Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

It's hard to keep chipping away at large amounts of data when your gut instinct tells you there's nothing there. Fortunately, Publisher IDs can provide surprising and invaluable targeting insights for your app marketing campaign.

By Simon Kendall, Product Manager at adjust, a leading mobile app attribution and analytics company.

It's hard to keep chipping away at large amounts of data when your gut instinct tells you there's nothing there. Publisher IDs tend to be exactly that sort of trade-off – there are vast amounts of information there, but with persistence and smart analysis, surprising insights can pop out and give invaluable targeting insights for your app marketing campaign.

Publisher IDs are unique identifiers for apps in which ads are shown. These identifiers can link back directly to the app ID and the specific ad-hosting apps (iOS, Android or another platforms). Marketers use a variety of tracking tools to delve into ad segmentation, and publisher IDs are one of the ways to do this. Occasionally, networks will provide the raw publisher ID data, and when mixed with your attribution analytics, it can be used to identify which specific apps host the ads that perform the best for your app.

A few months ago, Hardscore Games came to us to ensure they hit exactly the right audience with their upcoming global launch of Star Admiral (http://staradmiral.com), a trading card game where players compete in strategic space battles. Hardscore wanted to reach a more mature, core gaming audience.

Hardscore ran initial performance ad campaigns across a range of gaming placements in a few select countries. With each user click, traffic partners sent us the raw publisher IDs through our API integration, to which we attributed full life-time performance algorithms. As expected, the campaign ran across several hundreds of publishers, and generated detailed segmentation data on user engagement.

One approach for marketers to manage the data is to merely filter out certain publishers or define a subset from a given metric. This is a simplified approach to creating a target segment, better than a scattergun approach to advertising; however, you risk missing out on great opportunities and chance spending money and energy on poor targeting.

Publisher IDs provide the opportunity to aggregate data that offers fewer, yet more meaningful target segments. In the case of Hardscore’s Star Admiral, we first correlated the publisher IDs to app IDs across all platforms. This meant that we knew exactly which apps the ads were shown in. We then synced up the list of app IDs to our apptrace database and paired the gaming subgenre for each of the publishing games. Using this segmentation, we then calculated the number of sessions per active user for install-date cohorts over a four-week period after install. The result showed how often each user played Star Admiral in the first, second, third and fourth weeks after installation. Through attribution, we could correlate their unique device with the exact app in which they had seen and clicked on the ad that led them to installing Star Admiral.

That's a mouthful, for sure, but ultimately it means that we were able to isolate the pure engagement numbers without mixing in less relevant trends like changing churn or varying volumes of acquisition, which otherwise would have distorted our analysis.

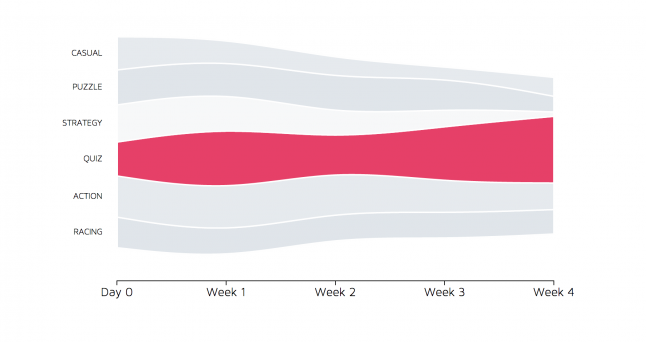

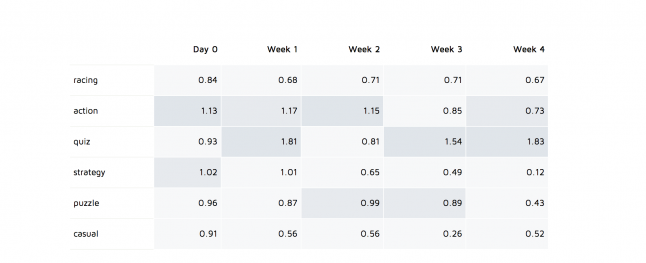

The graph below was generated entirely in Excel from our standard CSV cohort exports. Check out the indexed numbers for the largest categories. You can see the corresponding numbers in the table below the graph.

If we all played by our gut, we would have targeted ads in other similar strategy games, other trading card games, or maybe games with a similar aesthetic (in space) to promote Star Admiral. But, real data and cohort analysis identifies the real motivators and contributing factors to a user conversion. Surprisingly, Star Admiral attracts its best audience from quiz apps. Strategy games were actually their worst performing genre!

Why might quiz players make the bet target audience for a deep space strategy game? Having looked at the specific quiz games that made up the sample, I'd hypothesize that Hardscore's main selling points, such as the unobtrusive monetization and the less casual gameplay, appealed to a more mature audience that generally don't spend much time in other mobile strategy games, and more often frequent perhaps physics puzzles and clever quizzes.

The pieces to our puzzle continue to fall into place when we reflect on Hardscore's market positioning. In their ads and messaging, that also differentiated their game from other mobile games by appealing to audiences that were very different from their direct competition.

We were able to uncover this surprising and gut-contradicting result only by combining effective cohort analysis with strong, comparable KPIs and integrated app store analysis. Hardscore games now know where their actual target audience is so they can spend their advertising dollars more wisely to maximize results.

Take a moment for a long hard look at the assumptions you’ve made in developing target segments, and the metrics and methodology you used to back them up. Now consider the possibilities of attribution and target segments by leveraging publisher IDs…. you may wind up finding insights you didn't expect.

###

adjust is a mobile attribution and analytics company that provides app marketers with a comprehensive business intelligence platform. adjust combines attribution for advertising sources with advanced analytics and store statistics such as rankings, ratings and reviews.

Attribution enables mobile app marketers to identify where a user came from and when they installed the app. In the analytics department, adjust offers cohort analysis in addition to deliverable analytics that count sales, events, sessions, installs and clicks. Marketers can group users together by common criteria, such as the install time. KPIs can then be normalized over the lifetime of the user. Additional product features include: app store statistics like global rankings displayed in the dashboard, deep-linking fallback and reattribution for re-engagement campaigns.

adjust is an official Facebook and Twitter mobile measurement partner, and is also integrated with over 200 other major networks worldwide. adjust is ePrivacy certified, uses SSL encryption for data transfer, and is the only mobile analytics company to meet the most stringent privacy compliance standards internationally.

Clients include some of the world’s largest brands in Asia, the EU and the Americas, such as Baidu, Deutsche Telekom, Universal Music and Viacom. adjust delivers app analytics to the world’s largest advertising and media agencies including Vivaki, Publicis and GroupM.

For more information, visit www.adjust.com or contact [email protected].

You May Also Like