Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

A summary of Cogmind's second year of alpha (early access) sales data, including revenue, pricing effects, and a breakdown of development time.

Cogmind recently made it through a second whole year of its pre-Steam early access program, and as this period comes to an end I'd like to take the opportunity to, like the first year, share some data and pretty graphs :)

This is an interesting milestone because it more or less coincides with the completion of Cogmind's primary content, represented by the Beta release just last month, meaning it took around two years of work to bring the game from Alpha 1 to Beta 1. And it's still amazing that support has been sufficient to maintain full-time development for this long--Cogmind's lifetime revenue passed the $100k mark in April :D. So a big thanks to everyone who has helped it reach this stage!

Cogmind Beta Launch ASCII Fireworks

@'s celebrate the Beta :)For a more general summary of late-alpha progress you can check out the data in my 2016 annual review, whereas this article will instead be mostly looking at revenue and pricing. And while the first year of sales data was neat simply because it was seemingly the first time anyone in this genre has provided so much open data, the second year is much more interesting due to tier and pricing changes.

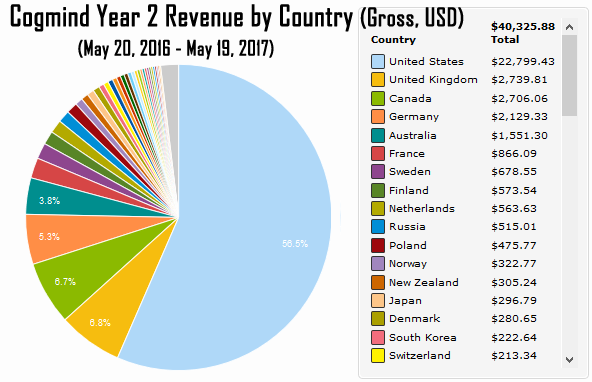

Let's jump right in: Cogmind made US$ 40,325 in its second year. Looking purely at the numbers, that's only two-thirds of what it made the year before, but it's important to note that a $25k chunk of year 1 revenue was earned in the first month of alpha alone, the result of pent up interest from two years of open pre-alpha development prior to that. In that light, the second year has technically been a little better than the first in terms of revenue, an 8% increase from $37k to $40k.

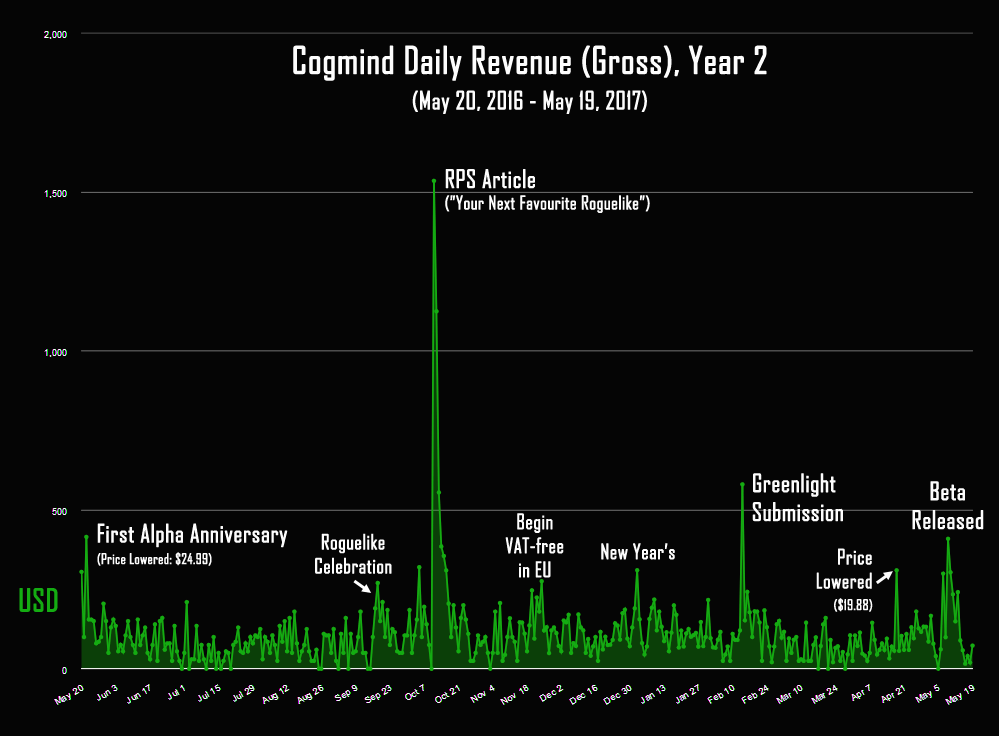

Cogmind Daily Revenue (Gross), Year 2

Cogmind Year 2 daily gross revenue, annotated (Year 1 graph here). (Click on any image in this article to see at full size.)Year 2 started with a minimum price drop, from $30 to $24.99 (albeit by adding a new lower tier without any perks, and keeping the old price as an option). This naturally sparked a good number of sales in the short term, which eventually died off as player growth returned to normal once those who'd been waiting for that to happen got their hands on it. At this point the price change didn't seem to have any long-term impact, but we'll get to data on that later.

The next noticeable bump coincides with the Roguelike Celebration, an awesome event at which I gave a talk and news about Cogmind subsequently made the rounds. The effects of that alone lasted for a good couple weeks.

Then the obvious spike is obvious :P. RPS has been following Cogmind since pre-alpha and I hadn't expected to see anything more until after alpha, but it was a nice surprise to have a sudden article about my work arrive the following month.

Starting mid-November, buyers in the EU could finally get Cogmind "VAT-free," which basically boils down to a loss for me though it's technically the industry norm to include VAT in the list price. Considering I was still losing money throughout development it took me a year and a half to reach a point where I was willing to eat a 20% cut in revenue from those regions. Since I made that change, between November 15 and June 6th $5,085 of actual revenue received originated from EU countries, meaning $1,271 went to extra taxes (a low estimate). That's all money I could've kept for development if Cogmind was available before 2015 when the EU introduced VAT for online purchases!

For New Year's day I made an ASCII fireworks gif (actually the first iteration of the one shown at the top of this post) and that garnered some attention, which pretty much always translates to more sales. That's not why I made it--it was just a fun side project to see if it was possible with the engine, but it's nice that it had that side effect :)

Valve pre-announced the end of Greenlight in February, and since I 1) wasn't sure whether I'd like what would replace it, 2) know that having a little Greenlight campaign is itself at least worth some exposure, and 3) already had all the required media on my own website anyway, I decided to put Cogmind up for voting. There was literally only two days between the time of this decision and hitting Publish :P. It was greenlit not long afterward, but that wasn't really the point--notice that nice little spike in the graph... it's nice to have some free exposure from Steam when people who'd rather not wait can already buy from my site! Putting Cogmind on Greenlight clearly contributed an instant $750 or so to revenue :D

In April I again lowered the price, to its current and final base price and the level at which I've always planned to sell Cogmind once the main game reached completion. In that sense the price change came a little earlier than expected, since the Beta release wasn't to happen until early the following month, but sales had been flagging over the previous six weeks and I couldn't let revenue fall too much since I'm relying on it to get by before bringing a mostly complete Cogmind to Steam. (Other reasons: It was also a good excuse/opportunity to do a little advertising that didn't overlap with the upcoming Beta release, and I also wanted a longer buffer between the price change and Cogmind's upcoming Steam debut.) I actually silently lowered the price a week before even announcing the change, just to see what kind of impact it would have on random visitors. It seems to have been beneficial, though one week is too short a period and there are too many other factors at play to really draw any conclusions. (I'll share more data below to shed light on conversion rates.)

The most recent mini-surge surrounded the Beta release, a pretty big milestone considering it allowed me to declare Cogmind essentially complete by multiple metrics. A number of people were waiting to hear that, and the price had already been lowered the previous month, factors that combined to generate a decent amount of revenue for May.

Another factor that I find valuable in examining daily revenue graphs, but that you might not immediately notice above, are "zero days." Any day during which there are no sales at all is a zero day, and too many of these, especially in a row, can honestly start to get demotivating. On the other hand, ongoing streaks of anything-but-zero days are quite motivational--even if just one or two sales. I always keep an eye on that sales number (it's easy to follow because I receive an email for every purchase, and I don't look at them but each one increments a label-based counter in my inbox :P), and if I start to see zeroes it means I'm not quite doing enough outward-facing development, like sharing my progress across social media. I always work harder when there are continued sales every day, so getting into a routine of posting updates is a nice long-term self-reinforcing cycle--especially when I wake up in the morning and get to see how many there were overnight! That's been a ritual wake-up habit for the past two years now...

Grid Sage Games Inbox Order Counter

The all-important Order counter :PThroughout Year 2 I made a more concerted effort to ensure there was always something to show at least once every week, and I believe this is reflected in the relative number of zero days: Year 1 was 9.8% (36) zero days, compared to 4.9% (18) in Year 2. In fact, the improvement is technically even better than that: notice a third of Year 2's zero days occurred close together over summer 2016--that was during my one-month vacation. No work, no pay xD

Cogmind Year 2 Revenue Zero Days

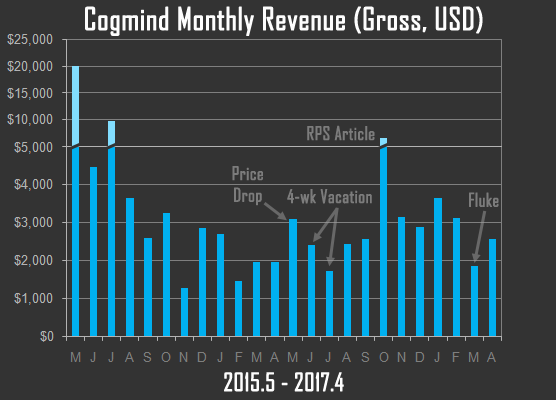

Cogmind Year 2 revenue zero days.Looking at revenue on a monthly basis, there's been a clear positive trend over the past year. (May passed $3k with its Beta release, though isn't shown here as it technically extends into the third year.)

Cogmind Monthly Revenue (Gross), 2015.5 - 2017.4

Cogmind monthly gross revenue, annotated.I've labeled a few of the larger effects already discussed earlier, though I can find no reasonable explanation for March. The graph includes Year 1 for comparison, though I didn't annotate those months--that stuff was covered with the first year's data.

Cogmind Year 2 Monthly Revenue (Gross), by Country

Cogmind Year 2 monthly gross revenue by country.By country the revenue data doesn't hold many surprises. Comparing to Year 1's country revenue graph, the only notable difference is that Germany overtook Australia, somewhat interesting because as an English-only game Cogmind is assumed to mostly sell in native English countries. Of course, Germany does have plenty of English speakers as well as three times the population of Australia, and (perhaps more key here) more than one German LP'er picked up Cogmind over the past year. (Plus there was the mentioned VAT change in November!)

That graph would be far more interesting if there were localization, but at least this gives you an idea of what an English-only fairly text-heavy game can achieve in an international sense. Localization is a great idea for any game that can manage it, but sadly it's simply not possible with Cogmind.

But we do have some extra interesting data to analyze for Cogmind's second year of sales, now that we've been through multiple tier and pricing adjustments!

At the beginning of the year I wrote a lot about Cogmind's first price change in 2016, including some common and not-so-common variables factored into my pricing decisions. Here I'll add to that discussion with some final results of that change and the most recent third phase.

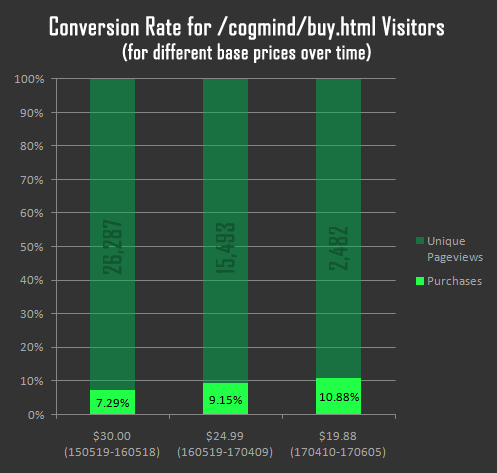

As a reminder, Cogmind's base price was $30 for the first 12 months, $24.99 for the 11 months following that, then $19.88 for the last month of the second year (and on through today). In the context of daily revenue above I already talked about some of the more immediate effects of those price changes, but the bigger picture holds a few more details. One element I finally have enough data to explore is Cogmind's conversion rate.

Cogmind Lifetime Conversion Rate (2015.5-2017.5) Based on buy.html Visitors

Cogmind lifetime conversion rate (2015.5 ~ 2017.5) based on buy.html visitors.I wouldn't read too much into that graph because there are a lot of factors at play here, so many that this data is not quite as meaningful as it appears, but it's fun so I wanted to talk about it anyway :P

First of all, notice that it's specifically the buy page! Unlike most other indie developers, I don't put a buy link on Cogmind's main web page. In fact, I also don't even put it front and center at the top of the buy page itself! I prefer to 1) avoid generating impulse buys and 2) manage potential player expectations. Thus I intentionally force visitors to wade through other stuff before finding a link to actually buy the game :). Yes, it's counterproductive from a marketing standpoint, but I don't care, I'm here to build a good game and foster a healthy community, not rake dollars from random people on the internet.

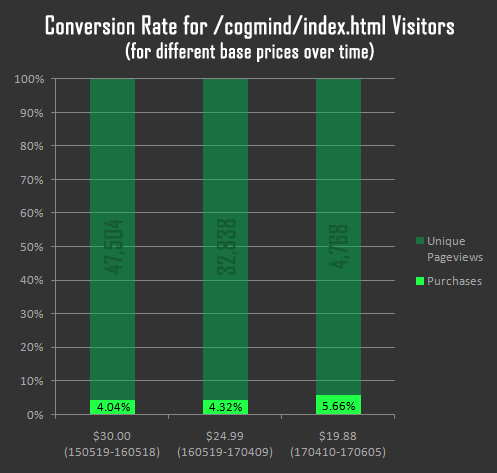

Thus this source data definitely skews the conversion rate higher, because anyone arriving on that page already has a somewhat higher interest in purchasing than the average visitor. (Note that based on general industry data, those rates are high.) For comparison I did the same with /cogmind/index.html.

Cogmind Lifetime Conversion Rate (2015.5-2017.5) Based on index.html Visitors

Cogmind lifetime conversion rate (2015.5 ~ 2017.5) based on index.html visitors.Part of the problem with sourcing stats from main page hits is that they're filled with referral spam which can't always be completely distinguished from real visits (which, like incessant referral spam, may simply leave without visiting other pages :P). This is why using the buy page provides nicer metrics, because it doesn't get referral spam--we just have to remember all the additional factors that feed into the buy.html stats.

Getting back to those factors, Cogmind's exposure comes primarily via roguelike-focused channels, so new visitors coming to the buy page are already going to be of a rogueliking disposition and even more likely to buy :)

Also specific to the fact that I prefer basing data on the buy page, there are a lot of people who have followed development for a long time, even years, who eventually make the decision to buy when it's right for them, whether due to a lower price,the right timing, or a combination of other personal factors. I believe there's a fairly steady stream of people who fall under this category, and they'll naturally just go to the buy page and... buy. This is often after having mostly obtained information about the game through one of the other channels I frequently use, like Twitter, r/Cogmind, the forums, the dev blog, TIGS, Bay 12, Facebook, etc...

Regarding what appears to be an upward trend in the conversion rate, while it makes some sense when paired with the fact that the price comes down for each period, I think that trend is much less meaningful on breaking down the average number of daily visitors and thinking about where those numbers are coming from. For example in its first year of release Cogmind had the greatest exposure on a number of major websites, so naturally visitors from those sites were less likely to be among the target audience. That was the highest average at 71.8 visitors per day. The second period, during which there was much less general exposure, saw a significantly lower 47.5 visitors/day. And the most recent period with the lowest price, albeit shorter, recorded only 43.5 visitors/day, yet had the highest conversion rate.

Of course, knowing this doesn't negate the fact that Cogmind's website and my frequent (if minimal) outreach efforts are fairly effective at selling the game to those who are interested. And on the reverse side, supporting the likelihood of an improving conversion rate, obviously during each consecutive period Cogmind was closer and closer to completion with a longer and longer history of steady releases. That helps convince anyone just discovering the game that it's both a substantial and promising project.

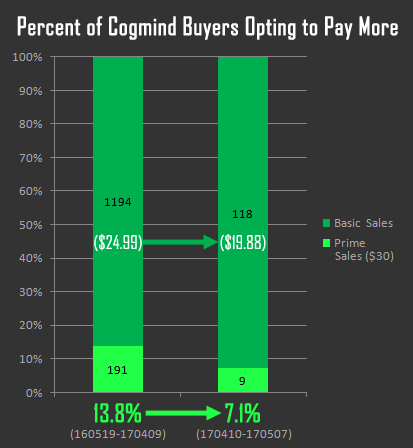

One of the buyer behaviors I've really been looking forward to quantifying is the percentage of those opting to pay more than the minimum price, and how that changed along with the tier adjustments.

Percent of Cogmind Buyers Opting to Pay More (Alpha)

Percent of Cogmind buyers opting to pay more. (This data just looks at the two lowest tiers for a given period, since the higher tiers are more complicated and aimed at group buys. The Prime tier and each respective basic tier are more directly comparable.)After Cogmind's first year, during which $30 ("Prime Tier") was the lowest price, I added a new perk-less Alpha Tier for $24.99. For the next 11 months, buyers could decide whether they just wanted the game, or if they could afford and would like to contribute a little extra in return for having their name in the credits. Surprisingly 13.8% of individual buyers still chose the Prime tier!

Part of the equation here would be the relatively low difference in price, percentage-wise. Only 20% more for some extra perks and to support a project they like? Why not? Compare to the rate after the price was lowered to $19.88, which means a 50% (!) increase for Prime, and the ratio of buyers choosing that option was basically halved. Many of the long-time fans interested in paying more to back the project will have already done so anyway. (Though also note that data for the latter period was only collected for about a month, because the Prime tier was removed as of the Beta release. That said, I don't suspect we'd see much of a difference if I continued to sell that tier--it was removed primarily because development was entering a new phase, and keeping the "early supporters" tier active for much longer didn't seem right.)

In the end I'm very glad I chose to handle tiers and pricing the way I did, because otherwise Cogmind wouldn't have gotten nearly as much pre-Steam development as it has! Lowering to $19.88 sooner also probably would've been a bad move based on what I'm seeing now, since over the long term there's been no noticeable increase in the raw number of buyers. Anything in the $19-$30 range really falls into the "too expensive" category for a lot of people, even more so if it's not on Steam where the convenience of purchases can take some of the edge off a price, or where there's more likely to be some sort of discount to provide additional impetus. (I'm still not working at getting more exposure to make up for the loss in revenue per player--it's just the same old social media channels--but that's why I chose April/May to do this, around when it's time to transition to Steam.)

However, I certainly wouldn't claim that sticking with $24.99 would continue to generate a proportionally higher revenue. Conversion rates would likely drop if the price remained unchanged. Each time I've reduced the price over the past two years, I was already feeling that sales were starting to flag and would likely continue to do so if I didn't take action. Even if that may not have come to pass, I also knew that there was already pent up interest in a lower price, and it was about time to lower the gates a bit further and let more fresh players in.

So where does this funding go? Well, as a solo dev with relatively low asset costs, much of it naturally goes to pay my meager salary, and my job is to both create and sell Cogmind :)

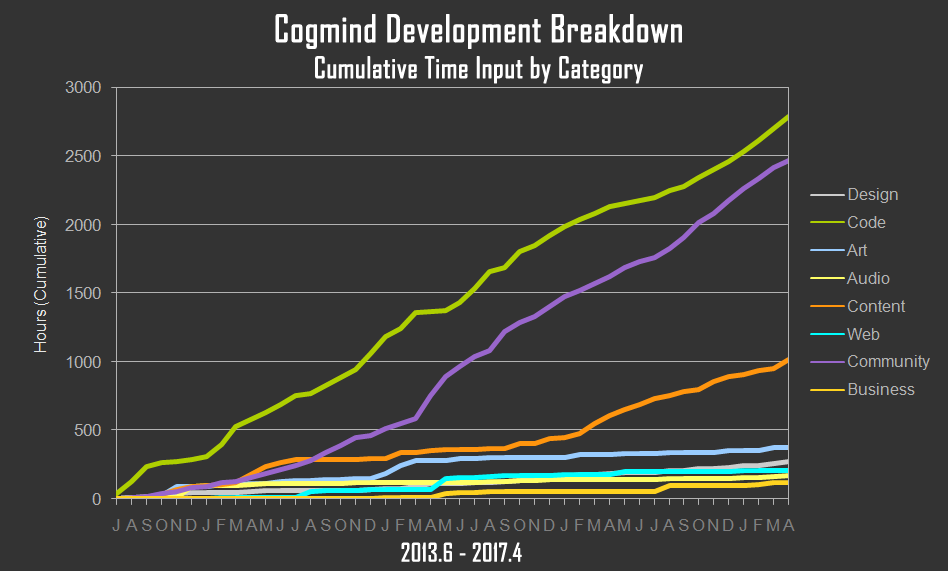

As always I've been maintaining my detailed records of development time, which show that compared to 3,065 hours of pre-alpha development and 2,177 hours for the first year of alpha, Year 2 continued at a stable 2,192 hours of work. These numbers aren't too pretty, because it shows that this is a lot of work for the amount of revenue coming in--certainly not worth it in an economic sense, but that's okay for now as long as it's been sustainable.

Cogmind Cumulative Development Hours, 2013.6-2017.4

Cogmind development time, July 2013 ~ April 2017 (excludes 2012 7DRL work).There's always more coding to do along with any new features, so that has of course continued its long-term upward drive, and community-related efforts are finally starting to catch up to it as I spend a little more time on promotional stuff as the core game approached completion. Content-focused development accelerated significantly over the past year, which is what ate into coding time.

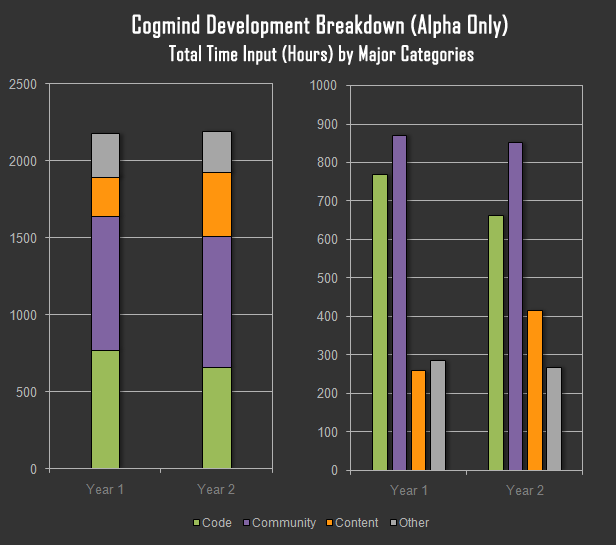

Comparing only the major development categories of Year 1 and Year 2 more directly, the shift from code to content is clear, while other areas stayed more or less constant.

Cogmind Alpha Development Breakdown (Time Input by Major Categories)

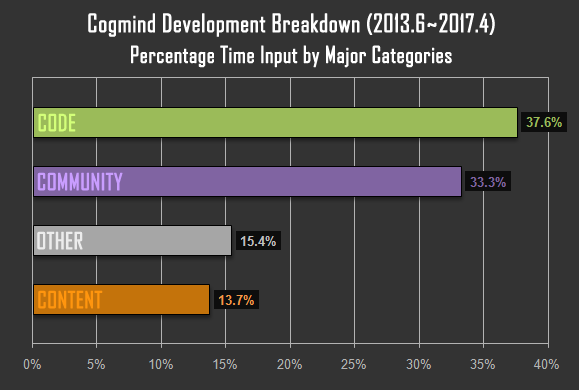

Cogmind Alpha development time breakdown by major categories.Because "what's a good percentage of time to spend on outward-facing efforts?" is a common question among newer gamedevs, let's also look at the major category breakdown for the project as a whole so far.

Cogmind Alpha Development Breakdown (Percent Time Input by Major Categories)

Percentage of Cogmind development time invested in each major area, July 2013 ~ April 2017 (excludes 2012 7DRL work).So altogether it's 66.7% game stuff vs. 33.3% community/marketing. This is really a bare minimum, which I can get away with because the traditional roguelike community is pretty tight knit with a small number of key places to stay in touch with players, making that part of the job easier. Other experienced devs will say literally half or more of your effort needs to be some kind work that helps get your game noticed (or in my opinion just as valuable: serves as time spent interacting with the existing player base).

I have much more behind-the-scenes dev stats and dedicated analysis to share once Cogmind is complete, though wanted to share a little of it in this article to give the revenue more context. (There's also a month-wise breakdown of development hours in the latest annual review.)

Aside from dev time there have been a number of other expenses, but they account for less than 6% of the total budget (which doesn't really have room for anything more xD). Music is something I've been thinking about, but how much money can be budgeted there is still an unknown for something that may not be entirely necessary and for which there are multiple valid approaches at different cost levels.

Cogmind still hasn't broken even, but the hope is that it will as soon as it's launched on Steam.

It's been a good two-year run of alpha releases (see history), and the ability to extend pre-Steam EA development has been wonderful for fleshing out the original vision--some of the stuff I've been adding, even entire maps, was totally not planned from the beginning! And as a result of sufficient support despite the previously higher prices, the player base could be kept from growing too large and distracting (as mentioned in my pricing article) while still getting constant feedback on new features and mechanics.

Now that the Beta is out and further development is mostly optional fun stuff, it's time to seek out more exposure and put Cogmind on Steam :D. Performance there will be extremely important for the future of Grid Sage Games... so hopefully it can make a splash.

Cogmind Nuclear Reactor Chain Exposions

Making a splash.(This article was originally published here, on the Grid Sage Games dev blog.)

Read more about:

Featured BlogsYou May Also Like