Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

For many developers the online Flash games industry was where they started. This is a fully researched write-up of where this part of the games industry stands today and how HTML5 has affected it.

This research was born out of the regularly proclaimed death of Flash and the purported rise of HTML5 and my need to look at my flash games portal (www.solitaireparadise.com) which specifically focuses on solitaire and card games. This website still has a worthwhile user base that was built up previously when it was possible to get casual games like these distributed all over the internet and get the occasional mention on peoples’ blogs when they were discovered. We’ve also been lucky in that over time we’ve ported all the popular solitaire games that we made for the site to iOS.

After more than a year of not making anything new or even discovering a new worthwhile game to add to the site I wanted to work out whether it was worth making new solitaire games and whether it would be more profitable to make them in Flash or HTML5. This led me to thoroughly research the online games industry as it stands today compared to a few years ago.

Specifically I’m talking about publishers that make their money by placing online games on their websites and monetising through adverts in and around the games without inapp purchases. This part of the industry excludes most games on Facebook or games that require a subscription to be played online. Examples of this kind of publisher include not only my own website but other games portals like Kongregate, Newgrounds, Armor Games and their casual equivalents for card games, mahjong games, puzzle games and others.

It’s a business model that requires a large volume of players to make viable. It allows for smaller games to be made before a player moves off and finds another one that they want to try. The idea for the majority of portals is to release a game over as many other portals as possible and then entice players back to their websites where hopefully they will return to play the next crop of games that regularly appear. Some portals feature exclusive content to retain players.

In this ecosystem, many independent games developers exist (or at least used to exist). They can release their game and try to get it distributed themselves, sell a publisher exclusive rights to distribute the game or finally create unique versions for various publishers that don’t link to any external sites for a smaller licensing fee. The business model for developers and publishers for HTML5 and Flash games has broadly remained the same for a decade. Developers and publishers alike can release games with adverts inside them to further increase their profit margin.

In the past distributing Flash games was relatively simple. In the early days of this industry, casual flash games and more serious gamer orientated content were picked up by the same portals.

However as the gamer orientated flash games proved so popular the business fragmented into more casual games portals and a larger selection of portals orientated to core gamers. With HTML5 there seems to have been an uptick in more casual games.

Flash games are easier to distribute than HTML5 games. This is because they only use one file. A notable amount of smaller portals do not appear to accept HTML5 games at all. Flash games benefit from several distribution networks such as Flash Game Distribution and Talk Arcades, there are fewer options for HTML5 games. With the declining number of actively updated portals the situation has returned to the past where developers and publishers are more likely to directly contact each other by email to arrange distribution.

One of the larger changes in distribution was the closure of MochiAds in 2014. Games using their system benefited from easily being able to collect metrics, use their advertising system and have updates provided automatically. The automatic updates were a unique feature that allowed developers to improve and modify their games without needing to redistribute their files which was and still is impractical. When MochiAds closed, the number of developers seemed to drop further.

With the reduced number of active portals, fewer distribution networks and the closed nature of the market, spreading a game far and wide looks harder than ever before. Due to the smaller size of the market it is harder than ever to get a game in front of a large number of customers.

At this point it seems that the majority of the large portals support both Flash and HTML5 games. This is a reversal of the situation from two years ago when some significant portal operations like SpilGames only actively courted HTML5 developers. Armor Games remains a notable exception in not accepting both, it only supports Unity and Flash games. Although there has been a significant uptake of HTML5, when it comes to games Flash still has a wider distribution potential.

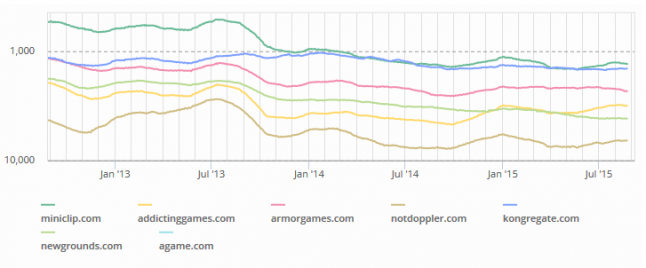

To see how the situation looks for online game portals I decided to look at their web rankings over the last three years by using Alexa. Although this information isn’t perfect it gives a strong picture of how well these portals have retained their audience.

I started by finding a representative sample of the most popular games websites that are still being updated with new content. All the data is for web rank in the USA.

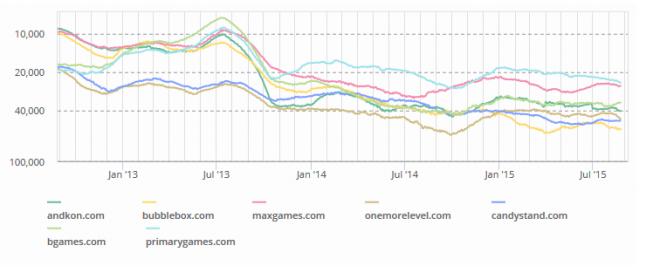

Afterwards, I looked at a selection of what I considered to be still important sites, but at a tier below the most popular websites.

This isn’t a pretty picture! The top tier portals have had better success at retaining high web ranks although their drops are significant. The second tier portals have seen the largest decline in their numbers. This shows that the amount of visitors for these online games has declined greatly in the last three years. On the positive side it appears that over the last six months the number of visitors has stabilised and it may be possible that the largest declines in players have now passed given the saturation of other devices that play games, at least in the USA.

To further add to this backdrop I tried to look for games portals that had maybe risen in the past few years to high web ranks. I found myself disappointed, there are several that appear to have risen, but not to the popularity of the top tier portals mentioned above. HTML5 exclusive games portals now exist but over the last year some of these appear to be abandoned. HTML5 games have not grown the market.

Entry to this market might still be possible with a strong advertising campaign but with stagnating/ declining revenues there is little incentive for new entrants.

There are several additional issues affecting all publishers.

The rise of ad blockers has directly reduced the amount earned per customer. This article isn’t here to argue about whether players should use ad blockers or not, but this is a reality for portals everywhere. So although earnings per advert have increased over time the number of players seeing and therefore clicking on those adverts is decreasing, further depressing revenue.

There are fewer online games created by developers than before. In researching this piece I went to FGL, a market place where developers can sell their games to online publishers. In early 2014 their blog stated that they considered that the market for flash games for developers had stagnated. By the end of 2014 this had actually dropped even further and HTML5 games had not grown in value. By early 2015 they announced they had stopped distributing HTML5 games and have not updated the earnings charts for developers since. Their auction page for games features fewer games for licensing than in previous years. There are fewer games being released and many promote their mobile equivalent whether they are made in Flash or HTML5.

You can read more here (https://www.fgl.com/blog/2015/02/fgl-4th-quarter-developer-earnings-update/)

Distribution is more challenging than before with at the very least fewer active online portals of all sizes for publishers to propagate their games.

There used to be a number of blogs and websites devoted to browser games, with very few exceptions these have all disappeared, further decreasing the possibility of getting “word of mouth” exposure.

The largest portals have a notable presence in mobile games which may offset their reduced revenues.

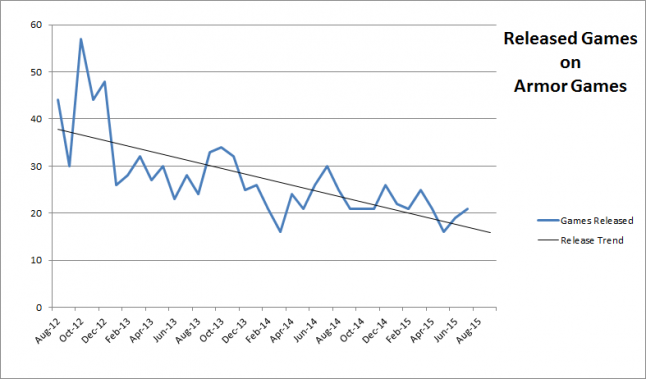

I investigated some of the games portals that only accept curated content on their websites. Their release schedules have thinned out over the years. For example Not Doppler now releases 6 games a week which is a slip from the 7 games a week they released from before early 2015. Armor Games latest news page suggests their releases have approximately halved since this time two years ago. These aren’t isolated incidents and it appears that these websites have fewer games that they are willing to make available.

So in conclusion the market for advert supported browser games is a smaller than before, and is at best stagnating. Revenues are pressured on several fronts. It seems that for portals that already have a strong presence there is still decent business to be made although many have moved their resources towards mobile.

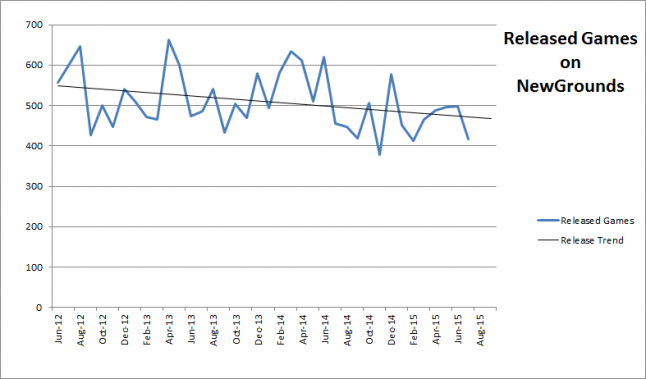

As I previously mentioned when looking at the distribution networks there seems to be a decline in releases although that is difficult to fully quantify. Simultaneously this has been coupled with a severe reduction in earnings for all online game developers from licensing deals. It is difficult to quantify the amount each remaining developer earns per game, but there are two statistics I can draw on here that may help.

Using the statistics from the previously mentioned FGL blog post, it can be seen that the total earned from HTML5 and Flash game licensing combined halved in the second half of 2014.

Likewise I have gone through the Newgrounds.com and the curated Armorgames.com catalogue of releases. The Newgrounds data includes many hobbyist developers but does give an indication of the release rate for all types of online games including online Unity games. Unfortunately it was not possible to easily remove Unity games from this data or to separate hobbyist game developers from professional game developers, but the data is still helpful. Armor Games only supports Flash and Unity games which as mentioned previously is a notable exception to the general change in this market. However because the releases here are much more carefully selected the developers are almost exclusively at a more professional standard.

These charts show a gradual decline in all online game releases. With all this data it can be inferred that the high revenues that top tier developers could claim has declined significantly. Likewise the amount of low quality games has also declined. When the market was growing there was a time when it was possible to release games of much lower quality and be guaranteed some earnings. These times have passed. The games now being released are simpler and shorter than previously, suggesting that the remaining developers have economised on their production values to take into account the less advantageous economic situation. In a similar way to game portals, independent developers often use their online games to promote versions that appear on mobile platforms.

Over the last few years a number of HTML5 exclusive developers appeared. The browser games industry has always had a high churn rate as it was often considered to be a stepping stone to larger productions. However anecdotally the number of HTML5 game developers seems to have dropped over the last year, maybe because HTML5 games did not grow the market? It is interesting to me that despite the improving maturity of the tools to create HTML5 games there seem to be fewer of them released than Flash games at this moment in time.

To summarise, professional browser game developers have had their earnings depressed at every level in this market and continue to leave the browser game industry behind them. If the overall market value remains the same and the overall number of games released continues to decline developer earnings could stabilise.

One of the notable aspects of HTML5 games is the direct compatibility of the games with mobile devices. At first glance this seems very important for online games portals. However it seems that mobile phone players and tablet users are conditioned to go to their respective app stores to find games. Likewise desktop users looking for this kind of game have had years of conditioning to use online game portals.

It becomes obvious that when even large companies like Facebook, Yahoo and others have dedicated apps for mobile the concept of playing a game on a website is less relevant. For games it is preferable to allow players to download them to their device and this offers the potential for more monetisation opportunities. Both HTML5 and Flash offer reasonable ways of creating apps that are native to these devices and directly support their features.

For Flash there are several options. One of the most popular environments is Starling, and it is known that a significant amount of Flash developers use this. Likewise on HTML5 wrappers exist to create games that can be started as an application, one of the most popular ones is CocoonJS.

It seems right that many online releases now also feature links to mobile app stores where players can continue to play their games. Having compared a few games in their online and mobile equivalents it often appears more effort is used on the mobile versions which are superior in terms of production values and updated unlike their online counterparts. Developers can use either development environment to deliver games directly to the mobile app stores without players knowing how the game was created.

While doing this research I played a number of Flash and HTML5 games of varying complexity. Flash seems to me to still have a marginal performance lead on HTML5 on my desktop machine (a quad core laptop bought three years ago). With a clean reboot both types of games played admirably with no frame skips. However after having had the machine running for a while with a number of programs in the background it seemed that HTML5 games were more likely to suffer from noticeable stuttering.

For all intense purposes for desktop machines the performance is similar. The games are playable whether they are made in Flash or HTML5.

The future is always tricky to examine. I think it’s reasonable to assume that as HTML5 is a standard that has been universally adopted in browsers it is definitely here to stay; however the case for Flash is less clear cut. Flash is still used and supported widely on desktop machines and is used for mobile development. However it’s dependant on Adobe continuing to have a business case to support it in the future. It’s unlikely to disappear in the very near future but its long term future is far less certain than that of HTML5 and its associated technologies.

Good games are still being released in Flash, but games seem to be the last bastion of flash along with advertising. New non-games related websites (interactive or not) no longer use flash in any context. There is a backlash against Flash with browsers able to block content (most recently with Firefox when a security issue was discovered) and Google has announced it will stop Flash adverts from automatically playing in their Chrome browser.

The question is will the community stay large enough for Adobe to continue supporting Flash? If not when will support end?

At the very least the online browser game industry for all types of games is smaller than it was two years ago in 2013 and appears to be at best stagnant and still vulnerable to further decline.

To survive in such a market both developers and publishers have economised and moved significant amounts of their resources to mobile game development, often using online games for cross-promotional purposes. There is still an obvious market for free advertising supported online games, but there are more pressures on it than previously and the already established publishers in this field have a clear incumbent advantage that reduces the likelihood of any new strong competitors appearing.

For developers the need for economisation has most likely meant that using the technologies that they consider most cost effective is particularly important to them. For games developers considering the option of switching from Flash to HTML5 there isn’t any significant benefit to swapping except the potential of futureproofing their online games.

The only glimmer for the remaining developers in this part of the games industry is that there are fewer of them and their games can be ported to mobile platforms. A developer that can efficiently make games with solid production values can still make a living exclusively with browser games, however the odds of going beyond that without supporting mobile devices is limited.

For me and my site Solitaire Paradise the conclusion is that a small number of economically created new games may help retain the current player base but it’s unlikely that this will grow the site’s popularity. For now the choice of Flash or HTML5 seems irrelevant.

The conclusion for the online browser market for developers and publishers alike is not positive and it remains to be seen if the market has stabilised.

Read more about:

Featured BlogsYou May Also Like