Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Since December, the VR market has encouraged everyone to calm the heck down in 2016. This is why (don't panic!).

There is a pivotal moment in the film The Lawnmower Man where the catatonic virtual reality addict named Jobe is convinced that VR will spread across the world like wildfire comparing it to television and the telephone. His psychiatrist played by Pierce Brosnan emphatically tells him that it's a delusion; "a struggle for reason".

Today we are going to bring some reason to the viability of VR with the help of the most recent sales statistics from JPR and other industry developments.

Key topics include:

The sales outlook for Samsung's Gear VR and why mobile processing power won't suddenly skip ahead to PC desktop levels for equivalent virtual reality.

The add-in-board / discrete GPU market for gamers, and how PC VR HMD sales and new AIB sales will unfold in 2016.

Why HMDs are priced the way they are, and when the price drop will happen.

Sales estimates for Sony PlayStation VR and why.

What the industry leaders are saying about viability; what is realistic to them.

Where the industry will see profit and opportunity in the short term.

Samsung Gear VR's Mobile Virtual Reality Outlook

There are big sales expectations around mobile and virtual reality. However, it takes about 10 years for the best mobile GPU to reach the equivalent performance of a desktop PC GPU. When Samsung announced a 30% increase in CPU power and just over 60% improvement in GPU power with their Galaxy S7, I was thinking that maybe—just maybe— there was a way to break out of the Moore's Law limitation. I was wrong.

Samsung’s Galaxy S7 (Source Samsung)

I contacted Jon Peddie of JPR, and Neil Trevett, President of the Khronos Group to get their opinions and check my own.

I cited the impressive performance increase of the Qualcomm Snapdragon 820 processor. We don't really know how much of an improvement is based on the hardware or the software or a combination. Qualcomm is using a pseudo water-cooled solution, and taking advantage of Khronos' new Vulkan API to get more processing performance out of their hardware and software.

According to Neil Trevett, the Vulkan API is designed to enable game engines, middleware and advanced applications to squeeze maximum performance from any system because of less overhead and latency from the driver. Neil also pointed out that Vulkan enables multi-threaded work to leverage multi-core CPUs and the GPU. The end result is that Vulkan is designed to enable more performance with lower battery consumption from existing hardware.

Jon cautioned that unless there are secondary innovations on a regular basis, this isn't going to be a year-over-year performance bump—performance isn't always a uniform curve going up and up and up at the same pace.

All things being equal, we are still looking at a ten-year window for today's top GPU capabilities on PC to be available on a mass market in the mobile space.

Samsung sells about 300 million smartphones a year with about 20% of these being high-end. This translates to a potential reach of 60 million phones for Gear VR in a given year. My original estimate was that Samsung could achieve an aggressive 5% attach rate within 12 months of the Gear VR launch and achieve three million units sold.

Samsung Gear VR

However, this assumption was based on customers actually buying the HMD. Samsung's Gear VR is now being given away for free as part of a pre-order bundle in multiple international regions. They did the same during the 2015 holiday season with the Galaxy S6. If Samsung is going to seed the market a couple periods during the year (e.g. launch and holiday season), then we could justifiably bump this up to a 15% - 20% adoption rate or 9-12 million units. The unknown is whether or not people will use the device.

Ever since the Gear VR was priced at $99, I've always maintained that this was going to primarily be a content business more than a hardware business for Samsung and Oculus.

Enthusiast Level AIB Sales: What We Know So Far

Based on JPR's latest quarterly GPU sales report, the total number of AIBs (Add-in Boards / Discrete Graphics Cards) sold in 2015 was 50 million compared to 44 million in 2014. Of these, about 5.93 million are "Enthusiast Level" AIBs shipped in 2015 compared to 2.9 million in 2014. "Enthusiast Level" refers to graphics cards that are in the mid to highest performance range and are fully intended for gaming prowess.

Had it only been the enthusiast level GPUs that saw the sales improvement, I would have credited some of this to VR equipment pre-sales. However, given that the total market size improved, I think this is more about a better economy and several new games than anything else. That said, while VR may not be pushing out more GPU sales, I do think that a larger portion of those sold will be VR-compliant.

So if people aren't buying AIBs for VR now, what then? The pattern that JPR is expecting is that people will buy the required hardware very close the time VR products are launched and the arrival of interesting content. We don't know how that will translate to actual CPU/GPU sales.

How Many PC VR Units Will Sell in 2016?

We are considering a VR-qualified GPU as an AMD 290 series or Nvidia 970/980 series AIB or better.

The VR-compliant AIBs are just a portion of the enthusiast AIB units shipped in 2014/2015. Let's arbitrarily say that 60% of the enthusiast level GPUs sold are VR compliant. That brings the number to about 5.3 million VR-qualified AIBs in the market. Throwing in another two million VR-compliant AIBs for the last quarter of 2014 and the first quarter of 2016 brings us to 7.3 million qualified AIBs for VR. Of the 7.3 million AIBs, they aren't all going to be attached to the right PC hardware (e.g. powerful CPUs, enough USB 3.0 ports, etc.), and many will be multi-GPU setups in a single PC. For these reasons, I'm thinking the total market size potential in 2016 is 3 million PCs.

Our 2016 sales expectation of about 500,000 PC HMD units industry-wide (including 300,000 consumer sales + up to 200,000 media / content developer sales) has not changed. Sure, PC VR makers like Oculus and HTC could do better— this is just an estimate based on available data.

These unit sales are not an indicator of whether or not VR will make revenue— at least not directly. The key is for the industry to figure out a way to thrive on the possibility of a few hundred thousand units in hardware sales in the short term.

We are already seeing some very creative ideas. FOVE, HTC, and Starbreeze Studios have already publicized efforts to have VR available in public exhibition. While this is just an educated guess, I don't think that their revenue models require oodles of hardware product sales to be profitable. Then there is the marketing angle where VR is used to help sell products in creative ways; I think real estate is going to be huge. Business, architecture, academia, engineering, medicine— these are all valid uses of VR that are only going to get better and more accessible without requiring droves of HMDs in the market. In the case of medicine, we're already seeing VR being using to treat post traumatic stress disorder, and experiments are being done to see if using VR to visualize genetic data will be a more effective means to find and to treat cancer.

As for entertainment, game developers will have specialized sales that they can bill significantly more for provided their content is exceptionally good. Content creators Estudiofuture based in Madrid has successfully created VR experiences that their local government has sold per use. Their public demo was paid for 15,000 times without a full consumer HMD product in the market. There is profit for those that know where and how to find it.

How Will Market Size Impact Price?

On the other hand...

I thought HMD makers such as Facebook and HTC could price their units as much as $1,000 because this is an early adoption market and there is disposable income in this space. Looks like both companies agreed with Oculus going for $600 plus the eventual price of their Touch Controllers and HTC's complete Vive package going for $800. With the reasonable 2016 sales expectations caused by the limited availability and affordability of processing power, I think this pricing model is to be expected.

I think it's highly likely that the prices will drop further for holiday sales and for special bundling discounts with the right computer hardware.

In all seriousness, complaining about the price for modern VR equipment which would have easily been valued in the tens of thousands of dollars just a couple of years ago, is nearly the same as complaining about not getting WiFi on the magic seat that takes us across the ocean over the course of a Saturday afternoon!

Virtual Reality on Gaming Console

Nothing has changed here with the exception that our predictions of a 35-40 million PS4 universe achieved by the end of 2015 was confirmed with a last count of over 36 million PS4s in the wild as of December 31, 2015.

Sony PSVR HMD

It's feasible for Sony to achieve a 10% attach rate within 2016, though that in itself doesn't matter as they will have sequential year to year growth given their platform's consistency and likely affordability.

Viability Projection

Senior Facebook management including Sheryl Sandberg (COO) and David Wehner (CFO) went on record at the Goldman Sachs Technology and Internet Conference in San Francisco earlier this month.

Facebook’s COO Sheryl Sandberg COO (source Fortune)

Sandberg explained that turning VR into a business is part of the social networking giant’s 10- year plan rather than an immediate action item. Facebook has been credited for taking an early bet on VR by buying start-up Oculus VR for $2 billion in early 2014.

CFO David Wehner echoed Sandberg’s by explaining that Facebook continues to invest in projects outside of VR. He said he believes that there’s much that can be “accomplished with VR,” but it’s still “very early days.”

“It will take time to develop the ecosystem,” Wehner said on stage.

We have to remember that Facebook's outlook is only applicable to Facebook. Their traditional financials are so out of scale, it's impossible for VR to appear in a meaningful business plan for them. However, Facebook is the exception to the rule! The rest of the industry needs viability within three to five years at the most, and we all have to prepare ourselves for much lower sales results than the crazy hype blasted out by much of the report-selling press (except JPR, of course!).

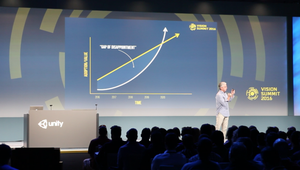

Unity CEO John Riccietello explain the “Gap of disappointment” (Source VR Sout)

Echoing our own projections, Unity CEO John Riccietello highlighted a year-to-year adoption map at the 2016 Vision Summit, though he made no reference to actual product sales or value in the diagram. Instead, it was a curve that nearly plateaued through 2017, with an adoption curve that quickly climbs to the year 2020. I think he had the right idea and was just missing the source data to explain why.

What Does This All Mean?

PC VR vendors are faced with Facebook’s $2 billion investment in a company that by their own estimates will take ten years to deliver meaningful success (for Facebook)—who knows what technology will look like a decade from now? Mobile is Oculus’ lowest hanging fruit thanks to their work with Samsung, though it will be difficult to maintain exclusivity with Google looming overheard with their own Cardboard API and public announcements that they are building a Gear VR competitor. Even Apple looks like they are taking an interest in virtual reality.

While HTC and Valve are a punch for punch worthy competitor to Facebook, they too are going to have to come up with some creative ideas to deliver 10% revenues from non-smartphone business including VR. Fortunately, they have been very public about pursuing alternative business ideas for VR, so they may not need the same hardware sales figures that others are depending on.

HTC Vive consumer edition (source HTC)

The alternative brands with up and coming devices are actually in a pretty good position. 2016 marks the period where the market potential is limited due to Moore's Law and the baked-in hardware requirements set by vendors such as Oculus and HTC. Opportunities will be better later rather than sooner because the processing power will be more widespread and more affordably accessible. The only catch is the other suppliers will need supportive standards or find a way to make sure content makers adopt their SDKs. Also, if the market tries to ramp up resolution or field of view, the qualified PC volume gets reset to 300,000 to 500,000 units because Moore's Law has to catch up again (and again and again).

It's unclear if GPU and processing power vendors will sell more units as much as it is about them selling better or more premium units with better margins. Both the Oculus and HTC platforms are encouraging AMD 290 series or Nvidia 970 series desktop GPUs as the minimum spec. Even if it's just from better margins, I think this will be a boon for the GPU makers.

The content makers are carrying the highest risk and reward. The moment HMDs are released, we won't have projected sales; we'll have real sales. Once we have real sales, the industry has to be sold on fundamentals rather than wild speculation—i.e., customers buying enough products that companies can pay their bills without an investor on their back. Very few content makers will have their work sponsored by the platforms in advance, so it's very likely they will have to support some kind of interoperability standard and/or support multiple SDKs to maximize their sales. It's the only way to get the required distribution.

When it comes to content makers, keep in mind that I am speaking about VR exclusive titles. There is a lot of software that would probably work well through traditional display monitors or better yet, the readily available and standardized 3D HDTVs (there really are tens of millions of them out there waiting for good content). The catch is the market will have to do some serious soul searching about how much of a VR purist they want (or need) to be.

So what does this all mean? Well, don't panic. Nothing has changed as this was all written in the VR book of life a very long time ago. Once you do the math, it's no wonder the market suddenly came to the realization that 2016 is going to be a modest introductory year instead of a bang from rags to riches. The real industry test is going to be what steps are taken to prepare for 2018 going forward; I know this is something The Immersive Technology Alliance and ITA VR Council are putting a lot of thought in. It's my belief that mass marketability is a thought-through plan rather than an instant reaction. Besides, the market needs time to learn and create amazing content!

So I leave you with this remaining question. As pondered above, will Virtual Reality and immersive technology be a reality or a delusion? I think reality, but we have to plan for it.

The second ITA annual meeting takes place 8:00AM - 10:30AM March 15, 2016 during VRDC / GDC. Industry players are encouraged to reach out and be part of the discussion. Basic level membership is free for qualified content makers.

Additional sales data and estimations can be found in this article's predecessor found here.

Read more about:

Featured BlogsYou May Also Like