halo: Reach.

While Microsoft has yet to replicate the success of Nintendo's evergreen software strategy -- it will have an opportunity with family-oriented Kinect titles, perhaps -- it has refined the art of a game launch as a media event, and no series embodies this more than the Halo series.

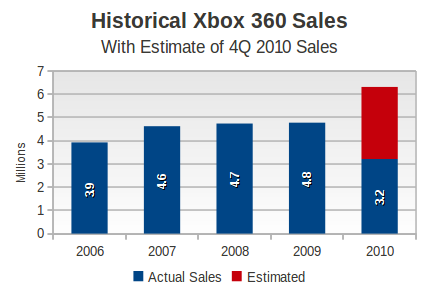

There is an appealing parallel here with 2007, which we feel will could be instructive for the final quarter of 2010. Recall that in August 2007 Microsoft cut the price on its systems just prior to the launch of Halo 3, and as a result it saw extraordinary hardware sales in September. In the last quarter of that year, the console saw its hardware sales increase 29%.

If we consider three events -- the robust Xbox 360 S uptake, launch of Halo: Reach, and introduction of Kinect -- as driving sales, then we think Microsoft could easily see a 30% increase in annual hardware sales. Under those circumstances Microsoft would sell approximately 6.3 million systems in all of 2010. If Kinect does well, or at the very least the promotion keeps the Xbox 360 in front of consumers, then we could envision that total reaching 6.6 million systems.

Finally, we cannot speak of the success of the Xbox 360 without mention of its increasingly compelling Xbox Live subscription service. Not only does Microsoft continue to add functionality and score exclusive content deals (for example, all map packs for Call of Duty games will launch first on the Xbox 360 through 2012), but it even feels it has room to raise the subscription fees without hurting its bottom line. As of 1 November 2010, the price for an annual subscription to Xbox Live Gold will rise from $50 to $60.

For years Sony has built motion-control sensors into its Sixaxis and Dual Shock 3 controllers, but it wasn't until the launch of the Move on 17 September 2010 that Sony finally committed to a complete motion-control system. Combined with the PlayStation Eye camera, the new Move wands and navigation controllers give Sony an opportunity to break into the market thus far dominated by the Wii.

At least, that's the theory. After all, Michael Pachter of Wedbush Securities calls the new PlayStation Move system and Microsoft's Kinect the manifestation of the Wii HD concept he's favored for years.

Regrettably, there will be a great deal of uncertainty surrounding the PlayStation Move controllers because they are classified as an accessory by the NPD Group. As a general rule, public accessories data from the NPD Group is limited to rankings only with no unit sales under any circumstances.

Moreover, according to Pachter the Move (and Kinect) systems will be reported by the NPD Group as hardware (when bundled with a console) or as accessory (when sold standalone or with a software bundle).

By our reading, this means that – unlike Nintendo's Wii Play (bundled with a Wii remote) and Wii Sports Resort (bundled with the Motion Plus accessory) – sales of software/controller bundles will give no insight into sales of Sony and Microsoft's motion-control systems. They will appear exclusively in the accessory segment, and thereby be even more obscure because sales numbers will never be publicly reported by the NPD Group itself.

Of course, Sony is free to release sales data about its own products, as we presume this extends to accessories, but the company declined even to release data about its own console hardware sales in September. (This last point is particularly unusual, since September 2009 and September 2010 are the only two months in which the PlayStation 3 hardware has outsold the Wii.)

Regardless of the obstacles, here is what we do know about the launch of PlayStation Move in the U.S. during September 2010:

NPD Group data provided exclusively to Gamasutra shows sales of approximately 20,000 standalone copies of Sports Champions, a key first-party launch title for the Move system.

Sports Champions was also bundled with special PlayStation 3 hardware and in a camera/wand bundle which would have been categorized by the NPD Group as an accessory. Moreover, Jim Reilly of IGN reported on the top six Move launch titles, according to NPD Group figures. (That table is reproduced below.)

Given that standalone copies of Sports Champions would have generally sold to consumers who already owned the PlayStation Eye camera, this figure seems quite robust to us. We have indications that total Sports Champions sales were significantly higher than this 20,000 figure.

We estimate that total sales of Sports Champions, including accessory bundles and hardware bundles, reached into the 100,000 to 150,000 unit range during September 2010. However, precise figures are not – and probably will not ever be – publicly available.

According to Anita Frazier, analyst for the NPD Group, PlayStation Move accessories contributed to the 5% growth of the accessory segment over last year. All three of the Move SKUs – the standalone Move controller, the navigation controller, and the Sports Champions wand/camera bundle – made the list of top 10 accessories for the month.

To this we would note that the accessory segment was up $15 million in September compared to the corresponding revenue figures for July and August. That suggests to us that some significant portion of that revenue could be ascribed to PlayStation Move sales. Sales of 100,000 Sports Champions wand/camera bundles would generate an additional $10 million in accessory revenue.

Frazier added that the average price of system hardware increased in September, driven primarily by the Halo: Reach Xbox 360 bundle and the PlayStation Move 320GB PlayStation 3 hardware bundle. Both of these hardware bundles retails for $400.

Finally, we note that Wedbush's Pachter suggested that he expected that Move controller sales were approximately 300,000 units including console bundles.

Here is our bottom line: During a 15-day period in September (and two days in October), Sony launched PlayStation Move and reached between 1% and 3% of the installed hardware base. We feel that Sony has put forth a modest effort and received a corresponding modest consumer reaction. The company has much work yet to do, should it wish to make Move a permanent fixture in the PlayStation product line.

While Sony has remained mum about U.S. sales of Move, we expect that Microsoft will show no such restraint when it comes to the launch of Kinect. Whatever comparisons we can draw after the launch of Kinect will have to be made to the limited data we've collected above, and anything Sony might release about October sales in approximately one month's time.

The only other data we have regarding Move sales comes from Europe, where SCEE head Andrew House said that Move sales were “somewhere in the region of 1.5 million units”, a notably fuzzy measure of success. He went on to suggest that the sales had been so robust that Sony will “probably be looking at accelerating production.”

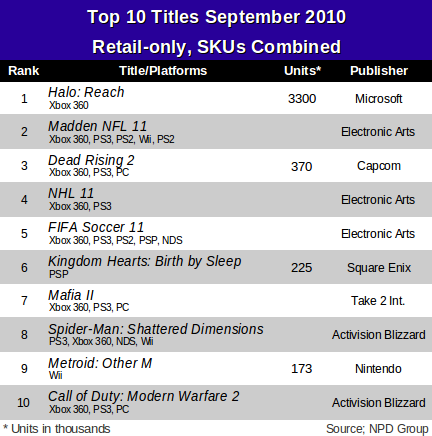

As expected, Microsoft's Halo: Reach was the best-selling game in September 2010, with sales of 3.29 million units. This compares favorably with the launch of Halo 3: ODST a year prior, which moved 1.52 million units.

In terms of reaching out to a larger base of players, however, we would note that when Halo 3 originally launched back in September 2007 it also moved 3.3 million units, and on an installed hardware base about one third the size of the current Xbox 360 base.

If Microsoft has enlarged its base of core Halo fans, the initial sales figures for Halo: Reach don't demonstrate that. To put it in percentages, Halo: Reach was bought by 15% of the Xbox 360 installed base at launch, while Halo 3 was bought by 49%. (For completeness, ODST was bought by 9% of the installed base at its launch.)

That said, Halo 3 went on to 4.8 million sales by the end of 2007, and there appears to be an opportunity for the same to happen with Reach in 2010. That is, we expect that consumers will find the new Xbox 360 S model an attractive device this holiday, and that those consumers will pick a popular game, like Halo: Reach, to accompany their new system.

So while Microsoft will no doubt be pushing Kinect, Halo: Reach will also be a top-seller alongside those new console purchases. We would not be surprised to see Halo: Reach top 5 million in sales by the end of 2010.

The other titles in the top 10 chart released by the NPD Group are listed below. (At this time the NPD Group is not releasing a top 20.)

We wish to dwell briefly upon two additional single-platform titles which made the chart.

In what is probably the last hurrah for the all-but-abandoned PlayStation Portable (PSP), Square Enix's Kingdom Hearts: Birth by Sleep sold an impressive 225,000 units. Unlike some other high-profile PSP releases this year, Birth by Sleep was not sold through Sony's online PlayStation Store.

Even with a top 10 title, PSP hardware sales were down 44% from last year, according to Wedbush's Pachter. There are still titles planned for the PSP, including Sony's own God of War: Ghost of Sparta launching in November with a special edition of the PSP system itself, but we agree with Pachter's assessment that there appears little that Sony can do with the system. The launch of the 3DS by Nintendo in five or six months makes Sony's handheld future even more difficult.

The second title we'd like to single out is Nintendo's Metroid: Other M, developed in conjunction with Team Ninja. Having moved only 173,000 units, the title serves to highlight the ongoing challenges in the Wii market, even for Nintendo itself. Even a first-party title with a well-known property on the current generation with the largest installed base may not set the market on fire. With several other high-profile Wii releases coming out soon (Donkey Kong Country Returns, Kirby's Epic Yarn, and Activision Blizzard's Goldeneye, to name a few) we feel confident that their sales will again drive many interesting, and heated, discussions.

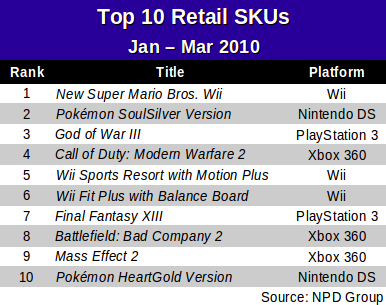

Finally, as we enter the final quarter of 2010, we'd like to look back at the first nine months and identify the top 10 best-selling games of the year so far. (Specifically, we're looking at the top 10 SKUs. SKU is industry jargon for a particular version of a game.)

It is interesting to compare to the same list from the first quarter of 2010, originally published by Gamasutra in May of this year.

While a front-loaded title like Halo: Reach leads the chart as of September 2010, supplanting New Super Mario Bros. Wii which led in March and has fallen to second for the present, we should be mindful that evergreen titles, especially on the Nintendo Wii, can eventually pull ahead given enough time.

Notice, for example, that Ubisoft's Just Dance for the Wii was not a top 10 SKU in March (it fell just outside the chart, in the eleventh spot), while Final Fantasy XIII for the PS3 did make seventh on that older chart. However, as noted at the time, sales of Final Fantasy XIII were almost entirely in the first month and have probably been practically nonexistent since summer. By comparison, Just Dance sales have been relatively strong and will probably end only with the rise of the sequel, Just Dance 2.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance and Anita Frazier for her helpful analysis. Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective and instrucive conversations. We also wish to thank Doug Creutz of Cowen and Company for his insights. Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like